Global OLED Lighting Market - Industry Dynamics, Size, And Opportunity Forecast To 2030

Report ID: MS-581 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

OLED Lighting Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

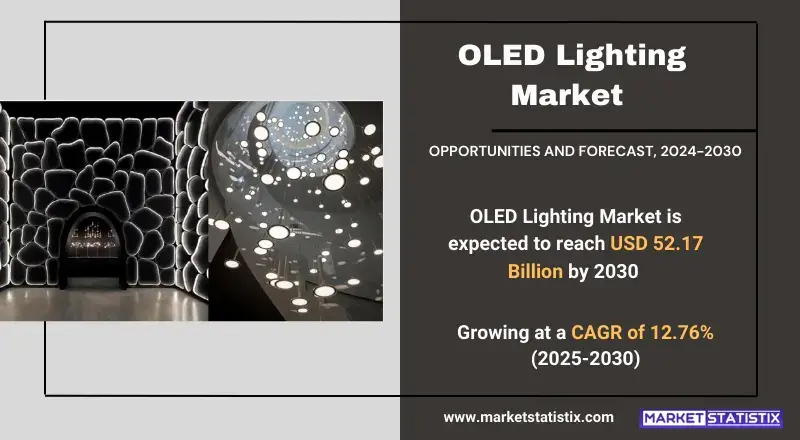

| Growth Rate | CAGR of 12.76% |

| Forecast Value (2030) | USD 52.17 Billion |

| By Product Type | AMOLED, PMOLED |

| Key Market Players |

|

| By Region |

OLED Lighting Market Trends

Betting on niche use applications, the trend in the OLED lighting market is gradual but sure. Architectural and decorative lighting are growing, where designers take advantage of the characteristics of OLED's thinness and flexibility to create new forms of installation using diffused light. Automotive interior and exterior lighting are also emerging, where sleek, customizable solutions are offered by OLED. Apart from that, another driving trend is for higher efficiency and cost reduction. Manufacturers are spending on research and development to improve OLED life, brightness, and energy efficiency so that the technology becomes more competitive with the current sources of traditional lighting and LEDs. More manufacturing processes are also being streamlined and scaled up for cost-lowering and enhanced accessibility. Although they have to depend on specialized applications and technological advancement to jump into general lighting, the industry is going.OLED Lighting Market Leading Players

The key players profiled in the report are Robert Bosch GmbH, Rit Display, IPG Automotive, Visionox, TDK Corporation, eMagin Corporation, Sony Corporation, Samsung Electronics, AU Optronics Corp, LG Electronics, BOE Display, Universal Display CorporationGrowth Accelerators

An OLED lighting market has been emerging owing to the special design flexibility and aesthetic beauty of OLED technology. As a result, they have helped develop thin, transparent, and flexible light sources. The creation of such possible light sources has brought a new prospect in architectural, automotive, and decorative designs. Thus, innovative and artistic playing lighting has increased demand for indoor and outdoor applications in these entities. Moreover, diffuse and glare-free lighting quality also adds to the comfort of users, hence valorizing these OLEDs for applications requiring high-quality illumination. Another important driving factor is the increasing importance of energy-efficient and sustainable lighting. Today, though more expensive than LEDs in their initial costing, OLEDs are expected to save energy costs and have a smaller environmental footprint in the future. Market developments are also manifest in the trend of incorporating more of such smart lighting systems and eventually coupling them with IoT devices while having OLEDs integrated into it. Such possibilities of a personalized lighting experience created from dynamically controlling the OLED panels have sparked interest across different sectors.OLED Lighting Market Segmentation analysis

The Global OLED Lighting is segmented by Type, Application, and Region. By Type, the market is divided into Distributed AMOLED, PMOLED . The Application segment categorizes the market based on its usage such as PC Monitors & Laptops, Smart Wearables, Automotive Display, Television Sets, Smartphones & Tablets, Digital Signage/Large Format Displays, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for OLED in lighting is characterized by competitive concentration by key players, which majorly comprise large electronics and display manufacturers investing heavily in OLED technology. These companies actively pursue the improvement of OLED efficiency, lifetime, and production scale-up for cost reduction and market expansion. Most of the competition is driven by technology, with an emphasis on flexible, transparent, and high-performing OLED panels. Strategic partnerships and collaboration are equally essential for gaining access to deep-level materials, manufacturing capabilities, and distribution channels.Challenges In OLED Lighting Market

The OLED lighting market does have many challenges before it can become established. High cost of entry is one big issue with OLED lighting technology when comparing it to conventional lighting solutions. OLED benefits include energy efficiency and design flexibility, but the conversion of manufacturing processes and expensive materials means higher investment in the upfront, thus making them the selection of choice for cost-averse customers and businesses. The other challenge is fierce competition from other lighting technologies, especially the LEDs, which have now matured and provide comparable energy efficiency at a lower price. LEDs shine bright and last longer, thus making them more attractive to many applications. The disposal and recycling of OLED products also have environmental considerations attached to them, providing a challenge since their improper disposal directly feeds into the electronic waste.Risks & Prospects in OLED Lighting Market

Strong growth opportunities are marked by the increased demand for environmentally friendly and customizable lighting solutions, alongside ongoing advancements in manufacturing processes that lower costs. Government initiatives beyond Europe and North America can spur adoption while further driving innovative market niches for smart lighting systems integrated with IoT. Regionally, Asia Pacific dominates the OLED light market, due to robust manufacturing hubs in South Korea, Japan, and China, where industries such as LG Display and Samsung are world leaders in production. Rapid urbanization drives demand, coupled with consumer electronics growth, prompting projections of an increase in market size from $1.68 billion in 2025 to over $4.5 billion by 2032. Europe is fast adopting OLED in luxury automotive applications, driven mainly by stringent environmental laws, while North America steadily embraces it in commercial and high-end residential spaces through technological innovations and infrastructure investments.Key Target Audience

The OLED lighting market has multiple target audience groups, including architects and interior designers who are in search of innovative and aesthetically pleasing products suitable for high-end residential or commercial spaces. These professionals appreciate OLEDs for their unique design flexibility and brilliant quality of light that allow them to create distinctive and immersive environments. Automotive manufacturers also represent a key target audience, as OLEDs offer unique opportunities for creating innovative lighting systems for vehicle interiors and exteriors to enhance safety and design attraction.,, The market also targets consumers interested in lighting on the premium side and energy-efficient for home and office applications. This includes individuals and businesses with a strong focus on sustainability, advanced technologies, etc. Niche applications such as medical lighting and display lighting also address small markets that find specific characteristics of lighting indispensable. The growth of the market rests on successfully making OLED lighting's benefits—calling out design flexibility, energy efficiency, and light quality—good matters across this group of diverse target audiences.Merger and acquisition

One of the most recent activities in M&A across the OLED lighting segment is still a thin activity as compared to the display sector. Most companies are focusing on technological partnerships and organic growth instead of mergers and acquisitions. However, a few mega companies merged to strengthen their capabilities. For instance, in 2023, OLEDWorks, a key player in OLED lighting, acquired certain assets from a smaller innovator in organic lighting solutions to boost its production efficiency and expand its portfolio for automotive and architectural applications. It might seem that the new OLED lighting market is full of promise. However, high production costs and competition from LEDs often show their influence on the M&A strategies. Larger companies like LG Display and Samsung, which are very active in OLED displays, reserved their pursuance of acquisition for lighting applications but instead turned to other lights integrated with their larger OLED ecosystems through internal R&D or cooperation. LG Chem's earlier acquisition in 2017 of LG Display's OLED lighting department still remains historically relevant, with its ambition to pool expertise. Current M&A activity is shifting toward strategic alliances rather than outright purchases, as firms prioritize cost reduction and scalability to compete in a market projected to grow from $1.68 billion in 2025 to more than $4.5 billion by 2032. >Analyst Comment

Due to its unique aesthetic and functional advantages, gradual growth is being noticed in the OLED lighting market: thin, flexible designs of light and diffuse, high-quality light. Although it is still a niche market compared to LED lighting, OLEDs have started finding utility in architectural lighting, automotive interiors, and premium decorative lighting. Constraints to the growth of this market are high production costs and the lesser efficiency of OLEDs compared with LEDs. Nonetheless, R&D is intensive to address these challenges. Human-centric lighting is emerging as a key accessory for allowing designers to implement their creative freedoms, which serves as a big pull factor in OLED adoption in specialized applications.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 OLED Lighting- Snapshot

- 2.2 OLED Lighting- Segment Snapshot

- 2.3 OLED Lighting- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: OLED Lighting Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 AMOLED

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 PMOLED

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: OLED Lighting Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Smartphones & Tablets

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 PC Monitors & Laptops

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Television Sets

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Digital Signage/Large Format Displays

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Smart Wearables

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Automotive Display

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Others

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: OLED Lighting Market by Prouct

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 OLED Display

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 OLED Lighting

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: OLED Lighting Market by Panel Type

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Rigid

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Flexible

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Others

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: Competitive Landscape

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Samsung Electronics

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 LG Electronics

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Sony Corporation

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 AU Optronics Corp

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 BOE Display

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 IPG Automotive

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Robert Bosch GmbH

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 TDK Corporation

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Rit Display

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Visionox

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 eMagin Corporation

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Universal Display Corporation

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Prouct |

|

By Panel Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of OLED Lighting in 2030?

+

-

How big is the Global OLED Lighting market?

+

-

How do regulatory policies impact the OLED Lighting Market?

+

-

What major players in OLED Lighting Market?

+

-

What applications are categorized in the OLED Lighting market study?

+

-

Which product types are examined in the OLED Lighting Market Study?

+

-

Which regions are expected to show the fastest growth in the OLED Lighting market?

+

-

Which region is the fastest growing in the OLED Lighting market?

+

-

What are the major growth drivers in the OLED Lighting market?

+

-

Is the study period of the OLED Lighting flexible or fixed?

+

-