Global Polymer Concrete Market Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-421 | Consumer Goods | Last updated: Feb, 2025 | Formats*:

The polymer concrete market, like any other market, pertains to the manufacture and trade of a composite material wherein polymer replaces the traditional cement in concrete, yielding a material with enhanced properties over cement-based concrete, namely, exceptional strength, shortened curing periods, and resistance against chemicals and weathering. Polymer concrete finds applications in areas where its superior characteristics are appropriate. The polymer concrete market is driven by the ever-increasing demand for construction materials that are durable and long-lasting, particularly in harsh conditions. Further fuelling the market is the growth recorded in industries such as construction, transportation, and chemical processing. All these factors thus contribute to the market: price of polymer resins, advancements in polymer technology, and awareness of the benefits of polymer concrete over conventional concrete in some applications.

Polymer Concrete Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

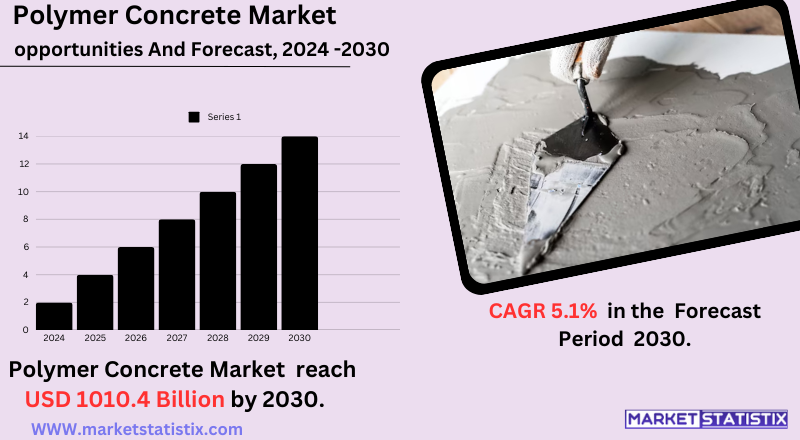

| Growth Rate | CAGR of 5.1% |

| Forecast Value (2030) | USD 686.1 Billion |

| By Product Type | Polymer Impregnated Concrete, Polymer Cement Concrete, Polymer Resin Concrete, Others |

| Key Market Players | ACO Group (Germany) BASF SE (Germany) Bechtel Corporation (United States) Bouygues S.A. (France) Crown Polymers Corp. (United States) DOW Chemical Company (United States) Dudick Inc. (United States) E. I. du Pont de Nemours and Company (United States) Forte Composites Inc. (United States) Fosroc International Ltd. (United Kingdom) Interplastic Corporation (United States) MAPEI Corporation (Italy) Sauereisen Inc. (United States) Sika AG (Switzerland) SIMONA AG (Germany) |

| By Region |

|

Polymer Concrete Market Trends

One of the significant trends is the increased call for sustainable and long-lasting construction materials. Polymer concrete is a long-lasting material and has potential recycled content by its very nature, therefore complying with such a requirement. As the construction activities are turning more and more towards making their activities green, polymer concrete is proving an alternative to existing conventional concrete for some applications. The need for such materials with low maintenance and durability in bridges, roads, and other infrastructure projects is driving their acceptance in the polymer concrete market, which is further powered by huge investments being made in the development of infrastructure in different regions of the world. Apart from this, these movements include ongoing improvement programs in research and development that will continue to innovate applications and performance characteristics of polymer concrete designs.

Polymer Concrete Market Leading Players

The key players profiled in the report are MAPEI Corporation (Italy), Sika AG (Switzerland), E. I. du Pont de Nemours and Company (United States), Fosroc International Ltd. (United Kingdom) Interplastic Corporation (United States), Forte Composites Inc. (United States), DOW Chemical Company (United States), BASF SE (Germany), Crown Polymers Corp. (United States), Dudick Inc. (United States), ACO Group (Germany), Bechtel Corporation (United States), Sauereisen Inc. (United States), Bouygues S.A. (France), SIMONA AG (Germany)Growth Accelerators

The need for strong and long-lasting construction materials is one of the prime factors propelling the use of polymer concrete. It is all because infrastructure and buildings need to withstand exposure to severe conditions, heavy load conditions, and chemical penetrations. It demonstrated properties like high strength, chemical resistance, and fast curing times compared to old-age conventional concrete applications, giving it more desirability. The increasing popularity of sustainable construction practices helps the market grow. The sustainability of polymer concrete is ratified through its long life and low maintenance, further with that of the overall green trend in the industry toward eco-friendly materials. Increasing investment in infrastructure development, especially in developing economies, also presents huge possibilities in the global polymer concrete market.

Polymer Concrete Market Segmentation analysis

The Global Polymer Concrete is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Polymer Impregnated Concrete, Polymer Cement Concrete, Polymer Resin Concrete, Others . The Application segment categorizes the market based on its usage such as Containments, Wastewater Containers, Pump Bases, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The polymer concrete market is characterised by moderate fragmentation, with a mix of established players and smaller, niche companies. Some of the noteworthy players in the market include BASF SE, Sika AG, and Interplastic Corporation, who have a worldwide presence and are actively dealing in several polymer concrete products. These companies focus heavily on research and development for improving their products and hence hold a considerable market share. Market competition is based on the quality of the product, performance characteristics, pricing, and location-specific expertise. Companies are concentrating on the design and development of innovative polymer concrete formulations with superior properties for different needs. Other commonly used strategies by the players to consolidate their market position and expand their geographical presence include strategic alliances, mergers, and acquisitions.

Challenges In Polymer Concrete Market

Although polymer concrete offers long-term benefits such as durability and low maintenance, it is much costlier than traditional concrete at the beginning. The investment made is quite high to deter the cash-poor project. With this cost, it is possible to restrict the usage in projects where budgeting is paramount. Another challenge facing polymer concrete is the outdatedness among some construction professionals and architect-led engineers. Many still ponder over whether to be on the same plane with the newest material, as most of their references focused on the conventional concrete. It entails reaching such professionals and establishing confidence in the performance of polymer concrete for a wider market acceptance.

Risks & Prospects in Polymer Concrete Market

Polymers such as structures are gaining a lot of interest due to the increasing demand for highly advanced construction materials. Infrastructures, industrial flooring, and drainage systems require a highly performing material. It has excellent characteristics that suit construction, including high strength, fire resistance, and durability. Increasing investment in smart cities, rapid urbanisation, and a requirement for corrosion-resistant material in the wastewater management sector and transportation infrastructure are just parts of the major factors boosting market expansion. Regionally, North America and Europe geography haunts the market with very strict regulations about sustainability and durability of construction materials. The Asia-Pacific region is skyrocketing due to significant infrastructure investment projects from China, India, and Southeast Asia. Additionally, the Middle East and Africa are stepping into emerging key markets due to growing investments in oil & gas and industrial infrastructure. Companies are opting for a technological advancement and strategic collaborations approach to grasp the opportunity in available markets

Key Target Audience

Construction companies, civil engineers, infrastructure developers, and consultants are the primary target audience for this market that deals with polymer concrete. Such professionals significantly specify and select surface materials for different applications, such as waste treatment plants, bridge decks, industrial flooring, and chemical containment structures. Control over these diverse aspects makes them crucial to the polymer concrete market. Their particular interests and concerns are durability, strength, and resistance against harsh conditions. Apart from direct end-users, the market covers material suppliers, distributors, and manufacturers of polymer resins and concrete admixtures. These individuals supply raw materials and expertise in making polymer concrete. They work closely with construction professionals to provide technical support and custom solutions to cater to specific project requirements. This secondary target audience plays an important role in the supply chain and influences adoption towards polymer concrete.

Merger and acquisition

The polymer concrete market remains rife with significant merger and acquisition activity towards strengthening and widening markets. One of them was in April 2024, when Sika AG, the leading company in the field of construction chemicals, acquired Kwik Bond Polymers, LLC of the United States. This acquisition should boost Sika's refurbishment capabilities in concrete structures because of Kwik Bond's proficiency in polymer concrete solutions. In November 2023, Sika also invested in its Texas plant, which expanded polymer production for concrete admixtures—the second investment made by the company in the state in the last five years. Further, this expansion is meant to strengthen Sika's market position as a company and enhance the ability to satisfy increased demand for advanced construction materials.

>Analyst Comment

Polymer concrete is steadily growing in the market due to the increasing needs of high-performance construction materials. Highly durable, chemically resistant, and highly fast-curing nature has increased its desirability as a material of choice for a diverse set of applications, especially in infrastructure projects, chemical processing plants, and within marine environments. Continued growth opportunity results from the rising needs of durable and long-lasting solutions against harsh conditions where conventional concrete will be degraded quickly.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Polymer Concrete- Snapshot

- 2.2 Polymer Concrete- Segment Snapshot

- 2.3 Polymer Concrete- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Polymer Concrete Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Polymer Cement Concrete

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Polymer Impregnated Concrete

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Polymer Resin Concrete

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Polymer Concrete Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Containments

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pump Bases

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Wastewater Containers

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Polymer Concrete Market by End-Use

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Residential

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Commercial

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Industrial

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Infrastructure

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Roadways

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

- 6.7 Bridges

- 6.7.1 Key market trends, factors driving growth, and opportunities

- 6.7.2 Market size and forecast, by region

- 6.7.3 Market share analysis by country

7: Polymer Concrete Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 ACO Group (Germany)

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 BASF SE (Germany)

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Bechtel Corporation (United States)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Bouygues S.A. (France)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Crown Polymers Corp. (United States)

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 DOW Chemical Company (United States)

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Dudick Inc. (United States)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 E. I. du Pont de Nemours and Company (United States)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Forte Composites Inc. (United States)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Fosroc International Ltd. (United Kingdom) Interplastic Corporation (United States)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 MAPEI Corporation (Italy)

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Sauereisen Inc. (United States)

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Sika AG (Switzerland)

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 SIMONA AG (Germany)

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By End-Use |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Polymer Concrete in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Polymer Concrete market?

+

-

How big is the Global Polymer Concrete market?

+

-

How do regulatory policies impact the Polymer Concrete Market?

+

-

What major players in Polymer Concrete Market?

+

-

What applications are categorized in the Polymer Concrete market study?

+

-

Which product types are examined in the Polymer Concrete Market Study?

+

-

Which regions are expected to show the fastest growth in the Polymer Concrete market?

+

-

Which application holds the second-highest market share in the Polymer Concrete market?

+

-

What are the major growth drivers in the Polymer Concrete market?

+

-

The need for strong and long-lasting construction materials is one of the prime factors propelling the use of polymer concrete. It is all because infrastructure and buildings need to withstand exposure to severe conditions, heavy load conditions, and chemical penetrations. It demonstrated properties like high strength, chemical resistance, and fast curing times compared to old-age conventional concrete applications, giving it more desirability. The increasing popularity of sustainable construction practices helps the market grow. The sustainability of polymer concrete is ratified through its long life and low maintenance, further with that of the overall green trend in the industry toward eco-friendly materials. Increasing investment in infrastructure development, especially in developing economies, also presents huge possibilities in the global polymer concrete market.