Global Railway telematics Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2031

Report ID: MS-2044 | Automotive and Transport | Last updated: Dec, 2024 | Formats*:

Railway telematics Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

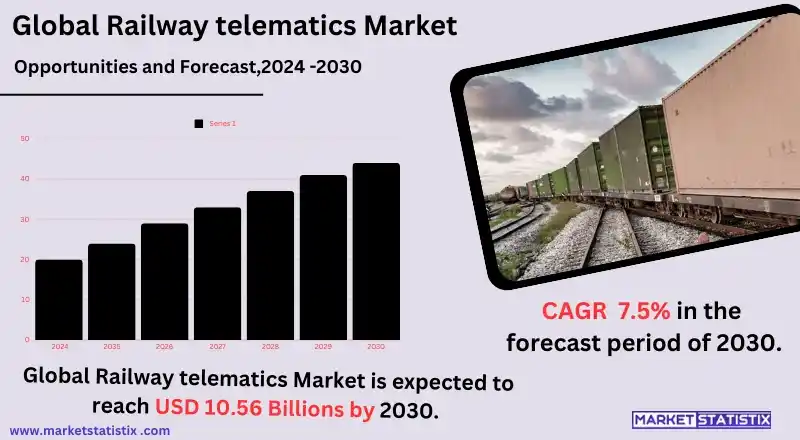

| Growth Rate | CAGR of 7.5% |

| Forecast Value (2031) | USD 10.56 Billion |

| Key Market Players |

|

| By Region |

|

Railway telematics Market Trends

The railway telematics market is going through a paradigmatic shift where connected devices and the use of data analytics are taking centre stage owing to the growing integration of Internet of Things (IoT) devices. Rail midspace structures are technologically sophisticated as they involve placing a system that monitors the condition of a train, the tracks, and the networks. Apart from enhancing the performance and safety of operations, this also aids in maintenance, allowing operators to manage problems before they occur. The marriage of telematics systems and big data analytics enables railways to improve their routing, cut down on fuel consumption, and improve on the quality of service with no drawback. Equally important is the increase in the consideration of environmental sustainability and efficiency in energy use in the railway systems. In particular, governments and authorities have introduced tighter regulatory limits on emissions and encouraged the adoption of cleaner modes of transport. Consequently, more and more railway telematics solutions have energy and emission monitoring capabilities, which assist operators in fulfilling the regulatory requirements and meeting their environmentally friendly aspirations. The combination of these features and trends will spur more growth and expansion in the railway telematics sector.Railway telematics Market Leading Players

The key players profiled in the report are A1 Digital, Alstom SA, Amsted Industries, Hitachi Ltd., Knorr-Bremse AG, Orbcomm, Rail nova SA, Robert Bosch GmbH, SAVVY Telematics Systems AG, Siemens AG, Wabtec CorporationGrowth Accelerators

The growth of the railway telematics market is mainly driven by the increasing needs for operational efficiency and safety in the rail industry. With the intention of improving their operations, rail operators deploy telematics solutions that provide information about the train’s position, velocity, and functioning in real-time, which improves decision-making and allocation of resources. In so doing, costs of operation are minimised, maintenance management is improved, and reliability of service is enhanced, thus increasing customer satisfaction and ultimately the number of passengers. One more element that pushes the market is the increasing emphasis on meeting safety standards and other regulations. In many countries, the rail transport systems are governed by strict levels of safety, which calls for the use of sophisticated telematics systems in monitoring and ensuring that safety measures are adhered to. However, this quest for safe tantalum mining activities has encouraged more attention and resources to be put towards the development of rail systems and technologies like telematics, which help in the conservation of the environment through better fuel management systems. The need for efficiency and, at the same time, compliance with requirements is enhancing the expansion of the railway telematics market.Railway telematics Market Segmentation analysis

The Global Railway telematics is segmented by and Region. . Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

This growth is driven by the growing need for real-time data analytics in the operation of trains, which improves efficiency, safety, and maintenance management. Notable segments of this market include fleet management systems, train tracking systems, and predictive maintenance systems, where fleet management takes centre stage as it is the most networked to train operations, ensuring efficient allocation of resources. The market is likely to account for the largest share in the Asia-Pacific region owing to the government policies driving the modernisation of rail infrastructure and transport systems. The railway telematics market is characterised by intense competition with the presence of major markets such as Siemens AG, Alstom, Hitachi Ltd., and Wabtec Corporation, among other players who are pouring a lot of money into new technology and novel designs in order to improve their products and services. There is a trend of companies engaging in alliances with other firms to enhance their market presence as well as the quality of services delivered. For example, the recent contracts won by companies, such as Thales, indicate their prioritisation of rehabilitation projects in different areas.Challenges In Railway telematics Market

Even though the railway telematics industry has numerous advantages, many challenges can inhibit its growth, especially the problem of deploying new technologies over existing legacy systems. Most of the railway companies today still operate on older infrastructure and technology, which makes it hard to deploy sophisticated telematics solutions that involve a lot of coordination and data sharing. Modernising such systems is often expensive and lengthy, and thus operators tend to avoid such changes, especially when they fear their operations will be compromised and when the costs involved do not make sense. Also, when it comes to different equipment and systems provided by different manufacturers, the issue of interoperability creeps back in since standard communication languages are not always provided, making it difficult to integrate them. The other serious problem is heightened dependence on information technology, which gives rise to issues surrounding data security and privacy, especially in the case of rail transport operations. Since such systems are telematics systems and are thus involved in the collecting and transmitting sectors, a lot of data, including operational data, would be put at risk, opening up avenues for hacking and other breaches appealing to operational risks. Therefore, the reliability and functionality of these measures are important in order to enhance stakeholder confidence as well as the safety of key systems.Risks & Prospects in Railway telematics Market

The opportunities in the railway telematics market are considerable due to the growing need for operational efficiency, safety, and real-time data analytics in rail transportation. With the smart rail concepts gaining prominence, technological advancements in telematics are needed by railway operators for better asset management, train health monitoring, and predictive maintenance operations. Such technologies help operators reduce downtime and operational costs and improve the reliability of services offered, which contributes to a better overall passenger experience. The escalating option of digitalisation in the railway sector also opens up the call for solutions that are not confined to the existing systems but enhance their capability for a better web of management systems for transport. Furthermore, the emphasis on sustainability or deviance from carbon intensive operations creates trends that are favourable for the railway telematics market. Countries and institutions are investing in cleaner modes of transport, hence a positive perception concerning railways and their contribution towards sustainable mobility. Railway companies are likely to implement measures, such as telematics solutions that enhance fuel efficiency and better management of operations, to achieve the sustainability targets and, at the same time, take advantage of regulatory reforms and modernisation funds. This provides an opportunity for technology providers to venture into the innovations and develop telematics solutions that are necessary for the performance of the organisations and the environment.Key Target Audience

The railway telematics market is primarily targeted at the railway operators and transport authorities who want to improve the effectiveness, safety, and reliability of the rail systems. These players apply telematics solutions to track the movements of trains, control their schedules, and maintain them more efficiently. With the use of modern-day facilities such as GPS and IoT sensors and analytics data in real time, a railway operating service is able not only to provide service, reduce costs, and respond to the possible disturbances almost instantly but also enhance the entire experience of passengers and freights.,, Another broad audience are those who offered telematics and data analytics as a service to railways and those who were developing relevant technology—service providers and systems integrators. They create and implement real-time monitoring, predictive maintenance, and asset management technologies. Working closely with the railway operators, they would facilitate the provision of the requisite technologies and tools to ensure that data was put to better use in the normal course of operations to enhance strategic and operational outcomes.Merger and acquisition

The latest trends in the railway telematics market indicate a rise in the number of mergers and acquisitions as a means of acquiring the existing technology. In September 2021, a Denmark-headquartered IoT provider, Trackunit, purchased the rail telematics unit from ZTR. The purpose of this acquisition is to facilitate the digital transformation of Trackunit and broaden the company’s offerings in railway businesses. Moreover, Wabtec Corporation in the month of July 2022 bought ARINC Rail Solutions, a subsidiary of Collins Aerospace, in order to incorporate intelligent rail dispatch systems into their operations, thus improving safety and efficiency levels in the rail ecosystem. Besides, strategic alliances are also common in this market. For example, in January 2022, Hitachi Rail announced a collaboration with Intermodal Telematics to place state-of-the art monitoring sensors within their digital freight services. The objective of the partnership is to improve freight management and safety with the help of better technology. These mergers and acquisitions, as well as these partnerships, are driven by the need of the industry to employ technology, improve efficiency, and enhance safety in railway operations, and this points to intense competition based on technology and partnerships among the major players in the industry.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Railway telematics- Snapshot

- 2.2 Railway telematics- Segment Snapshot

- 2.3 Railway telematics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Railway telematics Market by by Solution

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Fleet Management

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Collision Detection and Prevention

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Railway Tracking and Tracing

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Railway telematics Market by Train Type

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Passenger Train

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Freight Train

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Railway telematics Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 A1 Digital

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Alstom SA

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Amsted Industries

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Hitachi Ltd.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Knorr-Bremse AG

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Orbcomm

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Rail nova SA

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Robert Bosch GmbH

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 SAVVY Telematics Systems AG

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Siemens AG

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Wabtec Corporation

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By by Solution |

|

By Train Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Railway telematics in 2031?

+

-

What is the growth rate of Railway telematics Market?

+

-

What are the latest trends influencing the Railway telematics Market?

+

-

Who are the key players in the Railway telematics Market?

+

-

How is the Railway telematics } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Railway telematics Market Study?

+

-

What geographic breakdown is available in Global Railway telematics Market Study?

+

-

Which region holds the second position by market share in the Railway telematics market?

+

-

How are the key players in the Railway telematics market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Railway telematics market?

+

-