Global Motorcycle Rental Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2031

Report ID: MS-162 | Automotive and Transport | Last updated: Nov, 2024 | Formats*:

Motorcycle Rental Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

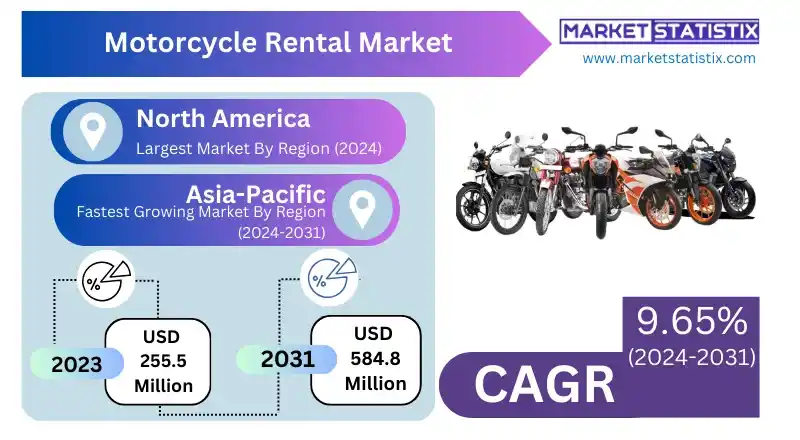

| Growth Rate | CAGR of 9.65% |

| Forecast Value (2031) | USD 584.8 Million |

| By Product Type | Luxury Motorcycle, Common Motorcycle |

| Key Market Players |

|

| By Region |

|

Motorcycle Rental Market Trends

The sector of renting motorcycles exhibits tremendous progress buoyed by the demand for traveling and eco-friendly tourism. Renting a bike is flexible and allows for time and space management, which has become a common trend owing to more than one traveller wishing to go out on adventurous holidays. This is more prevalent in areas where there are good sceneries, say, in Southeast Asia, Europe, and the Americas, where touring is favourable with the use of motorbikes. Another point worth noting is that the increase in popularity of renting motorbike services has been fuelled by the rise in solo and adventure tourism, where people want to experience more than the usual touristic offerings in a country. The use of technology aimed at providing consumer satisfaction is also another major trend observed in the motorcycle rental market. More and more companies that offer motorcycles on the shelf for the customers are starting to implement digital and mobile-based solutions for the bookings, payments, and vehicle administration. In this way, the customer-oriented services can be easily accessed by the users willing to rent a car, containing their preferred cabs, and following the position of their vehicles during the renting period. In addition, another trend that is gaining momentum in this segment is the use of electric motorcycles, as more and more travellers are becoming eco-friendly and looking for greener alternatives.Motorcycle Rental Market Leading Players

The key players profiled in the report are Rental 819 (Kizuki Rental Service), Motoroads, WickedRide Adventure Services Pvt. Ltd., The Hertz Corporation, Adriatic Moto Tours, MotoQuest, Harley-Davidson Inc., EagleRiderGrowth Accelerators

The demand for affordable and flexible transportation in tourist places and cities is the major driver for the motorcycle rental market. Global tourism is increasing, and therefore, travellers are looking for faster and cheaper modes of transport for new places other than hiring cars, and here motorcycles are more efficient than renting a car. They are of small size, easy to use, and can help cut through traffic, therefore increasing the rental demand in cities that are highly congested and the regions that have scenic driving routes. Also, the growing concern of people towards transport that is sustainable eases the acceptance of this trend. Generally, motorcycles have a lesser impact on the environment than cars, more so the electric motorcycles, which are on the upswing in the towns as replacements of car engines. Also, motorcycle rental consumption has been increasing due to the on-demand scooter rental business model that utilizes mobile applications for users to rent motorcycles from several suppliers. The rider-sharing schemes and the popularity of motorbikes for short distances have also enhanced the market’s growth.Motorcycle Rental Market Segmentation analysis

The Global Motorcycle Rental is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Luxury Motorcycle, Common Motorcycle . The Application segment categorizes the market based on its usage such as Motorcycle Tourism, Commutes. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

In addition, the dynamic state of competition in the motorcycle hiring segment is changing as many organizations are also seeking capital by forming alliances or buying out other companies in order to improve service delivery. Firms such as Edelweiss Bike Travel and West Coast Motorcycle Hire have made it their goal to widen their scope of operations through strategic alliances. There is a rise in the number of subscribers in the renting sector that is flexible and very convenient for the user. As the growth of the motorcycle rental business progresses, these activities will facilitate advances in technology and efficiency within the concerned industries, enabling them to better address the increased demand for motorcycle rentals in metropolitan and tourism-cantered areas.Challenges In Motorcycle Rental Market

Safety and compliance with the law are some of the greatest difficulties encountered in the motorcycle hire business. This is particularly important to safeguard riders against injuries or lawsuits and to prevent any governmental interventions from arising. Most regions have various restrictions about wearing helmets, age, licensing, and others, which, of course, the rental companies have to observe. Also, there are issues regarding the maintenance of the motorcycles, since one of the objectives that must be met in order to avoid accidents and ensure the contentment of clients is the regular servicing of every bike and keeping them in perfect working order. Another obstacle is high competitiveness and market congestion. Thanks to the rise of application-based vehicle hailing and shared user services, several customers today have many means of short-distance travel, including electric bikes and scooters. This means that most motorcycle rental services have to occupy a competitive position and offer more than just reasonable prices and good services but also invest in their fleet.Risks & Prospects in Motorcycle Rental Market

The motorcycle rental industry has promising prospects within the expanding tourism and travel market. More and more travellers want easy-to-use, to some extent adventurous, and affordable ways of getting around the places they visit, which is where motorcycle rentals come in handy for exploring even the countryside. This market is also found in the outskirts of the major cities where the demand is high, as tourists prefer motorcycle rentals to the traditional car hire services, which tend to be hydrocarbons and less affordable. Moreover, the increase in the use of online websites that assist in the process of booking in advance has come in handy to avail the service to many tourists who are willing to pay for it even if it’s not their region. In addition, there is an opportunity considering the growth in the use of motorcycles for last-mile services and for covering short distances within towns. In congested cities, for example, providing motorcycle rental services is very helpful for people who desire efficient transportation within the shortest time possible at a reasonable price, and hence the demand for the service. Moreover, going by the trend of population looking for shared mobility services coupled with the concern about going green, the rental firms can also avail electric motorcycles for hire, targeting the eco-minded consumers. This change is in line with sustainability strategies in cities, creating a bright future for growth in the motorcycle renting business.Key Target Audience

In the motorcycle rental sector, the major target market comprises tourists and travellers who are in search of convenient and cost-effective means of transport. This applies to most individuals who find it easier to rent a motorbike when touring new places such as cities or even regions, which are dominated by long, beautiful sceneries or heavy traffic jams. This is because motorcycles are more flexible, easily parked, and can manoeuvre in spaces and traffic where other vehicles cannot. This group also consists of those adventure travellers who take up motorcycles for long-distance trips, which involves riding on and off the road in demanding conditions as well as enjoying the ride.,, Another prominent audience is local travellers and those who require transportation for a very short period of time. This includes persons who do not possess a motorcycle but may need to use one for reasons such as going on a work trip, a short holiday, or a social event. Moreover, the motorcycle rental services are also used by fast food and other small businesses for their logistics purposes, mostly in the urbanized or inaccessible regions. The other consumers who are catered to in this market are those who would like to sample a number of types or brands of the products before they buy them, and these sell them on a rental basis.Merger and acquisition

The surge in the demand for flexible mobility options and the emergence of electric two-wheeled vehicles have also led to significant mergers and acquisitions in the motorbike rental industry. In March 2022, Indian mobility venture Chalo took over Vogo, a two-wheeler scooter rental firm based in Bengaluru, as a major step towards embracing electric vehicles in their fleet. This move is consistent with the DE transformation, where companies are choosing green transportation alternatives owing to global warming and the changing preferences of consumers for green modes of transportation. Furthermore, in April 2024, Royal Enfield expanded its reach to 52 tourist destinations worldwide by introducing a system for renting out motorcycles, pointing to further plans to tap into the expanding market for motorcycle tourism.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Motorcycle Rental- Snapshot

- 2.2 Motorcycle Rental- Segment Snapshot

- 2.3 Motorcycle Rental- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Motorcycle Rental Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Luxury Motorcycle

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Common Motorcycle

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Motorcycle Rental Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Motorcycle Tourism

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commutes

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Motorcycle Rental Market by Booking Channel

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Websites

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Apps

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Motorcycle Rental Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Rental 819 (Kizuki Rental Service)

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Motoroads

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 WickedRide Adventure Services Pvt. Ltd.

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 The Hertz Corporation

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Adriatic Moto Tours

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 MotoQuest

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Harley-Davidson Inc.

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 EagleRider

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Booking Channel |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Motorcycle Rental in 2031?

+

-

What is the growth rate of Motorcycle Rental Market?

+

-

What are the latest trends influencing the Motorcycle Rental Market?

+

-

Who are the key players in the Motorcycle Rental Market?

+

-

How is the Motorcycle Rental } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Motorcycle Rental Market Study?

+

-

What geographic breakdown is available in Global Motorcycle Rental Market Study?

+

-

Which region holds the second position by market share in the Motorcycle Rental market?

+

-

How are the key players in the Motorcycle Rental market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Motorcycle Rental market?

+

-