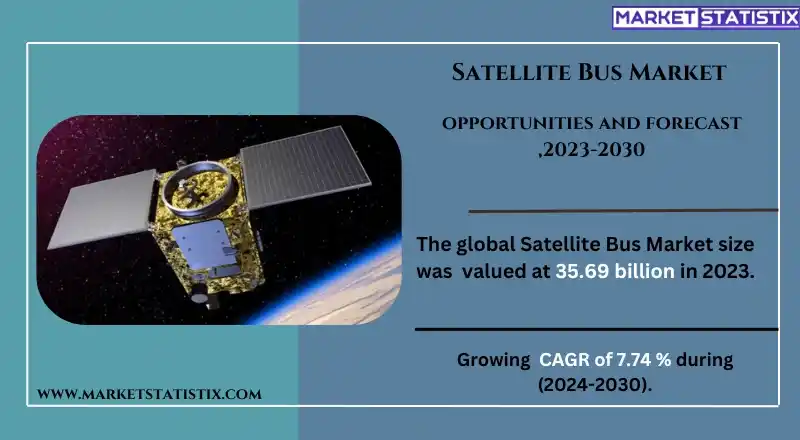

Global Satellite Bus Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-25 | Aerospace and Defence | Last updated: Sep, 2024 | Formats*:

Satellite Bus Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 7.74% |

| By Product Type | Small Satellite, Medium Satellite, Heavy Satellite |

| Key Market Players |

|

| By Region |

Satellite Bus Market Trends

The market for satellite buses is likely to grow tremendously owing to the rising popularisation of satellite services and applications in several industries such as telecommunications, earth observation, and global positioning systems. The market is also witnessing changes due to the miniaturisation of technology, in which small satellites and more election-cube-type satellite systems are being developed. Most of these smaller satellites make use of low-cost and modular satellite bus systems, allowing even the most conservative sectors of society, such as start-ups and research, to benefit from space technology as well as carrying out their missions at available lower expenses. This change is making the market bigger and increasing the urge for new designs and functions of the satellite bus. On the other hand, the increasing awareness of sustainability issues as well as environmental monitoring is causing an upsurge in the need for satellites that have sophisticated sensors and payloads, which also affects the design and the development of the satellite bus. Moreover, satellite bus technology is advancing due to increased interactions and collaborations between satellite manufacturers and the government and private company services that provide satellites.Satellite Bus Market Leading Players

The key players profiled in the report are Airbus (Netherlands), Boeing (U.S.), Centum (India), Honeywell International Inc. (U.S.), IAI (Israel), L3Harris Technologies, Inc. (U.S.), Lockheed Martin Corporation (U.S.), Maxar Technologies (U.S), Mitsubishi Electric Corporation (Japan), Northrop Grumman (U.S.), OHB SE (Germany), Thales Group (France)Growth Accelerators

Increasing demand for satellite launches and improving technology involved in satellites are the major factors that drive the growth of the satellite bus market. As governments and private organisations wish to improve communication, earth observation, and navigation, the demand for strong and effective satellite buses increased dramatically. Developments in satellite design, such as mini-satellites and the use of other designs combined or modular, reduce the costs of design and development of satellites, leading to the use of satellites for diverse purposes, which include telecommunications and scientific research. There is also a rising need for satellite buses and the availability of primary marketing, owing to the internet and data services-driven growth of small satellite constellations by enterprises. Another key factor is the increasing activities and investments in space and the launching of satellites for other business purposes. These are mostly remote sensing applications like agriculture, weather, and disaster management and require sophisticated technologies like satellite buses to carry heavy payloads on lengthy missions.Satellite Bus Market Segmentation analysis

The Global Satellite Bus is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Small Satellite, Medium Satellite, Heavy Satellite . The Application segment categorizes the market based on its usage such as Earth Observation & Meteorology, Communication, Scientific Research & Exploration, Surveillance & Security, Mapping & Navigation. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The satellite bus market structure is a hybrid one comprising the traditional aerospace firms, companies that predominantly focus on manufacturing satellites, and new technological companies emerging into the market. Major companies operating in this market encompass Boeing, Airbus Defence and Space, Lockheed Martin, and Thales Alenia Space, all of which provide an array of satellite bus solutions designed for different purposes, which include commercial communication and scientific quests. These conglomerates utilize their engineering, manufacturing and integration experience in the production of trustable and sophisticated satellite bus systems capable of fulfilling different mission requirements. On the other hand, emerging players and startups are also entering the satellite bus market concentrating on innovation that is cost effective. This includes the trend towards smaller and more flexible satellite bus design to respond to the upsurge in demand for small satellites and satellite constellations in Low Earth Orbit (LEO) ranges. Moreover, the competition is becoming stiffer because companies are putting in place measures such as research and development to enable them come up with advanced satellite buses that are more cost effective and with higher energy efficiency and modularity.Challenges In Satellite Bus Market

The market for satellite bus systems is also not free from burdens. The biggest burden is associated with the fast-paced nature of technological development in the industry, alongside heightened competition. One specific barrier to entry into the market and a challenge to innovation is the high research, development, and costing of manufacturing the satellite buses. In addition, designing and building satellites is so intricate that it often results in the elongation of the design period and its cost, making the burden of the project less tenable and economical. More so, the development of such Because the satellite industry is continually progressing, the manufacturers are always under pressure to comply with new requirements, which can put a lot of stress on the industry. Diminishing regulation of satellite assignments and embracing smaller, more functional satellites is another portrayal of this shift, as it motivates satellite bus manufacturers to come up with strategies or products to modify the satellite bus. Innovative changes in the design of satellite buses have been necessitated by the increase in demand for the small-sized high workers allowed for the mobility of the various components within the structure. In relation to this trend, the development of large Gerard or conventional satellite systems is gradually being shifted towards small, lightweight, high-performance systems, or rather, small, mass-produced buses fitted with hundreds of small satellites.Risks & Prospects in Satellite Bus Market

The satellite bus market is growing in view of the rising demand for satellite-based services in different industries, including telecommunications, earth observation, and scientific research. With growing levels of communication, data throughput, and remote sensing, there is an ever-increasing necessity for comprehensive and adaptable satellite bus systems that can incorporate complex payloads. Satellite technology is also evolving thanks to innovations like “modular” and “mini” designs, which make it possible to design and build smaller, lighter commercial off-the-shelf satellites for diverse deployments, thereby increasing the market scope. Yet another significant opportunity is also observed in the small satellites and constellation applications; satellite internet and worldwide broadband are the most commonly cited examples, although this coverage is increasing in other areas. This trend is accompanied by urgent requirements for multiple payload satellite buses operating in different orbits due to the emergence of mega-constellations and the evolution of launch systems.Key Target Audience

The primary target market for the satellite bus is comprised of satellite builders, aerospace industries, and governmental space agencies in need of reliable apparatuses to carry out their satellite missions. These players are turning to advanced satellite bus systems as they cater for a wide range of activities, namely communication, Earth observation, scientific as well as military activities. The need for high-efficiency satellite buses is accelerating due to the increasing need for satellite constellations for worldwide communication and data-gathering purposes.,, Another key target market comprises engineering firms and businesses that deal with satellite bus parts and systems, such as systems for propulsion, power supply, and thermal control. These companies ensure that the bus’s structure functions and remains functional after certain innovative solutions are offered to meet the unique needs of the particular mission.Merger and acquisition

The recent trends in the merger and acquisition in the satellite bus market are influenced greatly by the need for satellite-based services and improvements to satellite technology. For instance, the merger with Maxar Technologies containing the satellite manufacturing company SSL by Radiant Solutions has bolstered their integrated satellite solution services along with improving their advanced augmented satellite bus development for communication, earth observation, science, and a range of other applications. This merger is expected to fill in the gaps in cashed-in resources and inter-collaboration across diverse sectors or companies that manufacture satellites to satisfy the escalating needs of high-quality satellites. On the other hand, to further strengthen its position on the market, Airbus Defence and Space has turned to acquiring smaller technology entities that specialise in satellite bus creation and production. The outcome of such acquisitions was the possibility for Airbus to build up more satellite systems and increase the level of productivity. In particular, the growing tendency for launching satellite constellations, mostly for broadband internet and global coverage, has made the leading operators pool their resources together in deference to the fast pace of change in the industry. Further developments as regards the satellite bus markets are expected to yield further mergers and acquisitions, mainly in order to achieve size and creativity.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Satellite Bus- Snapshot

- 2.2 Satellite Bus- Segment Snapshot

- 2.3 Satellite Bus- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Satellite Bus Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Small Satellite

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Medium Satellite

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Heavy Satellite

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Satellite Bus Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Earth Observation & Meteorology

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Communication

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Scientific Research & Exploration

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Surveillance & Security

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Mapping & Navigation

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Satellite Bus Market by Subsystem

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Structures and Mechanisms

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Thermal Control System

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Electric Power System (EPS)

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Attitude Control System

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Telemetry Tracking & Command (TT&C)

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

- 6.7 Flight Software

- 6.7.1 Key market trends, factors driving growth, and opportunities

- 6.7.2 Market size and forecast, by region

- 6.7.3 Market share analysis by country

- 6.8 Propulsion System

- 6.8.1 Key market trends, factors driving growth, and opportunities

- 6.8.2 Market size and forecast, by region

- 6.8.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Airbus (Netherlands)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Boeing (U.S.)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Centum (India)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Honeywell International Inc. (U.S.)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 IAI (Israel)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 L3Harris Technologies

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Inc. (U.S.)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Lockheed Martin Corporation (U.S.)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Maxar Technologies (U.S)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Mitsubishi Electric Corporation (Japan)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Northrop Grumman (U.S.)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 OHB SE (Germany)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Thales Group (France)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Subsystem |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Satellite Bus Market?

+

-

What major players in Satellite Bus Market?

+

-

What applications are categorized in the Satellite Bus market study?

+

-

Which product types are examined in the Satellite Bus Market Study?

+

-

Which regions are expected to show the fastest growth in the Satellite Bus market?

+

-

What are the major growth drivers in the Satellite Bus market?

+

-

Is the study period of the Satellite Bus flexible or fixed?

+

-

How do economic factors influence the Satellite Bus market?

+

-

How does the supply chain affect the Satellite Bus Market?

+

-

Which players are included in the research coverage of the Satellite Bus Market Study?

+

-