Global Micro Electric Automotive (Micro EVs) Market - Industry Dynamics, Size, And Opportunity Forecast To 2030

Report ID: MS-2133 | Automotive and Transport | Last updated: Dec, 2024 | Formats*:

Micro Electric Automotive (Micro EVs) Report Highlights

| Report Metrics | Details |

|---|---|

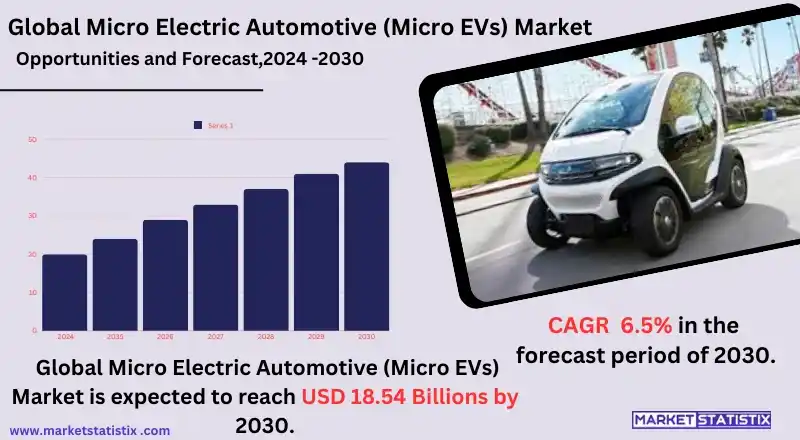

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 6.5% |

| Forecast Value (2030) | USD 18.54 billion |

| By Product Type | BEV, PHEV, HEV |

| Key Market Players |

|

| By Region |

|

Micro Electric Automotive (Micro EVs) Market Trends

Micro electric vehicles, or micro EVs, are currently taking the automotive industry by storm, mainly due to growing urbanization and the need for eco-friendly means of travel. One of the most important trends is the increasing adoption of small-sized electric vehicles for travel within cities where space is a challenge and emission controls are also present. Micro EVs are gaining a lot of popularity, especially among green consumers and city residents, because of lightweight designs, better battery technologies, and low costs. Oppositely, geographical developments in the shared mobility services are also shaping Micro-EV markets. As a result of their cheap pricing, low maintenance needs, and appropriate distance for use, micro-EVs are being incorporated more and more into the fleets of ride-sharing services, last-mile delivery, and courier services. Electric vehicle supply equipment is being developed for these vehicles, especially smart charging systems, coupled with government policies such as subsidies, tax rebates, and the provision of electric vehicles.Micro Electric Automotive (Micro EVs) Market Leading Players

The key players profiled in the report are Alke (Italy), Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd (China), Italcar Industrial S.r.l. (Italy), Toyota Motor Corporation (Japan), Club Car LLC (U.S.), Yamaha Golf Cart Company (U.S.), PMV Electric Pvt. Ltd. (India), Renault Group (France), Polaris (U.S.), Textron Inc. (U.S.)Growth Accelerators

The expansion of the Micro Electric Vehicle (Micro EV) market can be attributed to two factors, namely, urbanization as well as the quest for sustainable and affordable modes of transportation solutions. With the increase in urban population, micro EVs present a smaller and eco-friendly mode of transport in comparison to ordinary vehicles, where they help in solving the challenges of traffic jams as well as air pollution. Their relatively low operational expenses, coupled with minimal maintenance required and the fact that these types of vehicles are offered under government schemes, make them especially attractive to city- dwellers and the green-conscious customers. The market is also fuelled by technological developments in battery and charging technologies. Battery technology has improved with better energy densities, shorter charging times, and driving ranges, making micro EVs suitable for short uptake distances. The installing of smart features such as connectivity, navigation, and app-based fleet management has increased their uptake in shared mobility services, especially e-hailing and last-mile delivery, hence increasing their versatility from personal use.Micro Electric Automotive (Micro EVs) Market Segmentation analysis

The Global Micro Electric Automotive (Micro EVs) is segmented by Type, Application, and Region. By Type, the market is divided into Distributed BEV, PHEV, HEV . The Application segment categorizes the market based on its usage such as Urban Mobility, Shared Mobility, Delivery. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The micro electric vehicle (Micro EV) market and its competitive forces are seeing and increasingly understanding a steady influx of both old and new players in the industry. For example, current automotive giants, such as Toyota, Volkswagen, General Motors, and others, are investing in micro EVs in these separate market segments, considering it in their larger electric vehicle markets. These companies are tapping into their vast production facilities and technical know-how to produce small and cheap electric vehicles, which meet the demand of city dwellers. On the one hand, the companies that are actively developing such vehicles are not only the conventional automakers. Also, this market contends aggressively with mobility start-ups and technology-oriented businesses that aim to design compact smart vehicles that are energy-efficient. Such companies as well are creating new market niches by focusing on ultra-lightweight vehicles, autonomous driving systems, and connectivity. Policies encouraging car use, environmental constraints, and an ever-growing market for greener transportation solutions also increase competition. Collaboration of automotive manufacturers with battery producers and charging stations develops more often, which helps companies to improve the service they provide and widen the geographical area of their activity.Challenges In Micro Electric Automotive (Micro EVs) Market

The micro electric vehicle (Micro-EV) industry has its own set of challenges, among which is the short-range driving capability of these vehicles. Micro EVs tend to have a relatively shorter range than standard electric cars because of their smaller sizes and smaller battery packs, which limits consumer appeal for those who wish to travel over long distances. The problem is also worsened by the absence of an elaborate and user-friendly charging system, which leaves a majority of the owners not being able to charge their vehicles up comfortably, particularly in the countryside or other less developed regions. Also, while operational costs are low, micro EVs do present a significant initial investment. Even though these vehicles are usually cheaper as compared to the conventional car, they may still be out of reach for a significant number of would-be buyers, more so in less developed countries. Furthermore, the lack of awareness, as well as worries regarding the quality and performance of micro EVs, can also affect the prospects of widespread use.Risks & Prospects in Micro Electric Automotive (Micro EVs) Market

There is a high growth potential in the micro electric vehicle (Micro EV) market since there has been an increase in the number of individuals looking for environmentally friendly and cheaper means of transportation. With the rise in urbanization, cities are becoming more congested and polluted, making micro electric vehicles (EVs) more appealing than regular cars. These small and lightweight vehicles are efficient for short-distance traveling, providing an inexpensive and green option for city inhabitants. In addition, various countries are encouraging the use of the vehicles through inducements, provisions of grants, and enabling legislation, thus enhancing the prospective growth of the market. Additionally, the growth of shared mobility and fleet services presents another important opportunity. Micro EVs are perfect for flexible car-sharing and ride-hailing operations, as they can save a lot of money on running costs. Moreover, they are also easy to incorporate into existing car hire services and are simply added for a low-cost expansion of the electric fleet of the company.Key Target Audience

The market for micro electric vehicles (micro EVs) is catered mostly towards urban professionals and eco-friendly consumers. Micro EVs come in miniature sizes and consume less energy with less effect on the environment, factors that make them very suitable for use in urban centers and curbing emissions. Micro EVs are very much in demand by the youthful population and the metropolitan dwellers who find traffic in fast-moving cities impossible for normal vehicles, which are better suited for this type of environment and are cheaper to operate than a conventional vehicle.,, Another group of potential markets for the micro electric vehicles (micro EVs) is represented by the city emission control authorities, municipalities, and operators of commercial vehicle fleets. Local authorities are incorporating micro response vehicles more and more within their efforts to control emissions and encouraging active transport in areas with high-density populations. Furthermore, delivery and taxi vehicles and businesses with a logistics component are starting to use micro EVs to create high-efficiency, low-cost, short-range transportation systems. Ecologically conscious enterprises and green startups are also joining the market.Merger and acquisition

The recent tactical repositioning of companies in the automotive sector is demonstrated through the merger and acquisition activities in the micro electric vehicle (Micro EV) sector. The growth is encouraging older car manufacturers and technology companies to look for mergers and acquisitions, which provides a chance to assimilate modern advancements and broaden their range of products. In other words, after achieving the basic level of production in the country, the company is focused on the niche markets, as evidenced by Cenntro Electric Group’s introduction of ‘Avantier’ flooer cars for European and Central American urban centers. Besides that, there are signs of increased M&A activities in the Indian micro electric vehicle industry due to government initiatives and growing appetite for electric vehicles among consumers. The competition is rife with companies seeking out alliances or joint development agreements in partnerships and business ventures that will drive innovations in their core services or products, especially on lithium batteries and charging systems, as these technologies are key enablers for Micro EVs success. A greater degree of innovation and quick market deployment is anticipated with the coming together of conventional car manufacturers and players whose business model is built around electric mobility solutions.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Micro Electric Automotive (Micro EVs)- Snapshot

- 2.2 Micro Electric Automotive (Micro EVs)- Segment Snapshot

- 2.3 Micro Electric Automotive (Micro EVs)- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Micro Electric Automotive (Micro EVs) Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 BEV

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 PHEV

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 HEV

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Micro Electric Automotive (Micro EVs) Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Urban Mobility

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Shared Mobility

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Delivery

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Micro Electric Automotive (Micro EVs) Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Alke (Italy)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Suzhou Eagle Electric Vehicle Manufacturing Co.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Ltd (China)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Italcar Industrial S.r.l. (Italy)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Toyota Motor Corporation (Japan)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Club Car LLC (U.S.)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Yamaha Golf Cart Company (U.S.)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 PMV Electric Pvt. Ltd. (India)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Renault Group (France)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Polaris (U.S.)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Textron Inc. (U.S.)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Micro Electric Automotive (Micro EVs) in 2030?

+

-

How big is the Global Micro Electric Automotive (Micro EVs) market?

+

-

How do regulatory policies impact the Micro Electric Automotive (Micro EVs) Market?

+

-

What major players in Micro Electric Automotive (Micro EVs) Market?

+

-

What applications are categorized in the Micro Electric Automotive (Micro EVs) market study?

+

-

Which product types are examined in the Micro Electric Automotive (Micro EVs) Market Study?

+

-

Which regions are expected to show the fastest growth in the Micro Electric Automotive (Micro EVs) market?

+

-

What are the major growth drivers in the Micro Electric Automotive (Micro EVs) market?

+

-

Is the study period of the Micro Electric Automotive (Micro EVs) flexible or fixed?

+

-

How do economic factors influence the Micro Electric Automotive (Micro EVs) market?

+

-