Global Sanitary Ware Market Trends and Forecast to 2030

Report ID: MS-412 | Consumer Goods | Last updated: May, 2025 | Formats*:

Sanitary ware involves different types of production and distribution of products comprising sanitary ware and hygiene installations for the house and bathroom. These products include the essentials like water closets, washbasins, bathtubs, showers, and faucets made of ceramic, porcelain, or metal. Sanitary ware installation forms the important base for hygiene in residential or commercial sectors, thereby enhancing the functionality and aesthetics of these spaces. Urbanization, disposable incomes, and a rising tide of acceptance of hygiene and sanitation have influenced the Sanitary Ware Market. The current trend, however, is favouring smart bathrooms, green products, and custom-made designs. This market looks at segmentation based on product type, material, technology, and end-user request. Key players are sharpening their focus on innovation, product development, and strategic alliances to stay ahead in the competitive circuit.

Sanitary Ware Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

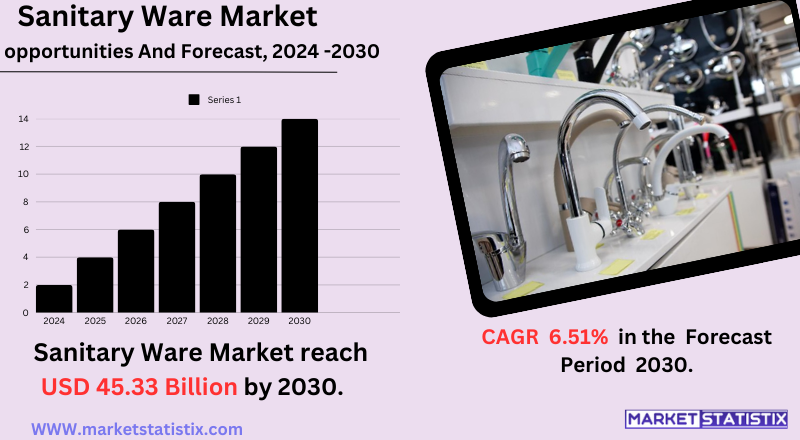

| Growth Rate | CAGR of 6.51% |

| Forecast Value (2030) | USD 45.33 Billion |

| By Product Type | Bathtubs, Cistern, Showers, Urinals, Toilet Seats, Bathroom Accessories, Wash Basin, Faucets, Others |

| Key Market Players |

|

| By Region |

|

Sanitary Ware Market Trends

Currently, the sanitary ware market is witnessing an increase in demand for innovative as well as sustainable products. Modern consumers want aesthetically beautiful and functional designs that also save water consumption through eco-friendly materials. All these trends make manufacturers develop smart bathroom solutions such as touchless faucets, automated flushing, and customised shower experiences. Besides, another market trend is the increase in the number of online retail channels selling sanitary ware products. E-commerce, as usual, has an accessibility factor in that with a click, various products at a practical and reasonable cost with logistic access just arrive at your doorstep. If shopping moved toward e-commerce, brick-and-mortar stores had no choice but to embrace this change by developing their online channel, lest they lose business across the board.

Sanitary Ware Market Leading Players

The key players profiled in the report are Zurn Industries LLC. (United States), LIXIL Corporation (Japan), VITRA INTERNATIONAL AG (Switzerland), CERA Sanitaryware Limited (India), BRIZO KITCHEN & BATH COMPANY (India), Masco Corporation (United States), Jaquar (India), Kerovit (India), Kohler Co. (United States), Bella Group (United States), Wenzhou Liangsha Sanitary Ware Co., Ltd. (China)Growth Accelerators

Several key factors are driving the growth of the Sanitary Ware Market. Rapid urbanization and increasing disposable incomes in developing countries are leading to higher demand for modern bathroom and kitchen fixtures. A growing emphasis on hygiene and sanitation, coupled with government initiatives promoting cleanliness, is also contributing to market expansion. Beyond these core drivers, evolving consumer preferences are also shaping the market. The increasing adoption of smart bathroom technologies, such as touchless faucets and sensor-based toilets, is creating new opportunities for manufacturers. Additionally, a growing awareness of environmental sustainability is driving demand for water-saving and eco-friendly sanitary ware solutions. These factors, combined with continuous product innovation and design advancements, are expected to propel the Sanitary Ware Market forward.

Sanitary Ware Market Segmentation analysis

The Global Sanitary Ware is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Bathtubs, Cistern, Showers, Urinals, Toilet Seats, Bathroom Accessories, Wash Basin, Faucets, Others . The Application segment categorizes the market based on its usage such as Institutional, Commercial, Residential, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The developmental landscapes for sanitary ware are competitive with space for old existing global players and regional manufacturers to make their inroads. Key players have pushed really hard on product innovations, design differentiation, and strategic alliances to gain a competitive edge. Some merger and acquisition activities are on the rise, as companies are trying to enhance their product portfolio and geographical coverage and/or production capacity. Pricing strategies, brand image, and distribution channels also come into play in influencing the competitiveness of them. Today, companies are increasingly investing in R&D to launch cutting-edge technologies such as advanced smart bathroom solutions and water-saving features.

Challenges In Sanitary Ware Market

One of the problems that poses a challenge to the sanitary ware market is the fluctuation of raw material prices. The cost of ceramics, metals, and plastics will change from time to time, thus affecting the final production costs and possibly reducing the profit margin of the manufacturers. Therefore, the planning for the long term becomes difficult here, besides maintaining the price of the products. Another problem is increasing competition in the area from more and more low-cost imports. Imported goods create much pressure on the domestic manufacturers to reduce the selling price, further adversely affecting the product quality and innovation efforts. Consumer preferences also change continually, along with demands for innovations in product design, thereby requiring companies to invest continuously in research and development for competitiveness.

Risks & Prospects in Sanitary Ware Market

Major opportunities in the sanitary ware market come from urbanisation, increasing incomes, and the rising awareness of hygiene and water efficiency products. The demand for premium and smart sanitary ware, like sensor-based faucets and touch-free flushing systems, is growing, thanks to improvements in the technologies and new requirements from consumers. Other factors contributing to market expansion include new government initiatives focusing on the promotion of sanitation and sustainable water usage, all of these especially in developing regions. The Asia-Pacific region surpasses all other regions in the sanitary ware market because of rapid urbanisation, a consistently developing population, and an increase in construction works, especially in India and China. North America and Europe also contribute substantial shares in the sanitary ware market due to their high demands on high-end and environmentally friendly bathroom solutions. The other regions experiencing steady growth include the Middle East and Africa, mostly because of infrastructure projects and growth in the hospitality sector. Latin America is fast becoming a potential market, with growth in living standards and investments in both commercial and residential buildings.

Key Target Audience

The sanitary ware market has a wide range of target audiences, segmented mainly by the end users, which include residential customers like homeowners and renters who look for functional and aesthetic sanitary ware for their bathrooms and kitchens. Such consumers may be influenced by design trends, price points, and brand name reputation. The commercial sector is yet another target group, with customers representing hotels, restaurants, offices, and public properties. For these customers, the primary selection criteria for sanitary ware will be durability, hygiene, and water efficiency. Architects, interior designers, and contractors together form another equally important target group in that they specify and purchase sanitary ware for projects.

Merger and acquisition

The sanitary ware market has been ignorant toward merger and acquisition activities recently; rather, it has been represented as a strategy by companies to build favourable market positions and diversify their product offerings. In July 2024, Villeroy & Boch, a significant manufacturer of ceramics, acquired Ideal Standard International for €600 million. This acquisition is intended to strengthen Villeroy & Boch's Bathroom & Wellness Division by diversifying its product range and reinforcing its presence in key markets. Sometime earlier, in June 2023, Warburg Pincus, a private equity firm from the USA, acquired controlling shareholding in Watertec India, a leading manufacturer of sanitary ware products. The goal of this acquisition was to strengthen Watertec's market leadership, diversify its product offerings, and enhance its geographic presence in India's burgeoning bath fittings market. Such strategic investments illuminate how dynamic the sanitary ware industry is, with companies seeking to exploit growth opportunities and changing consumer demands.

>Analyst Comment

The market for sanitary ware is expanding steadily, spurred by various factors such as urbanisation, increasing disposable income, and enhanced awareness of hygiene and sanitation. The burgeoning demand for innovative and aesthetically pleasing sanitary ware products encompasses smart bathroom solutions and personalised designs. Additionally, an increasing focus on water conservation and the production of eco-friendly products are other key factors affecting the market. Intense market competition among major players brings in innovation and strategic alliances that would extend their goal of distribution.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Sanitary Ware- Snapshot

- 2.2 Sanitary Ware- Segment Snapshot

- 2.3 Sanitary Ware- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Sanitary Ware Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Toilet Seats

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Urinals

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Cistern

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Wash Basin

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Faucets

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Showers

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 Bathtubs

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

- 4.9 Bathroom Accessories

- 4.9.1 Key market trends, factors driving growth, and opportunities

- 4.9.2 Market size and forecast, by region

- 4.9.3 Market share analysis by country

- 4.10 Others

- 4.10.1 Key market trends, factors driving growth, and opportunities

- 4.10.2 Market size and forecast, by region

- 4.10.3 Market share analysis by country

5: Sanitary Ware Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Residential

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Institutional

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Sanitary Ware Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 LIXIL Corporation (Japan)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Kohler Co. (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Masco Corporation (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Zurn Industries LLC. (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Bella Group (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Jaquar (India)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 CERA Sanitaryware Limited (India)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Kerovit (India)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 BRIZO KITCHEN & BATH COMPANY (India)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 VITRA INTERNATIONAL AG (Switzerland)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Wenzhou Liangsha Sanitary Ware Co.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Ltd. (China)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Sanitary Ware in 2030?

+

-

Which type of Sanitary Ware is widely popular?

+

-

What is the growth rate of Sanitary Ware Market?

+

-

What are the latest trends influencing the Sanitary Ware Market?

+

-

Who are the key players in the Sanitary Ware Market?

+

-

How is the Sanitary Ware } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Sanitary Ware Market Study?

+

-

What geographic breakdown is available in Global Sanitary Ware Market Study?

+

-

Which region holds the second position by market share in the Sanitary Ware market?

+

-

How are the key players in the Sanitary Ware market targeting growth in the future?

+

-

Several key factors are driving the growth of the Sanitary Ware Market. Rapid urbanization and increasing disposable incomes in developing countries are leading to higher demand for modern bathroom and kitchen fixtures. A growing emphasis on hygiene and sanitation, coupled with government initiatives promoting cleanliness, is also contributing to market expansion. Beyond these core drivers, evolving consumer preferences are also shaping the market. The increasing adoption of smart bathroom technologies, such as touchless faucets and sensor-based toilets, is creating new opportunities for manufacturers. Additionally, a growing awareness of environmental sustainability is driving demand for water-saving and eco-friendly sanitary ware solutions. These factors, combined with continuous product innovation and design advancements, are expected to propel the Sanitary Ware Market forward.