Global Slickline services Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-2544 | Energy and Natural Resources | Last updated: Feb, 2025 | Formats*:

Slickline services Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

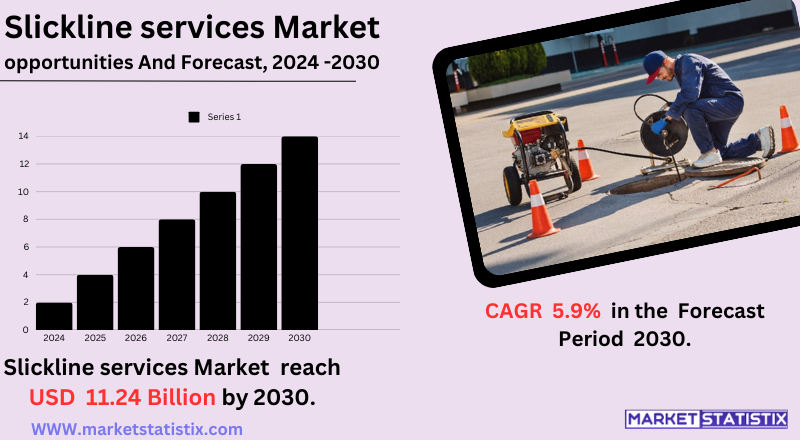

| Growth Rate | CAGR of 5.9% |

| Forecast Value (2030) | USD 11.24 Billion |

| Key Market Players |

|

| By Region |

|

Slickline services Market Trends

The slickline services market is trending in the direction of efficiency and cost-effectiveness in well-intervention operations. Well operators look for solutions that reduce the time of downtime and increase the time of production; hence, their demand for innovative technologies and slickline techniques is growing in profile. This encompasses fields like tool design, data acquisition capability, and operational procedures, all of which attempt to optimise well-intervention operations. Another major trend has been witnessed in an increasing degree of digitalisation and automation within the Slickline Services market. The integration of digital technologies is enabling real-time data monitoring, remote operations, and better decision-making during slickline operations. This trend is continuing to enhance the efficiency and accuracy of well interventions along with safety and operational risk reduction.Slickline services Market Leading Players

The key players profiled in the report are Nabors Industries Ltd., Casedhole Solutions, Inc., OiLSERV, SLB, Baker Hughes Company, Halliburton, Pioneer Energy Services Corp., Expro Group, Weatherford, Superior Energy Services.Growth Accelerators

One of the major drivers for growth of the Slickline Services market is the rising need for maintaining and improving production from oil and gas wells in their mature phase. At this stage, interventions become necessary to increase recovery rates so that the wells can exist longer. Slickline services are the least expensive option for participating in routine maintenance activities, which are critical for operators trying to maximise their return. The demand for slickline services is also being bolstered by the increased focus on unconventional resources and the increased complexity of wellbore designs. These difficult environments often require specialised intervention techniques, which is where the flexibility of slickline, along with the ability to perform interventions on live wells, becomes indispensable.Slickline services Market Segmentation analysis

The Global Slickline services is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Onshore, Offshore. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

As the slickline services market is composed of various companies like Schlumberger Limited, Halliburton Company, China Oilfield Services Limited, Weatherford International Plc, and Baker Hughes Company, which are the major companies offering slickline services for well completion, intervention, and logging operations, these global firms are so massively large and technologically advanced that they can give stiff competition to their rivals. Also, this moderate consolidation in the market has significant shares among these large players, while still allowing the market to be competitive through the contribution of regional and specialised service providers.Challenges In Slickline services Market

Several challenges exist in the growth and operational efficiency of slickline services. One of the major challenges faced is oil price volatility, which may reduce capital expenditure by the oil and gas companies and, as a consequence, the demand for slickline services. Also, oil well exploration requires huge capital outlays, and slickline operations, being very complex, have substantial risk due to involvement with hazardous materials and harsh environments. This has ramifications for employee safety and environmental integrity. There are very stringent regulatory standards in place, which not only create further complexities but also add to operational costs, thus potentially limiting market growth. In addition, wireline, coiled tubing, and hydraulic workover units are in competition with bypass techniques that have advantages in many respects over traditional slickline applications. Economic downturns can also reduce investment in exploration and production activity, in turn, translating to reduced demand for slickline services.Risks & Prospects in Slickline services Market

Above all, the slickline services market is expected to grow with increased energy demands and evolving oil and natural gas exploration technologies. The opportunity in the sector is further increased by a high number of offshore and onshore drilling activities, especially in the unconventional oil and gas reserves across the continents. New developments in downhole hardware and data analytics have increased the efficiency and accuracy of slickline operations, essentially making them the future of well completion, intervention, and maintenance tasks. On the regional scale, North America stands to hold the largest share of the slickline services market, owing to its oil and gas production and exploration facilities. The United States particularly boasts an ever-increasing production rate with respect to shale gas and drilling activities in the Gulf of Mexico. According to Baker Hughes' data, North America's rig count increased to 1,223 in 2018, up from 1,082 in 2017, indicating a healthy drilling activity trend in that region. Other regions, including Asia-Pacific and the Middle East, are expected to grow owing to their consistently increasing energy demands and project exploration activities.Key Target Audience

, The slickline services industry considers oil and gas exploration and production companies (or E&P companies) as its primary targets. The start of slickline intervention services is given importance by oil and gas companies to keep their wells running, fully exploited, and collecting necessary data on well performance. They then contract slickline service companies for varying intervention jobs that range from basic maintenance jobs to far more complex ones., Another prominent audience consists of well operators and field managers, who directly oversee the oil and gas wells' operation and management, from their need for slickline services to their execution. Their interaction with slickline service companies is intended to ensure that operations are safely and efficiently done, meeting the well's specifications.Merger and acquisition

Key market players like Halliburton, Schlumberger, and Baker Hughes are currently trading acquisitions and mergers in a bid to sharpen their technological edge and expand their service offerings. These strategic moves target the provision of cutting-edge solutions while rationalising operational efficiencies for clients within the oil and gas sector. Recent studies show that mergers, like that between Baker Hughes and other competitors, may change the competitive nature of the slickline services industry. Regulatory authorities are considering whether these mergers have passed anti-competitive effects, especially in the supply of tools relating to slickline operations. The UK's Competition and Markets Authority (CMA) has raised concern for the lack of competition that may ensue from such consolidations and the consequent impact on delivery of service and pricing in the market. >Analyst Comment

The slickline services market is a core segment of the wider oil and gas well-intervention industry. It is considered a closely linked service to drilling and production activity levels or health in general of the oil and gas industry. As production fields mature, maintenance and optimisation services, including slickline interventions, are, therefore, increasingly required for sustaining production levels. The market consists of well-established service providers and niche players. Competition usually revolves around technical know-how, service quality, and cost parameters. Although this market may experience cycles of opportunities and cyclicity in demand mirroring the price fluctuations in oil and gas, the fundamental demand for well maintenance and optimisation sustains a steady soil of demand for slickline services.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Slickline services- Snapshot

- 2.2 Slickline services- Segment Snapshot

- 2.3 Slickline services- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Slickline services Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Onshore

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Offshore

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Slickline services Market by Slickline Tools

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Pulling Tools

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Gauge Cutter

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Downhole Bailer

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Bridge Plug

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Slickline services Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Baker Hughes Company

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Casedhole Solutions

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Inc.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Expro Group

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Weatherford

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Pioneer Energy Services Corp.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Halliburton

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Nabors Industries Ltd.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 OiLSERV

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 SLB

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Superior Energy Services.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

By Slickline Tools |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Slickline services in 2030?

+

-

What is the growth rate of Slickline services Market?

+

-

What are the latest trends influencing the Slickline services Market?

+

-

Who are the key players in the Slickline services Market?

+

-

How is the Slickline services } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Slickline services Market Study?

+

-

What geographic breakdown is available in Global Slickline services Market Study?

+

-

How are the key players in the Slickline services market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Slickline services market?

+

-

What are the major challenges faced by the Slickline services Market?

+

-