Global Stick Packaging Market – Industry Trends and Forecast to 2031

Report ID: MS-2244 | Consumer Goods | Last updated: Dec, 2024 | Formats*:

Stick packaging Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

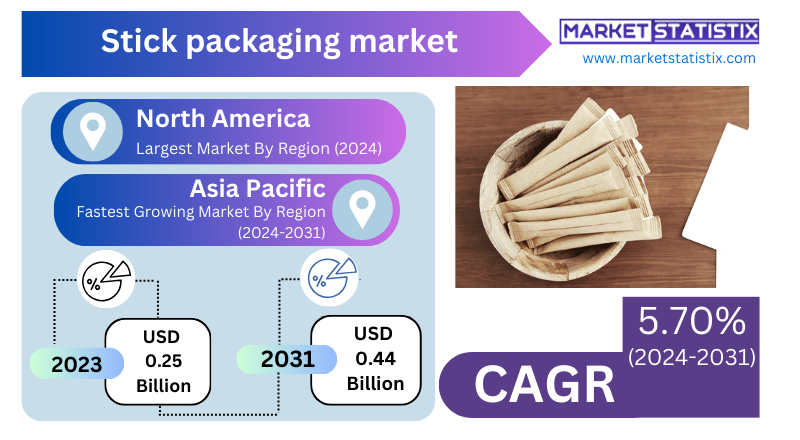

| Growth Rate | CAGR of 5.70% |

| Forecast Value (2031) | USD 0.44 Billion |

| By Product Type | Paper, BOPP, Aluminum, Plastic |

| Key Market Players |

|

| By Region |

|

Stick packaging Market Trends

The stick pack packaging sector has been enjoying the boom from the other industries, such as food and beverages, pharmaceuticals, and personal care, because more and more consumers are leaning toward on-the-go and single-serve packaging. This modern convenience lifestyle has led to the production of useful products such as powdered drinks, nutritional supplements, and single-dose medicines for convenient and controlled serving sizes. Eco-friendly and recyclable materials are slowly gaining market recognition as sustainability issues are becoming the primary interest across consumers and manufacturers. Branding in stick packaging is used for the simple sleekness it provides on the shell, adding to the aesthetics and marketing appeal of the product. Growth also depends on the thriving e-commerce business because the stick packs are lightweight and compact, which costs less on shipment. Emerging markets from Asia-Pacific and Latin America exhibit a good promise because disposable incomes are increasing. However, there is also a trend toward packaged goods consumption.Stick packaging Market Leading Players

The key players profiled in the report are Novamont S.p.A (Italy), Bosch Packaging Technology (U.S.)Spain), Armando Alvarez (Bemis Company Inc. (U.S.), BASF SE (Germany), Ball Corporation (U.S.), Trioworld Industrier AB (Sweden), RPC Group Plc. (U.S.), Coveris (U.K.), Amcor Corporation (U.S.), Rexam Plc. (U.S.), Rani Plast (Finland), Exxon Mobil Corporation (U.S.), Kuraray Co. Ltd. (Japan), Reynolds Group Holdings Inc. (U.S.), EXAIR Corporation (U.S.), Smurfit Kappa Group (U.K.), Berry Plastics Corporation (U.S.), Groupe Barbier (France), Berry Global Inc. (U.S.), rkw Group (Germany)Growth Accelerators

The stick pack packaging market is playing a role due to increasing demand for handy, mobile, and one-time packaging solutions witnessed mainly in the food, beverages, pharmaceuticals, and personal care sectors. Busy lifestyles and increased on-the-go consumption led to the increased popularity of stick packets with instant coffee, powdered drinks, dietary supplements, and medicines. The packing in compact size and popularity due to ease of use makes them appropriate against congestion and more wasted portions, driving the market further. Also, advancements in packaging materials and technology are good ones for the stick packaging segment. Innovations being made in flexible packaging, eco-friendly materials, and fast production techniques give stick packs an attractive opportunity to manufacturers looking for a cost-effective and sustainable solution.Stick packaging Market Segmentation analysis

The Global Stick packaging is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Paper, BOPP, Aluminum, Plastic . The Application segment categorizes the market based on its usage such as Food & Beverages, Pharmaceutical, Consumer Goods. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The stick packaging market involves established corporations and emerging companies providing innovative solutions for different industries such as food, beverages, pharmaceuticals, and personal care. Each market player tends to put more emphasis on stick package offerings ranging from pre-made pouches, stick packs, and sachet options that provide accessibility and portability with an easy usage factor as their market-size proposition. Besides adopting state-of-the-art technology in packaging, such players show an interest in sustainability and research to improve product quality and draw customers, differentiating their products and brand reputation from others.Challenges In Stick packaging Market

The stick packaging industry is facing numerous hurdles revolving around sustainability and material consumption. They now pressurise manufacturers to consider other factors, like biodegradable and recyclable importation, although being economically much costlier than plastics. All that pressure is increasingly causing various upstream supply chain difficulties for many producers sourcing these eco-friendly materials in sufficient volumes and at competitive prices. In such a situation, profitability demands adherence to environmental considerations. Increased rivalry is another challenge with the need for innovation, whereby innovation should address the various consumer demands. Packaging within sticks is typically single serve, so it abodes different types of products from food and beverages to pharmaceuticals and cosmetics. Technological developments must therefore be invested in by companies to enhance packaging functionality, such as tamper-proof and easy-open designs. Meanwhile, the integral freshness of products contained in stick packaging is demanding and may require various solutions to preserve the content while facilitating the convenient and portable usage.Risks & Prospects in Stick packaging Market

The stick packaging market boasts of enormous potential owing to increasing demand for convenient, easy, single-operation-type packaging solutions in different industries. People consumed in fast-paced lifestyles are gradually attaching themselves to snacking, beverages, and personal-care stick-packaged products, as this on-the-move way of living influences consumers toward these types of products. The food and beverage industry are besotted with these small packaging formats, with protein bars, powders, and ready-to-drink beverages benefitting from stick-shaped convenience, portion control, and easy use. Another opportunity in the market is increased consumer awareness regarding sustainable and eco-friendly aspects of packaging. The manufacturers are increasingly emphasizing the development of biodegradable, recyclable, or reusable material for stick packaging so that products would serve the greener generation in adherence to government regulations that advocate sustainability. Innovations in materials and packaging designs, such as multi-layered films and tamper-evident features, will create new avenues for growth.Key Target Audience

The stick packaging market primarily caters to food and beverage manufacturers who offer products such as single-serve snacks, powdered drink mixes, energy supplements, and condiments. For them, the advantage of packaging their products in stick form lies in its convenience, portability, and cost efficiency in offering small, precisely portioned servings. Many leading brands from the segments of coffee, tea, health supplements, and ready-to-eat meals are major consumers of stick packs for the effect they have on the customer experience and product shelf appeal.,, The other important category includes the pharmaceutical, cosmetics, and personal care businesses because they use stick packaging for many items, such as medications, skincare, and hygiene products. This compact, easy Refer van packaging type is made for sectors where convenience and on-the-go availability of product features are a norm among consumers.Merger and acquisition

Many companies in the stick packaging market have had mergers and acquisitions lately as they all try to make their products even better and further expand their reach into the market. The most notable acquisition happened when Novo Holdings announced in February 2024 that it would acquire Catalent Inc. The deal period was reported to be about $16.5 billion. On the pharmaceutical side, strengthening Novo's manufacturing and innovation in the stick packaging business, especially in nutraceuticals, is meant to address the anticipated demand for single-use packaging formats in the industry. Else, in a move to show sustainability and innovation for stick packaging, QuadPack launched ShapeUp Stick in September 2023, which is refillable and recyclable packaging for cosmetics. Increasing demand by consumers for convenient and portable packaging solutions is driving growth across various industries, including food, beverages, and personal care. Apart from Amcor PLC and Constantia Flexibles, new entrants interested in innovation and acquisition will put the stick packaging industry on a stronger consolidation and development route to becoming a dynamic segment in flexible packaging. >Analyst Comment

"The stick packaging market is growing considerably due to high demand for packaging that is convenient and portable. This packaging format has multiple benefits, such as portion control, easy usage, and lesser wastage. Major key drivers for the market growth include increasing preference for on-the-go consumption, a growing demand for single-serve products, and increasing importance attached to sustainability. Also, developments in packaging technologies such as the invention of new materials and printing have an influence on the market."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Stick packaging- Snapshot

- 2.2 Stick packaging- Segment Snapshot

- 2.3 Stick packaging- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Stick packaging Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Paper

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 BOPP

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Aluminum

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Plastic

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Stick packaging Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Food & Beverages

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pharmaceutical

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Consumer Goods

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Stick packaging Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Novamont S.p.A (Italy)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Bosch Packaging Technology (U.S.)Spain)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Armando Alvarez (Bemis Company Inc. (U.S.)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 BASF SE (Germany)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Ball Corporation (U.S.)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Trioworld Industrier AB (Sweden)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 RPC Group Plc. (U.S.)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Coveris (U.K.)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Amcor Corporation (U.S.)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Rexam Plc. (U.S.)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Rani Plast (Finland)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Exxon Mobil Corporation (U.S.)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Kuraray Co. Ltd. (Japan)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Reynolds Group Holdings Inc. (U.S.)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 EXAIR Corporation (U.S.)

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Smurfit Kappa Group (U.K.)

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 Berry Plastics Corporation (U.S.)

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 Groupe Barbier (France)

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Berry Global Inc. (U.S.)

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

- 8.20 rkw Group (Germany)

- 8.20.1 Company Overview

- 8.20.2 Key Executives

- 8.20.3 Company snapshot

- 8.20.4 Active Business Divisions

- 8.20.5 Product portfolio

- 8.20.6 Business performance

- 8.20.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Stick packaging in 2031?

+

-

What is the growth rate of Stick packaging Market?

+

-

What are the latest trends influencing the Stick packaging Market?

+

-

Who are the key players in the Stick packaging Market?

+

-

How is the Stick packaging } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Stick packaging Market Study?

+

-

What geographic breakdown is available in Global Stick packaging Market Study?

+

-

Which region holds the second position by market share in the Stick packaging market?

+

-

Which region holds the highest growth rate in the Stick packaging market?

+

-

How are the key players in the Stick packaging market targeting growth in the future?

+

-