Global Narrowband IoT Chipset Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2032

Report ID: MS-638 | Energy and Natural Resources | Last updated: Mar, 2025 | Formats*:

Narrowband IoT Chipset Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

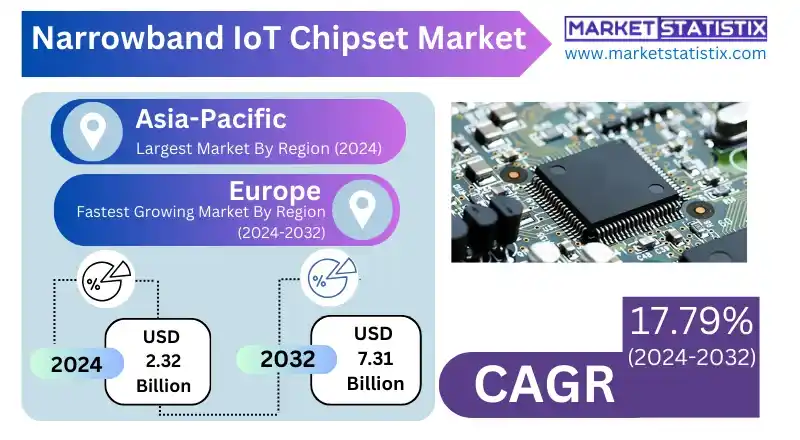

| Growth Rate | CAGR of 17.79% |

| Forecast Value (2032) | USD 7.31 Billion |

| Key Market Players |

|

| By Region |

|

Narrowband IoT Chipset Market Trends

The Narrowband IoT (NB-IoT) chipset market is extremely competitive and is primarily powered by the growing adoption of LPWAN technologies in a variety of IoT applications. One notable trend is the gradually increasing need for more enhanced, power-efficient, new coverage and more secure chipsets that can be deployed for large-scale IoT networks. In fact, the market is significantly divided regionally. Truly, Asia-Pacific has led the list for the greatest number of users in chipsets adopted because of rampant industrialization and growing investments from the competition due to the smart city project. Such applications that have risen recently in this region have revolved around smart agriculture, asset tracking, and smart metering. This growth trend in chipset adoption due to infrastructure availability and direct proliferation of 5G networks for NB-IoT consumers all further contribute to market growth on a global scale. It opens many possibilities across industries for low-power connectivity for their IoT installations.Narrowband IoT Chipset Market Leading Players

The key players profiled in the report are Sequans Communications S.A., Sanechips Technology Co.Ltd., Intel Corporation, MediaTek Inc., U-blox Holding AG, Nordic Semiconductor ASA, Sercomm Corporation, Qualcomm Inc., Huawei Technologies Co. Ltd., Samsung Electronics Co.Ltd.Growth Accelerators

The NB-IoT chipset market is mainly driven by the growing requirement for low-power and wide-area connecting solutions for various IoT devices. Rapid smart city initiatives, increased incorporation of smart metering and asset tracking applications, and the growing requirement for IoT deployment efficiency and cost-effectiveness are some of the major accelerators. The fact that these chipsets are capable of deep indoor coverage and long battery life makes them best suited for applications demanding infrequent data uploads over a longer period of time. In addition, the development of infrastructure for cellular IoT systems and their increasing NB-IoT network coverage propel the market. Enhanced national initiatives regarding IoT development drive the standardization of NB-IoT technology and quality, which builds the market. IIoT applications such as remote monitoring and predictive maintenance need high reliability and security for industrial growth, creating a need for NB-IoT chipsets. It also has much effect on more general applications, such as environmental monitoring, through broader and more effective data collection from sensors being widely deployed.Narrowband IoT Chipset Market Segmentation analysis

The Global Narrowband IoT Chipset is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Smart Metering, Trackers, Alarms & Detectors, Asset Tracking, Wearable Devices. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

NB-IoT chipsets generally have a very dynamic competitive environment, where important players try to attain prime positions in a rapidly expiring market. In this contest are major semiconductor companies, telecommunications giants, and emerging IoT solution providers. The parameters defining the competitive structure include innovation, cost-effectiveness, and provision of reliable and secure connectivity solutions. Among the companies occupying most of the limelight are Qualcomm, Huawei, and U-Blox, all of which are engaged in continuous research and development to further advance chipset performance and diversify product offerings. Competition from alternative LPWAN technologies is heating up now, forcing NB-IoT chipset suppliers to constantly innovate and differentiate their products to stay competitive.Challenges In Narrowband IoT Chipset Market

The NB-IoT chipset market faces many hurdles that it must overcome to be successful. The first key area that is problematic is the lack of standardization for all IoT protocols and LPWAN technologies, which creates interoperability issues and limits the ability for seamless integration of NB-IoT chipsets into varying applications. Also, competition from other LPWA technologies, such as LoRaWAN, Sigfox, and LTE-M, can pose challenges, as these technologies may present some advantages in bandwidth and latency in certain use cases. Additionally, the high initial deployment costs serve as a barrier, especially for small-scale enterprises and developing regions. Another area of challenge remains the technical complexity surrounding NB-IoT chipsets, which includes power efficiency and network coverage issues in challenging environments. These chipsets were mainly developed for low-speed applications and thus restrict their use for high-speed applications such as video surveillance and advanced industrial automation. As it stands, addressing those issues would require R&D investment to improve chipset performance, create better protocols for security, and develop a cost-oriented solution for different IoT applications.Risks & Prospects in Narrowband IoT Chipset Market

The low-power, wide-area connectivity demand is increasing in agriculture (smart farming), logistics (supply chain tracking), and healthcare (remote patient monitoring). In addition to that, by combining NB-IoT with the 5G networks and implementing advanced chipset features such as better power efficiency and enhanced security, the market will enhance its growth opportunities. On a regional level, Asia-Pacific is likely to take the lead as a highly lucrative market, owing to fast-paced industrialization and increasing initiatives towards developing smart cities as well as government initiatives supporting IoT deployments. China, South Korea, and Japan are writing the NB-IoT technology adaptation scripts. Europe is another important market, fuelled mainly by very vigorous energy efficiency regulations and high investments in smart infrastructure. North America has witnessed a gradual but steadfast growth trajectory, especially with regards to utility and logistics, spurred by increased demand for remote monitoring and asset tracking solutions. Emerging markets in Latin America and Africa are also expected to propel market growth, thanks to their investments in infrastructure and intelligent technologies.Key Target Audience

, The Narrowband IoT (NB-IoT) Chipset Market primarily aims its target audience across a wide range of industries and applications, especially focusing on those requiring low-power, wide-area connectivity applications. Utilities wishing to deploy smart metering solutions, asset tracking and logistics firms wishing to monitor their goods and equipment, and municipal bodies implementing smart city solutions such as environmental and street-lighting control all fall into this category., The applications also include developers and manufacturers of IoT devices such as those in smart agriculture, health care, and consumer electronics. A value for them would be a reliable and low-cost chipset that allows integration of NB-IoT connectivity in their products to facilitate long-range communication with minimal power consumption. The telecom operators and providers of network infrastructure are also an important set of audiences, as they deploy and maintain the NB-IoT networks on which the chipsets rely. All in all, the market targets whoever wants to connect low-bandwidth devices across larger areas with extended battery life.Merger and acquisition

In August 2024, Qualcomm Technologies, Inc. signed a definitive deal to acquire the 4G IoT technology for Qualcomm Technologies, Inc. to enhance its Industrial IoT portfolio with low-power optimized cellular connectivity solutions from Sequans, a leading provider of 4G and 5G semiconductor solutions for IoT. The acquisition includes select employees, assets, and licenses; Sequans holds a global perpetual license to continue utilizing the 4G IoT technology for its ongoing operations. By September 2024, this transaction was completed, enabling the incorporation of Sequans' 4G IoT technologies within the Qualcomm comprehensive spectrum of products. Hence, this integration will enable the company to enhance its range of available and future low-power, reliable industrial IoT applications. Meanwhile, Sequans retains ownership of 5G technology and will continue developing its 5G portfolio with solid strength across its financial assets. >Analyst Comment

There's a rapid growth rate in the Narrowband IoT (NB-IoT) Chipset Market primarily due to the increasing deployment of IoT devices in different sectors. The market also generates demand for low-power, wide-area connectivity solutions that enable long-range communication with low energy consumption. Major growth drivers are the progressive smart city missions, increasing uptake of asset tracking and remote monitoring applications, and the ever-expanding need for effective yet cost-effective IoT connectivity. Rapid advancement in chipset design technology integrated into a wider coverage of NB-IoT networks fuels the market.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Narrowband IoT Chipset- Snapshot

- 2.2 Narrowband IoT Chipset- Segment Snapshot

- 2.3 Narrowband IoT Chipset- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Narrowband IoT Chipset Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Smart Metering

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Asset Tracking

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Trackers

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Alarms & Detectors

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Wearable Devices

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Narrowband IoT Chipset Market by End-User

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Smart Cities

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Smart Agriculture

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Healthcare

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Narrowband IoT Chipset Market by Deployment Type

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 In-Band

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Guard Band

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Stand-Alone

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Narrowband IoT Chipset Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Qualcomm Inc.

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Sanechips Technology Co.Ltd.

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Sequans Communications S.A.

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Huawei Technologies Co. Ltd.

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Sercomm Corporation

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Nordic Semiconductor ASA

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 U-blox Holding AG

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Intel Corporation

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 MediaTek Inc.

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Samsung Electronics Co.Ltd.

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

By End-User |

|

By Deployment Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Narrowband IoT Chipset in 2032?

+

-

What is the growth rate of Narrowband IoT Chipset Market?

+

-

What are the latest trends influencing the Narrowband IoT Chipset Market?

+

-

Who are the key players in the Narrowband IoT Chipset Market?

+

-

How is the Narrowband IoT Chipset } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Narrowband IoT Chipset Market Study?

+

-

What geographic breakdown is available in Global Narrowband IoT Chipset Market Study?

+

-

Which region holds the second position by market share in the Narrowband IoT Chipset market?

+

-

Which region holds the highest growth rate in the Narrowband IoT Chipset market?

+

-

How are the key players in the Narrowband IoT Chipset market targeting growth in the future?

+

-