Global Quiet Tire Market Size, Share & Trends Analysis Report, Forecast Period, 2030

Report ID: MS-2147 | Automotive and Transport | Last updated: Dec, 2024 | Formats*:

Quiet Tire Report Highlights

| Report Metrics | Details |

|---|---|

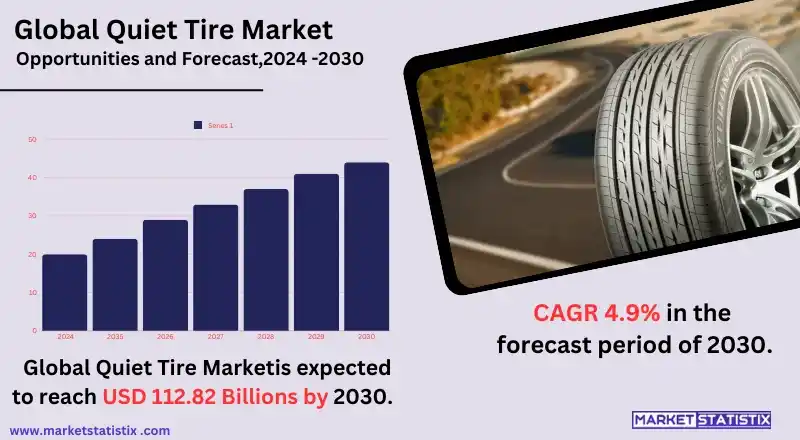

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 4.9% |

| Forecast Value (2030) | USD 26.5 Billion |

| By Product Type | Radial Tire, Bias Tire, Tubeless |

| Key Market Players |

|

| By Region |

|

Quiet Tire Market Trends

The tire industry is witnessing an upsurge in demand due to the need to curb noise pollution as well as accentuate the driving experience. With urbanization on the rise and noise control measures becoming stricter, the public is in search of quieter motor vehicles, most especially electric ones, which are already quiet. This calls for the tire manufacturers to come up with more sophisticated rubber elements, noise control measures, and improved tread pattern designs for the reduction of vibrational and tire-road interaction noise. This is further enhanced by the increase in sales of luxury, hybrid, and electric vehicles, where a smooth and noiseless driving experience is one of their main features. Also, it is worth mentioning that within the quiet tire market, environmental sustainability considerations have started to gain ground as manufacturers include more green resources in their designs. This also entails employing recycled contents, low rolling resistance systems, and rationalized operation, which not only curbs noise levels but also aids in mitigating global warming.Quiet Tire Market Leading Players

The key players profiled in the report are Michelin Group, Bridgestone Corporation, Continental AG, The Goodyear Tire & Rubber Company, Hankook Tire & Technology Co.Ltd., Pirelli & C. S.p.A., Yokohama Rubber Company, Limited, Cooper Tire & Rubber CompanyGrowth Accelerators

The silent tire market is gaining traction owing to the rising need for noise-controlling apparatus in urban and suburban environments. Due to rapid urbanization and more stringent laws of controlling noise pollution, both consumers and governments are in need of road transport systems that generate less noise and pollution. Manufacturers of vehicle engines are also looking to develop ‘roarless’ tires with the likes of noise-absorbing tread patterns, modifications of rubber, and others for the sake of passenger comfort and movement compliance. This has been further enhanced with the manufacture of electric vehicles (EVs) with the sole aim of ensuring that the sole component of the vehicle that produces sound, tires, supplements absent powertrain sounds completely. Another major factor is the increasing inclination of people towards the premium driving experience. In the luxurious segment of the vehicles, quiet tires are highly preferred as noise control is a primary factor for achieving a soft riding experience. Also, the development of tire technology, such as the use of foam layers and other creative designs, has encouraged the growth of noise-reducing tires to more sections of the market. With more people appreciating the advantage of silent tires, there has been an increase in demand in several vehicle segments.Quiet Tire Market Segmentation analysis

The Global Quiet Tire is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Radial Tire, Bias Tire, Tubeless . The Application segment categorizes the market based on its usage such as Motorcycle, Commercial Vehicle, Passenger Car. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The dynamics of competition in the quiet tire industry are informed by an array of old and new tire producers with varying levels of expertise in noise reduction technologies. There are well-known global tire companies like Michelin, Bridgestone, Goodyear, and Continental, which take the leading positions in this market since they have enormous opportunities for scientific research and development, enabling them to design new and better tires for noise suppression on the road. These manufacturers work on enhancing the driving experience and performance by coming up with new and improved surface designs, sound-absorbing substances, and special types of rubber. Moreover, the market presence of these companies is enhanced by their efficient distribution networks and the brand equity they possess. The quiet tire market has also attracted new entrants and specialized firms dealing with innovations and sustainability. These firms tend to be relatively free and provide customized responses on the healthy demand for specialized, silent, and environmentally friendly tires. Furthermore, the competition is also increasing due to the advancements in the technology, such as the use of tires for electric vehicles (EVs) and electric vehicle acoustic foam layers for better quietness.Challenges In Quiet Tire Market

One of the most significant challenges confronting the quiet tires market is the excessive cost of production and development. Due to their unique purpose, quiet tires may use extra resources and advanced technologies such as noise-damping layers or special tread patterns, which can increase production costs. These elevated prices are high often, and this increases the accessibility of such tires to the budget-constrained buyers. Further, the consumers have inadequate understanding of the quiet tires and their usefulness; thus, their demand is low in comparison to other cheaper alternative tires that are available. Additionally, another challenge is finding a compromise when it comes to the noise that the tires generate and their performance. Quiet tires are aimed at minimizing the road noise naturally, but the tire performance levels in terms of safety, durability, or handling should still be achieved. It can be a challenge for the manufacturers to maintain this compromise without negatively influencing the other parameters such as traction, wear management or fuel efficiency.Risks & Prospects in Quiet Tire Market

The relatively untapped, wide-area black circles market is on the rise as the need to combat noise pollution and improve driving dynamics fosters demand, especially in the cities. As electric vehicles come into play, the absorption of any trace of sound emitted by the moving parts of the vehicle becomes crucial. This creates room for tire makers to come up with novel products that have sound-absorbing capabilities and develop the overall experience when driving. Lastly, the external distortion that such noise comes with is controlled by policies that most municipalities put in place, providing a conducive market for quiet tire developments. Another potential opportunity exists in the enhancing of comfort by the raising of the standards of cars among the populace, thanks to noise, which has been a cause earmarked for the luxury and performance cars. Quiet tires provide automotive manufacturers with the competitive edge in the crowded automotive market. Owing to the technological development in tire materials and design, such companies can serve both original equipment manufacturers (OEMs) and secondary markets by offering low-profile tires for sporty cars at different prices to improve the comfort and quietness of vehicles.Key Target Audience

The primary focus for the quiet tire market appears to be in understanding the needs of urban drivers and consumers who are simply looking for a better driving experience. Most of the people in this group exist in towns and cities and, as such, are more concerned with comfort, less noise, and a better riding experience. Quiet tires, which are intended to reduce the noise from the road, are aimed at expansive and luxurious automobile drivers, people who drive for long distances, and people with a low concentration of noise around them while driving even in peripheral road traffic or during long vehicular traffic periods.,, Another crucial group is the fleet owners and the operators of commercial vehicles. This category seeks out tires that will allow for more quiet operation of their vehicles, such as delivery vans or shuttle buses, for the benefit of their passengers and the drivers. Further, quiet tires lessen the level of noise created by the busy drivers; consequently, businesses can widen their focus on productivity without concern about damaged personnel—thereby making them employable by firms focusing on enhancing their operations and employee comfort as well.Merger and acquisition

Recent moves in mergers and acquisitions (M&A) in the tire industry, and in the Quiet Tire and so forth, in particular, indicate further undertaking consolidation amongst key industry players. Titan International, for instance, purchased the Carlstar Group, a publisher that deals with specialty tires and outdoor apparatus, for $296.2 million. Such investment serves to augment Titan’s product range as well as global outreach due to the inclusion of Carl Star’s supply chain. Alongside this, acquisition endeavours have also been recorded in the retail tire markets, for instance, with companies such as Sun Auto and Mavis Tire growing significantly, enabling the addition of more services to their respective markets. Private equity firms are playing a bigger role in these M&As, with the likes of Percheron Investment Management making quick acquisitions in the tire retail sector. This includes a couple of major transactions whose activities fall under the Big Brand Tire group of companies. Such investments illustrate how imperative it is to improve market access and other services within the tire industry, particularly for markets like quiet tires, which benefit innovations geared towards noise mitigation.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Quiet Tire- Snapshot

- 2.2 Quiet Tire- Segment Snapshot

- 2.3 Quiet Tire- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Quiet Tire Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Radial Tire

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Bias Tire

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Tubeless

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Quiet Tire Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Motorcycle

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial Vehicle

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Passenger Car

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Quiet Tire Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Michelin Group

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Bridgestone Corporation

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Continental AG

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 The Goodyear Tire & Rubber Company

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Hankook Tire & Technology Co.Ltd.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Pirelli & C. S.p.A.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Yokohama Rubber Company

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Limited

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Cooper Tire & Rubber Company

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Quiet Tire in 2030?

+

-

How big is the Global Quiet Tire market?

+

-

How do regulatory policies impact the Quiet Tire Market?

+

-

What major players in Quiet Tire Market?

+

-

What applications are categorized in the Quiet Tire market study?

+

-

Which product types are examined in the Quiet Tire Market Study?

+

-

Which regions are expected to show the fastest growth in the Quiet Tire market?

+

-

What are the major growth drivers in the Quiet Tire market?

+

-

Is the study period of the Quiet Tire flexible or fixed?

+

-

How do economic factors influence the Quiet Tire market?

+

-