Global Railway Passenger Business Market – Industry Trends and Forecast to 2031

Report ID: MS-170 | Automotive and Transport | Last updated: Nov, 2024 | Formats*:

Railway Passenger Business Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

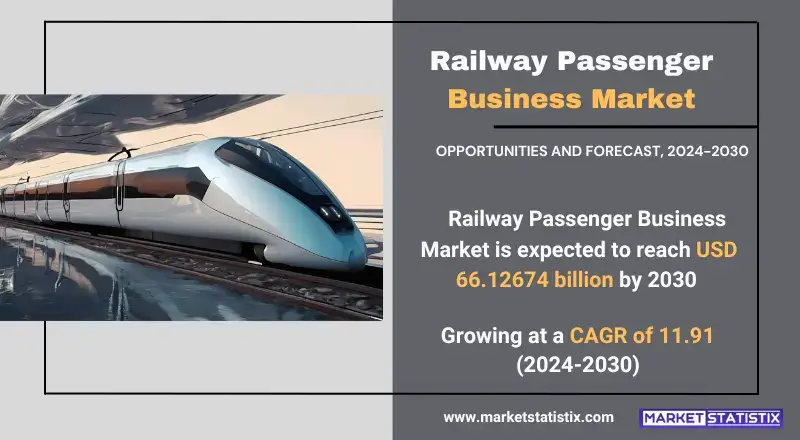

| Growth Rate | CAGR of 11.91% |

| Forecast Value (2031) | USD 66.12674 Billion |

| By Product Type | Ticket System, Passenger Information System, Others |

| Key Market Players |

|

| By Region |

Railway Passenger Business Market Trends

The railway travel market for passengers is evolving towards digital technology and enhancement of the passengers’ enjoyment. Mobile ticketing, tracking of the trains end route, and internet connectivity on the train have changed how the passengers use the train services. The convergence of AI and big data analytics has alleviated the problems that rail service providers faced, such as rich scheduling, crowd management, crowding in service provision, and extending their offerings to more tailored services. Furthermore, increasing interest in the seamless provision of multi-modal transport has induced partnerships between rail transport providers, buses, and ride-hailing companies. The railway passenger market also has a growing trend concerning sustainability, followed by more investments directed to energy-saving and environmentally friendly technologies. Most rail operators are now purchasing electric and hybrid trains while also introducing different fuels, such as hydrogen, in their operations in a bid to cut down on carbon emissions. Across the globe, governments are giving out subsidies and also encouraging the upgrading of facilities to support the green mobility agenda. This emphasis on green transport complements the increase in the number of rail, air, and road travellers who are very sensitive to environmental issues, making rail travel very viable for intercity travel over a short to medium distance as compared to air or road travel.Railway Passenger Business Market Leading Players

The key players profiled in the report are Advantech, Evolvi, Fujitsu, Hitachi, JR SYSTEMS, Masabi, SightLogix, SqillsGrowth Accelerators

The growing inclination towards procuring sustainable and green means of transport has made the railway passenger business market optimistic and lucrative as well. In the recent past, with more political and societal concerns on the impact of transport on the environment, rail transport has been considered a better option than road and air transportation. Investments have been made to add more infrastructure and services to cater to the demand for high-speed rail networks due to the need to cut down on travel times and traffic blockades in urban centres. This phenomenon is particularly high in areas such as Europe and Asia, where the rail landscape is undergoing rapid changes to meet the high population density and the need for ecological sustainability. Furthermore, another important factor is that of increasing urban areas together with modern smart city developments, which make it imperative to have functioning transport systems with less traffic. Urbanization leads to the movement of more people into cities, hence expanding rail networks to ease traffic, connect distant places, and offer better commuting services. Also, there are better travel speeds and comfortable commuting with high-speed rails and upgraded commuter services; hence, more travellers are enticed. Improved safety measures, advanced ticketing systems, and enhanced service attributes are also responsible for the growth of the market, making transport by rail convenient for both the daily commuter and long-distance transferees.Railway Passenger Business Market Segmentation analysis

The Global Railway Passenger Business is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Ticket System, Passenger Information System, Others . The Application segment categorizes the market based on its usage such as High Speed Railway, Common Slow Railway. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competition in the market for railway passenger business is marked by contributions from various actors, including national operators, regional transport providers, private firms, and a combination of the foregoing, public-private partnerships. The dominant players in this particular market and the market for railway transport services within the region are also large, state-owned entities like India Railways, Deutsche Bahn, and China Railway. These operators come from very expansive regions that are well endowed with infrastructural networks and government support. They, as well, are updating their services, putting money into high-speed rail, new and improved stations, and technological innovations that would enhance user experience and overall efficiency in operations. On the other hand, private operators have been less restrained, especially on the busy corridors when it comes to the luxury trains, availing themselves of the innovative pricing strategy coupled with advanced service standards. An example is seen where Virgin Trains in North America and Eurostar in Europe, and also private railways in Japan, have extended networks based on customer satisfaction by providing premium classes of travel. Also, other factors such as digital ticketing and smart services and green operations management practices as part of these entities’ business strategies are shaking the competitive establishments, hence forcing the public and private institutions to keep these in mind in their operations.Challenges In Railway Passenger Business Market

The market for railway transportation services for passengers has numerous challenges, but maintenance and upgrading of the infrastructure is among the most pressing issues. A lot of rail networks, predominantly in the older territories, are in dire need of upgrading their tracks, stations, and rolling stock in order to satisfy the current level of passenger traffic and safety requirements. The expensive nature of these upgrades, together with the limitation in funding, can impede the development and performance of the passenger rail transport sector. On the other hand, another issue that will be presented in this thesis is how to control and manage the growing customer expectations as well as the quality of service. Customers want trains to be on time; they wish to feel comfortable and to be offered services within reach, which is not easy to comply with all the time, particularly at busy times of the year or in extreme weather conditions. Factors such as delays, this crowdedness, and limited space can lead to a decline in customer satisfaction levels. In addition, the recent trends of better and more environmentally friendly solutions, along with digital transformation (for example, buying a ticket via an app and getting travel information with the app all the time), require large maintenance of such systems, and the modernizing of the operators becomes more difficult.Risks & Prospects in Railway Passenger Business Market

The passenger segment of the transport services market demonstrates some favourable trends that can be attributed to the growth of cities, a growing appeal of travelling to green destinations, and the state’s investments into infrastructure expansion. With spiking interest in easing the pressure brought upon roads and environmental friendliness, tomorrow's consumers and governments alike are turning to the railways as the most viable means of transport in metropolitan and other crowded places. It makes sense for the rail operators to offer more services, increase frequency, and introduce something new, like high-speed trains that provide for business tourists, leisure, and long-distance travellers as well. Furthermore, technology offers considerable enhancement of passenger services and operational performance. The deployment of features such as e-tickets, GPS-based train tracking, and train control systems can improve the client experience and efficiency of service delivery. The prospects of restructuring the existing old railway structure as well as the development of new high-speed rail lines create conditions for the establishment of private-public organizations and attracting investment for the development of railway passenger transport. These prospects also support the global shift in focus towards more sustainable and efficient means of transportation.Key Target Audience

The main focus group of the market for the railway passenger business is represented by ordinary people who travel by trains on a daily basis, particularly the working class and students in urban and suburban areas. These passengers demand cost-effective, dependable, and punctual services for their everyday travels. Moreover, tourists and leisure travellers also comprise a large share of the audience, especially in cases where there are attractive, scenic, or lengthy interstate rail journeys.,, Another important segment consists of state and transport authorities, which provide funding for construction, policy management, and expansion of railways to cope with the rising demand and improve the provision of the services. Railway system operators, or so-called railways, are private entities that are financing such railways and managing the stations, maintenance of the trains, sale of the tickets, and so on. They also focus on the passenger market in order to offer a better experience to the customers by technological, luxury, green, and other means.Merger and acquisition

The last few years have seen various mergers and acquisitions taking place within the railway sector, of which the passenger business has been greatly impacted. For instance, there is a merger between Eurostar and Thalys that was approved by the European Commission in the year 2022. This is a merger that aims at putting up an international passenger service covering the UK, France, Belgium, the Netherlands, and Germany and is aimed at promoting high-speed rail travel across different countries in Europe. The new entity, which will be headquartered in Brussels, aims at increasing passenger traffic to approximately 30 million by the year 2030. The merger is considered one of the first steps towards developing the railway system of the continent, and thus it will also address the existing transport emissions concerns. Another of those operations is the purchase of Arriva Sverige AB, which belongs to the Finnish VR Group. In 2022, the acquisition was completed, boosting the VR Group’s influence on the Swedish rail market, a development consistent with an emerging phenomenon where the railways are consolidating to extend their geographic footprint and enhance service efficiency. Furthermore, the global rail industry is undergoing transformation as well because of the companies such as Alstom and Bombardier, which have sought to engage in massive acquisitions so as to enhance their rail system and rolling stock capacity.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Railway Passenger Business- Snapshot

- 2.2 Railway Passenger Business- Segment Snapshot

- 2.3 Railway Passenger Business- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Railway Passenger Business Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Ticket System

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Passenger Information System

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Others

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Railway Passenger Business Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 High Speed Railway

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Common Slow Railway

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Advantech

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Evolvi

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Fujitsu

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Hitachi

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 JR SYSTEMS

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Masabi

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 SightLogix

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Sqills

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Railway Passenger Business in 2031?

+

-

What is the growth rate of Railway Passenger Business Market?

+

-

What are the latest trends influencing the Railway Passenger Business Market?

+

-

Who are the key players in the Railway Passenger Business Market?

+

-

How is the Railway Passenger Business } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Railway Passenger Business Market Study?

+

-

What geographic breakdown is available in Global Railway Passenger Business Market Study?

+

-

Which region holds the second position by market share in the Railway Passenger Business market?

+

-

Which region holds the highest growth rate in the Railway Passenger Business market?

+

-

How are the key players in the Railway Passenger Business market targeting growth in the future?

+

-