Global Modular Construction Market Size, Share & Trends Analysis Report, Forecast Period, 2025-2030

Report ID: MS-410 | Consumer Goods | Last updated: Feb, 2025 | Formats*:

Modular Construction Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

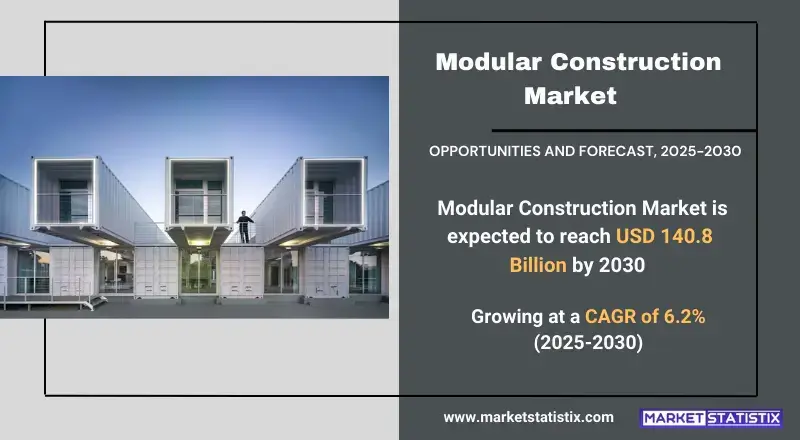

| Growth Rate | CAGR of 6.2% |

| Forecast Value (2030) | USD 140.8 Billion |

| By Product Type | Permanent, Relocatable |

| Key Market Players |

|

| By Region |

|

Modular Construction Market Trends

The modular construction market is booming due to its many advantages over traditional ways of building. One of the trends is the increasing use of Building Information Modelling and other digital technologies in the design and manufacture of modular components. This makes possible much more accuracy, efficient collaboration between stakeholders, and a reduced error rate, resulting in better outcomes for projects. Besides, the speed and efficiency of modular construction gain popularity because developers want to cut down on project periods and displacements on-site. This is interesting, especially in urban areas where the competition for time and space is very high.Modular Construction Market Leading Players

The key players profiled in the report are Bechtel Corporation (US), Laing O’Rourke (UK), Skanska AB (Sweden), Kleusberg GmbH (Germany), Modulaire Group (UK), Atco Ltd. (Canada), Lendlease Corporation (Australia), Red Sea Housing (Saudi Arabia), Fluor Corporation (US)Growth Accelerators

Increasing demand for quicker and more efficient construction is expected to drive the modular construction market. Traditionally, construction has been impeded by floods, the lack of materials, and sometimes the unavailability of labour. Modular construction minimizes such uncertainties through production at shrinking manufacturing cost speeds and allows quicker project completion, which is vital in the healthcare and education sectors, where rapid building may be valuable. In addition to this, the modular approach creates better possibilities for quality control, maximizing durability and energy efficiency of buildings. As the environmental issue gains wider canvassing bases, it will also be anticipated that the sustainability advantages of modular construction will drive future market growth.Modular Construction Market Segmentation analysis

The Global Modular Construction is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Permanent, Relocatable . The Application segment categorizes the market based on its usage such as Office, Education, Residential, Retail & Commercial, Hospitality, Healthcare, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

A modular construction market brings together large multinational companies and smaller, specialized regional players. Top companies in this space are companies like Skanska, Laing O'Rourke, and ATCO, which have considerable experience and resources to take on large-scale modular projects. These companies usually have integrated operations, covering design, manufacture, and assembly on-site, giving them the upper hand. But, at the same time, it is attracting new companies or emerging players who will focus on certain segments or provide specialized modular solutions. These would lead to increased competition and revive innovation with respect to design, materials, and construction techniques. The market competition is also shaped by aspects beyond these, like pricing, quality, delivery time, and the extent to which a firm is able to offer customized solutions for specific client demands.Challenges In Modular Construction Market

Challenges facing modular construction include high initial investment costs and the need for specialised manufacturing facilities, both of which deter smaller developers from getting involved. Transport and logistics problems, from the price of ferrying large prefabricated modules to the construction site, can further delay the course while ballooning project costs. Differences in regulatory hurdles, such as building codes and zoning restrictions in the various regions, create major challenges to the standardization process. Another impediment includes the dissatisfaction to contend with changes from within the traditional construction sector, which is still preponderantly characterized by conventional methods. Further, a shortage of skilled labour in the modular manufacturing segment feeds into reduced capacity and efficiency.Risks & Prospects in Modular Construction Market

The modular construction market is a promising affair owing primarily to increasing demand for cost-effective, sustainable, and time-saving solutions in buildings. These modular structures are benefiting from advancements in prefabrication technology, automation, and 3D printing, improving both quality and scalability, and are thus attractive for housing, commercial, and industrial applications. Increasing urbanization and shortages in housing, along with government initiatives to promote eco-friendly construction, are some of the engines driving the market. Geographical perspectives say that North America and Europe drive the market because they are the top in adopting modular constructions as well as in developing infrastructure investments and policies that support sustainable building practices. The growth of Asia-Pacific can relate to changes such as an increase in urbanisation, population, and government-sponsored housing projects in countries such as China, India, and Japan. The growth in modular solutions for large-scale commercial and hospitality projects is what the Middle East market is catering to right now. India and other emerging markets in Africa and Latin America are promising markets, being as they are developing markets where governments and developers are pushing towards affordable yet efficient innovation to be able to meet rising infrastructure demands.Key Target Audience

, Target customers can comprise real estate developers, government agencies, and business property owners—basically anyone searching for a low-cost and speedy solution to his/her building. Also, sectors like healthcare, education, and hospitality have begun to rely on this type of construction for faster infrastructure development. Expedite the project with fewer disruptions or shorten the total duration of the project. Furthermore, it is an important market for investors and private firms who look for sustainable and energy-efficient building options., Other interested parties that are crucial in this market are architects, engineers, and contractors who are familiar with modular solutions and use them in their projects to create flexibility and improve quality control. Components of prefabricated construction, material suppliers, and technology providers also have an essential function as providers of innovative designs and construction automation solutions.Merger and acquisition

The modular construction market is buzzing with intense merger and acquisition activity that requires consolidation among various players and results in efficiencies in the supply chain while leveraging some technology advances. In Q2 2024, six modular construction-related deals were reported by the tight-knit $34.6 million. NRB Modular Solutions was disclosed as the largest acquisition deal, amounting to $29.2 million. Even though modular construction-related deal activity fell by 92% compared to last quarter, there was 20% growth in the number of deals compared to last quarter, and it is 100% higher than Q2 2023. Key market players are also on strategies like expansions, acquisitions, and joint ventures, for instance, Laing O'Rourke, Red Sea Housing, and Skanska AB, among others, in a bid to strengthen their positions on the market. For instance, the acquisition of Kitchens to Go was made by McGrath RentCorp in April 2021, making it the largest interim and permanent modular food service facility in the world. These M&A activities show the dynamism of change in the industry to current market conditions. >Analyst Comment

The modular construction market is growing considerably, with the demand for quicker, better, and sustainable methods of building driving its growth. It offers significant advantages compared to traditional construction, which include shorter time scales to complete projects, better quality control since modules are made in factories, and lower generation of waste. The market is also augmented through technological innovations such as Building Information Modelling (BIM) and 3D printing, which help improve the design and manufacturing process.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Modular Construction- Snapshot

- 2.2 Modular Construction- Segment Snapshot

- 2.3 Modular Construction- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Modular Construction Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Permanent

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Relocatable

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Modular Construction Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Residential

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Office

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Education

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Retail & Commercial

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Hospitality

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Healthcare

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Others

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: Modular Construction Market by Material

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Steel

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Wood

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Concrete

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Modular Construction Market by Module

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Four-sided

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Open-sided

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Partially open-sided

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Mixed modules & floor cassettes

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

- 7.6 Modules supported by a primary structure

- 7.6.1 Key market trends, factors driving growth, and opportunities

- 7.6.2 Market size and forecast, by region

- 7.6.3 Market share analysis by country

- 7.7 Others

- 7.7.1 Key market trends, factors driving growth, and opportunities

- 7.7.2 Market size and forecast, by region

- 7.7.3 Market share analysis by country

8: Modular Construction Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Laing O’Rourke (UK)

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Red Sea Housing (Saudi Arabia)

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 Atco Ltd. (Canada)

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Skanska AB (Sweden)

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Modulaire Group (UK)

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Kleusberg GmbH (Germany)

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Lendlease Corporation (Australia)

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Bechtel Corporation (US)

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Fluor Corporation (US)

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Material |

|

By Module |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Modular Construction in 2030?

+

-

What is the growth rate of Modular Construction Market?

+

-

What are the latest trends influencing the Modular Construction Market?

+

-

Who are the key players in the Modular Construction Market?

+

-

How is the Modular Construction } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Modular Construction Market Study?

+

-

What geographic breakdown is available in Global Modular Construction Market Study?

+

-

Which region holds the second position by market share in the Modular Construction market?

+

-

Which region holds the highest growth rate in the Modular Construction market?

+

-

How are the key players in the Modular Construction market targeting growth in the future?

+

-