Global Supply Chain Finance Service Market – Industry Trends and Forecast to 2031

Report ID: MS-1993 | IT and Telecom | Last updated: Nov, 2024 | Formats*:

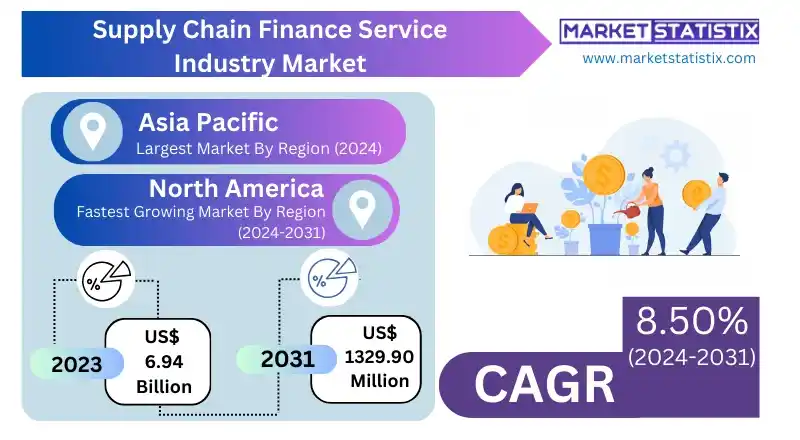

Supply Chain Finance Service Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 8.7% |

| Forecast Value (2031) | USD 13.5 Billion |

| Key Market Players |

|

| By Region |

|

Supply Chain Finance Service Market Trends

The global supply chain finance (SCF) service market is on the rise, as evident by projections of its growth from an estimated $6 billion in 2021 to almost $13.4 billion in 2031 with a growth during the same period. This growth stems mainly from the increasing demand for effective working capital management as well as improved liquidity, particularly of small and medium-sized enterprises (SMEs) in developing countries. Additionally, due to the emergence of digital platforms and the efficiency brought about by technologies such as blockchain and AI, SCF processes are also experiencing a rapid transformation. Moreover, there is another restructuring trend, which is growing traditional banks’ and fintech’s’ collaboration in supply chain finance. This is influenced by the desire to take advantage of technology in improving existing financial products and services and making their provision faster and easier. As the world becomes a global village and geographical distribution increases, SCF products are being applied more and more to protect the entity from the risks of modern trade. Without a doubt, these results indicate that over time the market will continue to grow for all the entities that wish to cope with changing market rules and look for ways to make their logistic service more efficient.Supply Chain Finance Service Market Leading Players

The key players profiled in the report are JPMorgan Chase & Co., HSBC, Asian Development Bank, Orbian Corporation, Mitsubishi UFJ Financial Group Inc., BNP Paribas, Royal Bank of Scotland plc (NatWest Group plc), Bank of America Corporation, DBS Bank India LimitedGrowth Accelerators

The international market of supply chain finance (SCF) services is booming due to numerous factors. The growing need for effective working capital management in services and retail industries is one of the most important factors. Companies implement SCF in order to allow buyers to lengthen their payables duration while accelerating payment processes to suppliers. This to-and-fro payment regarding terms of payments is very beneficial as it enhances supplier connections as well as safety towards destruction of the supply network, especially when the environment is globalized and the supply chain is complicated. In addition, the need to work together with banks is becoming more and more widespread within the fintech industry. This enhances the distribution demographic of various innovative SCF solutions that would otherwise be available for select clients only. Adoption of advanced technologies such as blockchain, artificial intelligence, and machine learning is also changing SCF, mainly through better risk management and improved transaction transparency.Supply Chain Finance Service Market Segmentation analysis

The Global Supply Chain Finance Service is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Domestic, International. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The marketplace for global supply chain finance services is being navigated by several older players and younger fintech companies who are striving to capture some market share. Stakeholders in the market include, but are not limited to, banks and factoring companies, which are traditional financial institutions, in addition to chains of financial services formulation. The nature of competition is aggressive, with competition enjoying product superiority and more efforts aimed at availing products that fit the needs of customers over time. There is high growth of supply chain finance services; hence, the demand for supply chain services is anticipated to be high with many new entrants and new ideas to unseat the leaders of the market.Challenges In Supply Chain Finance Service Market

There are various possible reasons for the relative ineffectiveness and modest growth of the global supply chain finance (SCF) service market. One of them is the misalignment of delivery and communication of data, making it difficult to avail of financing. There are companies that still depend on paper work, bearing the complete absence of SCF solutions integrated into their Enterprise Resource Planning (ERP) systems, thereby slowing down the processes and increasing frustrations. Such complexities do not give SCF room to most small businesses, as their credit profiles are limited, and so are the modern supply chains, which are multidimensional and cross-border. Yet another constraint is regulatory compliance and risk management with respect to international business. Given different legal structures in different territories, there are aspects that may interfere with the effective working of SCF initiatives. Furthermore, the majority of banks and other financial institutions are usually risk-averse when it comes to financing suppliers with whom they have no prior relationships, which makes it even harder for smaller or less creditworthy suppliers to access funds. Consequently, the SCF sector is associated with growing market potential, but some of these issues need resolution in order to make it possible and fully exploit the opportunities.Risks & Prospects in Supply Chain Finance Service Market

The service market for supply chain finance (SCF) projects worldwide is on a growth trajectory for a number of reasons, among them the growing sophistication of global supply chains and the increasing need for better financing alternatives. Most of this growth is due to the financing requirements of the small and medium-sized enterprises (SMEs) sector, which is rapidly turning to SCF systems to optimize working capital and improve cash flow management. Separately, technology also contributes to the current changes occurring in the SCF market. With the development of FinTech solutions such as block chain and smart contracts, the supply chain transaction process is being overly transformed to allow for high levels of transparency and security in the processes. Considering the fact that businesses around the world are adopting sustainable sourcing technologies and ethical practices, there has been growth in the focus of incorporating new SCF approaches that are in line with the trends. This change helps improve supplier relations and also relates to other corporate governance issues, which are more concerned with environmental, social, and gender (ESG) issues.Key Target Audience

The prominent scope of the global supply chain finance (SCF) service market can be divided into two broad categories, namely large enterprises and small to medium-sized enterprises (SMEs). SCF services tend to be mostly consumed by large corporations who seek to minimize their financing costs and enhance their customers/suppliers cash flow along the entire supply chain, thanks to their excellent credit grades. Typically, such companies install SCF systems in order to foster their suppliers and make sure that payments are done on time, hence eliminating the risks of operation due to lack of liquidity.,, Apart from larger corporations, the SCF market is also significantly and rapidly made up of SMEs. A lot of SMEs still struggle to overcome the traditional funding barriers owing to lack of credit history or adequate collateral. On the basis of SCF services, these businesses avail the working capital by way of enabling them to get the invoice cleared before the due date, which helps in enhancing their overall cash flow efficiency. Particularly, the trend of SCF being adopted by SMEs is taking larger proportions in the developing economies as economic growth and digitization opens up new channels for financial access.Merger and acquisition

Important mergers and acquisitions in the global supply chain finance service market have occurred primarily with the aim of expanding market share, complementing a portfolio of products and services, and improving operating efficiency. Significant mergers and acquisitions include Clear Acquisition of Xpedize: Acquisition had strengthened the companies' position in the market for small and medium-sized enterprises' credit and B2B payments with access to instant working capital and liquidity. Accenture's Acquisition of BOSLAN: This acquisition enhanced the net-zero capabilities of Accenture and enabled the company to provide its clients with more integrated sustainability offerings. These mergers and acquisitions have dramatically shaken the global supply chain finance service market scenario, contributed to increasing consolidation in the market, and birthed bigger and more integrated players.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Supply Chain Finance Service- Snapshot

- 2.2 Supply Chain Finance Service- Segment Snapshot

- 2.3 Supply Chain Finance Service- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Supply Chain Finance Service Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Domestic

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 International

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Supply Chain Finance Service Market by Offering

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Letter of Credit

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Export and Import Bills

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Performance Bonds

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Shipping Guarantees

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Supply Chain Finance Service Market by End User

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Large Enterprises

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Small and Medium-sized Enterprises

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Supply Chain Finance Service Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 JPMorgan Chase & Co.

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 HSBC

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Asian Development Bank

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Orbian Corporation

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Mitsubishi UFJ Financial Group Inc.

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 BNP Paribas

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Royal Bank of Scotland plc (NatWest Group plc)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Bank of America Corporation

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 DBS Bank India Limited

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

By Offering |

|

By End User |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Supply Chain Finance Service in 2031?

+

-

How big is the Global Supply Chain Finance Service market?

+

-

How do regulatory policies impact the Supply Chain Finance Service Market?

+

-

What major players in Supply Chain Finance Service Market?

+

-

What applications are categorized in the Supply Chain Finance Service market study?

+

-

Which product types are examined in the Supply Chain Finance Service Market Study?

+

-

Which regions are expected to show the fastest growth in the Supply Chain Finance Service market?

+

-

What are the major growth drivers in the Supply Chain Finance Service market?

+

-

Is the study period of the Supply Chain Finance Service flexible or fixed?

+

-

How do economic factors influence the Supply Chain Finance Service market?

+

-