Global Radar Security Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-594 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Radar Security Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

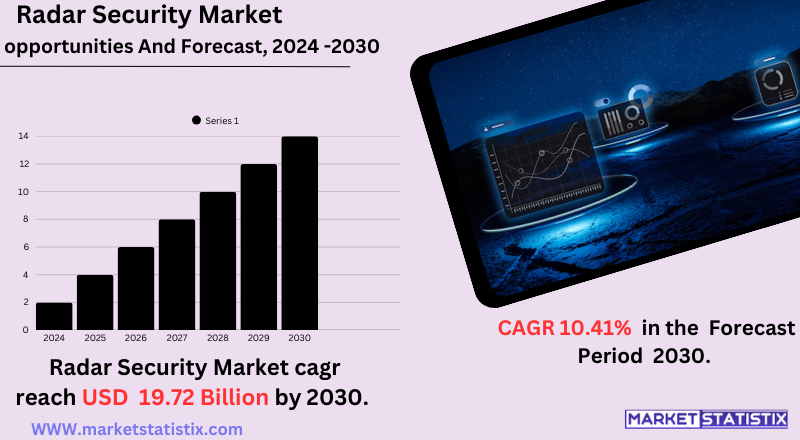

| Growth Rate | CAGR of 10.41% |

| Forecast Value (2030) | USD 19.72 Billion |

| By Product Type | Ground Surveillance Radar (GSR) Systems, Air Surveillance Radar (ASR) Systems, Marine Surveillance Radar (MSR) Systems |

| Key Market Players |

|

| By Region |

Radar Security Market Trends

Other technologies on radar security have grown strongly, such as the increase in acceptance of solid-state radar systems, which provide better reliability, less power consumption, and advanced performance as compared to the traditional magnetron-based systems. Also, there is an increase in demand for compact and portable radar solutions for mobile security applications, along with their integration with other security systems such as CCTV and access control. The demand for radar systems that mitigate and detect drones is increasing owing to the increased drone use in the commercial and malicious domains. The market segments by frequency bands, application, and end-user, with the defense and aerospace having been traditional strongholds. However, the commercial sector is emerging fast, particularly in transportation, energy, and public safety. In terms of regional analysis, North America and Europe count for a small share, whereas the Asia-Pacific segment is likely to witness the maximum growth on account of rising development activities and concerns over security.Radar Security Market Leading Players

The key players profiled in the report are Lockheed Martin Corporation (United States), Kongsberg Gruppen (Norway), Elbit Systems Ltd. (Israel), Thales SA (France), Israel Aerospace Industries Ltd. (Israel), Raytheon Company (United States), Blighter Surveillance Systems (United Kingdom), FLIR Systems, Inc. (United States), Saab AB (Sweden), DeTect Inc. (United States)Growth Accelerators

The rapid growth of the radar security market has been attributed to increased security concerns worldwide and the consequent requirement for improved surveillance systems. Modern border security, critical infrastructure protection, and defensive capabilities are being outfitted with advanced radar systems by governments or organizations around the globe. Furthermore, radar systems that help with situational awareness and threat detection are increasingly in demand due to geopolitical stressors and cross-border conflicts. Radar systems improved by AI and machine learning increase the characterization of objects while minimizing false alarms, thus making the overall efficiency operational on all fronts. Additionally, the ever-increasing demand for radar systems in civilian applications like weather, automobile safety features, and industrial monitoring has widened the market's scope. A multitude of aforementioned factors, notwithstanding high development costs, assures growth potential for the radar security market in the foreseeable future.Radar Security Market Segmentation analysis

The Global Radar Security is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Ground Surveillance Radar (GSR) Systems, Air Surveillance Radar (ASR) Systems, Marine Surveillance Radar (MSR) Systems . The Application segment categorizes the market based on its usage such as Border Security, Seaport & Harbor, Critical Infrastructure. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The radar security market is made up of a hodgepodge of established defense contractors, small enterprises with a focus on radar technology, and upcoming start-ups. The existing players focus on their extensive experience and resources to offer advanced and better-performing radar systems for critical infrastructure and military applications. The competition concentrates on detection range, accuracy, and the ability to integrate into existing security infrastructure. Smaller companies and start-ups often target niche applications or cutting-edge technologies such as low-power radar and AI-based analytics to carve a niche within the market.Challenges In Radar Security Market

The radar security market is subjected to a variety of topical challenges that restrain its growth and diffusion. One major challenge is the price levels of advanced radar technologies, especially those that perform sophisticated signal processing and use solid-state components. This high cost can serve as a barrier to widespread deployment, particularly in smaller businesses and residential installations. Another drawback is the difficulty in integrating radar systems with the existing security infrastructure and software platforms. The integration and data fusion processes require a huge amount of technical knowledge and financial investments, acting as impediments in the acceptance of complete security solutions. Environmental conditions, such as clutter and interference caused by other radio-frequency sources, can hamper radar performance, which in turn may require the implementation of different advanced signal processing schemes and site selection considerations.Risks & Prospects in Radar Security Market

The fusion of AI and machine learning for radar enhancement offers generous opportunities for better threat identification and fewer false alarms. Another evolving opportunity is developing compact and low-power radar systems for drone detection and counter-UAV applications against increasing unauthorized drone activity. With such increasing threats, critical infrastructure such as airports, power plants, and data centers calls for strong perimeter security, which presents an excellent market for radar solutions. The North American and European lands are currently at the forefront of the radar security market due to considerable investments in defense and security infrastructures. However, in the Asia-Pacific region, rapid growth is being observed due to urbanization, infrastructure development, and surging geopolitical tensions. Countries like China, India, and Japan are investing heavily in advanced security technologies, creating a huge market for radar systems. The regional analysis points toward varying needs and growth potentials across geographies driven by different security threats and levels of economic development.Key Target Audience

, The international radar security market addresses major defense & military organizations, government organizations, critical infrastructure operators, most transportation authorities, and commercial security. Defense and the army act using radar in border surveillance, threat detection, and missile defense as the largest beneficiary of all the radar systems. Government agencies utilize it mostly for the provision of national security and law enforcement as well as maritime monitoring to prevent and eliminate unauthorized entry and potential threats., Critical infrastructure operators, which include a power plant, oil & gas facilities, and airports, also adopt radar security mainly to avoid compromising the breach of security and improve situational awareness. However, the application of radar systems addresses air traffic control, marine navigation, and railway safety. Commercial security companies would also integrate radar-based solutions with their surveillance and perimeter security systems. Demand has been created within such diverse audiences for automated threat detection, along with real-time monitoring and improved security.Merger and acquisition

In recent times, there has been significant merger and acquisition activity in the radar security market, clearly showing the focus toward improving technology capabilities and gaining market share. In September 2024, CACI International announced the acquisition of Azure Summit Technology for $1.28 billion. Azure Summit is mainly in radar and communications equipment, especially in electronic warfare systems, and the reason for this acquisition is to enhance CACI's defense offerings to address the increasing needs for cybersecurity and defense products. Again, in December 2024, Triton, a private equity firm, also agreed to acquire Bosch's security and communications technology product business, which comprises units focused on video surveillance, access and intrusion systems, and communication technology. This acquisition highlights Triton's strategic endeavour to enhance its positioning in the security technology market further. The unit under acquisition had generated over 1 billion euros in sales and employed 4,300 people. >Analyst Comment

Radar security is witnessing rapid growth due to rising security concerns across the board. The foremost drivers are increasing sets for perimeter security, infrastructure protection, and border surveillance requirements. Technological progress is in favour of radar systems, with solid-state radar and artificial intelligence analytics providing enhanced detection and tracking capabilities. The integration is now being felt in the market: Radar is getting integrated with other security technologies: cameras and sensors—for a more comprehensive situational awareness system. The defense, aerospace, and commercial sectors are also creating some demand in that arena with drone detection and counter-UAV applications.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Radar Security- Snapshot

- 2.2 Radar Security- Segment Snapshot

- 2.3 Radar Security- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Radar Security Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Ground Surveillance Radar (GSR) Systems

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Air Surveillance Radar (ASR) Systems

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Marine Surveillance Radar (MSR) Systems

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Radar Security Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Border Security

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Seaport & Harbor

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Critical Infrastructure

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Thales SA (France)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Lockheed Martin Corporation (United States)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Raytheon Company (United States)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Saab AB (Sweden)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Elbit Systems Ltd. (Israel)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 FLIR Systems

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Inc. (United States)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Israel Aerospace Industries Ltd. (Israel)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Blighter Surveillance Systems (United Kingdom)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Kongsberg Gruppen (Norway)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 DeTect Inc. (United States)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Radar Security in 2030?

+

-

Which type of Radar Security is widely popular?

+

-

What is the growth rate of Radar Security Market?

+

-

What are the latest trends influencing the Radar Security Market?

+

-

Who are the key players in the Radar Security Market?

+

-

How is the Radar Security } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Radar Security Market Study?

+

-

What geographic breakdown is available in Global Radar Security Market Study?

+

-

Which region holds the second position by market share in the Radar Security market?

+

-

How are the key players in the Radar Security market targeting growth in the future?

+

-