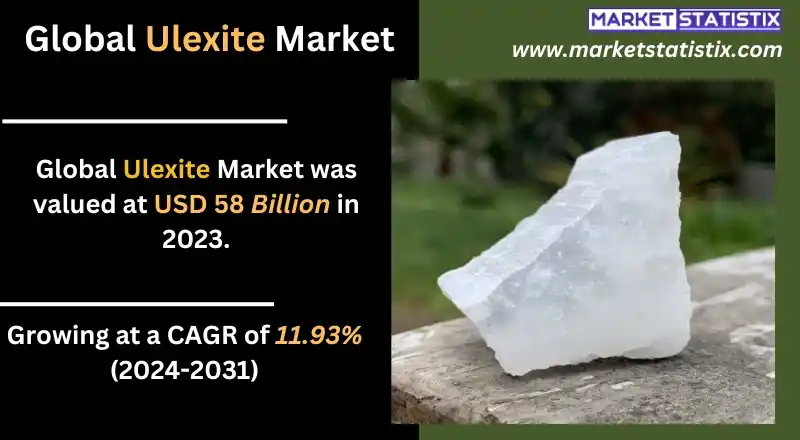

Global Ulexite Market - Industry Dynamics, Size, And Opportunity Forecast To 2031

Report ID: MS-1920 | Agriculture | Last updated: Nov, 2024 | Formats*:

Ulexite Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 11.93% |

| By Product Type | Agriculture, Glass and Fiberglass, Oilfield, Ceramics, Pulp and Paper |

| Key Market Players |

|

| By Region |

|

Ulexite Market Trends

Such trends in the Ulexite market can be attributed to a variety of factors, one of them being the rising demand for boron-based products in, for example, the agriculture, glass, ceramics, and cosmetics industries, among others. Ulexite is a natural boron ore that many companies seek to use more of, as it can be incorporated as a raw material in producing various boron compounds, which are largely used for making fertilizers and soil conditioners. This is especially the case with agriculturists, as boron has several uses, such as enhancing the growth of plants and increasing the yields of crops, making such an element a necessity in the farms. With the advance of green technologies in agriculture, however, Ulexite, being a natural source of boron for plants, is likely to see an increase in demand. Another trend influencing the Ulexite market is the increase in applications in the glass and ceramic markets. Ulexite is used to improve the physical characteristics of glass and other products' plasticity; thus, it is widely used in the manufacture of glass containers, ceramics, and tiling. Furthermore, the cosmetic sector is interested in Ulexite due to its potential in applications due to its properties of absorbency. As Ulexite continues to find new applications owing to innovative and research activities, especially given the current view on the use of eco-friendly products in the market, the growth of the market is expected to be continuous for the future.Ulexite Market Leading Players

The key players profiled in the report are Rio Tinto, ETI MADEN, American Borate Company, Minera Santa Rita, Quiborax, Bisley & Company, Amalgamated Metal CorporationGrowth Accelerators

The ulexite market is witnessing significant transformation owing to the increasing demand for boron-based products such as those used in making glass and ceramics, among others. The mineral is the major ore deposit associated with boron and employed in the production of ceramics and glass of high grade. The growth in global construction along with automotive market patterns has been expected to create high demand for boron in glass-reinforced plastics, borosilicate glass, and ceramic materials. There are various other valuable factors that enable the ulexite market growth, among them being the rise in the know-how concerning the applications of boron, for instance, in personal care and medicinal products. Consequently, the use of boron compounds derived from ulexite in cosmetic and skin care solutions has been attributed to their ability to fight bacteria and improve the stability of emulsions. Therefore, as different industries develop numerous innovations using boron, the need for ulexite as its primary source will increase, prompting the expansion of the market.Ulexite Market Segmentation analysis

The Global Ulexite is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Agriculture, Glass and Fiberglass, Oilfield, Ceramics, Pulp and Paper . The Application segment categorizes the market based on its usage such as White, Transparent. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The ulexite market has many players active in mining, marketing, and processing of ulexite. Some players in this ulexite market are ACI, Jindal, Linglong, and China National Minerals Co. In any case, key players are generally aimed at maximizing their production capabilities, minimizing supply chain inefficiencies, and growing their businesses in the new markets via deal-making. It is common for companies doing so to carry out R&D activities aimed at advancement of the technological processes in an attempt to enhance the ulexite products, which are especially useful in glass, ceramics, and agricultural industries. Besides this, the market also experiences some level of influence from the distribution of ulexite deposits across the regions, the environmental policies in practice, and the general demand from the user industries. U.S. mining firms are increasingly seeking ways of ‘green’ mining, owing to the increasing focus on what has come to be known as corporate social responsibility. In a way, as the ulexite market develops, distinct changes will be observed in the way companies that are able to cater for market changes and consumer needs remain relevant and competitive.Challenges In Ulexite Market

The ulexite market is furthermore associated with certain elements, which may restrain its growth and evolution. One of them is the price instability associated with ulexite and its end products, which may depend on other factors such as demand and supply forces, mining laws, as well as the availability of substitutes. The fluctuation of such prices may create a risk for investors, and this in turn may lead to manufacturers as well as end users withdrawing their investments in the market, which hampers its enlargement. Furthermore, another issue is the limited appreciation and knowledge of the uses of ulexite other than its conventional applications in the manufacture of glass and ceramics. It is recognised that ulexite has agricultural, pharmaceutical, and cosmetic advantages; however, these industries are unaware of its capabilities. This deficiency in knowledge leads to wastage of the excess and slow development of new uses.Risks & Prospects in Ulexite Market

The market for ulexite has vast potential because of the unique properties that this combination mineral has, as well as the different industries where it is applied. Ulexite, also called “TV rock” due to its application in the production of optical fibers and glass, is finding its place more in the manufacture of speciality glass, ceramic, and fiberglass products. With the endless demand for high glasses like those found in the automotive, construction, and electronic industries, ulexite being an ingredient that helps improve the overall performance of the products presents a lucrative market. Besides, the agricultural industry is now starting to appreciate the advantages of ulexite as a product that contains boron, a vitamin that is necessary for the proper growth of plants. In addition, given that the adoption of organic agricultural practices has been increasing at the global level, ulexite can also be used as a natural fertilizer that is beneficial to the environment. In general, the ulexite market will take advantage of its increasing uses, as well as the worldwide trend towards sustainability and innovation in existing and new industries.Key Target Audience

The ulexite market’s crucial user base mainly includes industrial product manufacturers and processing companies, which in this case use ulexite for its distinct features primarily when producing glass and ceramics. Also known as tincal, ulexite is a mineral that is composed of boron and is quite useful as it contains a high level of boron, which is important in making high-strength and thermal-resistance glass. Construction, automobile, and FMCG manufacturers are ultimate end users seeking to enhance the quality of their products durability, and therefore this segment of the audience is very useful to the market.,, Furthermore, another audience member that has to be reached includes research institutions and laboratories that deal with the study of minerals and agronomy, since they too want to find the uses and merits of ulexite in other fields. With the always increasing use of boron active materials in a number of industries, these classes of people will in turn determine the ulexite market.Merger and acquisition

The latest signs of consolidation in the ulexite market corroborate the enhanced appetite for this mineral, which is largely used in the manufacture of boron and its compounds. For example, Gulf Resources, Inc. seems to have made its ulexite business more robust from the recent activities carried out by the firm in acquiring more mining assets. The purpose of this strategy is to increase the market share of the company as well as cater for the demand for boron-based materials, which has penetrated into various sectors such as agriculture, glassmaking, and ceramic industries. American Pacific Borate and Lithium Ltd. joined forces with a number of smaller ulexite mining companies in a merger, which helped the newly created corporation to address the competitive challenges in the industry. This merger is likely to lead to operational synergies, product diversification for the players, and improved resource access. Such mergers illustrate the growing tendency in that industry to consolidate upwards, predictive of intensifying vertical amalgamations in many businesses around the world.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Ulexite- Snapshot

- 2.2 Ulexite- Segment Snapshot

- 2.3 Ulexite- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Ulexite Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Agriculture

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Glass and Fiberglass

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Oilfield

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Ceramics

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Pulp and Paper

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Ulexite Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 White

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Transparent

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Ulexite Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Rio Tinto

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 ETI MADEN

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 American Borate Company

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Minera Santa Rita

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Quiborax

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Bisley & Company

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Amalgamated Metal Corporation

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the growth rate of Ulexite Market?

+

-

What are the latest trends influencing the Ulexite Market?

+

-

Who are the key players in the Ulexite Market?

+

-

How is the Ulexite } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Ulexite Market Study?

+

-

What geographic breakdown is available in Global Ulexite Market Study?

+

-

Which region holds the second position by market share in the Ulexite market?

+

-

How are the key players in the Ulexite market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Ulexite market?

+

-

What are the major challenges faced by the Ulexite Market?

+

-