Global Residential Energy Storage Systems Market - Industry Dynamics, Size, And Opportunity Forecast To 2032

Report ID: MS-720 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Residential Energy Storage Systems Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

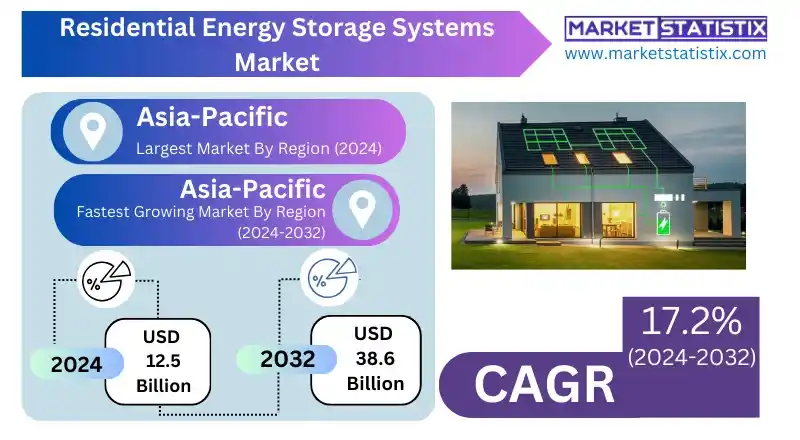

| Growth Rate | CAGR of 17.2% |

| Forecast Value (2032) | USD 38.6 Billion |

| By Product Type | Flow Battery, Lithium-ion Battery, Lead-acid Battery, Nickel-based Battery, Sodium-ion Battery (Emerging) |

| Key Market Players |

|

| By Region |

|

Residential Energy Storage Systems Market Trends

A major trend that has emerged is the ever-closer interrelationship of battery storage and rooftop solar PV systems. On the one hand, homeowners want to maximise their self-consumption of solar energy and therefore tie these two technologies together to lower the electricity bill and enhance energy independence. On the other hand, this synergy is aided and abetted by government incentives and a general trend of increasing economic attractiveness of combined solar and storage solutions. Energy resilience and backup power emerge as other important drivers with respect to battery storage, especially in areas that tend to be vulnerable to power interruptions; that provides backup power to critical circuits in the home. Moreover, intelligent house integration and grid service participation are growing trends. Residential energy storage systems increasingly come equipped with sophisticated software and connectivity features that allow homeowners to monitor and manage their energy usage from smart devices. In addition, they are being dispatched to virtual power plants (VPPs) and demand response programs, allowing homeowners to be paid for grid support services.Residential Energy Storage Systems Market Leading Players

The key players profiled in the report are Eaton Corporation PLC, Tesla, Inc., Maxwell Technologies, Inc., Enphase Energy, Inc., BYD Company Ltd, Delta Electronics, Inc., VARTA AG, LG Energy Solutions Ltd, ABB Ltd., Evapco, Inc., Huawei Technologies Co., Ltd., EOS Energy Storage, Sonnen GmbH, Panasonic Holdings Corporation, General Electric CompanyGrowth Accelerators

The adoption of rooftop solar photovoltaic installations is one major factor fuelling the growth of the residential energy storage systems market. Homeowners are looking to store surplus solar energy for later use in an endeavour to maximise the utilisation of their self-generated solar energy, thereby reducing their dependence on the grid and, in some instances, lowering electricity expenses. Additionally, with escalating electricity prices in many parts of the globe, energy storage now represents a potentially attractive opportunity for savings via consumption of stored energy in high-price times. Yet another driving factor is the growing consciousness of energy independence and resilience, especially in areas that suffer power outages due to extreme weather events or grid instability. The battery storage systems provide a capable backup supply, enabling the most important appliances to function in case of grid disruptions.Residential Energy Storage Systems Market Segmentation analysis

The Global Residential Energy Storage Systems is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Flow Battery, Lithium-ion Battery, Lead-acid Battery, Nickel-based Battery, Sodium-ion Battery (Emerging) . The Application segment categorizes the market based on its usage such as Off-grid, Solar Energy Storage, Backup Power Supply, On-grid, Time-of-Use Optimization. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Currently, the competition in the residential energy storage systems market involves a combination of mainstream companies and up-and-coming companies competing against each other. The leading international brands, such as Tesla, Panasonic, BYD, Sonnen, and Enphase Energy, have been able to carve out their niche in terms of their well-established brand identity, technical advancements, and robust product portfolios. They invest heavily in research and development in the areas of battery technology, software integration, and the design of the systems to provide homeowners with increasingly efficient, reliable, and cost-effective solutions. The market has many emerging regional players and entrants, with most entering or currently active in the fast-growing Asia-Pacific region. Coupled with this development is innovation and competition in price.Challenges In Residential Energy Storage Systems Market

The barriers that prevent the proliferation of residential energy storage systems within the market are many. These involve, chiefly, the cost of installing and acquiring devices, such as batteries and inverters, which many homeowners find prohibitively high, particularly low-income earners. For example, lithium-ion batteries, which are the most popular, are constructed from expensive materials, and installations usually involve other costly electrical upgrades requiring skilled manpower. Then, there are technical complexities. They range from the way one would operate these systems to the problems encountered during maintenance. This is because most residential systems are complex architectures integrating batteries, inverters, and other components that are only partially standardised, creating inefficiencies and likely problems with compatibility. Environmental considerations in the production and disposal of batteries, like lithium and cobalt mining, raise sustainability concerns. For example, little recycling options for lithium-ion batteries highlight issues such as the need for more sustainable alternatives, such as solid-state or sodium-ion batteries.Risks & Prospects in Residential Energy Storage Systems Market

Low-cost battery technologies, especially lithium-based systems, are increasingly becoming household energy storage systems. The availability of government benefits such as tax credits and subsidies speed up their usage. With the combination of renewable energy sources as such, like solar and wind, suitable for residential storage systems, households have an opportunity to optimise power usage and reduce reliance on the grid, power bills, and all those good things. Regionally, it is Asia-Pacific, driven by rapid urbanisation and population growth, as well as strong renewable energy policies in countries like China and India. North America is another key region, with large investments in grid modernisation and with supportive government policies to promote clean energy. Europe focuses on reducing carbon emissions through other means by integrating residential storage systems with renewable energy sources. Potential high emerging markets are Africa and Latin America as they solve electricity shortages through decentralised solutions. These regional dynamics give varied opportunities for market growth in both developed and developing economies.Key Target Audience

A key component of the primary target audience for the residential energy storage systems (RESS) market is any homeowner whose focus is on attaining energy independence and cost savings, as well as a backup power solution for their energy consumption. These homeowners are interested in reducing their reliance on the grid, reducing their electricity bills, and ensuring power availability in times of outage. Increased use of renewable energy sources, for example, solar panels, has also created interest in RESS among eco-conscious customers seeking to leverage their energy consumption while reducing their carbon footprint.,, Another big group in the RESS market is composed of utility companies and grid operators that seek to use residential storage systems for improved grid stability, peak load demand management, and higher renewable energy integration. Utilities can partner with homeowners and establish virtual power plants so that they earn new revenue streams as well as enhance grid reliability. A win-win for both sides: homeowners receive financial benefits while utilities optimise the distribution network.Merger and acquisition

The residential energy storage systems market has experienced significant mergers and acquisitions activity in consideration of its fast-growing nature and strategic importance. With corporate funding soaring 117% year-on-year in the very first half of 2024 and up to $15.4 billion from 64 deals, the driving force was majorly a combination of debt and public market financing of $13 billion across 16 deals, marking a 294% increase from the same period in 2023. In contrast, venture capital funding fell by 37% to $2.4 billion. The record shows that, during H1 2024, 14 mergers and acquisitions concerning energy storage were carried out, up from eight in H1 2023, pointing toward accelerating consolidation in this sector. Among the knockout deals, Energy Capital Partners (ECP) announced plans in May 2024 to complete the $2.56 billion acquisition of Atlantica Sustainable Infrastructure. Atlantica is a company known mainly for its environmentally sound conduct involving renewable energy assets such as solar and energy storage facilities, while the acquisition proposal was expected to be carried a lot more into the fourth quarter of 2024. Here, of course, the move demonstrates ECP's ongoing keenness to develop new avenues in the sustainable infrastructure sector. Meanwhile, in December 2024, TPG Rise Climate entered negotiations to buy Altus Power, a provider of solar and energy storage solutions for commercial and residential properties. This signals the increasing interest of private equity firms in the residential energy storage market. >Analyst Comment

The energy storage systems for the residence are considered to be growing rapidly, with renewable energy integration and battery technology being the two driving forces behind this market. With these systems, homeowners are enabled to store electricity from solar panels or the grid, thus promoting energy independence away from conventional sources of power. The market is expected to reach a revenue of $0.91 billion in 2024, increasing to $1.08 billion in 2025 and doubling to $1.99 billion by 2029. Driving forces behind all of this really are cheaper prices for batteries, growing adoption of solar rooftop systems, and supportive government policies like tax incentives and grants. As such, increasing concern for grid resilience in the face of decaying infrastructure and repeated outages is bringing forth greater rates of adoption.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Residential Energy Storage Systems- Snapshot

- 2.2 Residential Energy Storage Systems- Segment Snapshot

- 2.3 Residential Energy Storage Systems- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Residential Energy Storage Systems Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Lithium-ion Battery

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Lead-acid Battery

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Flow Battery

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Nickel-based Battery

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Sodium-ion Battery (Emerging)

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Residential Energy Storage Systems Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Off-grid

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 On-grid

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Backup Power Supply

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Solar Energy Storage

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Time-of-Use Optimization

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Residential Energy Storage Systems Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Maxwell Technologies

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Inc.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 LG Energy Solutions Ltd

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Enphase Energy

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Inc.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Eaton Corporation PLC

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Huawei Technologies Co.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Ltd.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Panasonic Holdings Corporation

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Tesla

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Inc.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 EOS Energy Storage

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 VARTA AG

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Sonnen GmbH

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Delta Electronics

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Inc.

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 ABB Ltd.

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 BYD Company Ltd

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Evapco

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

- 8.20 Inc.

- 8.20.1 Company Overview

- 8.20.2 Key Executives

- 8.20.3 Company snapshot

- 8.20.4 Active Business Divisions

- 8.20.5 Product portfolio

- 8.20.6 Business performance

- 8.20.7 Major Strategic Initiatives and Developments

- 8.21 General Electric Company

- 8.21.1 Company Overview

- 8.21.2 Key Executives

- 8.21.3 Company snapshot

- 8.21.4 Active Business Divisions

- 8.21.5 Product portfolio

- 8.21.6 Business performance

- 8.21.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Residential Energy Storage Systems in 2032?

+

-

Which type of Residential Energy Storage Systems is widely popular?

+

-

What is the growth rate of Residential Energy Storage Systems Market?

+

-

What are the latest trends influencing the Residential Energy Storage Systems Market?

+

-

Who are the key players in the Residential Energy Storage Systems Market?

+

-

How is the Residential Energy Storage Systems } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Residential Energy Storage Systems Market Study?

+

-

What geographic breakdown is available in Global Residential Energy Storage Systems Market Study?

+

-

Which region holds the second position by market share in the Residential Energy Storage Systems market?

+

-

Which region holds the highest growth rate in the Residential Energy Storage Systems market?

+

-