Global Mineral Acids Market – Industry Trends and Forecast to 2032

Report ID: MS-315 | Chemicals And Materials | Last updated: Jan, 2025 | Formats*:

Mineral Acids Report Highlights

| Report Metrics | Details |

|---|---|

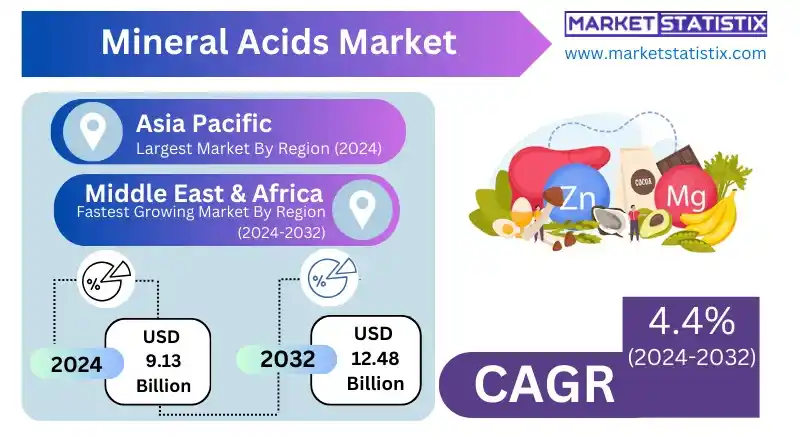

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 4.4% |

| Forecast Value (2032) | USD 12.48 Billion |

| By Product Type | Explosives, Pharmaceutical, Pigments & Dyes, Agrochemicals & Fertilizers, Others |

| Key Market Players |

|

| By Region |

|

Mineral Acids Market Trends

There are many trends prevailing in the mineral acids market. Such as, above-mentioned drivers coming forward for industry growth, the very critical demand from most significant end-use industries such as chemicals, fertilizers, and metals. The world has continuously been moving towards perfectionism through advanced technologies in production with high efficiency and minimum environmental impact. Besides this, sustainability has also drawn attention to developing an efficient and environmentally friendly production process through alternative raw materials. Emerging economies demand increased amounts of mineral acids because of industrialization and infrastructure development. Also, the other markets are supported by the growing contribution of agriculture and transport. Thus, phosphoric acid is important for fertilizers, while sulphuric acid is used to manufacture lead-acid car batteries. The trend towards precision agriculture and increased petrochemical demand and oil refining has already added more growth to this market.Mineral Acids Market Leading Players

The key players profiled in the report are LyondellBasell Industries (United States), Evonik Industries (Germany), BASF SE (Germany), PVS Chemicals Inc. (United States), INEOS Enterprises (United Kingdom), Azko Nobel N.V. (Netherlands), Dow Chemical (United States), DuPont de Nemours Inc (United States), Basic Chemical Solutions LLC (United States), General Chemicals (United States)Growth Accelerators

Chemicals, fertilisers, and metals are among the major consumers of mineral acids, and this goes a long way in driving the market demand for the mineral acids. They serve as key components for producing basic chemicals, which include sulphuric acid, hydrochloric acid, and nitric acid in the chemical industry, petrochemicals, polymers, and industrial solvents. A major driver for mineral acids is fertiliser production, especially phosphoric acid and sulphuric acid, which help create phosphatic fertilisers needed to cater to the global agricultural needs. The other significant aspect of market growth comes from rising use in the metal industry, such as for the pickling of steel and other products. With the increasing requirement for metals in various industrial sectors, such as automotive, construction, and electronics, the rising demand for acidic materials is being generated in the said sectors. Additionally, emerging markets tend to have high industrialization and urbanization, leading to heavy usage of mineral acids during industrial manufacturing.Mineral Acids Market Segmentation analysis

The Global Mineral Acids is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Explosives, Pharmaceutical, Pigments & Dyes, Agrochemicals & Fertilizers, Others . The Application segment categorizes the market based on its usage such as Sulphuric Acid, Hydrogen Fluoride, Nitric Acid, Phosphoric Acid, Hydrochloric Acid, Boric Acid, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

These competitive mineral acids market is made up of the development of both global and regional players that keep a range of products, including sulphuric, hydrochloric, nitric, and phosphoric acids. Some of the companies that include national and global names such as BASF, Dow Chemical, and Sinopec dominate the market in manufacturing capabilities, distribution networks, and product lines. This organization thus services different sectors, including chemicals, agriculture, automotive, and food processing, whose interest is due to the growing demand for mineral acids in industrial applications. Strategic mergers, acquisitions, and partnerships are common occurrences within this constellation as the companies strive to increase their market shares while improving production efficiency.Challenges In Mineral Acids Market

Challenges are evident in the mineral acids market. The most pertinent is the array of stringent environmental regulations governing the manufacturing processes. The requirement forces manufacturers to make considerable investments in pollution control technologies as well as increase the cost of production. Beyond being matured in refurbished areas, additional growth challenges apply toward emerging marketing campaigns or creating modern applications to generate growth. Further, the evolution of prices of raw materials, as well as an irregular supply chain, do apply challenges to holding steady the mineral acids market price. For instance, sulphur prices the primary element in the manufacture of sulphuric acid may be influenced by various geopolitical events or enterprising updates issued by industries such as mining and agriculture for their products. All these changes further aggravate the already high demand for greener alternatives and laws governing the usage of hazardous chemicals, which negatively affect market actors' profit-making endeavors regarding changing market tendencies.Risks & Prospects in Mineral Acids Market

There are some key opportunities for mineral acids to grow. Emerging applications in newer end-use industries, such as pharmaceuticals, electronics, and water purification, promise further possibilities. Advancing into more recent production technologies would lead to improved efficiency and reduced environmental impacts as well as production costs. Developing new, high-performance mineral-acid derivatives and formulations may even create new markets and applications. In addition, demands on many industries to offer more sustainable and greener solutions create opportunities for greener manufacturing processes and the possibility of using renewable energy sources in the production of mineral acids.Key Target Audience

The mineral acids market caters to industries like chemicals, petrochemicals, and fertilizers, where mineral acids are used for different applications. In the chemical industry, sulphuric acid, hydrochloric acid, and nitric acid are mainly used for manufacturing dyes and plastics as well as detergent products. In the fertilizer industry, sulphuric acid is mainly used for the production of phosphoric acid, an intermediate required for manufacturing phosphate fertilizers. In the petrochemical industry, large amounts of mineral acids are consumed for using them in refining processes like oil refining and gas processing.,, Such as metal manufacturing, mining, and water treatment; these are also large consumers of mineral acid products. In metal production, sulphuric acid is used for most of the ore extraction processes and metal pickling, while hydrochloric acid is used in the removal of impurities from steel and aluminum. The mining industry uses such acids for leaching purposes in their operations.Merger and acquisition

Recently, mergers and acquisitions in the mineral acids market have focused strategically on expanding production capabilities and market reach. For instance, BASF has announced the acquisition of a stake in Kraton Corporation, which specializes in bio-based products, including some mineral acid ones, as part of its acquisition plan. By leveraging Kraton's sophisticated technologies in the future, BASF will enhance its portfolio in sustainable chemistry for the mineral acid applications. On the other hand, INEOS Enterprises is also active in the market, recently acquiring the Sulphur Chemicals business from the International Chemical Investors Group. With acquiring the sulphur chemicals segment, INEOS becomes one of the leading manufacturers in Spain of sulphuric acid and oleum, applying these in a set of diverse applications for agriculture and chemical intermediates. Thus, these are strategic moves up for broader consolidation in the mineral acids market, as they increasingly present themselves as businesses driven by greater demand for chemical solutions in industries going green and efficient. >Analyst Comment

"At present, the global demand landscape for the mineral acids market segment, which falls within the broader chemicals industry, is reflected most heavily in agriculture, manufacture, and industrial use. Some key examples of essential mineral acids include sulphuric acid, hydrochloric acid, and nitric acid, all of which are integral in producing fertilizers, chemicals, and metals. Indeed, the aforementioned acids include sulphuric acid, which is heavily used in phosphate fertilizer manufacture, while hydrochloric acid is widely used in the oil and gas industry during well stimulation or in metal processing. Mineral acids are also forecast to grow areas such as the automotive and food industries that have them for cleaning purposes and food preservation."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Mineral Acids- Snapshot

- 2.2 Mineral Acids- Segment Snapshot

- 2.3 Mineral Acids- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Mineral Acids Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Agrochemicals & Fertilizers

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Pigments & Dyes

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Pharmaceutical

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Explosives

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Mineral Acids Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hydrochloric Acid

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Sulphuric Acid

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Nitric Acid

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Phosphoric Acid

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Boric Acid

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Hydrogen Fluoride

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Others

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: Mineral Acids Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 BASF SE (Germany)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Dow Chemical (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 LyondellBasell Industries (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Evonik Industries (Germany)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Azko Nobel N.V. (Netherlands)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 DuPont de Nemours Inc (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 INEOS Enterprises (United Kingdom)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 PVS Chemicals Inc. (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Basic Chemical Solutions LLC (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 General Chemicals (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Mineral Acids in 2032?

+

-

How big is the Global Mineral Acids market?

+

-

How do regulatory policies impact the Mineral Acids Market?

+

-

What major players in Mineral Acids Market?

+

-

What applications are categorized in the Mineral Acids market study?

+

-

Which product types are examined in the Mineral Acids Market Study?

+

-

Which regions are expected to show the fastest growth in the Mineral Acids market?

+

-

Which region is the fastest growing in the Mineral Acids market?

+

-

What are the major growth drivers in the Mineral Acids market?

+

-

Is the study period of the Mineral Acids flexible or fixed?

+

-