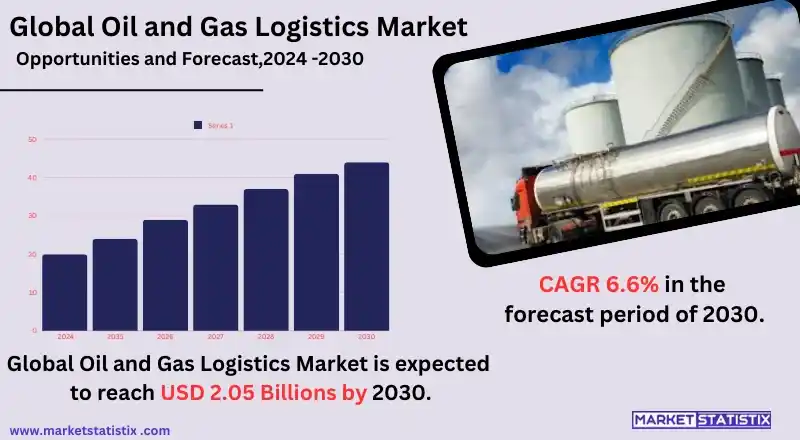

Global Oil and Gas Logistics Market – Industry Trends and Forecast to 2030

Report ID: MS-2141 | Automotive and Transport | Last updated: Dec, 2024 | Formats*:

Oil and Gas Logistics Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 6.6% |

| Forecast Value (2030) | USD 585.3 Billion |

| By Product Type | Pipeline, Railroads, Tanker and trucks |

| Key Market Players |

|

| By Region |

|

Oil and Gas Logistics Market Trends

The soaring global energy consumption coupled with rising exploration and production activities in both offshore and far-flung areas is one of the factors compelling the growth of the oil and gas logistics market. As a result, companies are embracing new technologies, including the Internet of Things, artificial intelligence, and blockchain for better supply chain visibility, more efficient resource allocation, and decreased operating expenses. Moreover, the trends of automation, which entail the use of self-driving vehicles and even drones for delivery and surveillance, are revolutionizing the logistics sector thanks to enhanced speed and security. Furthermore, external factors such as geopolitics and pandemic-associated supply chain challenges have been compelling firms to find alternative sources and hence develop more robust supply chains. Dynamics of the market are also changing in light of increasing focus on the sustainable development of business activities as the restrictions on environmental pollution and the energy transition become actionable. To this end, firms have begun adopting greener means of transportation such as LNG-carrying vessels and electric cars. There is also an increasing focus on the provision of integrated logistics solutions to support the changes taking place within the oil and gas sector.Oil and Gas Logistics Market Leading Players

The key players profiled in the report are GasLog Ltd., Teekay Corporation, Savage Services Corporation, Koninklijke Vopak N.V., P. Moller Maersk A/S, Lindsay Transport, Danos, TechnipFMC plc., Vallourec S.A., McDermott International, Inc.Growth Accelerators

The increasing energy demand in industrial, residential, and transportation sectors globally is the primary factor driving the growth of the oil and gas logistics market. Rising urbanization and industrialization, especially in developing countries, create a great need for efficient transportation and storage of oil and gas. Also, an increase in exploration technologies and the extension of offshore drilling activities have made the supply chain systems more complex to support operations in far and difficult places. Another factor that is driving the market is the improved logistics operational performance due to the introduction of digital technologies and automation. Logistics practices take advantage of innovations such as real-time visibility, data analytics, and artificial intelligence-based tactical logistics planning, which aids in decision-making while avoiding delay or disruption risks. In addition, the increasing concern towards environmental degradation and climate change, such as using renewable energy and low-emission transport, also influences how players in the market develop their strategies to comply with the laws and environmental concerns.Oil and Gas Logistics Market Segmentation analysis

The Global Oil and Gas Logistics is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Pipeline, Railroads, Tanker and trucks . The Application segment categorizes the market based on its usage such as Onshore, Offshore. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competition in the oil and gas logistics market is composed of global logistics companies, local players, and oil companies that have in-house supply chain management systems. To be among the contenders, logistics companies such as DHL, Schlumberger, and Halliburton are incorporating current technologies such as IoT, AI, and blockchain into their operations to make them more efficient and safer, and at the same time cost-effective. In addition, due to the concern of better regional coverage and logistics networks optimization, inter-firm strategic alliances, mergers, and acquisitions are common practices as well.Challenges In Oil and Gas Logistics Market

The oil and gas logistics market is impacted by a range of factors, including political risk and oil and gas demand and supply patterns. Dependencies of many countries on certain regions for oil and gas exports or imports contribute to crises and therefore high prices. In addition, the industry is facing pressure to go green due to global warming and the environmental agenda in the mission while these strategies search for other renewable energy sources. These necessitate logistics solutions that are adaptive and far-sighted in order to avoid losses. Emerging markets, on the other hand, have limited infrastructure as well as technology adoption. Lack of developed road, rail, and port networks in major producing areas may result in the inefficient transportation of oil and gas commodities. On the other hand, though the new technologies would enhance the optimization of business processes, particularly with the use of digitalization and advanced analytics, still a lot of companies cannot afford them or are against their adoption. As a result, these logistical shortcomings not only increase costs but also affect delivery schedules and competitiveness in the market.Risks & Prospects in Oil and Gas Logistics Market

The logistical aspect of the oil and gas sector has numerous prospects due to the increased global appetite for energy and efficient transportation, as well as supply chain management solutions. With more oil and gas exploration done, especially offshore and in the aunt group reserves, there is also a need for enhanced logistics services like pipelines, offshore supply vessels, and even rail or road transportation. The results also indicate that emergent economies with the expanding industrial sector and energy consumption require a well-organized logistics system. In addition, the connectivity offered by such internet capabilities is changing the digital logistics landscape with the use of IoT for tracking items, blockchain for transactions, and automation for stock control, among other aspects. With these new ideas, they help in streamlining the processes, cutting the cost, and increasing the clarity of the processes. In addition, the shift from traditional fuels to cleaner options such as liquefied natural gas (LNG) presents an opportunity for logistic players. Firms that expand in oil and gas logistics in aspects of environmental sustainability and safety are likely to benefit from the current tendencies of stricter environmental policies and management of risks.Key Target Audience

Oil and gas exploration and production companies, refineries, and distributors, among others, are key target customers for the oil and gas logistics market. They depend on effective logistical services for the movement, storage, and distribution of materials such as crude oil, natural gas, and refined products and equipment. Logistics market players serving these clients ensure that materials are supplied on time, as well as managing and reducing inefficiencies in the delivery of goods and services and reducing costs, all of which allow smooth operation within the upstream, midstream, and downstream activities. Certain services, such as pipeline transport, marine transport, and storage of tanks, on the other hand, provide additional approaches suited for the strategies in this particular market.,, In addition, they are also significant stakeholders: the heavy equipment producers, building companies, and state authorities. These ones more frequently rely on third-party services for delivering oversized containers, ports, or pipe systems and other supplies to distant offshore projects. The state and its agencies are also important players in this market; they affect it through tenders and prescriptions on when to build certain facilities. Oil and gas logistics providers thus offer vital support in the implementation of the industry’s global business expansion strategy by meeting the demands of these varying segments.Merger and acquisition

The most recent consolidation activities in the oil and gas logistics industry have influenced the changes in market dynamics. In this respect, ConocoPhillips’ takeover of Marathon Oil, whose value is estimated at $22.5 billion, has been regarded as one of the largest deals executed in the second quarter of 2024. Such a strategy aims towards resource consolidation and operational efficiency under the ever-changing need for energy. Also, the acquisition of Western Midstream by Crescent Energy, which took place in the investment area of pipeline logistics, also attests to the recent interest in midstream development in the improvement of supply chain management. In addition, ADNOC Logistics & Services bought out Navig8 Topco Holdings in an effort to enhance its shipping and storage capacities on a global scale. In the same fashion, SilverBow Resources secured its merger with some partners, which was also strategic, because the niche is determined to scale. All these transactions demonstrate the reality of strategic direction towards achieving success through vertical integration in the ever-changing energy sector.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Oil and Gas Logistics- Snapshot

- 2.2 Oil and Gas Logistics- Segment Snapshot

- 2.3 Oil and Gas Logistics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Oil and Gas Logistics Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Pipeline

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Railroads

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Tanker and trucks

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Oil and Gas Logistics Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Onshore

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Offshore

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Oil and Gas Logistics Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 GasLog Ltd.

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Teekay Corporation

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Savage Services Corporation

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Koninklijke Vopak N.V.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 P. Moller Maersk A/S

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Lindsay Transport

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Danos

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 TechnipFMC plc.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Vallourec S.A.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 McDermott International

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Inc.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Oil and Gas Logistics in 2030?

+

-

How big is the Global Oil and Gas Logistics market?

+

-

How do regulatory policies impact the Oil and Gas Logistics Market?

+

-

What major players in Oil and Gas Logistics Market?

+

-

What applications are categorized in the Oil and Gas Logistics market study?

+

-

Which product types are examined in the Oil and Gas Logistics Market Study?

+

-

Which regions are expected to show the fastest growth in the Oil and Gas Logistics market?

+

-

What are the major growth drivers in the Oil and Gas Logistics market?

+

-

Is the study period of the Oil and Gas Logistics flexible or fixed?

+

-

How do economic factors influence the Oil and Gas Logistics market?

+

-