Global Spend Analytics Market – Industry Trends and Forecast to 2032

Report ID: MS-544 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Spend Analytics Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2034 |

| Base Year Of Estimation | 2024 |

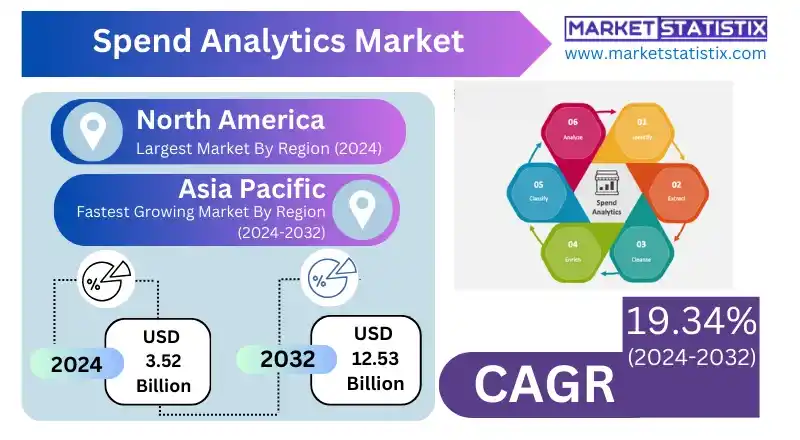

| Growth Rate | CAGR of 19.34% |

| Forecast Value (2034) | USD 12.53 Billion |

| By Product Type | Prescriptive Analytics, Predictive Analytics, Descriptive Analytics |

| Key Market Players |

|

| By Region |

|

Spend Analytics Market Trends

Currently, the companies in the spend analytic domain are getting attracted towards more investment in the market, mainly to address the rising demand among organisations for optimising the procurement process and cutting costs. The major trend has been the application of artificial intelligence and machine learning for data cleansing, categorisation, and analysis, thereby leading to deeper insights and more accurate forecasts of performance. Another growing trend is cloud-based spending analysis solutions due to the scalability, accessibility, and real-time visualization of data they can offer. Supplier relationship management and risk mitigation take centre stage among these trends. Spend analytics can then be used to inform the suppliers about performance measurements, risk identification, and compliance with rules. Sustainability and ethically sourced products are becoming the new focus areas for organizations. Demand for spend analytics is growing as companies need to analyse and assess such aspects. Integration with other enterprise systems like ERP, procurement systems, and others is becoming a norm for spend analytics, providing a comprehensive view of financial operations and eventually leading to more strategic decision-making.Spend Analytics Market Leading Players

The key players profiled in the report are Empronc Solutions Pvt. Ltd., IBM Corporation, Rosslyn Analytics Ltd., SAS Institute Inc., Coupa Software Inc, Zycus Inc., Ivalua Inc., Oracle Corporation, BravoSolution SPA, Proactis, JAGGAER, SAP SEGrowth Accelerators

The major driving factor of this spend analytics market is that organizations are demanding enhanced procurement efficiency coupled with cost optimisation. Businesses all over the world from the public to private sector are under pressure to control expenses and thus improve their bottom line. Spend analytics, then, offers visibility and insights on where there's overspending and potential savings. Furthermore, the increasing complexity of supply chain procurement coupled with an increasing amount of procurement data is expected to drive demand for highly advanced analytics tools with the capability to process and interpret such information. The advent of newer cloud-based solutions and newly developed AI-augmented analytics applications has also made spend analytics more affordable and attainable while encouraging its widespread adoption.Spend Analytics Market Segmentation analysis

The Global Spend Analytics is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Prescriptive Analytics, Predictive Analytics, Descriptive Analytics . The Application segment categorizes the market based on its usage such as Financial Management, Governance and Compliance Management, Supplier Sourcing and Performance Management, Risk Management, Demand and Supply Forecasting. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The spend analytics market is defined by the key players like the major software vendors, cloud-based solution firms, and local or niche analytics firms. Some of the companies that provide spend analytics solutions using a complete integration of AI, machine learning, and big data capabilities are SAP, IBM, Oracle, Coupa, and SAS. The stream is dominated by these firms that have to stay focused on product innovation, strategic partnerships, and acquisitions to gain more market share. Specialisation or business size-limited competition is therefore intensified by minor vendors and startups offering individual, cost-effective solutions. Market rivalry is also intensified by the growing need to facilitate real-time visibility on spending, cut costs, and mitigate risks from the supplier's standpoint. Cloud-based spend analytics are becoming popular among firms as they give them access to scalable AI-based insights for procurement optimisation and can be part of enabling further competition and differentiation. Other differentiators for vendors are friendly user interfaces, advanced reporting, and integration with the ERP and procurement systems.Challenges In Spend Analytics Market

Several constraints in the spend analytics market can inhibit its growth and adoption. First, data privacy concerns arise, such as when the spend analytics solution processes sensitive financial data and procurement documentation. These data render the solution vulnerable to security breaches. Furthermore, organizations struggle with getting consistent semantics and interpretations across multiple datasets, creating more difficulties in breaking out actionable insights. On top of that, making the migration from legacy systems to modern spend analytics solutions is itself a big challenge, calling for huge money, time, and expertise. These delays in implementation reduce the overall perceived ROI for the organisation. In addition, many organisations find it difficult to integrate the spend analytics tools they are using with the systems and workflows they have in place already, hence limiting their usefulness. The disjointed nature of the market with a plethora of vendors offering disparate solutions makes the situation even worse. All solutions to these challenges will invariably require high technology, high skill, and strategic planning to unlock the full potential of spend analytics solutions.Risks & Prospects in Spend Analytics Market

The market for spend analytics is offering numerous new prospects propelled by the increasing adoption of digital transformation with AI-based analytics and cloud-orientated solutions. For e-commerce, healthcare, and retail industries, and even the BFSI sector, spend analytics would optimise procurement processes while reducing costs and improving supplier performance. Innovations will only be fuelling further development of the market, such as predictive and prescriptive analytics, blockchains for transparency, and even IoT integration. North America is selling most of the spend analytics because of the developed digital infrastructure and early adopters of advanced technologies that can make regions rise, like IBM, Oracle, or SAP in North America. In contrast, Asia-Pacific is expected to emerge as the fastest-growing market with increasing adoption among SMEs, rising awareness of cost-effective solutions, and high volumes of spend data. Countries like China lead the way, along with India, given that the latter is mainly because of the booming e-commerce sector in these countries and the resulting demand for efficient procurement strategies. Europe remains an important continent in that respect, particularly in very high-pull industries such as manufacturing and telecom, where companies are focussing on compliance and cost optimisation.Key Target Audience

The primary target audiences for the spend analytics market are large enterprises, small and medium-sized businesses (SMBs), procurement practitioners, and financial analysts. Large enterprises form a primary audience segment because their complex supply chains and high-volume procurement activities require elaborate insights into optimising spending. The SMB segment is equally significant in that they also are increasingly using spend analytics to drive cost efficiencies and competitive advantages. Procurement practitioners rely upon these tools to find areas for savings, maintain supplier relationships, and ensure compliance with procurement policies. Financial analysts derive insights from spend analytics to correlate spending patterns to wider financial strategies and objectives.Merger and acquisition

Spend analytics have gone through notable merger and acquisition (M&A) activities in recent times, therefore indicating a tendency towards consolidation and diversification of service offerings. In July 2021, Microsoft acquired Suplari, a spend analytics vendor intended to enhance the Dynamics 365 suite, with goals to create end-to-end data and spend insights across the supply chains. Following suit, in February 2020, McKinsey & Company acquired Orpheus GmbH, a digital procurement innovator focused on spend analytics, to offer even better procurement service. In 2021, Banyan Software acquired Atamis, a spend analytics vendor, while Onventis expanded its offering with the acquisition of Spendency, a Swedish specialist in spend analytics. Later still, in July 2022, SpendHQ merged with procurement performance management expert Per Angusta, with support from a $65 million investment made to enhance the joint spend analysis strengths. In March 2022, Xeeva, an AI-led spend management and procurement software provider, launched Spend Analytics with Intelligent Opportunities, enabling clients to dynamically assess and execute against savings and sourcing opportunities generated within an application. >Analyst Comment

Strong growth is taking place within the spend analytics market that results from the increased pressures for organizations to optimise their procurement processes and save costs. Today, every organisation is data-driven when making decisions to improve their financial performance while alleviating risks within the competitive business landscape. This has resulted in an ever-increasing need for advanced spend analytics solutions that help give organisations accurate direction with visibility into where their spending is going and allow their easy execution of sourcing strategies. The market is also boosted by the rapid promotion of cloud-based platforms and the convergence of artificial intelligence and machine learning, which harness accurate and efficient spend analytics.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Spend Analytics- Snapshot

- 2.2 Spend Analytics- Segment Snapshot

- 2.3 Spend Analytics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Spend Analytics Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Predictive Analytics

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Prescriptive Analytics

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Descriptive Analytics

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Spend Analytics Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Financial Management

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Risk Management

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Governance and Compliance Management

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Supplier Sourcing and Performance Management

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Demand and Supply Forecasting

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Spend Analytics Market by Component

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Services

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Software

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Spend Analytics Market by Business Function

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Finance

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Information Technology (IT)

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Marketing

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Procurement

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

8: Spend Analytics Market by Deployment

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 On-Cloud

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 On-Premises

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

9: Spend Analytics Market by Industry Vertical

- 9.1 Overview

- 9.1.1 Market size and forecast

- 9.2 Energy and Utilities

- 9.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.2 Market size and forecast, by region

- 9.2.3 Market share analysis by country

- 9.3 Government and Defense

- 9.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.2 Market size and forecast, by region

- 9.3.3 Market share analysis by country

- 9.4 Healthcare and Life Sciences

- 9.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.2 Market size and forecast, by region

- 9.4.3 Market share analysis by country

- 9.5 Manufacturing

- 9.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.2 Market size and forecast, by region

- 9.5.3 Market share analysis by country

- 9.6 Retail and E-commerce

- 9.6.1 Key market trends, factors driving growth, and opportunities

- 9.6.2 Market size and forecast, by region

- 9.6.3 Market share analysis by country

- 9.7 Telecommunications and IT

- 9.7.1 Key market trends, factors driving growth, and opportunities

- 9.7.2 Market size and forecast, by region

- 9.7.3 Market share analysis by country

10: Spend Analytics Market by Region

- 10.1 Overview

- 10.1.1 Market size and forecast By Region

- 10.2 North America

- 10.2.1 Key trends and opportunities

- 10.2.2 Market size and forecast, by Type

- 10.2.3 Market size and forecast, by Application

- 10.2.4 Market size and forecast, by country

- 10.2.4.1 United States

- 10.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.2.4.1.2 Market size and forecast, by Type

- 10.2.4.1.3 Market size and forecast, by Application

- 10.2.4.2 Canada

- 10.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.2.4.2.2 Market size and forecast, by Type

- 10.2.4.2.3 Market size and forecast, by Application

- 10.2.4.3 Mexico

- 10.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.2.4.3.2 Market size and forecast, by Type

- 10.2.4.3.3 Market size and forecast, by Application

- 10.2.4.1 United States

- 10.3 South America

- 10.3.1 Key trends and opportunities

- 10.3.2 Market size and forecast, by Type

- 10.3.3 Market size and forecast, by Application

- 10.3.4 Market size and forecast, by country

- 10.3.4.1 Brazil

- 10.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.1.2 Market size and forecast, by Type

- 10.3.4.1.3 Market size and forecast, by Application

- 10.3.4.2 Argentina

- 10.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.2.2 Market size and forecast, by Type

- 10.3.4.2.3 Market size and forecast, by Application

- 10.3.4.3 Chile

- 10.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.3.2 Market size and forecast, by Type

- 10.3.4.3.3 Market size and forecast, by Application

- 10.3.4.4 Rest of South America

- 10.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.4.2 Market size and forecast, by Type

- 10.3.4.4.3 Market size and forecast, by Application

- 10.3.4.1 Brazil

- 10.4 Europe

- 10.4.1 Key trends and opportunities

- 10.4.2 Market size and forecast, by Type

- 10.4.3 Market size and forecast, by Application

- 10.4.4 Market size and forecast, by country

- 10.4.4.1 Germany

- 10.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.1.2 Market size and forecast, by Type

- 10.4.4.1.3 Market size and forecast, by Application

- 10.4.4.2 France

- 10.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.2.2 Market size and forecast, by Type

- 10.4.4.2.3 Market size and forecast, by Application

- 10.4.4.3 Italy

- 10.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.3.2 Market size and forecast, by Type

- 10.4.4.3.3 Market size and forecast, by Application

- 10.4.4.4 United Kingdom

- 10.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.4.2 Market size and forecast, by Type

- 10.4.4.4.3 Market size and forecast, by Application

- 10.4.4.5 Benelux

- 10.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.5.2 Market size and forecast, by Type

- 10.4.4.5.3 Market size and forecast, by Application

- 10.4.4.6 Nordics

- 10.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.6.2 Market size and forecast, by Type

- 10.4.4.6.3 Market size and forecast, by Application

- 10.4.4.7 Rest of Europe

- 10.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.7.2 Market size and forecast, by Type

- 10.4.4.7.3 Market size and forecast, by Application

- 10.4.4.1 Germany

- 10.5 Asia Pacific

- 10.5.1 Key trends and opportunities

- 10.5.2 Market size and forecast, by Type

- 10.5.3 Market size and forecast, by Application

- 10.5.4 Market size and forecast, by country

- 10.5.4.1 China

- 10.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.1.2 Market size and forecast, by Type

- 10.5.4.1.3 Market size and forecast, by Application

- 10.5.4.2 Japan

- 10.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.2.2 Market size and forecast, by Type

- 10.5.4.2.3 Market size and forecast, by Application

- 10.5.4.3 India

- 10.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.3.2 Market size and forecast, by Type

- 10.5.4.3.3 Market size and forecast, by Application

- 10.5.4.4 South Korea

- 10.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.4.2 Market size and forecast, by Type

- 10.5.4.4.3 Market size and forecast, by Application

- 10.5.4.5 Australia

- 10.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.5.2 Market size and forecast, by Type

- 10.5.4.5.3 Market size and forecast, by Application

- 10.5.4.6 Southeast Asia

- 10.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.6.2 Market size and forecast, by Type

- 10.5.4.6.3 Market size and forecast, by Application

- 10.5.4.7 Rest of Asia-Pacific

- 10.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.7.2 Market size and forecast, by Type

- 10.5.4.7.3 Market size and forecast, by Application

- 10.5.4.1 China

- 10.6 MEA

- 10.6.1 Key trends and opportunities

- 10.6.2 Market size and forecast, by Type

- 10.6.3 Market size and forecast, by Application

- 10.6.4 Market size and forecast, by country

- 10.6.4.1 Middle East

- 10.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.6.4.1.2 Market size and forecast, by Type

- 10.6.4.1.3 Market size and forecast, by Application

- 10.6.4.2 Africa

- 10.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.6.4.2.2 Market size and forecast, by Type

- 10.6.4.2.3 Market size and forecast, by Application

- 10.6.4.1 Middle East

- 11.1 Overview

- 11.2 Key Winning Strategies

- 11.3 Top 10 Players: Product Mapping

- 11.4 Competitive Analysis Dashboard

- 11.5 Market Competition Heatmap

- 11.6 Leading Player Positions, 2022

12: Company Profiles

- 12.1 Empronc Solutions Pvt. Ltd.

- 12.1.1 Company Overview

- 12.1.2 Key Executives

- 12.1.3 Company snapshot

- 12.1.4 Active Business Divisions

- 12.1.5 Product portfolio

- 12.1.6 Business performance

- 12.1.7 Major Strategic Initiatives and Developments

- 12.2 Coupa Software Inc

- 12.2.1 Company Overview

- 12.2.2 Key Executives

- 12.2.3 Company snapshot

- 12.2.4 Active Business Divisions

- 12.2.5 Product portfolio

- 12.2.6 Business performance

- 12.2.7 Major Strategic Initiatives and Developments

- 12.3 SAS Institute Inc.

- 12.3.1 Company Overview

- 12.3.2 Key Executives

- 12.3.3 Company snapshot

- 12.3.4 Active Business Divisions

- 12.3.5 Product portfolio

- 12.3.6 Business performance

- 12.3.7 Major Strategic Initiatives and Developments

- 12.4 Oracle Corporation

- 12.4.1 Company Overview

- 12.4.2 Key Executives

- 12.4.3 Company snapshot

- 12.4.4 Active Business Divisions

- 12.4.5 Product portfolio

- 12.4.6 Business performance

- 12.4.7 Major Strategic Initiatives and Developments

- 12.5 BravoSolution SPA

- 12.5.1 Company Overview

- 12.5.2 Key Executives

- 12.5.3 Company snapshot

- 12.5.4 Active Business Divisions

- 12.5.5 Product portfolio

- 12.5.6 Business performance

- 12.5.7 Major Strategic Initiatives and Developments

- 12.6 JAGGAER

- 12.6.1 Company Overview

- 12.6.2 Key Executives

- 12.6.3 Company snapshot

- 12.6.4 Active Business Divisions

- 12.6.5 Product portfolio

- 12.6.6 Business performance

- 12.6.7 Major Strategic Initiatives and Developments

- 12.7 IBM Corporation

- 12.7.1 Company Overview

- 12.7.2 Key Executives

- 12.7.3 Company snapshot

- 12.7.4 Active Business Divisions

- 12.7.5 Product portfolio

- 12.7.6 Business performance

- 12.7.7 Major Strategic Initiatives and Developments

- 12.8 Ivalua Inc.

- 12.8.1 Company Overview

- 12.8.2 Key Executives

- 12.8.3 Company snapshot

- 12.8.4 Active Business Divisions

- 12.8.5 Product portfolio

- 12.8.6 Business performance

- 12.8.7 Major Strategic Initiatives and Developments

- 12.9 Rosslyn Analytics Ltd.

- 12.9.1 Company Overview

- 12.9.2 Key Executives

- 12.9.3 Company snapshot

- 12.9.4 Active Business Divisions

- 12.9.5 Product portfolio

- 12.9.6 Business performance

- 12.9.7 Major Strategic Initiatives and Developments

- 12.10 Proactis

- 12.10.1 Company Overview

- 12.10.2 Key Executives

- 12.10.3 Company snapshot

- 12.10.4 Active Business Divisions

- 12.10.5 Product portfolio

- 12.10.6 Business performance

- 12.10.7 Major Strategic Initiatives and Developments

- 12.11 Zycus Inc.

- 12.11.1 Company Overview

- 12.11.2 Key Executives

- 12.11.3 Company snapshot

- 12.11.4 Active Business Divisions

- 12.11.5 Product portfolio

- 12.11.6 Business performance

- 12.11.7 Major Strategic Initiatives and Developments

- 12.12 SAP SE

- 12.12.1 Company Overview

- 12.12.2 Key Executives

- 12.12.3 Company snapshot

- 12.12.4 Active Business Divisions

- 12.12.5 Product portfolio

- 12.12.6 Business performance

- 12.12.7 Major Strategic Initiatives and Developments

13: Analyst Perspective and Conclusion

- 13.1 Concluding Recommendations and Analysis

- 13.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Component |

|

By Business Function |

|

By Deployment |

|

By Industry Vertical |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Spend Analytics in 2034?

+

-

Which type of Spend Analytics is widely popular?

+

-

What is the growth rate of Spend Analytics Market?

+

-

What are the latest trends influencing the Spend Analytics Market?

+

-

Who are the key players in the Spend Analytics Market?

+

-

How is the Spend Analytics } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Spend Analytics Market Study?

+

-

What geographic breakdown is available in Global Spend Analytics Market Study?

+

-

Which region holds the second position by market share in the Spend Analytics market?

+

-

Which region holds the highest growth rate in the Spend Analytics market?

+

-