Global RFID and Barcode Printer Market Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-627 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

RFID and Barcode Printer Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

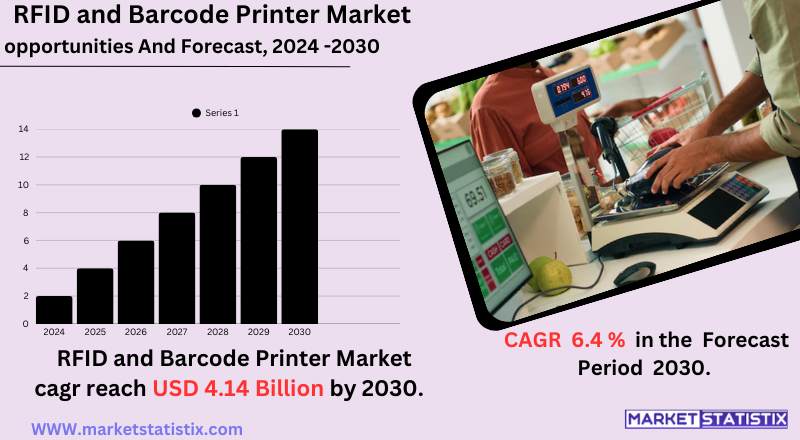

| Growth Rate | CAGR of 6.4% |

| Forecast Value (2030) | USD 4.14 billion |

| By Product Type | Industrial RFID Printers, Desktop RFID Printers, Mobile RFID Printer |

| Key Market Players |

|

| By Region |

RFID and Barcode Printer Market Trends

A major trend is the widespread acceptance of RFID technology, which extends the tracking potential beyond that of traditional barcodes—the increase in adoption of RFID for retail, logistics, and healthcare, where inventory management must be faultless and efficient. This is coupled with increasing demand for mobile and wireless printing solutions, which allow for on-demand creation of labels and tags in dynamic environments. In addition, improvements in printing technology for better print quality, speed, and durability are being attained. The integration of IoT and cloud solutions that aid in seamless data integration and remote printer management continues to dictate the market dynamics. Such trends are a reflection of the industry's responsibility to offer much more efficient, reliable, and flexible solutions to businesses keen on optimizing their operations using advanced identification and tracking technologies.RFID and Barcode Printer Market Leading Players

The key players profiled in the report are Honeywell International, SATO Holdings, Toshiba Tec Corporation, Printronix Inc., Godex International, Avery Dennison Corporation, Lexmark, Zebra Technologies Corporation, BOCA SystemsGrowth Accelerators

The RFID and Barcode Printer market is poised for growth due to a mix of realities, the largest being the growing need for greater inventory management and supply chain efficiency in various industrial segments. In an e-commerce environment, the growing complexity of logistics networks calls for tracking goods in an accurate and real-time fashion, which is what these printers support. Furthermore, the higher levels of automation being installed in manufacturing and retail, supported by businesses now eager to gain efficiency and curb operational errors, further fuel the appetite. In addition, the increasing reliance of the healthcare industry on correct tracking of patients and medications and that of transport and logistics companies on orderly shipment management considerably adds to the growth of this market. Efficiency, accuracy, and traceability for varied sectors constitute the root driver of this market growth.RFID and Barcode Printer Market Segmentation analysis

The Global RFID and Barcode Printer is segmented by Type, and Region. By Type, the market is divided into Distributed Industrial RFID Printers, Desktop RFID Printers, Mobile RFID Printer . Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The industry dynamic with respect to competition is determined by numerous factors such as technological advancement, price points, and the ability to meet different industry needs, including retail, healthcare, manufacturing, and logistics. Differentiation is about product quality, reliability, and after-sales support. The other market contributors are smaller players and startups targeting niche segments, increasing competition. All in all, it is a quick-evolving technological market oriented mainly towards meeting the surging demand for efficient inventory management and asset tracking solutions.Challenges In RFID and Barcode Printer Market

High initial costs and compatibility with legacy systems remain challenges for the RFID and barcode printer market. Companies struggle to justify investments in complex RFID-enabled printers due to high initial set-up and maintenance costs. Integration with older systems creates operational delays, thus delaying widespread adoption in small and medium enterprises (SMEs). Some technical difficulties reducing popularity in barcoding industries requiring high-quality prints arise due to low contrast in the RFID elements and smudging of barcodes from excess heat settings. To make matters worse, the heightened demand for sustainable practices is forcing manufacturers to create environmentally friendly offerings. Biodegradable labels and non-toxic inks are in focus, but the prices of both are blocking entry to price-sensitive markets. All these navigating issues converge to ramp up the complexity in the market: establishing criteria for firms that resolve for trade-offs between cost and technological enhancement.Risks & Prospects in RFID and Barcode Printer Market

The biggest opportunity emerges as combining RFID technology with barcode printers, as it allows real-time monitoring as well as capability improvements in all sectors, such as retail, logistics, and healthcare. Other promising mobile and wireless printing, cloud printing, and eco-friendly consumers will continuously attract other dimensions expanding in the market. Such moves toward implementing Industry 4.0 or other smart factory initiatives will certainly continue to increase the demand for RFID-enabled printers. North America is the most established market, thanks to the level of technological adoption and the proliferation of e-commerce. Asia-Pacific has become a significant region for growth thanks to increasing industrialization, government initiatives like "Make in India," and the emergence of organized retail. In Europe, with its increasingly sustainable and regulated markets such as food and pharmaceuticals, it remains a prominent market. Japan is leading innovation by combining IoT with robotics in barcode printing systems; while developing economies such as India are witnessing increased adoption because of affordable solutions offered to SMEs.Key Target Audience

, The RFID and Barcode Printer market primarily targets retailers and manufacturers, along with logistics providers. Retailers are able to manage their inventories through these printers for identification of products and improvement in customer service in price tagging, promotional material, or even shipping labels. Manufacturers use RFID and barcode printers to increase productivity while streamlining operations through tracking of components and finished goods. Logistics providers such as these form part of the major audience who, under these, carry out operations such as tracking packages and warehousing., These healthcare establishments, transport systems, and government offices also make up considerable target group segments. Here, the applications of RFID and barcode printers for identification of patients, tracking medical equipment, and management of pharmaceutical stocks are used directly in the health sector. The government employs them in asset tracking and authentication of documents, whereas the transportation sector uses them in ticketing and cargo management. Another important customer segment that is emerging includes small businesses adopting mobile printing solutions due to the flood of new compact easy-to-carry and low-cost printer models.Merger and acquisition

The RFID and barcode printer market has seen considerable consolidation through mergers and acquisitions that redefine the competitive landscape of the industry. Perhaps the most significant recent occurrence was Xerox Holdings' announcement of an acquisition of Lexmark International in the amount of $1.50 billion, thus returning the printer manufacturer to U.S. ownership from Chinese investors. The purpose of this very strategic step is to grow Xerox's market share, especially in the Asia-Pacific region, and increase its capabilities to service more than 200,000 customers in 170 nations. Traditionally, major players in the industry have gone for acquisition to fortify their market standing and diversify their product range. For instance, Zebra Technologies acquired Motorola Solutions' Enterprise Business in 2014 for $3.45 billion, creating an established global leader in barcode scanning, mobile computing, and RFID solutions. Similarly, Honeywell's acquisition of Intermec in 2013 for $600 million further established its presence in the area of barcode printing, scanning, and mobile computing. Such strategic consolidations have given companies the strength to advance their technological capabilities further to address diverse and evolving needs across various industries, including retail, healthcare, manufacturing, and logistics. >Analyst Comment

The RFID and Barcode Printer segment is quite stable, with growing needs for tracking and identification solutions in various industries. Due to the modern need posed by supply chains, logistics, and retail operations, there is an increase in the adoption of automated data-capturing technologies. Barcode printers are mainly for simple inventory and product labelling, while RFID printers are picking up for those requiring live tracking and better data management. Another dominant trend would be the smart printing systems supporting wireless connectivity and cloud-based management systems for better operational efficiency.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 RFID and Barcode Printer- Snapshot

- 2.2 RFID and Barcode Printer- Segment Snapshot

- 2.3 RFID and Barcode Printer- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: RFID and Barcode Printer Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Desktop RFID Printers

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Industrial RFID Printers

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Mobile RFID Printer

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Competitive Landscape

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 Zebra Technologies Corporation

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 Honeywell International

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 SATO Holdings

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 Toshiba Tec Corporation

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 Avery Dennison Corporation

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 Lexmark

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 Godex International

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 Printronix Inc.

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

- 6.9 BOCA Systems

- 6.9.1 Company Overview

- 6.9.2 Key Executives

- 6.9.3 Company snapshot

- 6.9.4 Active Business Divisions

- 6.9.5 Product portfolio

- 6.9.6 Business performance

- 6.9.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of RFID and Barcode Printer in 2030?

+

-

How big is the Global RFID and Barcode Printer market?

+

-

How do regulatory policies impact the RFID and Barcode Printer Market?

+

-

What major players in RFID and Barcode Printer Market?

+

-

What applications are categorized in the RFID and Barcode Printer market study?

+

-

Which product types are examined in the RFID and Barcode Printer Market Study?

+

-

Which regions are expected to show the fastest growth in the RFID and Barcode Printer market?

+

-

Which region is the fastest growing in the RFID and Barcode Printer market?

+

-

What are the major growth drivers in the RFID and Barcode Printer market?

+

-

Is the study period of the RFID and Barcode Printer flexible or fixed?

+

-