Global Methyl Carbamate Market – Industry Trends and Forecast to 2031

Report ID: MS-1957 | Chemicals And Materials | Last updated: Oct, 2024 | Formats*:

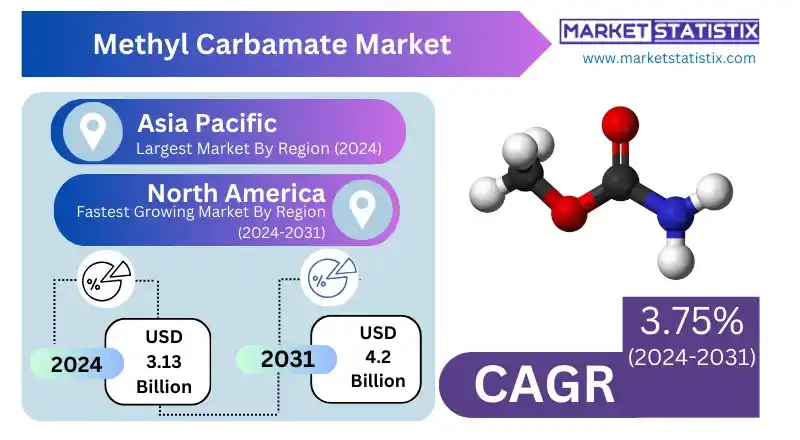

Methyl Carbamate Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 3.75% |

| Forecast Value (2031) | USD 4.2 Billion |

| By Product Type | Industrial Grade, Pharmaceutical Grade |

| Key Market Players |

|

| By Region |

|

Methyl Carbamate Market Trends

The methyl carbamate market in the world is observing a significant growing tendency towards the agricultural sector, especially due to the agricultural uses of methyl carbamate as a pesticide and herbicide intermediate compound. As agriculture progresses and the demand for appropriate pest control increases, methyl carbamate is preferred due to its effectiveness in several pests’ management. Furthermore, the unhealthy and toxic organophosphates are being avoided, leading to manufacturers concentrating on developing methyl carbamate that adheres to these practices. Biopesticides and soy-based methyl carbamate herbicides, for instance, are non-toxic and animal-non-harmful. The other market, which presents an increase in demand for methyl carbamate, is the pharmaceutical sector, primarily as an intermediate in the synthesis of several drug compounds. This is as a result of the need for more sophisticated drug development processes, which in most cases need more than just a few drug compounds. In general, the global methyl carbamate market is likely to be affected by the interrelationship of agricultural and pharmaceutical uses of methyl carbamate, as well as an emphasis on sustainability.Methyl Carbamate Market Leading Players

The key players profiled in the report are Amadis Chemical Co. Ltd., Acros Organics B.V.B.A., Inkemia Green Chemicals Inc., ICC Industries B.V, UBE Industries Ltd., Shanghai Chaining Chemicals Co. Ltd., Anhui Meisenbao Chemical Co. Ltd., Hangzhou JandH Chemical Co. Ltd., Hangzhou Dayangchem Co. Ltd., Chemos GmbH and Co. KG, Ambeed Inc, Huntsman International, Cambridge Isotope Laboratories, Glaconchemie GmbHGrowth Accelerators

The global market for methyl carbamate is primarily propelling owing to the rising use of agrochemicals, in particular, a growth for pesticides and herbicides. The methyl carbamate compounds are used in the agricultural sector due to their abilities to control pests and increase crop productivity. With the introduction and expansion of farming practices mainly to address the ever-increasing food demand, the emergence of pest control measures that are not only effective but also environmentally sustainable is becoming increasingly important. Consumer awareness concerning the therapeutic benefits of methyl carbamate has also set the stage for appreciable growth in the methyl carbamate market. However, this attention is projected to shift towards the pharmaceutical intermediates and chemical synthesis industries. Methyl carbamate is highly employed in the manufacturing of different categories of medications and speciality chemicals, thus driving the growth of the pharmaceutical sector. Due to this enduring innovation of the pharmaceutical industry through research, methyl carbamate is expected to be in high demand as an essential synthesis intermediate.Methyl Carbamate Market Segmentation analysis

The Global Methyl Carbamate is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Industrial Grade, Pharmaceutical Grade . The Application segment categorizes the market based on its usage such as Pharmaceutical Industry, Chemical Industry. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The methyl carbamate market on a global scale is characterized by robust competition owing to the presence of several important players in the industry. Key manufacturers and suppliers encompass companies such as, but not limited to: BASF SE, Bayer AG, Drexel Chemical Company, DuPont, Lebanon Seaboard Corporation, Monsanto Company, Sumitomo Chemical Co. Ltd., and Syngenta, The Dow Chemical Company. Such companies vie for the consumer's attention on the basis of product quality, price, and innovation, among other aspects, such as the scope of regions targeted. The study also identifies that the market is witnessing heavy investments in research and development with the aim of coming up with new and enhanced methyl carbamate products as well as striving to meet the changing demands of various industries and applications.Challenges In Methyl Carbamate Market

With regards to the global methyl carbamate market, a number of issues need to be addressed, such as regulatory challenges and the safety of the compound, which limits its usage in different applications. Environmental protection and safety measures are at most times any government relevant authorities'-imposed limitations on the quantity of methyl carbamate produced and its applications, especially in agriculture and medicinal products. Most of these provisions require excess resources towards manufacturing facilities for safe practices, quality, and safety procedures, which puts pressure on smaller companies, leading them to high costs of manufacturing. The problem also lies in the unpredictability of the raw material costs and interruptions in the supply chain. Methyl carbamate requires a number of chemical precursors, which are known to be available at varying price rates. Therefore, variations in the prices of such raw materials have an impact on the total costs of production. Such ambiguities can stall the growth of the market and jeopardize the profit of the manufacturers; thus, it is important for the businesses to come up with socially acceptable supply chain plans and alternative sources of materials.Risks & Prospects in Methyl Carbamate Market

Various market opportunities are identified in the global methyl carbamate market owing to the increase in demand for agrochemicals and speciality chemicals. Methyl carbamate finds its foremost application as an intermediate in the synthesis of several insecticides and pesticides like herbicides and fungicides, and for that reason, it is essential in the agriculture sector. As the population across the globe continues to rise, the need for effective protection of crops increases to reduce the risk of food insecurity. This demand provides an opportunity for the players in the market to increase the volume of production and research on new types of preparation in a bid to improve agricultural yields without harming the environment. Furthermore, the pharmaceutical and cosmetic industry is also emerging as a key user of methyl carbamate, creating more opportunities on the market. Methyl carbamate is used in the production of some drugs and also as an ingredient in the manufacturing of cosmetic products, including nail polish, thus responding to the need for safer and more effective beauty products. Moreover, the growing concern over environmental impact encourages the use of green chemistry, which in turn encourages the introduction of bio-engineered products to replace conventional methyl carbamate, benefiting such consumers.Key Target Audience

The worldwide methyl carbamate market has an important focus group, which is the manufacturing plants of agrochemicals, particularly pesticides and herbicides. Methyl carbamate is one of the primary raw materials in the production of a number of insecticides, which is most significant for the manufacturers who want to design suitable and efficient crop protector products. Also, this market is driven by agricultural companies that are interested in using the chemical for biological pest management so as to increase their crop production levels.,, The second audience that we should mention is the pharmaceutical and chemical sectors, as well as the markets where they consume methyl carbamate in the making of fine chemicals and drugs. Companies in those areas demand much purer methyl carbamate for use in drug delivery development and for the production of other chemical products. Another target group is represented by research institutes and laboratories, since they also use methyl carbamate for reaction substrate studies or for toxicity testing. Such a range of utilisation emphasises the relevance of methyl carbamate in different industries, thus stimulating advancement and expansion of the market.Merger and acquisition

The global methyl carbamate market over the recent past has experienced a number of mergers and acquisitions, which have been more of strategic partnerships and expansions focused on improving the products on offer as well as the geographical footprint. One of the key acquisitions was the one completed by Amines & Plasticisers Ltd., which bought a plant that produces methyl carbamate for its chemical production enhancement. This enables the firm to expand its product range, which in turn helps in enhancing its competitiveness in the speciality chemicals market. Moreover, BASF SE has similarly been participating in acquisition activities in order to grow its methyl carbamate business. Since smaller specialist chemical companies often have unique technologies, BASF has chosen to ally with such companies to enhance its processes. Such mergers and acquisitions are prevalent in the chemical industry as more companies are shifting their attention to sustainability and eco-friendlier products. These allow companies to meet both the current levels of demand and the intentions of the market regulators while also preparing for the development of the methyl carbamate industry.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Methyl Carbamate- Snapshot

- 2.2 Methyl Carbamate- Segment Snapshot

- 2.3 Methyl Carbamate- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Methyl Carbamate Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Industrial Grade

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Pharmaceutical Grade

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Methyl Carbamate Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Pharmaceutical Industry

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Chemical Industry

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Methyl Carbamate Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Amadis Chemical Co. Ltd.

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Acros Organics B.V.B.A.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Inkemia Green Chemicals Inc.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 ICC Industries B.V

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 UBE Industries Ltd.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Shanghai Chaining Chemicals Co. Ltd.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Anhui Meisenbao Chemical Co. Ltd.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Hangzhou JandH Chemical Co. Ltd.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Hangzhou Dayangchem Co. Ltd.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Chemos GmbH and Co. KG

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Ambeed Inc

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Huntsman International

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Cambridge Isotope Laboratories

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Glaconchemie GmbH

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Methyl Carbamate in 2031?

+

-

How big is the Global Methyl Carbamate market?

+

-

How do regulatory policies impact the Methyl Carbamate Market?

+

-

What major players in Methyl Carbamate Market?

+

-

What applications are categorized in the Methyl Carbamate market study?

+

-

Which product types are examined in the Methyl Carbamate Market Study?

+

-

Which regions are expected to show the fastest growth in the Methyl Carbamate market?

+

-

What are the major growth drivers in the Methyl Carbamate market?

+

-

Is the study period of the Methyl Carbamate flexible or fixed?

+

-

How do economic factors influence the Methyl Carbamate market?

+

-