Global Panel Solar Simulator Industry Market – Industry Trends and Forecast to 2030

Report ID: MS-641 | Energy and Natural Resources | Last updated: Mar, 2025 | Formats*:

Panel Solar Simulator Industry Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

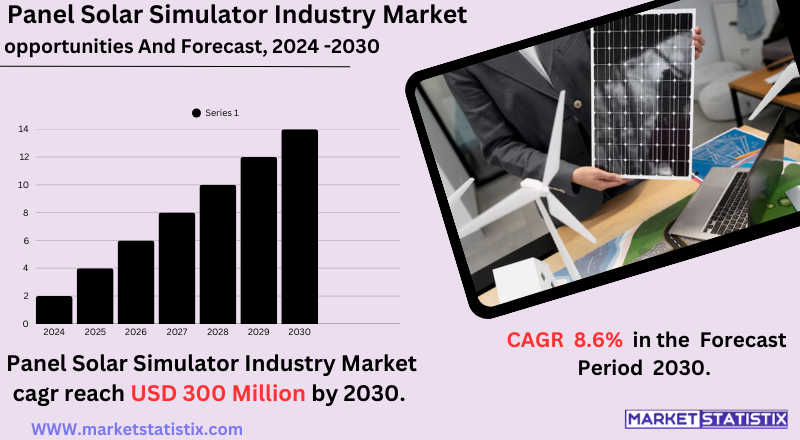

| Growth Rate | CAGR of 8.6% |

| Forecast Value (2030) | USD 300 Million |

| By Product Type | Multi-Junction, Concentrated Photovoltaics (CPV), Thin Film Solar, C-Si (Crystalline Silicon), Organic Photovoltaic (OPV) |

| Key Market Players |

|

| By Region |

Panel Solar Simulator Industry Market Trends

A prominent trend is their increasingly popular use of advanced light sources, particularly LEDs, which provide much better control over spectral output and energy efficiency than xenon arc lamps. Another thing is the high demand for simulators with automation features and data-acquisition systems for more accurate and easier testing activities. The next important trend will be the regional spread of the market, with the Asia-Pacific region being under the spotlight of the market due to the boom of solar panel manufacturing in the region. At the same time, many researchers are focusing on the advancements of solar simulators with other types of testing and measuring devices for obtaining a complete performance analysis of photovoltaic modules. Moreover, the market is seeing an emerging demand for simulators that can easily and accurately represent various environmental conditions to check the reliability of solar panels.Panel Solar Simulator Industry Market Leading Players

The key players profiled in the report are Spectrolab, Kenmec Group, WASAKI Electric, PV Measurements, OAI, Solar Light, Aescusoft, Nisshinbo, Micronics Japan, HSPV Corporation, Gsolar, Iwasaki Electric, EETS, KUKA Systems, Atonometrics, Boostsolar PVGrowth Accelerators

From the growing global requirement of solar energy, the Panel Solar Simulator Industry Market has been driven directly because of the intense need for testing and quality assurance of photovoltaic (PV) modules. In addition, as the solar industry advances into a highly elaborate industry, manufacturers and researchers alike would need specific, accurate, and reliable simulation tools to assess panel performance within controlled conditions. This also relates to technological improvements in solar panels and the rising need for reducing the Levelized Cost of Electricity, or LCOE, hence also concerning the enhanced efficiency and durability of the solar panels. In addition, rigorous quality control standards and regulations in the solar energy sector significantly contribute to market development. There would be needs for standardized testing procedures in ensuring reliability and life span for solar installations, resulting in an increase in the number of advanced solar simulators. Furthermore, with the growing investment directed towards R&D for next-generation solar technologies like thin-film and perovskite solar cells, more powerful simulation equipment is essential for performance characterization and optimization.Panel Solar Simulator Industry Market Segmentation analysis

The Global Panel Solar Simulator Industry is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Multi-Junction, Concentrated Photovoltaics (CPV), Thin Film Solar, C-Si (Crystalline Silicon), Organic Photovoltaic (OPV) . The Application segment categorizes the market based on its usage such as Residential, Industrial, Utility-Scale, Commercial, Off-Grid Systems. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The panel solar simulator industry market can be defined as moderately competitive, with a pool of established as well as specialized manufacturers. Important competitive factors are technological innovation, product quality, customization capabilities, and pricing. Major players invest heavily in R&D activities to manufacture advanced simulators that can closely mimic different solar radiation conditions for the solar panel industry's evolving needs. Strategic alliances and collaborations between research institutes, manufacturers of solar panels, etc., also play a vital role in market penetration and expansion. Additionally, the trend of automation and integration into other testing systems acts as a driving force for innovation. Demand from different regions and regulatory requirements also affect the competitive strategies of market players. Providing customized solutions complemented by a strong after-sales service structure is a key aspect of gaining a competitive edge.Challenges In Panel Solar Simulator Industry Market

Various challenges have emerged that threaten to derail the growth prospects of the panel solar simulator. A primary issue with advanced solar simulator equipment like xenon arc and metal halide arc lamps is that the high initial investment and maintenance costs make it prohibitive for smaller research institutions and startups to adopt them extensively. In addition, there are no internationally accepted standards for classifying and performing measurements on these instruments. This makes the selection of instrumentation tricky for end-users, as the possibility for variation in the results they obtain would increase. Moreover, being dependent on the solar energy market at large, the industry is vulnerable to external risks from economic conditions, policy changes, and competition from other renewable energy sources. For example, the recent layoffs in solar companies Enphase Energy and Sunnova Energy are a testament to the fragility of the industry when demand falters. The cash flow crunch in these solar firms only adds to the list. These are the characteristics, which require a lot of planning and innovation to be sustained in a complex market of the panel solar simulator industry.Risks & Prospects in Panel Solar Simulator Industry Market

With the rising demand for solar photovoltaic (PV) installations worldwide, the use of any advanced technology solar simulator concerning solar panel efficiency and reliability has become very important. Technological advancement in that it has led to LED-based simulators capable of providing consistent and accurate light spectrums is yet another driver enhancing the growth of the market. The technologies thus improve testing accuracy and aid differing applications in the domains of R&D, electronics, and automotive sectors. In a regional context, the Asia Pacific had a commanding presence in the panel solar simulator market and contributed more than 41% of the total global share in 2023. This position is sustained by massive investments in solar energy projects and by the presence of some large manufacturers of solar panels in China, India, and Japan. The North American region comes next, with 26% of the market, driven by a well-established solar industry and strong research and development projects. Europe becomes a fast-growing region and is anticipated to witness good growth owing to rising demand for electric vehicles and advancements in solar technologies.Key Target Audience

, The panel solar simulator industry market caters to various potential target audiences in the solar energy sector, such as manufacturers of solar panels and photovoltaic modules employing simulators for quality control, performance tests, and research and development. An accurate and reliable simulated environment is crucial in enabling these manufacturers to optimize their products within the industry norms., Further, test and certification laboratories that evaluate the performance and compliance criteria of solar panels under various international standards are key stakeholders of solar simulators. These are supplemented by installers and developers of large solar power plants, who test site assessment and performance prediction through simulators for optimum design of the system and operation.Merger and acquisition

Making technological collaborations and market presence through mergers and acquisitions has become somewhat of a norm in the solar simulator industry. In May 2023, First Solar, Inc., one of the leading manufacturers of solar panels in the United States, bought Evolar AB, a pioneering European factory in perovskite technology. This strategic acquisition will reinforce First Solar's thin-film photovoltaics position by conducting advanced perovskite innovations into their thin-film solar products. As another example, in April 2022, Alternus Energy entered a definitive agreement to acquire solar projects in Spain of up to 228 MW. Midway into construction, these projects are anticipated to be ready to build by the second or third quarter of 2023, depending on permitting and grid connection. Therefore, this acquisition will further boost the expansion of Alternus Energy's renewable energy portfolio across Europe. >Analyst Comment

A panel solar simulator industry market is flourishing, mainly due to the growth of the world solar energy industry and the increasing demand for reliable and efficient photovoltaic modules. As the requirement for accurate and standardized testing becomes essential for ensuring their quality and performance, the adoption of higher solar simulators is on the rise. The increase in accuracy and versatility that current technology is giving for solar simulators has been made possible due to advancements such as LED-based solar simulators and spectral matching technology. In addition, market growth is supported by heightened research and development activities in solar energy to enhance module efficiency and durability.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Panel Solar Simulator Industry- Snapshot

- 2.2 Panel Solar Simulator Industry- Segment Snapshot

- 2.3 Panel Solar Simulator Industry- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Panel Solar Simulator Industry Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 C-Si (Crystalline Silicon)

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Thin Film Solar

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Multi-Junction

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Concentrated Photovoltaics (CPV)

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Organic Photovoltaic (OPV)

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Panel Solar Simulator Industry Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Residential

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Utility-Scale

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Off-Grid Systems

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Nisshinbo

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Gsolar

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 OAI

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 HSPV Corporation

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Atonometrics

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 PV Measurements

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 EETS

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Aescusoft

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Solar Light

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Spectrolab

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 KUKA Systems

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Kenmec Group

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 WASAKI Electric

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Micronics Japan

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Iwasaki Electric

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Boostsolar PV

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Panel Solar Simulator Industry in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Panel Solar Simulator Industry market?

+

-

How big is the Global Panel Solar Simulator Industry market?

+

-

How do regulatory policies impact the Panel Solar Simulator Industry Market?

+

-

What major players in Panel Solar Simulator Industry Market?

+

-

What applications are categorized in the Panel Solar Simulator Industry market study?

+

-

Which product types are examined in the Panel Solar Simulator Industry Market Study?

+

-

Which regions are expected to show the fastest growth in the Panel Solar Simulator Industry market?

+

-

Which application holds the second-highest market share in the Panel Solar Simulator Industry market?

+

-

What are the major growth drivers in the Panel Solar Simulator Industry market?

+

-