Global Sweet Biscuit Market – Industry Trends and Forecast to 2030

Report ID: MS-2058 | Food and Beverages | Last updated: Dec, 2024 | Formats*:

sweet biscuit Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

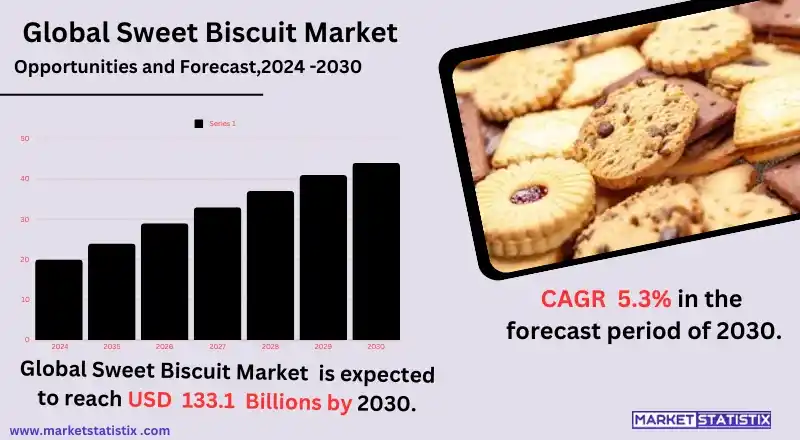

| Growth Rate | CAGR of 5.3% |

| Forecast Value (2030) | USD 133.1 Billion |

| By Product Type | Chocolate-coated Biscuits, Cookies, Filled Biscuits, Plain Biscuits, Sandwich Biscuits, Others |

| Key Market Players |

|

| By Region |

|

sweet biscuit Market Trends

Important trends are also taking shape in the global sweet biscuit market on the backdrop of changing consumer preferences and lifestyles. One of the most significant trends is a shift in focus towards healthier snacking options, which forces manufacturers to design innovative products that have less sugar, fat, and calories and also use natural and whole grain ingredients. Besides, more consumers are seeking gluten-free and organic biscuits as they watch their health and look for products that will suit their diets and clean eating. These trends are encouraging the brands to change the formulation of the products currently being manufactured or introduce new products altogether that will meet the demands. The increasing inflow of high-end and gourmet products into the market is another trend that is observed in the sweet biscuit market. There is an increasing tendency among consumers to spend more on biscuits with better flavours and quality ingredients and biscotti of a higher class. This demand has led to the establishment of a number of retail outlets and online stores specialising in gourmet and baked biscuits that are targeted at consumers seeking these types of snacks. These trends portray a very active but responsive economy where its members are working towards fulfilling the various wants of people from all over the world.sweet biscuit Market Leading Players

The key players profiled in the report are Britannia Industries Ltd., . Burton`s Foods Ltd., . Campbell Soup Company, . Groupo Bimbo, . Kellogg Company, . Kraft Foods Group, Inc., . Mondelez International, . Nestle, . Parle Products Ltd, . United Biscuits, . Border Biscuits Ltd, . Poppies Bakeries, . BAKEMATEGrowth Accelerators

The obesity epidemic afflicting many countries is a key factor in sustaining such emphasis on healthy snacking. As shown by the fast segmentation of the sweet biscuit market in the study, focused attention on health concerns has made the stiff competition very severe. Busy people-orientated urban environments have a growing demand for ready-to-eat or ready-to-carry food products. Sweet biscuits in various types and tastes serve exactly this purpose, being a delicious, ready-to-eat food for everyone anytime. In addition to that, the proportion of sweet biscuits that are purchased through e-retail has also increased due to the widespread acceptance of online grocery shopping, thereby extending the varieties of sweet biscuits that the consumers are willing to try. The growing snacking indulgence and premiumization trend is a further driver for the growth of the sweet biscuit market. There are more and more consumers ready to pay a premium for exquisitely crafted or speciality biscuits exhibiting great taste and made of exquisite ingredients. In tandem with this change in consumer snacking policies comes an upsurge in interest in healthy foods, which has resulted in manufacturers coming up with new recipes featuring whole grains, natural sugars, or other health benefits added. The widening of the range of retail channels such as supermarkets, pasalubong centres, and speciality stores further drives the growth of the market to increase the consumption of sweet biscuits.sweet biscuit Market Segmentation analysis

The Global sweet biscuit is segmented by Type, and Region. By Type, the market is divided into Distributed Chocolate-coated Biscuits, Cookies, Filled Biscuits, Plain Biscuits, Sandwich Biscuits, Others . Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The expansion is attributed to the transformation of consumers' habits, elevation in income levels, and the increasing need for easily accessible food for busy individuals. The market is presently led by North America, with an estimated market revenue contribution of roughly 43% in the year 2023 as a result of the appeal that numerous types of biscuits have on the working-class people. On the other hand, the Asia-Pacific region is forecasted to emerge as the market with the highest growth rate, owing to the process of urbanisation and the increasing acceptance of sweet biscuits among different customers. The sweet biscuit market exhibits a competitive environment that is a mix of a few dominant players and many local players. The sweet biscuit market is majorly controlled by key players like Nestle S.A., Britannia Industries Ltd., Kellogg Company, and others whose concept is based on creating new products and extending the already available ones to new flavours as per consumer trends. The competition in the market is stiff as regards market penetration due to the presence of do-it-yourself and fresh finishes. The distribution is also broad-based, with supermarkets and hypermarkets being the most dominant, and online retailing is rapidly growing a trend as a result of its fast nature and availability of a variety of products.Challenges In sweet biscuit Market

As with any market, the global sweet biscuit market has its share of threats, including competition from healthier alternatives in the form of snacks. With a wider array of options available, consumers are beginning to move in the direction of healthier snacking, which has resulted in increased sales of healthier snacks like granola bars, fruit snacks, low-calorie snacks, and the like. Sweet biscuit manufacturers innovate and reformulate their products to contain better nutritional contents, which are great expectations but can also complicate production processes along with high costs, especially for sweet biscuits. Additionally, the sweet biscuit market is confronted by reducing availability and increasing prices of most, if not all, basic raw materials and factors of production. The costs of certain raw materials such as flour, sugar, and butter, not to mention packaging materials, tend to fluctuate for every single manufacturer and thus affect the profit margins of the manufacturers. Additionally, the pandemic that hit the world in 2019 has contributed negatively to these supply chain systems, implying delays in production and more costs overall. Last but definitely not least, there are political barriers such as legislation on labelling, details about ingredients, and health benefits, compliance with which involves a lot of changes for the companies in this market.Risks & Prospects in sweet biscuit Market

The worldwide sweet biscuit industry is full of scope owing to the increase in demand for snack foods, especially handy snacks, and rise in the propensity for snacking, especially on the go. Sweet biscuits are often viewed as convenient and able to fit in several flavours as lifestyles get busy and most people tend to look for something simple and easy to carry. This is especially true for a while, with the young consumers, the millennials, and the Gen Z population preferring to marry pleasure and utility packing products. This is an area where manufacturers can play around with innovative flavours, healthy options, and premium lines due to changing consumer behaviour. Additionally, there is an opportunity for growth in the sweet biscuit market due to rising health consciousness, which calls for organic, gluten-free, and low-sugar muffin sweet biscuits. With a majority of consumers now leaning toward healthiness, clean labels are more preferred, and brands focusing on fewer chemicals and fewer processes in the markets will gain more sales.Key Target Audience

The primary target audience for the sweet biscuit market on a global level is end users of every age group who are fond of sweet snacks and desserts. This age group incorporates kids, teenagers, and adults with preferences ranging from the basic boring chocolate and vanilla to advanced flavour variations incorporating organic or healthy options. As sweet biscuits are portable aids to school, picnics, or even dessert, most families buy this snack, which makes it convenient for busy mothers whose children are always on the move, having quick yet fun meals.,, Another important audience of the sweet biscuit market is embodied by those who provide the consumer with the product, for instance, retailers and wholesalers such as supermarkets, convenience shops, and online sellers and purchasers of sweet biscuits. Those businesses try to keep in stock all possible brand names and different types of sweet biscuits to meet the requirements of various customers, including gluten-free, vegan, and other such diets. All of them contribute to the overall innovation and competition in the sweet biscuit market.Merger and acquisition

Recently completed mergers and acquisitions in the global sweet biscuit market showcase the frequent consolidation as well as strategic expansions of major sweet biscuit market players. It is worth noticing that in June 2021, Ferrero entered into an agreement with Burton’s Biscuit Company, which has under its umbrella popular brands such as Maryland Cookies and Jammie Dodgers. This means that Ferrero can widen its portfolio while reinforcing its influence within the British biscuit market. In addition, acquisition strategies include expansion in the Australasia region by Mondelez International. In March 2021, for instance, it revealed that it would be acquiring Gourmet Food Holdings Pty Ltd, an Australian offer aimed at enhancing its regional offerings. All these strategic moves signify a shift in the corporate culture, where in the past firms used to concentrate on one line of products only. Additionally, the nature of competition is characterised by high levels of product innovation in addition to mergers and acquisitions. For example, in November 2023, Barilla and Milma introduced dark chocolate and butter-sweet biscuits to the health companions, which illustrates the trend shift by the consumers and how curve balls can make players evolve. The market is described as having low concentration as there are many regional and local players in the market competing for the market. With healthier snacks recorded high demand in the market, a challenge has been posed with already established players such as Britannia Industries and ITC Limited in making new product introductions and inking alliances further in this market.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 sweet biscuit- Snapshot

- 2.2 sweet biscuit- Segment Snapshot

- 2.3 sweet biscuit- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: sweet biscuit Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Chocolate-coated Biscuits

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Cookies

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Filled Biscuits

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Plain Biscuits

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Sandwich Biscuits

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: sweet biscuit Market by Source

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Wheat

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Oats

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Millets

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: sweet biscuit Market by Distribution Channel

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Supermarket/Hypermarket

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Convenience Store

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Specialty Store

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Online Retail

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: sweet biscuit Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Britannia Industries Ltd.

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 . Burton`s Foods Ltd.

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 . Campbell Soup Company

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 . Groupo Bimbo

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 . Kellogg Company

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 . Kraft Foods Group

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Inc.

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 . Mondelez International

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 . Nestle

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 . Parle Products Ltd

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 . United Biscuits

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 . Border Biscuits Ltd

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 . Poppies Bakeries

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 . BAKEMATE

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Source |

|

By Distribution Channel |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of sweet biscuit in 2030?

+

-

What is the growth rate of sweet biscuit Market?

+

-

What are the latest trends influencing the sweet biscuit Market?

+

-

Who are the key players in the sweet biscuit Market?

+

-

How is the sweet biscuit } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the sweet biscuit Market Study?

+

-

What geographic breakdown is available in Global sweet biscuit Market Study?

+

-

Which region holds the second position by market share in the sweet biscuit market?

+

-

How are the key players in the sweet biscuit market targeting growth in the future?

+

-

What are the opportunities for new entrants in the sweet biscuit market?

+

-