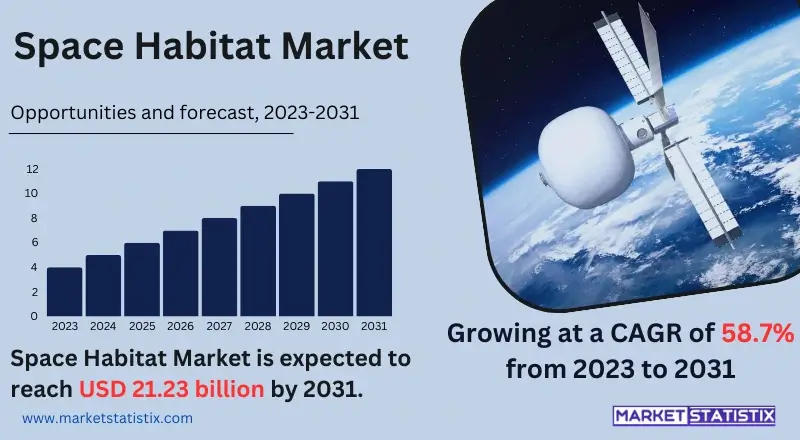

Global Space Habitat Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-26 | Aerospace and Defence | Last updated: Sep, 2024 | Formats*:

Space Habitat Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 58.7% |

| By Product Type | Inflatable Modules, Rigid Modules, Hybrid Structures, 3D-Printed Habitats, Modular Space Stations |

| Key Market Players |

|

| By Region |

Space Habitat Market Trends

The space habitat market has several significant trends that can be attributed to technological advancements, the increased take-up by private investors, and the ever-pressing need for sustained human activity in outer space. One of these major trends is the emergence of modular and easily configurable habitat designs capable of being “built” for different missions, whether the mission is research, tourism, or colonization. Companies such as SpaceX and Blue Origin are putting a lot of their financing into technologies for building-in-space and sustainability components, and most importantly, systems and networks focused on their causes as life support, energy, and resources and their effective use on the Moon, Mars, or in low orbits for a long-duration stay. An additional trend worthy of mention is the combination of government space agencies with commercial firms to develop space habitats. Such programs as the Artemis missions by NASA, which seek to return humans to the moon permanently, are also promoting the need for the design of exploration specialised habitats for the use of astronauts during such travels in the private sector.Space Habitat Market Leading Players

The key players profiled in the report are Momentus Inc., SpaceX, Orbital Assembly Corporation, Axiom Space, Boeing, Blue Origin, Mitsubishi Heavy Industries, Roscosmos, Nanoracks, Bigelow Aerospace, Lockheed Martin, Thales Alenia Space, Sierra Space, China Aerospace Science and Technology Corporation (CASC), DOrbitGrowth Accelerators

The market for space habitats is mainly influenced by the growing demand for deep space missions. Missions such as those planned by NASA, SpaceX, and other space agencies to the Moon, Mars, and further. It is essential in these efforts to develop next-generation habitats for extended space activities. The need to facilitate sustainable living in outer space encourages the advancement of life support technology, radiation shielding, and resource utilisation, thus enhancing the space habitat industry. Commercialisation of space and space-related activities is another factor that increases contributes to the growth of the industry. This in turn leads to heavy investments from private firms to create space modules to house tourists, researchers, and even astronauts for short and long expeditions. This trend towards privatisation of space ventures not only increases the market potential but also encourages improvement in habitat design and technology.Space Habitat Market Segmentation analysis

The Global Space Habitat is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Inflatable Modules, Rigid Modules, Hybrid Structures, 3D-Printed Habitats, Modular Space Stations . The Application segment categorizes the market based on its usage such as Tourism and Recreation, Industrial and Commercial Activities, Permanent Human Habitation, Space Research and Exploration. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The spatial habitat market is highly competitive, featuring not only companies that have been in the aerospace industry for decades but also newer companies as well as space agencies, all looking to come up with original concepts for settlement in space. This has seen major stakeholders like NASA, SpaceX, and more recently Blue Origin take the lead in developing technologies for operation in long-term missions like the Artemis and colonisation of Mars. These institutions utilise large R&D budgets, capital investment, and specialised knowledge in aerospace and engineering to build structures capable of sustaining human life in space, with a great focus on life support systems, radiation shields, and environmentally friendly practices. While major players tend to dominate in existing markets, new entrants and spin-offs also make their way in the space habitat sector nowadays, usually more often than not weighting for niche markets or particular technologies in places like modular habitable structures, ISRU, or habitat printing. Such enterprises quite frequently engage in partnerships with market incumbents or government agencies in order to receive funding and expertise.Challenges In Space Habitat Market

The market for space habitats, or space tourism for that matter, has a few notable drawbacks, the major one being high expenditure on research, development, and construction of space-populated facilities. Given the cost effectiveness of launching commodities and the drawn-out branch of engineering aimed at providing means of living in inhospitable places, both the public and private sectors put up financial constraints. Also, within space agencies, limited funds and other priorities for funding often contribute to poor management of resources earmarked for time-bound habitat projects and lag behind in technology. Also, the modern-day challenge is to provide an environment that allows all the space occupants to be healthy and safe even in the longer run. Factors like radiation, life support systems, and other psychological-in nature interventions are very vital, especially for missions that involve staying in space for long periods. Technology and design have to come in to prevent adverse physiological modifications that are caused by microgravity, such as muscles and bones wasting away.Risks & Prospects in Space Habitat Market

The market for space habitats is booming because of the growing concern for space travel, colonisation, and missions to last longer than earth. As governmental space agencies such as NASA and private corporations like Space X and Blue Origin turn their focus to human space flight programs, the need for space habitats that are capable of housing humans in difficult environments is growing. These habitats will need to incorporate life support systems, sustain the desired envelope for human habitation, and incorporate modern research and development technologies, thus providing room for manufacturers and service providers to build and fit these infrastructures. In addition, growing demand in view of business opportunities in space, such as space holidays and colonising the moon or Mars, is providing room for the invention of space habitats for both functional and tourism purposes. Self-contained units that provide protection, relaxation, and work areas in space are possible due to the integration of construction companies, material science companies, and life science companies.Key Target Audience

The space habitat market highlights a clear target: government space agencies, especially bodies like NASA and ESA, which are focused on building space habitats for astronauts on their missions. Such agencies are always looking for innovations in structural mechanics and life-support systems, as well as habitats, and minimising the risks to the crew in outer space. With humanity’s ambition of exploring the Moon, Mars, and outer space, the demand for practical and versatile space habitats has intensified.,, The other section of the audience includes private aerospace and space bending/spectacles businesses that are pursuing or would like to pursue space tourism and research and/or exploration. Such companies host developed and comfortable spaces for those interested in tourism, research, or commercial purposes, permitting advances in habitat systems, modular construction, and resource utilisation.Merger and acquisition

The latest rounds of consolidation in the space habitat industry have concentrated on the ability to deploy humans in outer space, as well as on developing the infrastructure for inhabiting such spaces for long periods. Whereas in this regard, an important step was made in 2022 when Axiom Space reported purchasing a large stake in the future commercial use of the International Space Station (ISS). The aim is to build the first commercial space station in history. This firmly places Axiom at the forefront of the evolution of space stations from being purely governmental to being opened up for commercial purposes, thus availing research and tourism within low Earth orbit to new heights. On the other hand, Blue Origin received the rights to the Orbital Reef project, the project by Sierra Space that aims to build an operational space station by the end of the 2020s. This purchase demonstrates the growing demand for the creation of space and its resources, which can easily be utilised for carrying out research and trade activities. Given that the landscape for space habitats becomes very competitive, these mergers and acquisitions reflect a growing pattern of merging and synergising within such spaces in order to position themselves for future human explorations’ economic viability.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Space Habitat- Snapshot

- 2.2 Space Habitat- Segment Snapshot

- 2.3 Space Habitat- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Space Habitat Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Inflatable Modules

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Rigid Modules

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Hybrid Structures

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 3D-Printed Habitats

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Modular Space Stations

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Space Habitat Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Tourism and Recreation

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Industrial and Commercial Activities

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Permanent Human Habitation

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Space Research and Exploration

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Space Habitat Market by Mission Duration

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Short-Term (Less than 6 months)

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Medium-Term (6 months to 2 years)

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Long-Term (Over 2 years)

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Permanent

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Space Habitat Market by Propulsion System

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Chemical Propulsion

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Electric Propulsion

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Ion Propulsion

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Plasma Propulsion

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

- 7.6 Solar Sails

- 7.6.1 Key market trends, factors driving growth, and opportunities

- 7.6.2 Market size and forecast, by region

- 7.6.3 Market share analysis by country

8: Competitive Landscape

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Momentus Inc.

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 SpaceX

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Orbital Assembly Corporation

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Axiom Space

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Boeing

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Blue Origin

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Mitsubishi Heavy Industries

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Roscosmos

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Nanoracks

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Bigelow Aerospace

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Lockheed Martin

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Thales Alenia Space

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Sierra Space

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 China Aerospace Science and Technology Corporation (CASC)

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 DOrbit

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Mission Duration |

|

By Propulsion System |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which type of Space Habitat is widely popular?

+

-

What is the growth rate of Space Habitat Market?

+

-

What are the latest trends influencing the Space Habitat Market?

+

-

Who are the key players in the Space Habitat Market?

+

-

How is the Space Habitat } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Space Habitat Market Study?

+

-

What geographic breakdown is available in Global Space Habitat Market Study?

+

-

Which region holds the second position by market share in the Space Habitat market?

+

-

How are the key players in the Space Habitat market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Space Habitat market?

+

-