Global Peaches And Nectarines Market – Industry Trends and Forecast to 2031

Report ID: MS-1961 | Food and Beverages | Last updated: Oct, 2024 | Formats*:

Peaches And Nectarines Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

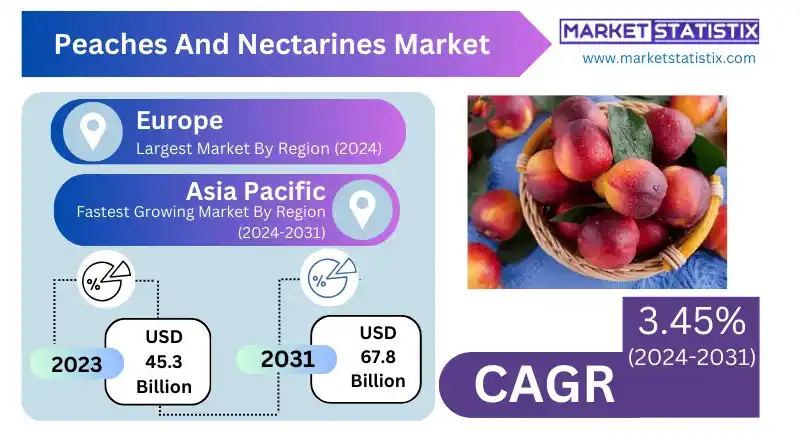

| Growth Rate | CAGR of 3.45% |

| By Product Type | Fresh, Processed |

| Key Market Players |

|

| By Region |

|

Peaches And Nectarines Market Trends

The global peaches and nectarines market is witnessing considerable transformation, with consumers opting for organic and sustainably grown products. The trend stems from the phenomenon where consumers are becoming more health-orientated and environmentally conscious, resulting in an increased demand for fruits free of synthetic pesticides and utilizers. As a result, growers are also starting to practice organic farming to meet the demand, which has resulted in more organic peaches and nectarines in the market. Even retailers have taken advantage of this trend by promoting the sale of organic varieties purposely designed for health-conscious consumers in search of healthy fresh foods. On another note, the market observes changes in packaging and distribution strategies to improve the quality and maintenance of peaches and nectarines. In the era of e-commerce and online grocery shopping, companies have been researching better packaging technologies that help the fruits to retain their freshness throughout the transportation process. Such emphasis on enhanced strategies of supply chain supervision and protection of quality will increase the market performance as well as customers’ satisfaction.Peaches And Nectarines Market Leading Players

The key players profiled in the report are Sainsbury's, Ahold Delhaize, Intermarché, Del Monte Foods Inc., Spar International, Dole Food Company Inc., Metro AG, Migros, Lidl Stiftung & Co. KG, Tesco PLC, Walmart Inc., Woolworths Group Limited, Aldi Einkauf GmbH & Co. oHG, Rewe Group, Costco Wholesale Corporation, Auchan Retail, The Kroger Co., Carrefour S.A., Coles Group Limited, Edeka GroupGrowth Accelerators

The global market for peaches and nectarines has been correlated significantly with the increasing preference for healthy and nutritious food consumption by consumers. Peaches and nectarines are also high in vitamins, minerals, and antioxidants, and as such have become food products that health-conscious individuals appreciate. In addition, the wide range of uses these fruits can be put into, from eating them raw to use in desserts, mixed in salads, and in beverages, makes them more attractive, causing an increase in demand for the fruits in retail and food service markets. Moreover, the increasing occurrence of the global consumer market for organic foods also affects the need for peaches and nectarines. Organic food production has become popular among consumers because of fears related to the use of chemical pesticides and general ecology. Similarly, many producers are already turning to organic farming, thus broadening the possibilities for the growth of the market segment.Peaches And Nectarines Market Segmentation analysis

The Global Peaches And Nectarines is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Fresh, Processed . The Application segment categorizes the market based on its usage such as Food and Beverages, Cosmetics, Pharmaceuticals, Others. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive assessment of the Global Peaches and Nectarines Market is a combination of many old agricultural businesses and their new opponents. These players are more concerned with how different their products are from each other and how innovative they can be. It is very common for the leading firms to concentrate on the creation of better types of fruits or vegetables, e.g., improvements in taste, shelf life, resistance to diseases, etc. Advanced horticulture practices such as precision agriculture combined with integrated pest management are applied to enhance the overall yield and quality. Furthermore, the increased desire of consumers for organic and sustainably produced fruits encourages many companies to incorporate social responsibility and environmental practices. Besides this, there are also local players who impact the market. Individual farmers and farmer associations target specific regions with certain crops or even genetic varieties, which include direct marketing options. The business outlook also includes vertical integration of producers, distributors, and retailers in order to respond to market demand more effectively.Challenges In Peaches And Nectarines Market

The global market for peaches and nectarines has several obstacles, mostly climate changes and environmental concerns. Changes in weather patterns such as unexpected frosts, droughts, and too much rainfall, among others, have damaging effects on both crop production and its quality. These situations lead to not only the unavailability of peaches and nectarines but also result in fluctuation of prices and disruption of the supply chain. The other challenge is the pressure from substitute fruits and suppliers from other countries. With every change in consumers' tastes and preferences, enhancement in other fruits such as, for instance, berries and tropical fruits becomes a sizeable threat to the market of peaches and nectarines. In addition, factors such as international trade policy, tariffs, and trade barriers usually create constraints on the export and especially import of these fruits, and as such, their prices and supply vary from one region to the other. Therefore, producers ought to improve cultivation aspects and quality of the fruit produced and embark on aggressive marketing of their products in response to market dynamics.Risks & Prospects in Peaches And Nectarines Market

The Peaches and Nectarines Global Market is filled with opportunities owing to the growing consumer need for fresh, healthy, and natural food products. As health-conscious consumers scan the food market for healthy diets, peaches, and nectarines with all their vitamins and antioxidants, low-calorie counts and all other cubic benefits head the food trends. Such a trend motivates farmers and producers to increase the area under cultivation as well as the diversity of what they grow or produce, including organic and speciality lines, to reach more consumers. Moreover, the current increased interest in clean eating and plant-based diet maintenance also stimulates the market for the above-mentioned fruits, both in fresh and processed form. Also, the growth of e-commerce and online grocery shopping allows the peaches and nectarines market to create a more compelling and unique proposition. With a growing number of consumers appreciating the advantages of home-delivered meals, online mediums are guaranteed to break new ground and reach new audience sectors. Therefore, verticals of direct-to-consumer sales and logistics operation have to be realized by all manufacturers and/or retailers wanting to participate in this market with the aim of making sure that quality peaches and nectarines are within reach of the consumers.Key Target Audience

The global peaches and nectarines market mainly targets consumers in search of fresh taste and healthy fruit options. Health-conscious individuals and families also have their share of peaches and nectarines in consideration of the vitamin, antioxidant, and dietary fibre value of the two stone fruits. The tendency towards plant-based diets and natural food options has created demand for these stone fruits, resulting in increased supply in retail outlets, supermarkets, farmers’ markets, and grocery shopping online.,, Moreover, the food processing sector is also a considerable market for peaches and nectarines. This fruit is also utilized by producers of canned, frozen, and dehydrated fruits due to its taste and functionality. It is the demand from food processors that further elucidates the fact that peaches and nectarines are not just any fruits but are also a pivotal component of a number of dishes and contributes to the growth of the market.Merger and acquisition

Recent developments in the global peaches and nectarines market signify the growing trend of consolidation among agricultural firms aiming at increasing their market share and operational efficiencies. For example, earlier this year, California-based Dole Food Company sought to widen its range of fruit products and logistics solutions by purchasing a local peach-growing company. The purpose of such investments is also to satisfy the growing appetite of consumers for fresh fruits and vegetables and take advantage of Dole’s distribution network in order to address a wider market. Moreover, Fresh Del Monte has not been left behind within the industry as it has been able to purchase a major issuance in one of the suppliers of nectarines produced for the fresh fruit segment of the company. The objective of this purchase is to assist Fresh Del Monte in enhancing its fresh fruit range since the industry is very competitive. It is worth noting that such mergers and acquisitions assist these organisations in entering new territories, as well as creating new products and methods of organic farming.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Peaches And Nectarines- Snapshot

- 2.2 Peaches And Nectarines- Segment Snapshot

- 2.3 Peaches And Nectarines- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Peaches And Nectarines Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Fresh

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Processed

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Peaches And Nectarines Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Food and Beverages

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Cosmetics

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Pharmaceuticals

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Peaches And Nectarines Market by Distribution Channel

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Supermarkets/Hypermarkets

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Convenience Stores

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Online Retailers

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Others

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Peaches And Nectarines Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Sainsbury's

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Ahold Delhaize

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Intermarché

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Del Monte Foods Inc.

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Spar International

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Dole Food Company Inc.

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Metro AG

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Migros

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Lidl Stiftung & Co. KG

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Tesco PLC

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Walmart Inc.

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Woolworths Group Limited

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Aldi Einkauf GmbH & Co. oHG

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Rewe Group

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 Costco Wholesale Corporation

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 Auchan Retail

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

- 9.17 The Kroger Co.

- 9.17.1 Company Overview

- 9.17.2 Key Executives

- 9.17.3 Company snapshot

- 9.17.4 Active Business Divisions

- 9.17.5 Product portfolio

- 9.17.6 Business performance

- 9.17.7 Major Strategic Initiatives and Developments

- 9.18 Carrefour S.A.

- 9.18.1 Company Overview

- 9.18.2 Key Executives

- 9.18.3 Company snapshot

- 9.18.4 Active Business Divisions

- 9.18.5 Product portfolio

- 9.18.6 Business performance

- 9.18.7 Major Strategic Initiatives and Developments

- 9.19 Coles Group Limited

- 9.19.1 Company Overview

- 9.19.2 Key Executives

- 9.19.3 Company snapshot

- 9.19.4 Active Business Divisions

- 9.19.5 Product portfolio

- 9.19.6 Business performance

- 9.19.7 Major Strategic Initiatives and Developments

- 9.20 Edeka Group

- 9.20.1 Company Overview

- 9.20.2 Key Executives

- 9.20.3 Company snapshot

- 9.20.4 Active Business Divisions

- 9.20.5 Product portfolio

- 9.20.6 Business performance

- 9.20.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Distribution Channel |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Peaches And Nectarines Market?

+

-

What major players in Peaches And Nectarines Market?

+

-

What applications are categorized in the Peaches And Nectarines market study?

+

-

Which product types are examined in the Peaches And Nectarines Market Study?

+

-

Which regions are expected to show the fastest growth in the Peaches And Nectarines market?

+

-

What are the major growth drivers in the Peaches And Nectarines market?

+

-

Is the study period of the Peaches And Nectarines flexible or fixed?

+

-

How do economic factors influence the Peaches And Nectarines market?

+

-

How does the supply chain affect the Peaches And Nectarines Market?

+

-

Which players are included in the research coverage of the Peaches And Nectarines Market Study?

+

-