Global Orthopedic joint replacement Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-2125 | Healthcare and Pharma | Last updated: Dec, 2024 | Formats*:

Orthopedic joint replacement Report Highlights

| Report Metrics | Details |

|---|---|

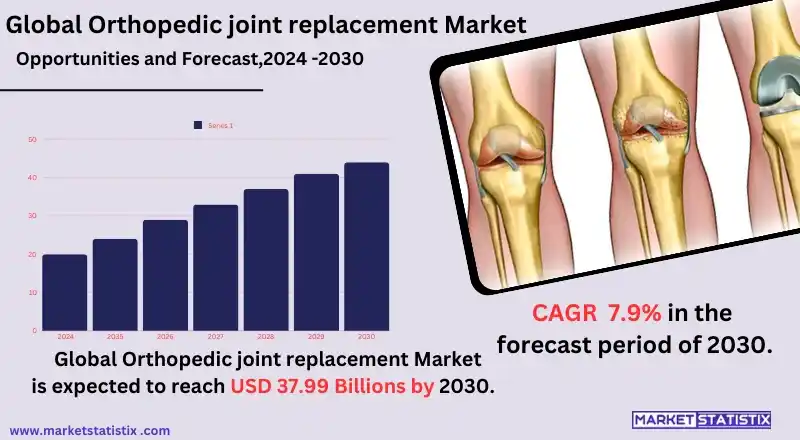

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 7.9% |

| Forecast Value (2030) | USD 37.99 Billion |

| By Product Type | Total Replacement, Partial Replacement, Others |

| Key Market Players |

|

| By Region |

|

Orthopedic joint replacement Market Trends

The orthopedic joint replacement market is currently in a transitional phase with a move towards minimally invasive surgeries and robotic-related surgeries. Such advancements in technology have improved precision, reduced the time taken to convalesce after surgery, and improved the general outcome of the patient, which has hence increased the demand for sophisticated surgical instruments and implants. The use of robotic systems and computer navigation systems is on the rise because they offer better and well-placed implants than in the standard joint replacement operations, hence fewer complications and risks involved. Additionally, customized and patient-specific joint prosthetics are on the rise owing to the enhanced experimental 3D printing technologies and biomaterials. The use of such custom-made implants that conform to the design of the individual is surging and is enhancing the fit and durability of the implants. A geriatric tendency also plays a significant role owing to the fact that elderly patients tend to get more surgical interventions, especially arthritis cases, which in turn leads to a higher market share of knee implants. This is because with the increase in chronic muscle wear and tear-related treatments and increased life span, the requirements for knee replacement operations will invariably escalate.Orthopedic joint replacement Market Leading Players

The key players profiled in the report are Stryker (U.S.), Johnson & Johnson Services, Inc. (U.S.), Smith + Nephew (U.K.), Zimmer Biomet (U.S.), Bioimpianti (Italy), Conformis (U.S.), MicroPort Scientific Corporation (China), Enovis (U.S.) , B. Braun Melsungen AG (Germany)Growth Accelerators

The key factor propelling the expansion of the orthopaedic joint replacement market is the increasing incidence of orthopaedic conditions like osteoarthritis and rheumatoid arthritis, particularly in the ever-increasing aged population around the world. Increasing elderly populations all over the world have also increased demand for joint replacement surgeries, particularly for hips as well as knees. Moreover, improving education levels and growing adoption of advanced surgical techniques, such as minimal access surgeries, are also aiding the market growth, as these procedures help the patients in quick recovery and better results, making joint replacement surgeries more feasible and appealing. One more prominent factor is the persistent enhancements in the technologies behind the implants, which encouraged the design of stronger and better-functioning biological prostheses. These advancements have also improved the rates of success (and the period of survivorship) of joint replacements, which empowers both the patients and the practitioners to seek these interventions.Orthopedic joint replacement Market Segmentation analysis

The Global Orthopedic joint replacement is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Total Replacement, Partial Replacement, Others . The Application segment categorizes the market based on its usage such as Knee, Hip, Shoulder, Ankle, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The orthopedic joint replacement market is highly competitive owing to the presence of a vast number of international companies that manufacture and provide different surgical implants and solutions. Market advancements are attributed largely to the strong markets enshrined by key companies’ product insurance, a wide range of distribution channels, and efficient brand marketing of players such as Johnson & Johnson (DePuy Synthes), Stryker Corporation, Zimmer Biomet, and Smith & Nephew. The firms are also developing advanced materials, surgical robots, and minimally invasive operations to enhance their services and grow their revenues, and this creativity has inspired growth and expansion of the market. The other factor influencing competition is strategic alliances and the usage of M&A as companies seek to broaden their product or information technology portfolio in order to compete in this fast-changing marketplace.Challenges In Orthopedic joint replacement Market

One of the significant impediments in the orthopedic joint replacement market is the expense attached to the procedures and the implants. The entire expense post knee replacement surgeries, inclusive of the rehabilitation and other related healthcare services, tends to be quite high for the majority of the individuals, especially those that come from underdeveloped countries. Coupled with this geographic risk factor is the increase in elderly persons who are the primary target for joint replacement, which means more surgery; this has created a strain on the healthcare systems to ensure that surgery is provided but, at the same time, keep the costs within reach. Another challenge of matches, complications induced, and probability of the implants failing as time goes by. Joint replacement operations are successful in most cases; however, joint infections, pulmonary embolism, and prosthesis loosening require that the patient undergo reoperation, which is usually expensive and detrimental to the patient’s prognosis. This means that new materials, new technologies, and novel methods have to be introduced, and that is expensive and slow to the manufacturers.Risks & Prospects in Orthopedic joint replacement Market

The orthopedic joint replacement market has favourable prospects owing to the growth in the aging global population and the increase in the number of patients suffering from joint diseases, including osteoarthritis. Aging populations are likely to raise the demand for joint replacement surgeries like those of hips, knees, and shoulders, among others, in the near future. In addition, the new trends in the joint replacement market, like the advanced new techniques, especially the minimally invasive ones, and the implants that are more advanced and more durable, are enhancing the chances of shorter patient recovery and better patient recovery, which in turn propels the growth. In addition, the middle class in developing or emerging economies is growing, which means that it creates an added potential for the market as the provision of health services improves. With the rising trend of campaigning for awareness of the importance of joint replacement surgery and its treatment in the areas of Asia Pacific, Latin America, and the Middle East, the demand for such orthopedic procedures is expected to increase.Key Target Audience

The primary demographics of the orthopedic joint replacement market include the older population and individuals who are diagnosed with joint-related illnesses such as osteoarthritis, rheumatoid arthritis, and degenerative joint diseases. This cohort, majorly aged 50 years and above, is in search of ways to reduce pain, regain movement, and improve their general well-being. Therefore, there many hospitals, orthopedic surgeons and healthcare providers who constitute a major part of this market working on diagnosing the conditions and referring patients for joint replacement intervention.,, Younger adults and sportspersons who sustain joint injuries or those with degenerative changes of the joints also account for a large portion of the market. Given that joint degeneration is a common source of pain in active people who engage in sports that end with force, such as tennis, or who play contact sports, many people suffering from this problem has no option but to seek joint replacement. There are also health systems, insurance providers, as well as medical aid and state rehabs present in the market that market inclusive of surgery post-care as well as rehabilitation and insurance for joint care.Merger and acquisition

Reportedly, 29 deals were announced in the orthopedic joint replacement market in 2023, which is an increase of more than 30% year on year. This resurgence in M&A is largely due to the recovery of joint replacement procedure volumes following the pandemic and growing emphasis on enabling technologies that improve surgical outcomes and efficiency. Among the notable acquirers are Enovis and OrthoPedics. These are firms in high active search modes for expansion in their portfolios as well as consolidating their market shares through strategic acquisitions of companies like LimaCorporate and Mathys, which fit into their growth strategies in the high-demand segments. M&A in the form of technology-driven transactions likely will continue to play a core role in 2024, with nearly one-half of orthopedic-related M&A deals falling under the spines category. Industry leaders Stryker and Zimmer Biomet are driving M&A activity to improve product lines while realizing synergies that can positively impact patients and efficient operations in an even more competitive environment.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Orthopedic joint replacement- Snapshot

- 2.2 Orthopedic joint replacement- Segment Snapshot

- 2.3 Orthopedic joint replacement- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Orthopedic joint replacement Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Total Replacement

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Partial Replacement

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Others

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Orthopedic joint replacement Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Knee

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Hip

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Shoulder

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Ankle

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Orthopedic joint replacement Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Stryker (U.S.)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Johnson & Johnson Services

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Inc. (U.S.)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Smith + Nephew (U.K.)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Zimmer Biomet (U.S.)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Bioimpianti (Italy)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Conformis (U.S.)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 MicroPort Scientific Corporation (China)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Enovis (U.S.)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 B. Braun Melsungen AG (Germany)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Orthopedic joint replacement in 2030?

+

-

How big is the Global Orthopedic joint replacement market?

+

-

How do regulatory policies impact the Orthopedic joint replacement Market?

+

-

What major players in Orthopedic joint replacement Market?

+

-

What applications are categorized in the Orthopedic joint replacement market study?

+

-

Which product types are examined in the Orthopedic joint replacement Market Study?

+

-

Which regions are expected to show the fastest growth in the Orthopedic joint replacement market?

+

-

What are the major growth drivers in the Orthopedic joint replacement market?

+

-

Is the study period of the Orthopedic joint replacement flexible or fixed?

+

-

How do economic factors influence the Orthopedic joint replacement market?

+

-