Global Passenger Vehicle Telematics Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2031

Report ID: MS-1755 | Automotive and Transport | Last updated: Sep, 2024 | Formats*:

Passenger Vehicle Telematics Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

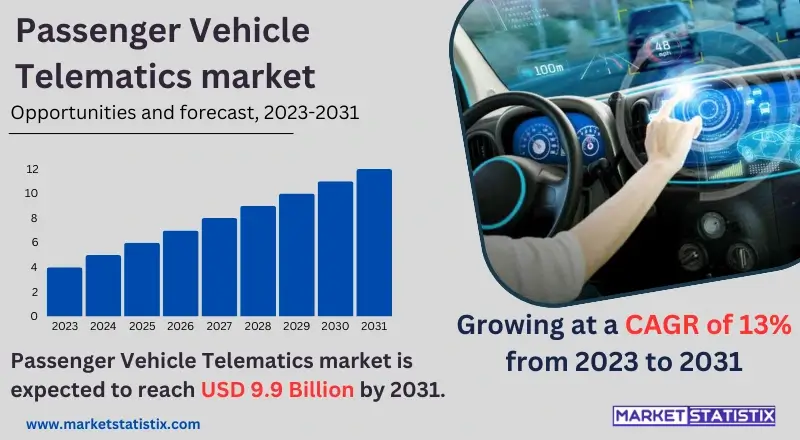

| Growth Rate | CAGR of 13% |

| Key Market Players |

|

| By Region |

|

Passenger Vehicle Telematics Market Trends

Numerous important changes have occurred in the passenger vehicle telematics market as a result of new technologies that have been developed and altered customer expectations. The integration of advanced connectivity such as 5G and IoT (Internet of Things) are examples, for instance, that facilitate V2X, real-time data sharing, as well as optimised navigation systems. Moreover, there has been an increase in the number of telematics services or in-car infotainment systems in addition to remote diagnostics, car tracking, and driver assistance features. Another trend is experiencing AI-driven analytics and predictive maintenance to enhance safety and the driver experience. There are personalised services that help monitor automobile health with warnings before any eventualities can arise through big data and machine learning in telematics.Passenger Vehicle Telematics Market Leading Players

The key players profiled in the report are Geotab Inc, Octo Telematics, OnStar Corporation, Qualcomm Incorporated, Verizon Connect, Agero Inc, Continental AG, Fleet Complete, LG Electronics, MiX TelematicsGrowth Accelerators

The market for telematics in passenger vehicles is driven by several key factors, one of which is the rising demand for advanced vehicle safety and navigation features. Various features, including navigation assistance, emergency response, and vehicle health monitoring, make driving safer and easier within the telematics systems that integrate GPS tracking with onboard diagnostics and real-time data communication. Moreover, increasing integration in consumer’s lives through more intelligent driving experiences has contributed to the rapid adoption of such systems in passenger vehicles. In addition, a major factor driving this growth is the increased focus on connectivity as well as smart technologies in cars. The introduction of 5G and IoT (Internet of Things) has spurred on the development of sophisticated telematics solutions, including vehicle-to-everything (V2X) communication as well as support for autonomous driving. Furthermore, regulations that require it to be done for purposes of safety and efficiency plus insurance incentives are also some other forces behind this upward trend of market development.Passenger Vehicle Telematics Market Segmentation analysis

The Global Passenger Vehicle Telematics is segmented by and Region. . Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the passenger vehicle telematics market is made up of numerous important players, such as large technology firms, automobile makers, and specialised telematics service providers. The sector is led by key players like Verizon Connect, Trimble, and Geotab, as well as car manufacturers such as BMW, Toyota, and Ford, who are at the forefront of designing and rolling out telematics solutions. These companies compete on factors such as technology innovation, integration capabilities, and customer service with the aim of providing services like real-time vehicle tracking, driver behaviour analysis, and advanced safety systems. In this market, there is highly dynamic competition characterised by ever-changing technological advancements alongside strategic partnerships resulting in significant changes within the industry. Firms are investing heavily into research and development so they can improve their telematics offerings, for example, through AI-driven analytic features or IoT integration, among others. Besides, there is more collaboration between car makers and technologists in delivering integrated solutions aimed at improving vehicle performance while at the same time enhancing the user experience overall.Challenges In Passenger Vehicle Telematics Market

The passenger vehicle telematics market is faced with a number of challenges, such as high implementation costs and the need for complex integration with already existing vehicle systems. In a telematics solution, telecommunication technologies together with advanced sensors can be costly, especially if a manufacturer or fleet owner intends to retrofit an existing car. Also, they are technically difficult to integrate with different types of cars and ensure compatibility across different models or brands. Moreover, another major challenge is data privacy and security issues. With telematics systems collecting and sending private information about car performance, location, and drivers’ behaviours, there exists a lot of likelihood that this information may end up in the wrong hands. However, due to the increasing customer demand for connected vehicle features and advancements in technology, the market remains vibrant.Risks & Prospects in Passenger Vehicle Telematics Market

Several opportunities are created in the passenger vehicle telematics market as the need for better connectivity and advanced car features rises. For example, it is possible to integrate telematics systems with new technologies like 5G and IoT that allow improved communication between vehicles, near real-time data analytics, as well as better entertainment alternatives. Moreover, since there is an increasing focus on car safety, navigation, and predictive maintenance, telematics solutions that entail immediate diagnostics, accident alerts, and route optimisation offer room for more options. Another major opportunity is through subscription-based services and data-driven business models. It’s possible to come up with tailored solutions such as insurance telematics, remote diagnostics, or even driver behaviour monitoring by telematics providers targeting consumers and fleet managers looking for personalised or value-added services. Furthermore, the emergence of electric cars and self-driving automobiles presents another chance for telematics solution development since these vehicles require very sophisticated monitoring systems and management tools.Key Target Audience

The smartphone market has several opportunities that result from technological advancements coupled with changing needs of consumers. One such major opportunity is the introduction of 5G technology, which offers faster data speeds alongside better connectivity, hence allowing applications like augmented reality (AR), virtual reality (VR), and high-end mobile gaming, among others. In addition to this, increasing purchasing power among people from developing nations and enhanced internet services present tremendous expansion chances for manufacturers.,, Another possible niche involves integrating innovative devices, including folding screens, improved camera systems, or advanced biometric security, as enhancements among them while also considering artificial intelligence (AI) integration as a means of differentiating their products by making them personalised experiences or smarter features, respectively. Consequently, these opportunities allow firms to exploit new markets and keep competitors with similar offerings at bay, thereby enabling them to weather storms brought about by changing consumer preferences.Merger and acquisition

The push for integrated and advanced telematics solutions is reflected in recent mergers and acquisitions within the passenger vehicle telematics market. Major deals include the acquisitions of telematics companies by certain car makers and tech firms to augment their talent in connected vehicle technology as well as data analytics. For example, Qualcomm and Bosch are among some companies that have made small acquisitions of telematics firms to develop capabilities in real-time data processing, vehicle tracking, and driver assistance systems. An increase in demand for connected vehicle solutions aimed at improving safety, navigation, and entertainment has driven these strategic moves. The fast-evolving landscape of telematics necessitates consolidation of resources and capabilities in order to foster innovation for competitive advantage. On the other hand, integrating the acquired technologies with existing ones is difficult since it requires companies to provide consumers or fleet operators with seamless advanced telematics solutions.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Passenger Vehicle Telematics- Snapshot

- 2.2 Passenger Vehicle Telematics- Segment Snapshot

- 2.3 Passenger Vehicle Telematics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Passenger Vehicle Telematics Market by Technology

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Embedded

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Tethered

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Integrated

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Passenger Vehicle Telematics Market by Communication Technology

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Cellular telematics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Satellite telematics

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Passenger Vehicle Telematics Market by service offiering

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Safety and security

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Infotainment and navigation

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Remote control and monitoring

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Others

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Passenger Vehicle Telematics Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Geotab Inc

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Octo Telematics

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 OnStar Corporation

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Qualcomm Incorporated

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Verizon Connect

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Agero Inc

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Continental AG

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Fleet Complete

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 LG Electronics

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 MiX Telematics

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Technology |

|

By Communication Technology |

|

By service offiering |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Passenger Vehicle Telematics Market?

+

-

What major players in Passenger Vehicle Telematics Market?

+

-

What applications are categorized in the Passenger Vehicle Telematics market study?

+

-

Which product types are examined in the Passenger Vehicle Telematics Market Study?

+

-

Which regions are expected to show the fastest growth in the Passenger Vehicle Telematics market?

+

-

What are the major growth drivers in the Passenger Vehicle Telematics market?

+

-

Is the study period of the Passenger Vehicle Telematics flexible or fixed?

+

-

How do economic factors influence the Passenger Vehicle Telematics market?

+

-

How does the supply chain affect the Passenger Vehicle Telematics Market?

+

-

Which players are included in the research coverage of the Passenger Vehicle Telematics Market Study?

+

-