Global Photovoltaic Copper Plating Equipment Market – Industry Trends and Forecast to 2030

Report ID: MS-2231 | Machinery and Equipment | Last updated: Dec, 2024 | Formats*:

Photovoltaic copper plating equipment Report Highlights

| Report Metrics | Details |

|---|---|

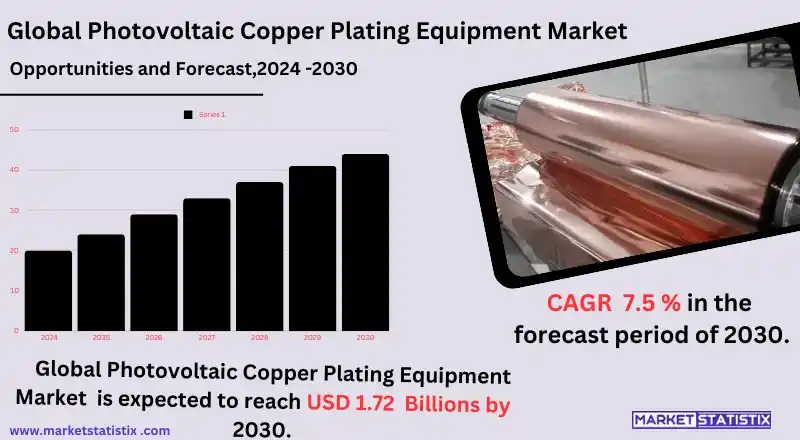

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 7.5% |

| Forecast Value (2030) | USD 1.72 Billion |

| By Product Type | Vertical Plating Equipment, Horizontal Plating Equipment |

| Key Market Players |

|

| By Region |

|

Photovoltaic copper plating equipment Market Trends

The industry for photovoltaic copper plating equipment booms under a variety of aspects. Above all, the most critical aspect is undoubtedly the ever-increasing demand for solar energy or greater energy-efficient and cost-efficient solar arrays. Concomitantly, advancing solar technology gradually propels the adoption of copper as a crucial material for photovoltaic cells and modules because of its much superior electrical conductivity coupled with lower costs and improved sustainability features when contrasted with traditional silver electroplating supplies. In addition, recent trends dictate that these institutions should become more inclined towards automation and advanced coating methodologies. As an example, it is notable how the manufacturers have embraced automation systems in the copper plating processes to improve scalability, precision, and productivity so that demand across the globe for solar energy can be satisfied promptly. Not only that, it will also usher in the use of digital technologies such as IoT and AI in process optimisation and predictive maintenance.Photovoltaic copper plating equipment Market Leading Players

The key players profiled in the report are Wuhan Dr Laser Technology Corp.,ltd, JBAO Technologies Co.,ltd, Jiangsu Boamax Technologies Group Co.,Ltd, Suzhou Maxwell Technology Co.,ltd, Jiangxi Haiyuan Composites Technology Co.,ltd., Circuit Fabology Microelectronics Equipment Co.,ltd, Kunshan Dongwei Technology Co.,ltd., Entegris, Umicore, ATMI, Moses Lake Industries, Enthone, Shanghai Sinyang Semiconductor Materials, MKS (Atotech), PhiChem Corporation, RESOUND TEGrowth Accelerators

The photovoltaic copper plating equipment industry has a bright future mainly due to the increasing demand for solar energy as a sustainable and renewable power source. With increasing global pressure for clean energy, the demand for the most efficient and affordable photovoltaic (PV) panels is rising. By increasing the electrical conductivity and reducing the costs of production, copper plating plays a vital role in improving module performance and durability. Combined with government incentives and policies establishing a supportive infrastructure for renewable energy projects, this is causing a rise in demand for better copper plating technologies in PV manufacturing. Other important factors driving advancements in solar panels and the increasing capacity and affordability of PV systems have been copper plating technologies that help manufacturers produce thinner, lighter, and more efficient solar cells while reducing material costs and improving energy conversion rates. The photovoltaic industry continues to downscale operations, and the need for specialised copper plating equipment scalable to higher volumes with consistent quality becomes more urgent.Photovoltaic copper plating equipment Market Segmentation analysis

The Global Photovoltaic copper plating equipment is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Vertical Plating Equipment, Horizontal Plating Equipment . The Application segment categorizes the market based on its usage such as HJT Battery, Topcon Battery. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the photovoltaic (PV) copper plating equipment sector is characterised by several major key players focusing on advances in technology, cost efficiency, and developmental customisation to meet the demand for solutions in solar energy. Major equipment manufacturers have been continuously enhancing their copper plating technology to improve the efficiency and durability of photovoltaic cells. Most companies competing in this market contend with each other on equipment performance, precision of plating processes, and scalability for mass production. They are also investing in research and development to come up with new products in automated systems and green plating technologies to satisfy the changing markets of the solar industry.Challenges In Photovoltaic copper plating equipment Market

A major issue impacting the photovoltaic copper plating equipment industry is that advanced technologies and equipment are generally costly. Costly investments in both research and development as well as manufacturing capabilities will be required to produce efficient copper plating systems. Furthermore, in recent times, with the growing demand for solar energy, more pressure has been added to manufacturers, compelling them to offer cost-effective solutions without compromising on quality standards. Again, the demand for high-precision, high-performance equipment adds to the complexity in production; hence it becomes difficult for small-scale players to penetrate the market and even for existing players to scale up effectively. Further, things start to worsen with the global supply chain fluctuations resulting from sourcing things like copper and the likes of other essential raw materials. A variation in material prices and supply shortages can have a crippling effect on production schedules, thus increasing costs and, ultimately, reducing the entire profitability of businesses in the sector of photovoltaic copper plating. All these make the business environment unfavourable for companies in the industry striving to remain competitive.Risks & Prospects in Photovoltaic copper plating equipment Market

Rather, the photovoltaic copper plating equipment industry assumes a strong market potential buoyed by the global transition toward renewable energy and the growing demand for solar power systems. With the increased focus on efficiency, copper plating is becoming increasingly important as it improves electrical conductivity and overall performance in the functioning of photovoltaic cells. This offers opportunities to manufacturers to develop more innovative copper plating technologies that deliver high efficiency, low cost, and increased durability for solar panel manufacturers wishing to cost-effectively produce high-performance panels. A further tremendous market opportunity exists in the rapid expansion of solar energy installations across geographies, especially in the emerging markets where governments promote the use of solar energy as part of their sustainability goals. Increased demand for high-quality photovoltaic copper plating equipment is created due to these larger solar installations that require the establishment of large solar power plants and thousands of residential solar solutions.Key Target Audience

Photovoltaic copper plating equipment is of interest to the manufacturers in the solar panel and photovoltaic (PV) module industry. These manufacturers consider copper plating equipment the best for developing efficiencies and performance for solar cells—the most widely used form being copper contacts and conductive layers in the production process. The popularity of renewable and solar energy drives the demand for contemporary copper plating technologies that ensure quality, durability, and economic viability while improving performance output and longevity in photovoltaic systems.,, It also includes producers of semiconductor devices as well as the other types of electronics that utilise copper plating, either on circuitry boards or other components. This industry intends to benefit from the effectiveness and precision that copper plating equipment offers in producing high-performance, energy-efficient products.Merger and acquisition

Strategic mergers and acquisitions are currently ongoing in the photovoltaic copper plating equipment sector to improve technological strength and geographic scope. In this direction, major activity is noted in that Applied Materials, Inc. has completed the signing of an acquisition agreement with Schmid Group, in which the intent is to expand the advanced copper plating technologies for solar applications. This acceptance indicates the demand for effective manufacturing and scalable processes in solar energy in the era of high efficiency for photovoltaic cells. Also, Jiangxi Haiyuan Composites Technology has entered somewhat actively into mergers and acquisitions to forge strong ties in the photovoltaic copper plating marketplace. Synergies with other similar manufacturers shall thus be utilised to better product lines and efficiencies in production. >Analyst Comment

"The photovoltaic copper plating equipment market is expanding by leaps and bounds as the population increases its demand for renewable energies, especially solar power. This technology is projected to provide the most economical and efficient means of enhancing solar cells performance and durability. Major drivers of the market remain rising silver prices, improving efficiencies of copper solar cells, and a growing emphasis on reduced environmental impact of solar cell manufacturing."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Photovoltaic copper plating equipment- Snapshot

- 2.2 Photovoltaic copper plating equipment- Segment Snapshot

- 2.3 Photovoltaic copper plating equipment- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Photovoltaic copper plating equipment Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Vertical Plating Equipment

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Horizontal Plating Equipment

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Photovoltaic copper plating equipment Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 HJT Battery

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Topcon Battery

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Photovoltaic copper plating equipment Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Wuhan Dr Laser Technology Corp.

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 ltd

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 JBAO Technologies Co.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 ltd

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Jiangsu Boamax Technologies Group Co.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Ltd

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Suzhou Maxwell Technology Co.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 ltd

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Jiangxi Haiyuan Composites Technology Co.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 ltd.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Circuit Fabology Microelectronics Equipment Co.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 ltd

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Kunshan Dongwei Technology Co.

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 ltd.

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Entegris

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Umicore

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 ATMI

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 Moses Lake Industries

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Enthone

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

- 8.20 Shanghai Sinyang Semiconductor Materials

- 8.20.1 Company Overview

- 8.20.2 Key Executives

- 8.20.3 Company snapshot

- 8.20.4 Active Business Divisions

- 8.20.5 Product portfolio

- 8.20.6 Business performance

- 8.20.7 Major Strategic Initiatives and Developments

- 8.21 MKS (Atotech)

- 8.21.1 Company Overview

- 8.21.2 Key Executives

- 8.21.3 Company snapshot

- 8.21.4 Active Business Divisions

- 8.21.5 Product portfolio

- 8.21.6 Business performance

- 8.21.7 Major Strategic Initiatives and Developments

- 8.22 PhiChem Corporation

- 8.22.1 Company Overview

- 8.22.2 Key Executives

- 8.22.3 Company snapshot

- 8.22.4 Active Business Divisions

- 8.22.5 Product portfolio

- 8.22.6 Business performance

- 8.22.7 Major Strategic Initiatives and Developments

- 8.23 RESOUND TE

- 8.23.1 Company Overview

- 8.23.2 Key Executives

- 8.23.3 Company snapshot

- 8.23.4 Active Business Divisions

- 8.23.5 Product portfolio

- 8.23.6 Business performance

- 8.23.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Photovoltaic copper plating equipment in 2030?

+

-

How big is the Global Photovoltaic copper plating equipment market?

+

-

How do regulatory policies impact the Photovoltaic copper plating equipment Market?

+

-

What major players in Photovoltaic copper plating equipment Market?

+

-

What applications are categorized in the Photovoltaic copper plating equipment market study?

+

-

Which product types are examined in the Photovoltaic copper plating equipment Market Study?

+

-

Which regions are expected to show the fastest growth in the Photovoltaic copper plating equipment market?

+

-

What are the major growth drivers in the Photovoltaic copper plating equipment market?

+

-

Is the study period of the Photovoltaic copper plating equipment flexible or fixed?

+

-

How do economic factors influence the Photovoltaic copper plating equipment market?

+

-