Global Small Molecule API Market - Industry Dynamics, Size, And Opportunity Forecast To 2032

Report ID: MS-874 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The Small Molecule Active Pharmaceutical Ingredient (API) Market is the worldwide business involved in the production and sale of low molecular weight organic substances that have a pharmacological action. The small molecules, with a molecular weight of below 900 Daltons, are the major ingredients found in most medicines, and they are behind their therapeutic effect. The market involves several steps, ranging from the first synthesis of such molecules in intricate chemical procedures to purification and characterisation and their final supply to drug manufacturing industries for formulation into finished drugs such as tablets, capsules, and injections.

The market for small molecule APIs is a key and sizeable portion of the larger pharmaceutical sector. It is propelled by the rise in the prevalence of chronic ailments, the global population's ageing, and the constant research and development activities that result in new drug candidates' discovery. The market is diversified by the type of APIs with both generic and patented drugs across a broad array of therapeutic classes.

Small Molecule API Report Highlights

| Report Metrics | Details |

|---|---|

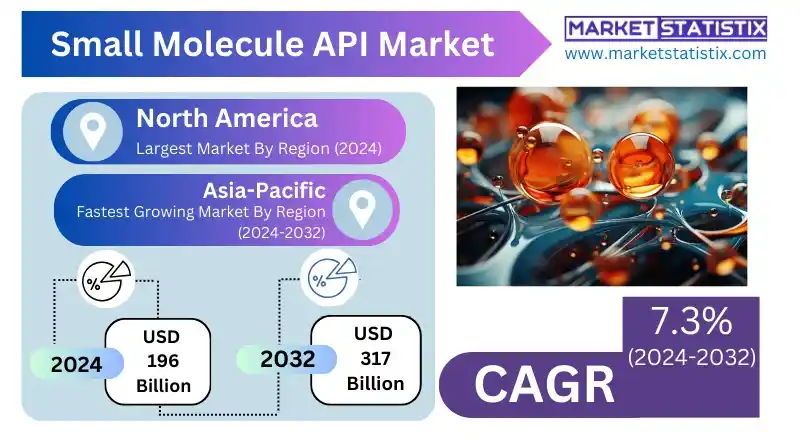

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 7.3% |

| Forecast Value (2032) | USD 317 Billion |

| By Product Type | Synthetic, Biotech |

| Key Market Players |

|

| By Region |

|

Small Molecule API Market Trends

The market for small molecule APIs is now facing a number of major trends. One of the most important is the growing need for sophisticated APIs, especially for new therapies such as GLP-1 receptor agonists and antibody-drug conjugates. This requires advanced manufacturing technologies and speciality facilities. Sustainability is also emerging as a key element, as pharma companies are placing greater emphasis on greener manufacturing and eco-friendly raw materials. Lastly, the incorporation of cutting-edge technologies such as AI and digitalisation is transforming drug discovery and streamlining production processes in the industry.

Another major trend is the increase in outsourcing API production to Contract Development and Manufacturing Organizations (CDMOs). This enables pharmaceutical companies, particularly small ones, to focus on their core activities such as drug discovery and marketing and utilise the specialist knowledge and facilities of CDMOs. Another major growth area is the production of High Potency APIs (HPAPIs) for targeted therapies, most notably in oncology.

Small Molecule API Market Leading Players

The key players profiled in the report are Merck KGaA, Albemarle Corporation, BASF SE, Celgene Corporation, Siegfried Holding AG, Cambrex Corporation, Allergan, Gilead Sciences Inc., Albany Molecular Research Inc., Johnson Matthey, GSk plc, Novartis AG, Dr. Reddy's Laboratories Ltd., Boehringer Ingelheim International GmbH, Teva Pharmaceutical Industries Ltd., Hoffmann-La Roche Ltd., Pfizer, AstraZeneca, Lonza, Baxter International Inc., Sanofi S.A, Sun Pharmaceutical Industries Ltd.Growth Accelerators

The expansion of the Small Molecule API (Active Pharmaceutical Ingredient) Market is mainly driven by the growing worldwide prevalence of chronic conditions like cancer, cardiovascular diseases, diabetes, and neurological disorders. This expansion in disease incidence triggers a heightened demand for drugs, where small molecule APIs are the basic therapeutic agent. In addition, the ageing world population also drives this demand significantly, as adults tend to be more prone to chronic diseases necessitating continuous medication.

Pharma firms are investing significantly in research and development to launch new small-molecule drugs with higher efficacy and reduced side effects. Moreover, patent expirations of blockbuster products open the window for generic drug makers, who are dependent on small molecule APIs, thereby inducing further market growth. The growing practice of outsourcing API production to Contract Manufacturing Organizations (CMOs) also plays a role by inducing more efficient production and cost reductions for the pharma firms.

Small Molecule API Market Segmentation analysis

The Global Small Molecule API is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Synthetic, Biotech . The Application segment categorizes the market based on its usage such as Cardiovascular Diseases, Pulmonology, Oncology, Endocrinology, CNS & Neurology, Gastroenterology, Orthopedic, Ophthalmology, Nephrology, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the small molecule API market is heterogeneous and comprises a combination of large, generic pharmaceutical firms with in-house API manufacturing capabilities, specialised API producers (both merchant and captive), and contract development and manufacturing organizations (CDMOs). Some key players are firms such as Pfizer, Sanofi, Merck & Co., Teva Pharmaceutical Industries, and Sun Pharmaceutical Industries, which possess large scale and a wide portfolio of APIs. This market is also dominated by the availability of many small and specialised API producers, especially in countries such as India and China, which are renowned for low-cost production.

The competition in this market is stiff and is on aspects including price, quality, regulatory acceptability, and the scope of the API portfolio. The rising demand for generics, fuelled by patent loss and cost-containment initiatives, escalates price competition. In addition, rigorous regulatory demands for manufacturing processes and quality control provide yet another dimension to the competitive landscape. Firms that are capable of providing high-quality APIs at affordable prices with compliance to international regulatory standards have the potential to succeed.

Challenges In Small Molecule API Market

The market for small molecule APIs has serious challenges because of the ever-growing complexity of drug molecules, especially with new advanced therapies including GLP-1 receptor agonists and antibody-drug conjugates (ADCs). Their production requires customized facilities, strict high-purity requirements, and scalability in terms of production to meet the requirement, which poses a huge outlay in capital and sophisticated chemical processes. Furthermore, the majority of emerging drug candidates also have poor solubility, which requires developing enabling technologies for improving bioavailability, further aggravating the manufacturing scenario.

Among others, supply chain risks fuelled by geopolitical tensions and pushing for the turn towards local production and improved supply chain resiliency and accelerated development timelines through compressed regulatory routes also amplify the threat and resource pressure, especially among small companies. Striking the right balance of speed, quality, and conformance in the backdrop of transforming trade policies and digitalisation remains an ongoing obstacle to industry actors.

Risks & Prospects in Small Molecule API Market

Major growth areas are the growing adoption of precision medicine, growth in speciality therapeutics, and a continuing trend towards outsourcing and contract manufacturing that increases production capacity as well as operational flexibility.

Geographically, North America is the market leader with a high incidence of chronic diseases, well-developed healthcare infrastructure, and good government programmes to encourage innovative drug development. The area's swift uptake of small-molecule drugs and a developed pharmaceutical industry further add to its supremacy. In the meantime, Asia-Pacific is expected to be the most rapidly growing area, driven by the spread of contract development and manufacturing organizations (CDMOs) and pharmaceutical manufacturing centers in China and India. These countries are increasingly emphasising the export of APIs to international markets, taking advantage of cost savings and favourable regulatory environments.

Key Target Audience

,

The major target population of the Small Molecule API (Active Pharmaceutical Ingredient) market includes pharmaceutical and biopharmaceutical organizations. These are the ultimate users of APIs, making use of APIs as the prime building blocks in formulating broad categories of drug products, which range from branded to generic medications. Their requirements are motivated by reasons like refilling current supplies of drugs, formulating new drugs, and broadening their product lines to cover different areas of therapy and patient populations.

, Another important target audience segment consists of Contract Development and Manufacturing Organizations (CDMOs) and Contract Manufacturing Organizations (CMOs). These firms deliver outsourced services to pharmaceutical entities, including the manufacturing and development of APIs and final drug products. They form a high-demanding pool for small molecule APIs, as they usually get the sourcing and procurement of the ingredients done for their pharmaceutical clients themselves. The expansion of outsourcing practices in the pharma sector even more highlights the significance of CDMOs and CMOs as major customers in the market for small molecule APIs.

Merger and acquisition

In 2024, the market for small molecule active pharmaceutical ingredients (APIs) saw a significant reduction in mergers and acquisitions (M&A), its lowest level of activity in almost a decade. Pharmaceutical deal value decreased to $67.2 billion, a huge drop from prior years, as top players such as Eli Lilly, Novartis, and Vertex Pharmaceuticals signed off on 558 deals as of late November. This decline was caused by reasons like overheated valuations of major biotech companies, integration issues stemming from prior large deals, and a tough antitrust climate under the Federal Trade Commission. Pharmaceutical firms thus focused on smaller, bolt-on deals, usually below $5 billion, to complement internal development research. Although overall M&A action declined, some companies made strategic purchases to strengthen their portfolios.

For example, Merck & Co. grew its oncology pipeline with the acquisition of Harpoon Therapeutics for $680 million in January 2024, EyeBio for $3 billion in July 2024, and Modifi Biosciences for $1.3 billion in October 2024. In the same vein, Bristol Myers Squibb made major deals, including acquiring Mirati Therapeutics for $4.8 billion in January 2024, Karuna Therapeutics for $14 billion in March 2024, and RayzeBio for $4.1 billion in December 2023. These acquisitions reflect a continued focus on growing therapeutic capabilities, especially in oncology and neuroscience, even amid the general slowdown in the M&A market.

Analyst Comment

The worldwide small molecule API (Active Pharmaceutical Ingredient) industry is growing steadily, with the market being worth around USD 205.7 billion in 2025 and set to reach around USD 331.6 billion by 2034. This growth is fuelled by the increasing number of chronic diseases like cancer, cardiovascular diseases, and diabetes, which raises demand for effective small-molecule medicines. The synthetic API segment controls the market with around 80% market share in 2024, whereas regionally, North America is the leader with well-developed pharmaceutical infrastructure, strong R&D activity, and favourable regulatory environments. Outsourced manufacturing is also a notable trend, with contract development and manufacturing organizations (CDMOs) gaining an increasing share of production.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Small Molecule API- Snapshot

- 2.2 Small Molecule API- Segment Snapshot

- 2.3 Small Molecule API- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Small Molecule API Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Synthetic

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Biotech

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Small Molecule API Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Cardiovascular Diseases

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Oncology

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 CNS & Neurology

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Orthopedic

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Endocrinology

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Pulmonology

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Gastroenterology

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Nephrology

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

- 5.10 Ophthalmology

- 5.10.1 Key market trends, factors driving growth, and opportunities

- 5.10.2 Market size and forecast, by region

- 5.10.3 Market share analysis by country

- 5.11 Others

- 5.11.1 Key market trends, factors driving growth, and opportunities

- 5.11.2 Market size and forecast, by region

- 5.11.3 Market share analysis by country

6: Small Molecule API Market by Manufacturer

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 In-house

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Outsourced

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Small Molecule API Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Sanofi S.A

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Albany Molecular Research Inc.

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Baxter International Inc.

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Lonza

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 GSk plc

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Cambrex Corporation

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Allergan

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 BASF SE

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Boehringer Ingelheim International GmbH

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Teva Pharmaceutical Industries Ltd.

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Dr. Reddy's Laboratories Ltd.

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Siegfried Holding AG

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Johnson Matthey

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Hoffmann-La Roche Ltd.

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 Pfizer

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 Gilead Sciences Inc.

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

- 9.17 Merck KGaA

- 9.17.1 Company Overview

- 9.17.2 Key Executives

- 9.17.3 Company snapshot

- 9.17.4 Active Business Divisions

- 9.17.5 Product portfolio

- 9.17.6 Business performance

- 9.17.7 Major Strategic Initiatives and Developments

- 9.18 Albemarle Corporation

- 9.18.1 Company Overview

- 9.18.2 Key Executives

- 9.18.3 Company snapshot

- 9.18.4 Active Business Divisions

- 9.18.5 Product portfolio

- 9.18.6 Business performance

- 9.18.7 Major Strategic Initiatives and Developments

- 9.19 Novartis AG

- 9.19.1 Company Overview

- 9.19.2 Key Executives

- 9.19.3 Company snapshot

- 9.19.4 Active Business Divisions

- 9.19.5 Product portfolio

- 9.19.6 Business performance

- 9.19.7 Major Strategic Initiatives and Developments

- 9.20 Celgene Corporation

- 9.20.1 Company Overview

- 9.20.2 Key Executives

- 9.20.3 Company snapshot

- 9.20.4 Active Business Divisions

- 9.20.5 Product portfolio

- 9.20.6 Business performance

- 9.20.7 Major Strategic Initiatives and Developments

- 9.21 AstraZeneca

- 9.21.1 Company Overview

- 9.21.2 Key Executives

- 9.21.3 Company snapshot

- 9.21.4 Active Business Divisions

- 9.21.5 Product portfolio

- 9.21.6 Business performance

- 9.21.7 Major Strategic Initiatives and Developments

- 9.22 Sun Pharmaceutical Industries Ltd.

- 9.22.1 Company Overview

- 9.22.2 Key Executives

- 9.22.3 Company snapshot

- 9.22.4 Active Business Divisions

- 9.22.5 Product portfolio

- 9.22.6 Business performance

- 9.22.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Manufacturer |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Small Molecule API in 2032?

+

-

Which type of Small Molecule API is widely popular?

+

-

What is the growth rate of Small Molecule API Market?

+

-

What are the latest trends influencing the Small Molecule API Market?

+

-

Who are the key players in the Small Molecule API Market?

+

-

How is the Small Molecule API } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Small Molecule API Market Study?

+

-

What geographic breakdown is available in Global Small Molecule API Market Study?

+

-

Which region holds the second position by market share in the Small Molecule API market?

+

-

Which region holds the highest growth rate in the Small Molecule API market?

+

-