Global Molecular Biology Enzymes Reagents and Kits Market – Industry Trends and Forecast to 2030

Report ID: MS-2261 | Healthcare and Pharma | Last updated: Dec, 2024 | Formats*:

Molecular Biology Enzymes Reagents and Kits Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

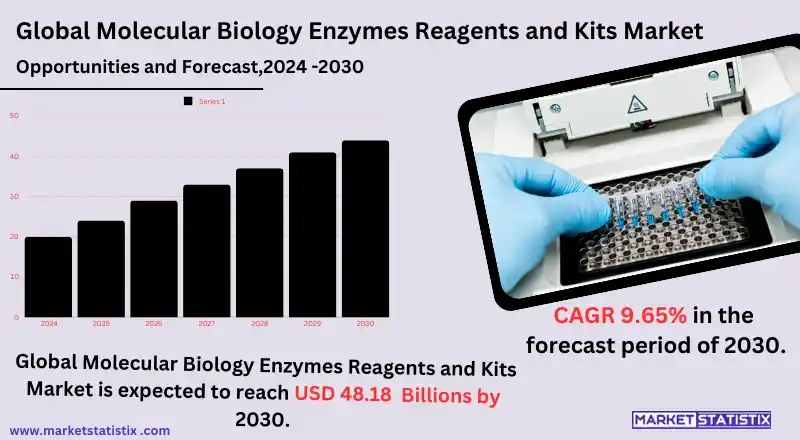

| Growth Rate | CAGR of 9.65% |

| Forecast Value (2030) | USD 48.18 Billion |

| By Product Type | Kits & Reagents, Enzymes |

| Key Market Players |

|

| By Region |

|

Molecular Biology Enzymes Reagents and Kits Market Trends

The market for molecular biology enzymes, reagents, and kits has been blossoming in demand concerning the recent advancements in the genomics, personalised medicine, and biotechnology fields. Major trends are into increased use of CRISPR and other gene-editing technologies, enjoying sufficient high-end enzymes and reagents for precision editing. It is also worth observing that the growth of considerable research into molecular diagnostics and infectious disease testing propels the demand for these tools for PCR amplification, DNA sequencing, and RNA analysis. Another area of increasing demand is the ready-to-use kits that help simplify complex laboratory processes and improve reproducibility. Such demand for these kits is particularly high in academic research, clinical diagnostics, and the pharmaceutical industry, where gaining time efficiency and cost savings are critical. Moreover, with an increased number of biotechnology and pharmaceutical companies focusing on drug discovery, prototyping, gene therapy, or vaccine manufacture, there is great drive toward engine-proof innovative enzyme solutions and reagents improving efficiency, scale, and accuracy in laboratory processes.Molecular Biology Enzymes Reagents and Kits Market Leading Players

The key players profiled in the report are Thermo Fisher Scientific, Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, Promega Corporation, New England Biolabs, Merck KGaA, F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Takara Bio, Inc., LGC Limited, Bausch Health Companies Inc.Growth Accelerators

The requirement for advanced research in genomics, proteomics, and molecular diagnostics propels the molecular biology enzymes, reagents, and kits market. The extension of research and development areas in biotechnology, pharmaceuticals, and health care generates a requirement for more rapid, efficient, and accurate approaches and tools for DNA/RNA analysis, funding gene editing, and protein manipulation. These tools sound well. All of them have been formulated and packaged into molecular biology reagents and kit solutions, setting them up throughout research laboratories, academic institutions, and biotech companies. Personalised medicine and a growing number of molecular diagnostics practices also fuel the development of this market. To complete molecular testing in cancer diagnostics, genetic screening, and infectious disease detection, clinical operations, enzymes, and reagents are applied more and more.Molecular Biology Enzymes Reagents and Kits Market Segmentation analysis

The Global Molecular Biology Enzymes Reagents and Kits is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Kits & Reagents, Enzymes . The Application segment categorizes the market based on its usage such as Cloning, Sequencing, PCR, Epigenetics, Restriction Digestion, Other Applications. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for molecular biology enzymes, reagents, and kits is both competitive and diverse; it's filled not only with huge corporations that attend to the different areas of this market but also with very small, innovative start-up companies. So far, companies like Thermo Fisher Scientific, Agilent Technologies, Roche, and Merck dominate the markets with their products for PCR, DNA sequencing, cloning, and gene expression analysis. These companies rely on competitive advantages for their powerful research and development activities, wide product portfolios, and extensive distribution channels. They usually pursue smaller companies or partner with research institutions for improvements to product offerings and access to new technologies.Challenges In Molecular Biology Enzymes Reagents and Kits Market

This makes the market of molecular biology enzymes, reagents, and kits suffer the challenge of their price due to high-priced advanced or specialised products. This conflict is faced by many research institutions, academic organisations, and smaller laboratories, limiting access to the most recently developed technologies. Alongside the reason, the fact that they are complex and specific products even increases the extent of chances for misuse or obtaining an inaccurate result. Another major challenge is the regulatory environment, requiring compliance with stringent requirements in different regions. The molecular biology field has very rigorous regulations, especially for clinical applications and diagnostics kit production. This often turns into delays in product approvals, increased development costs, and barriers to entry into the market for new companies. That fierce competition that exists makes it possible for any company to lose market share if constant investment in innovation and customer support is not carried out.Risks & Prospects in Molecular Biology Enzymes Reagents and Kits Market

Molecular Biology Enzymes, Reagents, and Kits The market is poised for enormous opportunity positively influenced by the growing demand for effective diagnostic tools and personalised medicines. With the growth of research in the fields of genomics, proteomics, and molecular diagnostics, there is a rising need for quality enzymes and reagents regarding applications like DNA amplification, gene editing, and protein analysis. Biotechnology and pharmaceutical industries, which are on the growing demand side for these reagents and kits in drug discovery, development, and clinical trials, would also offer opportunities. The world over, healthcare systems are making improvements in disease prevention, diagnosis, and treatment processes; consequently, the market for molecular biology products will broaden. In addition, emerging markets, especially Asia-Pacific, show clear potential since research activities are on the rise, government investments in health infrastructure are increasing, and awareness of genetic testing and personalised medicine is on the rise.Key Target Audience

Schools and research centres are the main targets for the molecular biology enzymes, reagents, and kits market, especially those engaged in genetics research, biochemistry, and biotechnology. Scientists and researchers in genomics, proteomics, and microbiology depend on these products in experiments such as DNA sequencing, PCR amplification, cloning, and gene editing. These institutions put a premium on high-quality and reliable reagents, enzymes, and kits because they are vital for ensuring accurate research and development results.,, Another key audience is comprised of pharmaceutical and biotechnology companies that depend on molecular biology for drug discovery, diagnostics, and gene therapy development. Such companies continue to seek sophisticated enzymes, reagents, and kits to support research toward developing the best products in pipeline therapies, from research to clinical applications.Merger and acquisition

The recent mergers and acquisitions (M&A) taking place in the molecular biology enzymes, reagents, and kits market are directed to strategically enhance product portfolios and technological capabilities. A prime talent acquisition in this respect was that of Aldevron LLC by Danaher Corporation, which inflated the company by $9.6 billion in June 2021. The signing was meant to improve the biotechnology reach of Danaher, particularly in gene therapies. Early in 2023, Ultima Genomics also aligned forces with New England Biolabs Inc. to prepare for a next-generation sequencing (NGS) enhancement of technologies for sequencing DNA, RNA, and methylation. Partnerships further support strategic manoeuvres, such as the one formed between Thermo Fisher Scientific and QIAGEN, where QIAGEN could add to its enzyme products for customised workflows in PCR, RNA analysis, and cloning DNA activities. They expand their reach in the areas of academic research and biotech sectors. >Analyst Comment

"The market for molecular biology enzymes, reagents, and kits is growing exponentially owing to the advances in biotechnology and various research and development activities in the life sciences sector. These products are useful in numerous applications, such as drug discovery, genetic research, and personal medicine. The key growth drivers of the market include a greater number of genetic disorders in the population, increased demand for molecular diagnostics, and the interest in personalised medicine."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Molecular Biology Enzymes Reagents and Kits- Snapshot

- 2.2 Molecular Biology Enzymes Reagents and Kits- Segment Snapshot

- 2.3 Molecular Biology Enzymes Reagents and Kits- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Molecular Biology Enzymes Reagents and Kits Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Kits & Reagents

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Enzymes

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Molecular Biology Enzymes Reagents and Kits Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Cloning

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Sequencing

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 PCR

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Epigenetics

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Restriction Digestion

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Other Applications

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: Molecular Biology Enzymes Reagents and Kits Market by End-use

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Pharma & Biotech

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Academic & Research

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Hospital & Diagnostics

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Others

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Molecular Biology Enzymes Reagents and Kits Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Thermo Fisher Scientific

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Inc.

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Illumina

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Inc.

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Agilent Technologies

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Inc.

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 QIAGEN

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Promega Corporation

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 New England Biolabs

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Merck KGaA

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 F. Hoffmann-La Roche Ltd.

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Bio-Rad Laboratories

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Inc.

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Takara Bio

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 Inc.

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 LGC Limited

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

- 9.17 Bausch Health Companies Inc.

- 9.17.1 Company Overview

- 9.17.2 Key Executives

- 9.17.3 Company snapshot

- 9.17.4 Active Business Divisions

- 9.17.5 Product portfolio

- 9.17.6 Business performance

- 9.17.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By End-use |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Molecular Biology Enzymes Reagents and Kits in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Molecular Biology Enzymes Reagents and Kits market?

+

-

How big is the Global Molecular Biology Enzymes Reagents and Kits market?

+

-

How do regulatory policies impact the Molecular Biology Enzymes Reagents and Kits Market?

+

-

What major players in Molecular Biology Enzymes Reagents and Kits Market?

+

-

What applications are categorized in the Molecular Biology Enzymes Reagents and Kits market study?

+

-

Which product types are examined in the Molecular Biology Enzymes Reagents and Kits Market Study?

+

-

Which regions are expected to show the fastest growth in the Molecular Biology Enzymes Reagents and Kits market?

+

-

Which application holds the second-highest market share in the Molecular Biology Enzymes Reagents and Kits market?

+

-

What are the major growth drivers in the Molecular Biology Enzymes Reagents and Kits market?

+

-