Global Merchant Acquiring Market – Industry Trends and Forecast to 2031

Report ID: MS-1962 | IT and Telecom | Last updated: Oct, 2024 | Formats*:

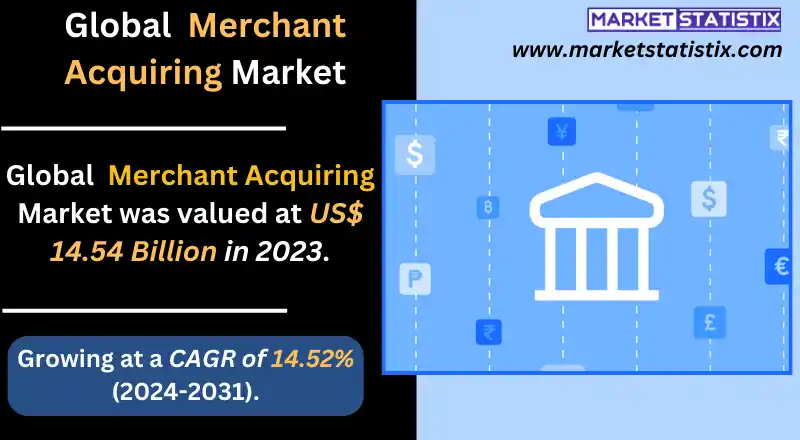

Merchant Acquiring Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 7.8% |

| Forecast Value (2031) | USD 41.9 Billion |

| By Product Type | B2C E-commerce, B2B E-commerce |

| Key Market Players |

|

| By Region |

|

Merchant Acquiring Market Trends

The global merchant acquisition market is now gearing up for the next wave of digitalization and contactless payment solutions. For merchants, demand for an almost limitless acquisition solution to enable high-value transactions across various channels is gaining importance because of the growth of e-commerce and mobile payment applications. The growing consumer preference for convenience and speed has given a boost to the adoption of contactless payment methods in the form of NFC, QR code payments, etc. This development compelled the merchants-acquirers to raise the bar of their service offerings and infuse innovative technology support for various types of payments. Increased competition in the market has again compelled acquirers to differentiate themselves by offering value-added services in the form of fraud prevention, analytics, customer loyalty programs, and so on. More and more merchants are looking for acquirers that are not only payment processors but are also giving them insights into consumer behaviour and trends to make effective use of operations to enhance their experience. This has seen partnerships and collaborations between acquirers and fintech companies advance in order to better address the needs of merchants and consumers.Merchant Acquiring Market Leading Players

The key players profiled in the report are Global Payments (U.S.), FIS (U.S.), CUP Merchant Services (China), Wells Fargo Merchant Services (U.S.), Chase Paymentech Solutions (U.S.), Elavon (U.S.)Growth Accelerators

Digital commerce coupled with digital methods of payment has largely fuelled the growth of the global merchant acquisition market. There are more customers purchasing products over the internet, and therefore there is a need for merchants looking for trustworthy payment processing services to handle the increased number of transactions. Consumerism has also evolved with the need for fast and secure payment methods such as mobile wallets and contactless payments, which in turn necessitated sophisticated merchant acquisition services that make transaction processing very fast and smooth, leading to high client satisfaction and retention. Awareness of global financial inclusion trends and the widespread adoption of payment solutions in the developing regions is another market growth driver. In the course of time, more and more SMEs become eager to join the digital economy, which makes it viable for merchant acquiring services because such organizations need to process different payment methods, i.e., credit and debit cards.Merchant Acquiring Market Segmentation analysis

The Global Merchant Acquiring is segmented by Type, Application, and Region. By Type, the market is divided into Distributed B2C E-commerce, B2B E-commerce . The Application segment categorizes the market based on its usage such as Sellers, E-commerce Operators. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The worldwide merchant acquiring sector is very contested, with numerous incumbents and new technology-based businesses fighting for dominance. Among the major players in the sector are conventional credit card processors such as Visa, Mastercard, and American Express and technology-based companies such as PayPal, Stripe, and Adyen. The competition is fierce, and services are differentiated with high emphasis placed on creativity and affordable offerings to merchants. The market is also expected to be vibrant and competitive as new entrants will be disorderly attempting to put up challenges to the existing dominant players due to the increase in the demand for merchant-acquiring services.Challenges In Merchant Acquiring Market

The globally unified merchant acquisition can be termed a perfect fit for problems with many challenges, as significant competition from fintech and digital payment systems is on the rise too. These new entrants tend to introduce new approaches and better practices with regards to the fees charged and any transactions involving the services offered. Hence, the old-line players, the financial institutions, ought to find ways of scaling up their operations and investing in technology, pricing strategies, and even customer care to avoid the risk of losing their position in the market. One other factor that poses challenges is the fact that the regulatory environment is dynamic, and as such, it comes with its own issues for merchant acquirers. There are numerous important regulations that these entities have to comply with, such as the Payment Services Directive 2 (PSD2) in Europe or the General Data Protection Regulation (GDPR), and they require heavy investment in both technology and systems.Risks & Prospects in Merchant Acquiring Market

The worldwide market for merchant acquisition represents great potential because of the extensive use of digital payments and the growth of e-commerce. Businesses understand the importance of merchant acquiring solutions that are capable of efficient and effective payment processing, as consumers are inclined to support cashless means of payments. This change calls for more advanced payment methods, which in turn implies that merchant acquirers are compelled to advance their technology and processes to include round the mPOS, payment integration, and even cloud services so that their customers’ experiences and processes are optimized. In addition, the growth of SMEs and the gig economy continues to provide room for growth in the merchant acquiring space. With the increased adoption of digital payment systems by the SMEs geared toward the young and tech-savvy consumers, there is an upsurge for acquiring solutions that are fit for different business models. Merchant acquirers have an opportunity to take advantage of these developments and formulate alliances that will help them increase their footprint in the market, thus increasing their revenues and improving their position in the new financial order.Key Target Audience

The primary focus of participants in the global merchant acquiring market is on retailers and e-commerce merchants who need dependable payment processing solutions as part of their operations. These kinds of businesses require offers such as merchant acquiring services in order to be able to accept payments made via credit and debit cards and formulate different payment systems such as mobile payments and even digital wallets. Due to the changing payment trends wherein consumers prefer cashless transactions, retail outlets have begun to focus more on advanced payment systems in order to create better satisfaction for their customers as well as improve their performance.,, Also, there are banks and other fintech corporations, since such organisations act as acquirers in the merchant acquiring sector. These firms—acquisitors—sign up with merchants so as to provide them with payment acceptance and processing services while employing sophisticated systems for effective transaction security. The emergence of new payment technologies like contactless payment and subscription billing also motivates these financial entities to seek more funds in their acquiring services so that they take advantage of the rapid growth in the volume of digital payments.Merger and acquisition

Expanding on the global merchant acquiring market dimension, the latest mergers and acquisitions show growth through consolidation and formation of strategic partnerships to improve the payment solutions offered as well as widen the market. Take, for example, in 2023, FIS made public that it had entered into an agreement to purchase Worldpay, which is a top payment processing company. The reason for this union was to blend their payment technologies so that the two companies would be able to better serve merchants by easing transactions. The focus of the new company’s strategy is to enhance payment processing services by employing their customer bases and technology deployed for both, apart from the technological dual. Another acquisition worth mentioning is that PayPal, the well-known payment processing company, bought Zettle, which is a Swedish point of sale (POS) system provider, at the beginning of the year 2023. This acquisition of Zettle enabled PayPal to reinforce its presence within merchant services, especially in Europe and the Nordic region, where small and medium-scale enterprises require sophisticated payment processing solutions. By adding the products and services of Zettle into its portfolio, PayPal seeks to cement its top position in the merchant acquisition industry by making available end-to-end payment services along with other features for business support.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Merchant Acquiring- Snapshot

- 2.2 Merchant Acquiring- Segment Snapshot

- 2.3 Merchant Acquiring- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Merchant Acquiring Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 B2C E-commerce

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 B2B E-commerce

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Merchant Acquiring Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Sellers

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 E-commerce Operators

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Merchant Acquiring Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Global Payments (U.S.)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 FIS (U.S.)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 CUP Merchant Services (China)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Wells Fargo Merchant Services (U.S.)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Chase Paymentech Solutions (U.S.)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Elavon (U.S.)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Merchant Acquiring in 2031?

+

-

What is the growth rate of Merchant Acquiring Market?

+

-

What are the latest trends influencing the Merchant Acquiring Market?

+

-

Who are the key players in the Merchant Acquiring Market?

+

-

How is the Merchant Acquiring } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Merchant Acquiring Market Study?

+

-

What geographic breakdown is available in Global Merchant Acquiring Market Study?

+

-

Which region holds the second position by market share in the Merchant Acquiring market?

+

-

How are the key players in the Merchant Acquiring market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Merchant Acquiring market?

+

-