Global Skincare Devices Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-655 | Energy and Natural Resources | Last updated: Mar, 2025 | Formats*:

Skincare Devices Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

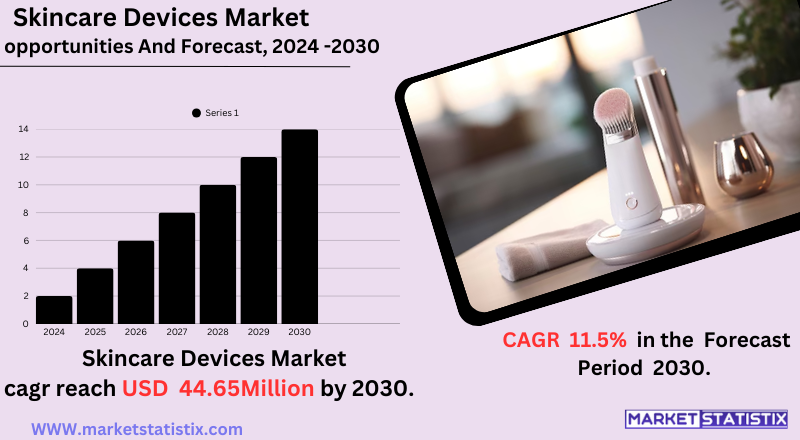

| Growth Rate | CAGR of 11.5% |

| Forecast Value (2030) | USD 44.65 Billion |

| By Product Type | Treatment Devices, Diagnostic Devices |

| Key Market Players |

|

| By Region |

Skincare Devices Market Trends

At-home devices are becoming a trend since people are convenient and technology changes. It is being incorporated with a much-increased demand for non-invasive treatments along with innovations in technologies such as LED, radiofrequency, ultrasound devices, and many others. Another promising segment of the markets now leans toward multifunctional devices that serve multiple purposes to save time; for example, devices that treat different skin problems at once to simplify the process of skincare. In addition, sustainability is becoming key since, nowadays, many manufacturers are adopting eco-friendly materials and energy-efficient designs. Another reason that will improve the market is that there are a lot of geriatric people in the country, and the increasing frequency of skin problems will also affect the increasing markets for devices with applications in anti-aging and therapeutic purposes.Skincare Devices Market Leading Players

The key players profiled in the report are Aesthetic Group, Image Derm, Inc., Alma Lasers GmbH, Ambicare Health, Cutera, Inc., Syneron Medical Ltd., Solta Medical, Inc, Canfield Scientific, Inc., 3Gen, Cynosure, Inc., FotonaGrowth Accelerators

Consumer preferences toward aesthetic appeal and the demand for non-invasive cosmetic procedures are substantially changing the Skincare Devices Market. People today desire effective at-home and professional treatments for their skin based on social media trends and skin awareness; these desires, along with the search for little downtime and safer options to traditional surgical procedures, have pushed the adoption of LED light therapy, radiofrequency, and ultrasound devices. User experiences and effectiveness have been enhanced even more by the introduction of AI-driven personalized skincare devices and combination equipment. The increasing incidence of skin disorders such as acne and hyperpigmentation are causing an upsurge in the demand for these devices, as physicians and beauty clinics are now using them for targeted therapies. This is creating monumental market traction, where technological breakthroughs and shifts in consumer demands intersect.Skincare Devices Market Segmentation analysis

The Global Skincare Devices is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Treatment Devices, Diagnostic Devices . The Application segment categorizes the market based on its usage such as Cellulite Reduction, Vascular and Pigmented Lesion Removal, Wrinkle Removal and Skin Resurfacing, Hair Removal, Skin Rejuvenation, Acne, Solar Energy, Body Contouring and Fat Removal, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competition within the healthcare device market gets tougher as the end-user grows in the search for advanced skin care machines and improvements in technology and increased awareness for skin health. Such companies include L'Oreal, Procter & Gamble, Nu Skin Enterprises, and Philips, which operate by means of innovative products, brand launching, and strategic partnership-forming. The rising trend in AI-enabled and IoT-based skin care devices can be related to the growing use of market automation and personalization toward skin care by organizations so as to provide competitive advantages. Moreover, growing e-commerce and direct-to-consumer brands intensified competition so that digital marketing and influencer collaborations are now considered avenues to penetrate the general market.Challenges In Skincare Devices Market

Certain factors come to mind when looking at the challenges that the sector industry is facing with skincare device growth opportunities. The high costs related to advanced devices have rendered them out of reach for a greater part of the consumer population, especially in emerging economies where low disposable income exists, as well as less opportunity to spend on health. This makes these devices less adopted or accessed in rural or remote areas. Moreover, safety and efficacy concerns connected with home-use devices impede the growth of the market since they raise user reluctance. In addition, the existing competition from traditional anti-aging treatments like creams, chemical peels, and salon practices is quite a major drawback to these new high-cost interventions since they are generally cheaper and more available. Limited consumer awareness regarding the benefits of skincare devices also leads to slower consumer adoption rates. Moreover, the lack of well-trained professionals who can competently operate the advanced devices poses another barrier in the professional segment. Most importantly, for the sake of competing, the excess competition in the industry has imposed the need for constant innovation by using AI-driven diagnosis and eco-friendly materials.Risks & Prospects in Skincare Devices Market

There are immense opportunities in the incorporation of advanced technology such as artificial intelligence (AI) and smart sensors that provide personalized and effective treatments. The alternative boom in home-use devices due to convenience and progress in telemedicine promises high potential. Furthermore, an increase in skin conditions like acne and aging-related complaints is creating a demand for innovative solutions such as laser therapy and microdermabrasion devices. In the regional market, North America leads due to high disposable income, advanced healthcare infrastructure, and many players present. However, Asia-Pacific is becoming the fastest-growing region due to rising disposable income, urbanization, and consumer awareness in countries like China and India. On the opposite side, we have the Middle East and Africa, which are growing, especially in the affluent populations of the GCC countries and medical tourism. Within the European region, the demand for non-invasive procedures is increasing due to personal grooming trends. These regional dynamics create various opportunities for manufacturers to cater to unique world market demands.Key Target Audience

, The primary target market for the skincare devices market includes dermatologists, beauty clinics, and spas, along with individual consumers looking for at-home skincare solutions. These professional users, namely dermatologists and estheticians, rely on advanced skincare devices for the treatment of laser therapy, microdermabrasion, skin rejuvenation, and so forth. Spas and beauty clinics also invest in the higher end of the spectrum of skincare devices to create specialized services, thus creating demand for products that are technologically advanced as well as FDA-approved., On the consumer end, a growing demand for at-home skincare devices stems from the increasing trend of self-care and beauty consciousness. Portable, easy-to-use, and non-invasive options are particularly favoured by the Millennials and Gen Z consumers, who lean toward devices such as facial rollers, LED therapy masks, and microcurrent devices. Also, individuals with special skin concerns such as acne, the signs of aging, and hyperpigmentation are seeking customized solutions, creating a market for AI-enabled and customizable skincare technologies.Merger and acquisition

The skincare equipment market has been lively in recent mergers and acquisitions (M&As) over the last couple of years, which exhibit how dynamic this change is for industries with companies adopting such strategies to improve themselves in their markets. In December 2023, RW Pressprich acted as exclusive financial adviser to 3GEN/Dermlite in the acquisition of its parent company by a healthcare-focused private equity firm operating in the USA and Canada. This signals another phase of increasing appetite shown by investment firms in skincare devices as they want to become part of this growing market. In February 2025, L'Oréal acquired stakes in medical aesthetic clinics in China and North America to gain deeper insights into the medical aesthetics market. This is in line with the overall strategic intention of L'Oréal to understand and penetrate the segment of rapid growth being medical aesthetics, apart from which there was also the September 2024 acquisition of a 10% stake in the Swiss skin care firm Galderma by L'Oréal to show how much it was committed to its growth in the skin care and medical aesthetic institutions. >Analyst Comment

An increasing emphasis on aesthetic appearance, coupled with the advanced but highly acceptable technologies, has triggered notable growth in the global skincare devices market. The market is characterized by rapid technological developments, with manufacturers coming up with multifunctional devices to address various skin issues with regard to anti-aging, acne treatment, hair removal, and skin rejuvenation. Growth potential also arises from the rising disposable incomes, especially in developing regions, as well as from trends generated by social media.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Skincare Devices- Snapshot

- 2.2 Skincare Devices- Segment Snapshot

- 2.3 Skincare Devices- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Skincare Devices Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Treatment Devices

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Diagnostic Devices

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Skincare Devices Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Solar Energy

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Hair Removal

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Skin Rejuvenation

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Acne

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Wrinkle Removal and Skin Resurfacing

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Body Contouring and Fat Removal

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Cellulite Reduction

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Vascular and Pigmented Lesion Removal

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

- 5.10 Others

- 5.10.1 Key market trends, factors driving growth, and opportunities

- 5.10.2 Market size and forecast, by region

- 5.10.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Alma Lasers GmbH

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Cynosure

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Inc.

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Solta Medical

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Inc

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Cutera

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Inc.

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Syneron Medical Ltd.

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Canfield Scientific

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Inc.

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 3Gen

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Aesthetic Group

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Ambicare Health

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Image Derm

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Inc.

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Fotona

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Skincare Devices in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Skincare Devices market?

+

-

How big is the Global Skincare Devices market?

+

-

How do regulatory policies impact the Skincare Devices Market?

+

-

What major players in Skincare Devices Market?

+

-

What applications are categorized in the Skincare Devices market study?

+

-

Which product types are examined in the Skincare Devices Market Study?

+

-

Which regions are expected to show the fastest growth in the Skincare Devices market?

+

-

Which application holds the second-highest market share in the Skincare Devices market?

+

-

What are the major growth drivers in the Skincare Devices market?

+

-