Global Smart Parking Market – Industry Trends and Forecast to 2030

Report ID: MS-656 | Energy and Natural Resources | Last updated: Mar, 2025 | Formats*:

Smart Parking Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

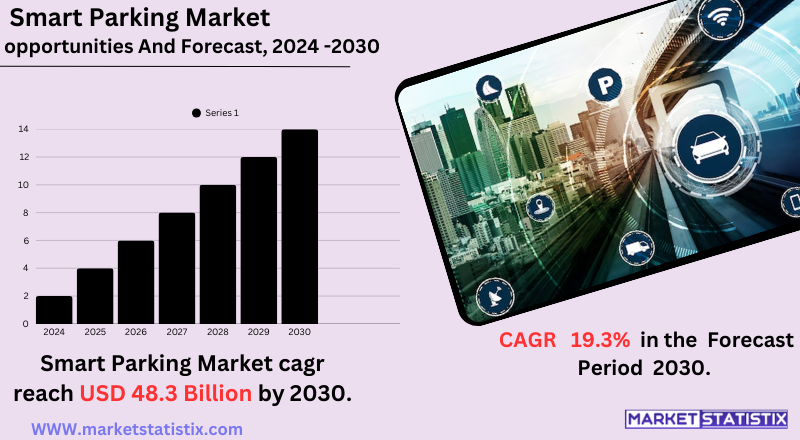

| Growth Rate | CAGR of 19.3% |

| Forecast Value (2030) | USD 48.3 Billion |

| By Product Type | On-street, Off-street |

| Key Market Players |

|

| By Region |

Smart Parking Market Trends

This technology allows for real-time monitoring of parking availability to optimize space utilization and future parking demands, ultimately resulting in the efficient management of parking facilities. Another trend is the increasing focus on seamless integration with mobile apps and navigation systems so that drivers can easily find and reserve parking spots. Such an integration enhances user experience while adding distress to the conventional parking process. Another noteworthy growing trend is the integration of EV charge infrastructure with smart parking systems in line with the global conversion toward electric mobility. Importance is growing in regard to data analytics for urban planning and traffic management so that cities may use smart parking data for much better urban mobility and congestion management.Smart Parking Market Leading Players

The key players profiled in the report are BMW AG (ParkNow GmbH, Mindteck, Smart Parking Ltd., ParkHelp Technologies, Libelium Comunicaciones Distribuidas S.L., ParkJockey, Cisco Systems, Inc., Park Assist, Siemens AG, Parkmobile LLC), Nedap N.V., INDECT Electronics & Distribution GmbH, Municipal Parking Services, Inc., ParkMe Inc., Deteq Solutions, SKIDATA AG, Robert Bosch GmbH, Kapsch TrafficCom, Flowbirdgtechn, CivicSmart, Inc., Meter Feeder, Inc., SpotHero, Inc.Growth Accelerators

Increasing urban congestion and the recognition of a need for effective parking solutions are significant smart parking market drivers. Increased urbanization and faster growth in vehicle ownership have already aggravated the parking problem in cities worldwide. This has explained the need for systems that can optimize space use, reduce search times, and minimize traffic movements caused by drivers circling for parking. Environmental conservation results from high fuel consumption and emissions related to inefficient parking practices. Hence, cities would make a smart decision and priority to adapt smart parking technologies in sustainability initiatives. Incorporating smart parking solutions with navigation and mobile apps provides better access and user-friendliness to drivers. Thus, the government support programs for investing in smart cities keep championing smart parking infrastructure adoption, which will also stimulate further market growth. Enabling cities to realize a seamless, digitalized urban experience is pushing both private and public sectors into these solutions.Smart Parking Market Segmentation analysis

The Global Smart Parking is segmented by Type, Application, and Region. By Type, the market is divided into Distributed On-street, Off-street . The Application segment categorizes the market based on its usage such as Commercial, Government, Transport Transit. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Key players such as advanced technology providers, specialist parking solution companies, and new startups comprise the competitive landscape of the smart parking market. Major players are focusing on advanced technologies such as IoT, AI, and cloud computing in order to offer complete smart parking solutions. Competition is fierce, with companies competing for territorial market shares through innovative products, technology partnerships, and acquisitions. This scenario aligns with the increasing need for efficient parking solutions in urban environments. Integrated platforms, including sensor technology, a mobile app, and data analytics for real-time parking information with convenient payment options, have become one major competitive strategy. Companies are also deploying custom-fit solutions such as on-street parking management and off-street parking facility optimization that integrate with smart city infrastructure. The competitive environment encourages innovation at a constant pace, thus driving companies to design more accurate, reliable, and user-friendly smart parking systems.Challenges In Smart Parking Market

Several serious obstacles challenge the adoption of the smart parking market. High implementing and mandating complexity are the important disincentives because advanced technologies like IoT, artificial intelligence, and sensors require higher financial and technical investments for implementation. Thus, it deprives smaller municipalities and private operators of adopting smart parking solutions, thus impacting the market growth of the solution. Supplementing this is that in developing parts of the areas, poor penetration of the internet reduces the operational capabilities of smart parking systems, which depend significantly on constant connectivity for real-time data holding and cloud operations. Indeed, this infrastructure deficiency has made these solutions less efficient and attractive in some of the most underserved areas. Another challenge would be having a fragmented market with several parking operators using their own independent systems. It becomes challenging for the user since they will have to use two or more different applications to be able to navigate services at different parking facilities. Coupled with electromagnetic interference in RFID-equipped systems and the security concern over data, this exacerbates things. Hence, cost-effective solutions, good internet infrastructure, and higher standardization are necessary to champion broad adoption of smart parking technologies.Risks & Prospects in Smart Parking Market

Growing demand for smart parking integrated with the EV charging stations is further augmented by the proliferation of electric vehicles (EVs). The introduction of parking-as-a-service has also opened up alternate revenue streams for operators, particularly with the improvements in predictive analytics. Substantial investments on the part of governments in sustainable urban infrastructure, especially in developing regions like Asia-Pacific, are anticipated to lead to considerable growth opportunities in this market. Regionally, North America leads the market due to its advanced technological infrastructure and rather strong acceptance of smart parking solutions. Europe is being closely followed by an array of environmental regulations and smart city investments. Meanwhile, Asia-Pacific is said to grow at the fastest pace due to rapid urbanization, increasing numbers of vehicles, and governments' initiatives in countries like China and India. On the other side, challenges such as high implementation costs and standardization issues of the systems subsist, but yet, they are being almost eradicated by enhancements in the technology and strategic partnerships of various stakeholders.Key Target Audience

, The main targets of the smart parking market are municipalities, commercial parking operators, and private companies that want parking efficiency. Cities and countries install smart parking systems to minimize congested traffic flows, attain mobility in their cities, and improve sustainability through IoT-enabled parking sensors and automated payment systems. Commercial parking operators such as shopping malls, airports, and event venues invest in these technologies for optimized use of space and improved user convenience through real-time updates about parking availability., On the consumer side, use is restricted to individual users of parking spaces, fleet managers, and rideshare organizations. Those who benefit are these as well as a few others since smart parking solutions reduce the amount of time spent searching for available parking spots. The tech-savvy urban commuter favours smart parking systems that offer the option of booking a parking space and paying for it via a mobile application. Organizations with a larger employee workforce also spend some resources on smart parking management systems with the objective of streamlining efficiencies on employee parking and benefitting employee’s overall experience.Merger and acquisition

Smart parking technology has come a long way in consolidations with mergers and acquisition events aimed at improving technological capability and augmenting market presence. The acquisition of Austin-based Peak Parking for $36 million in February 2025 by Smart Parking Limited, a global provider of parking technology and management services, marked the company's entry into the U.S. market. This strategic move brought 134 managed sites across various states into the Smart Parking portfolio, thus scaling up its global operations. In another major deal, Metropolis Technologies, an AI-powered parking platform, acquired SP Plus Corporation for $1.5 billion in May 2024, making Metropolis the largest parking operator in North America and enabling it to bolster its AI-driven offerings through SP Plus's vast network. Furthermore, in October 2024, Spanish parking operator Saba Infrastructures and Belgium-based Interparking announced they would merge into a new entity operating more than 2,000 car parks across 16 countries. Merging was intended to boost their presence in the European parking market while providing additional services, including the integration of about 8,000 electric vehicle charging points. >Analyst Comment

Intelligent parking is an emerging domain with a booming market owing to increasing urban congestion and demands for efficient parking solutions. This market can be characterized by the application of various technologies such as IoT, cloud computing, and AI to maximize parking space utilization and improve user experience. The pertinent features presently driving the acceptance of the smart parking market are real-time parking availability, automated payment systems, and guiding the users with navigation to a free parking slot, be it municipal, commercial, or residential-based. Sustainable solutions are the need of the hour, into which the smart parking environment is gravitating, whereas it is subsumed under the larger smart city umbrella.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Smart Parking- Snapshot

- 2.2 Smart Parking- Segment Snapshot

- 2.3 Smart Parking- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Smart Parking Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 On-street

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Off-street

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Smart Parking Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Commercial

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Government

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Transport Transit

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 BMW AG (ParkNow GmbH

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Parkmobile LLC)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Cisco Systems

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Inc.

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 CivicSmart

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Inc.

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Deteq Solutions

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Flowbirdgtechn

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 INDECT Electronics & Distribution GmbH

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Kapsch TrafficCom

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Libelium Comunicaciones Distribuidas S.L.

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Meter Feeder

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Inc.

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Mindteck

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Municipal Parking Services

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Inc.

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 Nedap N.V.

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 Park Assist

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

- 7.19 ParkHelp Technologies

- 7.19.1 Company Overview

- 7.19.2 Key Executives

- 7.19.3 Company snapshot

- 7.19.4 Active Business Divisions

- 7.19.5 Product portfolio

- 7.19.6 Business performance

- 7.19.7 Major Strategic Initiatives and Developments

- 7.20 ParkJockey

- 7.20.1 Company Overview

- 7.20.2 Key Executives

- 7.20.3 Company snapshot

- 7.20.4 Active Business Divisions

- 7.20.5 Product portfolio

- 7.20.6 Business performance

- 7.20.7 Major Strategic Initiatives and Developments

- 7.21 ParkMe Inc.

- 7.21.1 Company Overview

- 7.21.2 Key Executives

- 7.21.3 Company snapshot

- 7.21.4 Active Business Divisions

- 7.21.5 Product portfolio

- 7.21.6 Business performance

- 7.21.7 Major Strategic Initiatives and Developments

- 7.22 Robert Bosch GmbH

- 7.22.1 Company Overview

- 7.22.2 Key Executives

- 7.22.3 Company snapshot

- 7.22.4 Active Business Divisions

- 7.22.5 Product portfolio

- 7.22.6 Business performance

- 7.22.7 Major Strategic Initiatives and Developments

- 7.23 Siemens AG

- 7.23.1 Company Overview

- 7.23.2 Key Executives

- 7.23.3 Company snapshot

- 7.23.4 Active Business Divisions

- 7.23.5 Product portfolio

- 7.23.6 Business performance

- 7.23.7 Major Strategic Initiatives and Developments

- 7.24 SKIDATA AG

- 7.24.1 Company Overview

- 7.24.2 Key Executives

- 7.24.3 Company snapshot

- 7.24.4 Active Business Divisions

- 7.24.5 Product portfolio

- 7.24.6 Business performance

- 7.24.7 Major Strategic Initiatives and Developments

- 7.25 Smart Parking Ltd.

- 7.25.1 Company Overview

- 7.25.2 Key Executives

- 7.25.3 Company snapshot

- 7.25.4 Active Business Divisions

- 7.25.5 Product portfolio

- 7.25.6 Business performance

- 7.25.7 Major Strategic Initiatives and Developments

- 7.26 SpotHero

- 7.26.1 Company Overview

- 7.26.2 Key Executives

- 7.26.3 Company snapshot

- 7.26.4 Active Business Divisions

- 7.26.5 Product portfolio

- 7.26.6 Business performance

- 7.26.7 Major Strategic Initiatives and Developments

- 7.27 Inc.

- 7.27.1 Company Overview

- 7.27.2 Key Executives

- 7.27.3 Company snapshot

- 7.27.4 Active Business Divisions

- 7.27.5 Product portfolio

- 7.27.6 Business performance

- 7.27.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Smart Parking in 2030?

+

-

Which type of Smart Parking is widely popular?

+

-

What is the growth rate of Smart Parking Market?

+

-

What are the latest trends influencing the Smart Parking Market?

+

-

Who are the key players in the Smart Parking Market?

+

-

How is the Smart Parking } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Smart Parking Market Study?

+

-

What geographic breakdown is available in Global Smart Parking Market Study?

+

-

Which region holds the second position by market share in the Smart Parking market?

+

-

How are the key players in the Smart Parking market targeting growth in the future?

+

-