Global Political Risk Insurance Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2031

Report ID: MS-252 | Service Industry | Last updated: Dec, 2024 | Formats*:

Political Risk Insurance Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

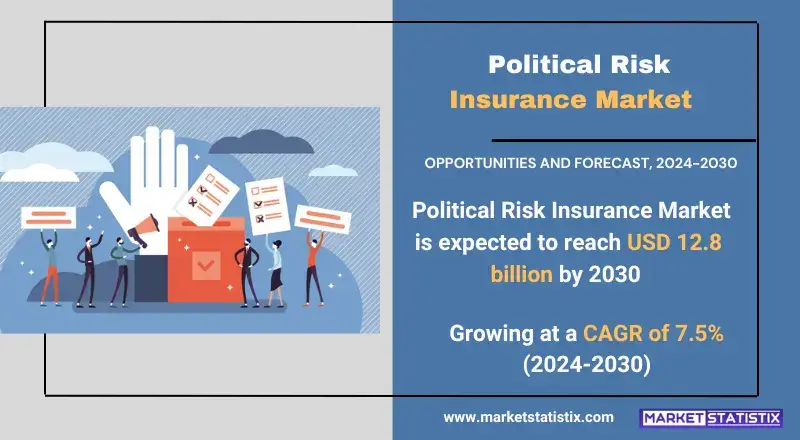

| Growth Rate | CAGR of 7.5% |

| Forecast Value (2031) | USD 12.8 Billion |

| By Product Type | Expropriation Coverage, Contract Frustration Coverage, Sovereign Non-payment Coverage, Political Violence Coverage, Currency Inconvertibility Coverage |

| Key Market Players |

|

| By Region |

|

Political Risk Insurance Market Trends

Political risk insurance (PRI) markets are mainly due to the needs of global investors who are increasingly in need of insurance protection from damages caused by political instability, expropriation, currency inconvertibility, or other government-related risks. Expansion into emerging markets, especially in regions with volatile political landscapes, leads to a growing demand for insurance policies that cover asset exposure to government action, civil unrest, and regulatory changes. Political risk insurance policies are increasingly customized and flexible as market providers adapt to the specific needs of certain industries and geographies. Technological changes transforming the market include digital platforms making access to PRI products and services easier for businesses. Finally, demand from private investors and new entrants to the market seeking increased specialization is also on the rise.Political Risk Insurance Market Leading Players

The key players profiled in the report are African Trade & Investment Development Insurance (ATIDI), Allianz Trade, Aon, Atradius, Chubb, Coface, Export Development Canada (EDC), Liberty Mutual Insurance, Marsh, Multilateral Investment Guarantee Agency (MIGA), UK Export Finance (UKEF), XL Catlin (A division of AXA), Zurich Insurance GroupGrowth Accelerators

Currently, the political risk insurance (PRI) market is seen as moving along with the times due to the world level of increasing globalization among businesses and companies needing assistance in protecting their foreign program risks. Companies that have now decided to expand their business internationally would potentially face various kinds of political risks, including but not limited to expropriation, violence, currency inconvertibility, and breach of contracts. With political risk insurance that provides safety nets, companies can mitigate such risks and protect their investments. This makes PRI a strategic consideration in doing foreign direct investment, more so in emerging markets where investment activities are poorly developed and the environment is more prone to political instabilities. Also, among these drivers would be the emerging trend of insurance coverages offered by government-backed insurers and other international organizations, which increases foreign investors' confidence. As well as the growing consciousness on the need for risk management strategies that spur the demand for political risk insurance in sectors such as energy, infrastructure, and finance.Political Risk Insurance Market Segmentation analysis

The Global Political Risk Insurance is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Expropriation Coverage, Contract Frustration Coverage, Sovereign Non-payment Coverage, Political Violence Coverage, Currency Inconvertibility Coverage . The Application segment categorizes the market based on its usage such as Corporates, Banks and Financial Institutions, Investors, Exporters and Traders. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The Political Risk Insurance (PRI) Market is marked by robust competition, mainly because of the many players providing risk mitigation solutions for businesses operating in politically unstable regions. Big international insurance firms, specialized insurers, and government-backed entities such as the Multilateral Investment Guarantee Agency (MIGA) and Export Credit Agencies (ECAs) are some of the leading participants in the market. These players compete by offering solutions tailored towards risks induced by political events such as expropriation, political violence, and causes that imply currency inconvertibility among businesses in the energy, infrastructure, and manufacturing sectors. As emerging markets are being aggressively penetrated with investments by global businesses, the market has witnessed growth in demand for comprehensive PRI products; however, it is intensifying competition.Challenges In Political Risk Insurance Market

Unquestionably, the Political Risk Insurance (PRI) Market has two glaringly conflicting issues due to the tendency of the political events in various countries to impart greater uncertainty into their affairs. One of the major problems that can ever be talked of in PRI markets is that so many political risks, like government expropriation, nationalization, and fictionally enacted laws, are not discernible and impossible to predict unless such events occur. Then, such occurrences underscore the result of more indecisiveness for insurance companies, which would otherwise be able to put the price of risks and create the necessary loss aversion. Another hurdle to cross is the notoriously tough underwriting requirements of political risk, where insurers must negotiate the same legal, economic, and cultural relationship that differs from one country to another. The absence of standardization and the lack of trustworthy amounts with which to measure or assess political risks make the risk evaluation even more complicated. Global economics, trade litigations, geopolitical conflicts, and trade and economic sanctions further muddy waters in an already foggy political risk environment.Risks & Prospects in Political Risk Insurance Market

As global businesses and investors increasingly expand towards emerging markets, the political risk insurance (PRI) market offers significant untapped opportunities. Political instability and the risks of expropriation, currency inconvertibility, and civil unrest damage investments. This ever-increasing demand in developing regions with economies categorised as Africa, Asia, and Latin America is mainly due to the construction of new infrastructure development schemes as well as foreign direct investment inflows. With continuously changing international trade agreements and government policies, as well as political landscapes, basically a growing demand for coverage to protect investments is shown in insurance products against the risks associated with doing business across borders. Moreover, an increasing incidence of geopolitical risks and events transpiring regulatory environments adds to the vigour in the PRI market. Consequently, more and more insurance companies are inventing very specialized products for very industry-specific lines like energy, infrastructure, and financial services within this flexible and growing opportunity market.Key Target Audience

The Political Risk Insurance (PRI) Market very directly targets large multinational corporations, financial institutions, and enterprises with operations in regions experiencing higher levels of political instability. These entities seek indemnity against events arising purely from political occurrences, such as expropriation, currency inconvertibility, political violence, or breach of contract. PRI enables companies to keep their foreign investments and operations protected in such a way that they can manage the loss that may arise from unfavourable government agencies, civil unrest, or other political uncertainties they may face in the countries where they operate.,, Major government departments, development agencies, and NGOs are also important audiences for political risk insurance. They often seek PRI coverage for infrastructure projects, humanitarian missions, and investments in emerging or developing markets where political instability is somewhat more pronounced.Merger and acquisition

The political risk insurance (PRI) environment is changing, which is attributed to the geopolitical environment and market dynamics. Recent reports have confirmed a rising demand for credit and political risk insurance, with statements indicating that there has been an increase of 35% in inquiry applications in 2023. In the wake of this demand increase, underwriters responded with capacity extension, with an average increase of 17% in total capacity available in 2024 for transactional credit insurance. In the area of closing mergers and acquisitions, the PRI market has gained new entrants as organisations aim to increase their portfolios' offerings. One of the pilot examples is collaboration between Marsh and one of the top-tier insurers to develop tailored, portfolio-based political risk coverage for private equity firms through which investments may be managed across some highly politically risky countries. This goes contrary to the basis whereby insurance is acquired on a deal-by-deal basis and is indicative of a move towards more comprehensive solutions in the market. >Analyst Comment

"The growth of the political risk insurance market is witnessed as businesses embracing globalization are compelled to move toward regions that are politically less predictable. We need PRI because of the influence in areas plagued by political instability and government-inconsistent governance. The market is majorly dominated by multilateral investment guarantee agency-backed risk underwriting insurance agencies and private insurers. Moreover, innovations in risk assessment technologies and data analytics have facilitated finer and more effective political risk coverage, drawing an increasingly wider spectrum of businesses into insurance adoption."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Political Risk Insurance- Snapshot

- 2.2 Political Risk Insurance- Segment Snapshot

- 2.3 Political Risk Insurance- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Political Risk Insurance Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Expropriation Coverage

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Contract Frustration Coverage

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Sovereign Non-payment Coverage

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Political Violence Coverage

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Currency Inconvertibility Coverage

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Political Risk Insurance Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Corporates

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Banks and Financial Institutions

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Investors

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Exporters and Traders

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Political Risk Insurance Market by Enterprise Size

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Small and Medium Enterprises (SMEs)

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Large Enterprises

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Political Risk Insurance Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 African Trade & Investment Development Insurance (ATIDI)

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Allianz Trade

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Aon

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Atradius

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Chubb

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Coface

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Export Development Canada (EDC)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Liberty Mutual Insurance

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Marsh

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Multilateral Investment Guarantee Agency (MIGA)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 UK Export Finance (UKEF)

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 XL Catlin (A division of AXA)

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Zurich Insurance Group

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Enterprise Size |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Political Risk Insurance in 2031?

+

-

What is the growth rate of Political Risk Insurance Market?

+

-

What are the latest trends influencing the Political Risk Insurance Market?

+

-

Who are the key players in the Political Risk Insurance Market?

+

-

How is the Political Risk Insurance } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Political Risk Insurance Market Study?

+

-

What geographic breakdown is available in Global Political Risk Insurance Market Study?

+

-

Which region holds the second position by market share in the Political Risk Insurance market?

+

-

Which region holds the highest growth rate in the Political Risk Insurance market?

+

-

How are the key players in the Political Risk Insurance market targeting growth in the future?

+

-