Global solid state relay Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-2006 | Automotive and Transport | Last updated: Dec, 2024 | Formats*:

solid state relay Report Highlights

| Report Metrics | Details |

|---|---|

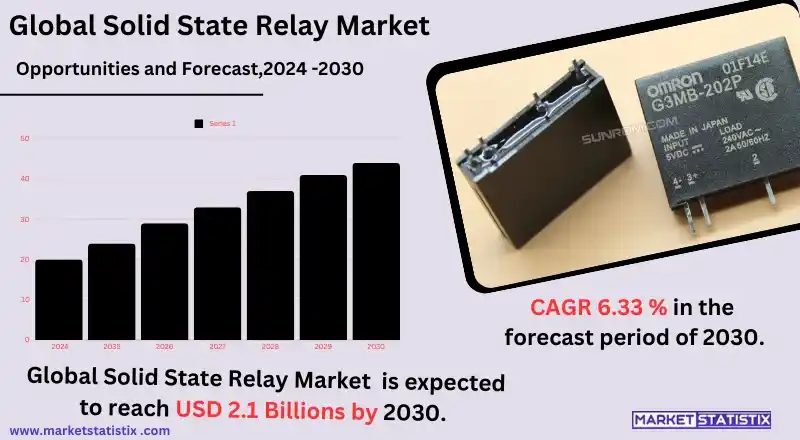

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 6.33% |

| Forecast Value (2031) | USD 2.1 Billion |

| Key Market Players | Crydom Inc. (Sensata Technology) Omron Corporation Schneider Electric ABB Ltd. IXYS Corp.. (Littelfuse) STMicroelectronics Rockwell Automation Inc. General Electric Vishay Intertechnology (Siliconix) Fujitsu Limited Carlo Gavazzi Holding AG Honeywell International Inc Texas Instruments Inc. Source: https://www.marketresearchfuture.com/reports/solid-state-relay-market-8645 |

| By Region |

|

solid state relay Market Trends

The global market for solid state relays (SSR) has a huge, significant growth owing to the surging need for automation and energy savings across the industries. With the advent of smart manufacturing, also known as the Industrial Internet of Things (IIoT), solid-state relays are utilised in areas such as motor control, lighting, and heating systems more and more. The benefits of solid-state relays over electromagnetic relays—faster switching speeds, longer life, shock and vibration resistance, among others—make them appealing to modern industries. Also, the demand for solid-state relays is growing in other industries, such as solar energy and electric cars, due to the ever-increasing shift to low-carbon, energy-efficient technologies. With the objective of cutting back on energy use and decreasing downtime in operational processes, industries have adopted SSRs as key devices in power management and distribution. Additionally, the continuous improvement of semiconductor technology is enabling the production of smaller, more efficient, and cheaper solid-state relays, stimulating their use in any application and hence broadening the market.solid state relay Market Leading Players

The key players profiled in the report are Crydom Inc. (Sensata Technology), Omron Corporation, Schneider Electric, ABB Ltd., IXYS Corp.. (Littelfuse), STMicroelectronics, Rockwell Automation Inc., General Electric, Vishay Intertechnology (Siliconix), Fujitsu Limited, Carlo Gavazzi Holding AG, Honeywell International Inc, Texas Instruments Inc. Source: https://www.marketresearchfuture.com/reports/solid-state-relay-market-8645Growth Accelerators

The driving force behind the global solid-state relay (SSR) market is the upsurge in the need for energy-efficient solutions across the spectrum of industries. Production industries are striving much to save on energy and bring down greenhouse emissions, and so the SSRs, which are fast switching and very reliable, get to replace the traditional electromechanical relays. Their function of controlling high voltage and current loads without mechanical failure makes them suitable for use in automation and HVAC systems, as well as for the renewable energy verticals, which also enhances the growth of the solid-state relay market. Industrialisation and smart technology advancement is another important driver contributing to market growth. Automation systems, when integrated with SSRs, improve performance owing to the enhancements in the control of machines and processes. As industries evolve with the aid of Industry 4.0 and the Internet of Things (IoT) concepts, there is an increasing demand for components like SSRs, which are reliable, compact, and durable. Also, this trend is positively influenced by the increasing use of electric vehicles and renewable energy systems, in which SSRs are crucial in the power distribution management in the systemsolid state relay Market Segmentation analysis

The Global solid state relay is segmented by and Region. . Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The worldwide market for solid-state relays (SSR) exhibits many entrepreneurial activities, with many existing firms as well as new entrants seeking to exploit and acquire a share of the market. For instance, the market has players such as Omron, Crydom, and TE Connectivity, which are all manufacturers of electronic appliances, while Solid State Electronics and Opto 22 are manufacturers solely based on SSR technologies. The competition in the competitive landscape involves fierce rivalry, the need to be different, and the pressing need to come up with and deliver quality, dependable, and creative SSRs. With the increasing demand for SSRs, the market is forecasted to be upbeat and optimistic, full of competition coupled with the introduction of new players and product innovations targeting the current leaders of the market.Challenges In solid state relay Market

Several factors act as many market restraints in the global solid-state relay (SSR) market, with the competition from traditional electromechanical relays (EMRs) being one of the main factors. Although SSRs have benefits like high switching speeds, enhanced endurance, and lesser electromagnetic interference, EMRs are still widely used due to their low costs in most applications. This price sensitivity, more so in less profitable sectors, may prevent the further penetration of SSRs into the market, with customers preferring the cheap, low-performance EMRs instead. In addition, the other factors that have much business impact include the complex technologies that are involved regarding SSRs. Processes related to heat dissipating, electrical noises, and ratings of voltages had to be taken into account by the producers so as to avoid functional failures. Besides, the skill barrier to dealing with SSR integration in existing systems may restrain a good number of potential users, especially in smaller businesses since they do not have the know-how. In the process of the solid-state relay market maturing, it will be important to find ways around these obstacles, first and foremost through the use of new technology, educating customers, and pricing over competition.Risks & Prospects in solid state relay Market

One of the most significant growth drivers of the global solid-state relay (SSR) market is the increasing penetration of energy-efficient solutions in several industries. This is especially true for organisations that are focused on energy conservation measures and improving the functioning of their operations. Since solid-state relays are an advancement over the traditional electric relays, enabling faster switching, longer life, and reduced heat loss, which is clearly the case with solid-state relays, the shift is also apparent in industries like renewable energy where solar inverters and energy management systems incorporate, indeed, SSRs. Another factor that will help propel further growth of the solid-state relay market during the forecast period is the increase in automation and adoption of smart technologies in the manufacturing and industrial processes. Particularly with the introduction of the fourth industrial revolution, more and more manufacturers look for alternative means of controlling and improving production for the processes carried out. SSRs are tough and reliable and hence find applications in robotics, HVAC, and process control systems. This also makes SSRs more attractive but also a necessity for the creation of innovative automation systems in many industries.Key Target Audience

The primary market for global solid-state relays (SSR) encompasses several industries, including but not limited to manufacturing, automation, and energy management. In manufacturing, SSRs are indispensable in the control of motors and other electrical loads since they are reliable, fast switching, and shock and vibration proof. The automation uses SSRs in PLCs and other control systems primarily to eliminate inefficiencies and downtime, and these components have become essential in today’s industrial setups.,, Few Other substantial audiences include sectors like renewable energy and HVAC (heating, ventilation, and air conditioning). In renewable energy, for instance, solid-state relays find their applications in solar SSRs and wind turbines in order to improve their performance. In HVAC systems, it helps in the management of temperature controls, where it enhances energy savings through accurate on and off switching of electrical loads. Due to companies’ growing engineering works towards energy efficiency and automation, the need and supply of solid-state relays are on the rise, encroaching both the older manufacturers and the newer tech-savvy ones.Merger and acquisition

In recent years, a number of important mergers and acquisitions have occurred in the worldwide solid-state relay (SSR) market, which indicates that the vertical integration strategies have gone further than just the economies of scale. Certain examples of deals are as follows: The case of Omron’s purchase of Littelfuse’s SSR business unit: This move has placed Omron in a prime position for growth as a supplier of solid-state relays by bolstering its product offer and coverage. TE Connectivity’s buyout of Amphenol ICC: This represented a merger of two companies that were involved in the production of electronic components, including solid-state relays, thus forming a bigger and more complex firm. Cree's acquisition of Wolfspeed: In this transaction, two of the biggest players in the market for power semiconductors, inclusively solid-state relays, came together and thus had the ability to market more products and solutions to the customers. These instances of merging have made the market more concentrated and competitive, and it has made it easier to come up with newer versions and applications of SSRs.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 solid state relay- Snapshot

- 2.2 solid state relay- Segment Snapshot

- 2.3 solid state relay- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: solid state relay Market by Relay

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 DC to AC

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 DC to DC

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 AC to DC

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 AC/DC to AC

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: solid state relay Market by Mounting

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Panel Mount

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 PCB Mount

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Din Rail Mount

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: solid state relay Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Crydom Inc. (Sensata Technology)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Omron Corporation

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Schneider Electric

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 ABB Ltd.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 IXYS Corp.. (Littelfuse)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 STMicroelectronics

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Rockwell Automation Inc.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 General Electric

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Vishay Intertechnology (Siliconix)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Fujitsu Limited

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Carlo Gavazzi Holding AG

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Honeywell International Inc

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Texas Instruments Inc. Source: https://www.marketresearchfuture.com/reports/solid-state-relay-market-8645

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Relay |

|

By Mounting |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of solid state relay in 2031?

+

-

What is the growth rate of solid state relay Market?

+

-

What are the latest trends influencing the solid state relay Market?

+

-

Who are the key players in the solid state relay Market?

+

-

How is the solid state relay } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the solid state relay Market Study?

+

-

What geographic breakdown is available in Global solid state relay Market Study?

+

-

Which region holds the second position by market share in the solid state relay market?

+

-

How are the key players in the solid state relay market targeting growth in the future?

+

-

What are the opportunities for new entrants in the solid state relay market?

+

-