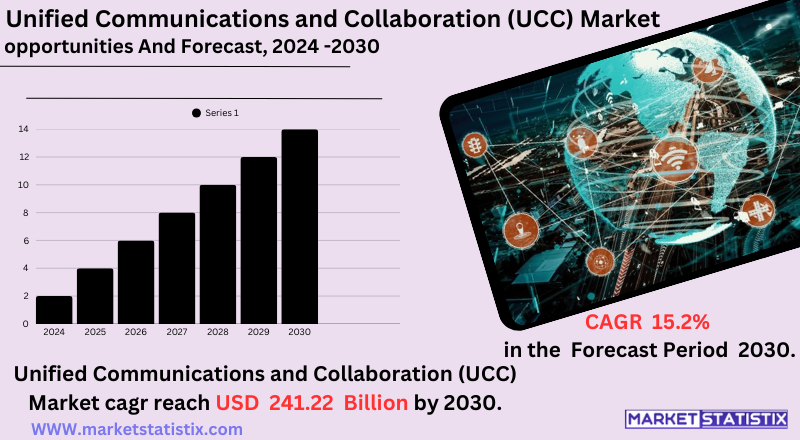

Global Unified Communications and Collaboration (UCC) Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-665 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Unified Communications and Collaboration (UCC) Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| By Product Type | Telephony, Unified Messaging, Conferencing, Others (Contact Centers, Live Streaming) |

| Key Market Players |

|

| By Region |

Unified Communications and Collaboration (UCC) Market Trends

The cloud-based solutions acquisition trends are soaring currently in the Unified Communications and Collaboration (UCC) market. Scalability, flexibility, and cost-effectiveness facilitate the rapid response of businesses to changing needs. Also, the incorporation of Artificial Intelligence (AI) and Machine Learning (ML) technologies is advancing rapidly, leading to innovations such as intelligent virtual assistant solutions, automated transcriptions, and added value features for video conferencing. These developments are certainly geared toward enhancing users' experience and providing a smooth workflow. An additional trend is the ever-growing emphasis on the mobile-first UCC solution. Companies today are looking for platforms that provide a seamless communication and collaboration experience across all devices as remote and hybrid work increasingly becomes the norm. Optimization of UCC tools for smartphones and tablets means that employees can always stay connected, regardless of their work environment. Security and compliance also stand out as major areas of concern as demand increases for robust encryption, data protection, and adherence to industry regulations.Unified Communications and Collaboration (UCC) Market Leading Players

The key players profiled in the report are Microsoft Corporation (U.S.), 8x8, Inc. (U.S.), Vonage Holdings Corp. (U.S.), Zoom Video Communications, Inc. (U.S.), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), RingCentral, Inc. (U.S.), Verizon Communication, Inc. (U.S.), Avaya, Inc. (U.S.), Google LLC (U.S.)Growth Accelerators

The Unified Communications and Collaboration (UCC) Market is primarily driven by the increasing acceptance of remote work and hybrid work models. To achieve this, appropriate communication and collaboration tools must be put in place to allow employees to keep in touch and stay productive wherever they may be. The necessity to bring together seamlessly multiple communication channels, such as voice, video, or messaging, into one platform is a major incentive. The cloud advantages of scalability, flexibility, and cost-effectiveness appeal to enterprises of all sizes. The integration of artificial intelligence (AI) and machine learning (ML) in UCC platforms is another major motivator for the UCC market, whether via intelligent routing, automated meeting summaries, sentiment analysis, or other advanced features. These advances in technology, together with the need for better customer experiences, push the UCC market.Unified Communications and Collaboration (UCC) Market Segmentation analysis

The Global Unified Communications and Collaboration (UCC) is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Telephony, Unified Messaging, Conferencing, Others (Contact Centers, Live Streaming) . The Application segment categorizes the market based on its usage such as BFSI, Public Sector, Healthcare, IT & Telecom, Retail. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

This analysis of the Unified Communications and Collaboration (UCC) market focuses on major technology players such as Microsoft, Cisco, Zoom, Google, and Avaya, who provide integrated communications platforms delivering messaging services, voice and video conferencing, and collaboration tools. The companies offer divergent services according to their capacity while competing in cloud solutions, automation through AI, security features, and seamless integration within enterprise applications. The growing demand for hybrid work solutions now poses additional competition, and thus investments in the development of AI-based virtual assistants, real-time transcription, and secure systems are equally on the rise. Finally, the vendors try to capitalize on their price structures, whether that be subscription-based cloud services, on-premises licensing, or hybrid deployment models.Challenges In Unified Communications and Collaboration (UCC) Market

Some crucial challenges faced by the UCC market include security and interoperability. Security issues remain realities in UCC platforms, which deal with sensitive data requiring security from any cyber threats. Secure communications, in this case, are complicated by the different hardware and network configurations; constant updates and security protocols' enforcement are required for maintaining such security. Interoperability is also proving to be a significant problem since there is no seamless integration between UCC platforms and different legacy systems. This lack of standardization can impede smooth communication and collaboration, especially for organizations that have heterogeneous technology environments. Another important issue for the market is user adoption and change management. Widespread change in behaviour within organizations is necessary for the realization of UCC solutions, and resistance to change can seriously impede successful adoption. Ensuring that employees are educated and comfortable with the new tools is extremely critical but often time-intensive and costly. The evolution of technology has increased pressure on vendors to innovate and adapt continuously, thus further straining development and marketing resources.Risks & Prospects in Unified Communications and Collaboration (UCC) Market

The adoption of 5G technologies and the BYOD (Bring Your Own Device) trend have fuelled opportunities, especially for industries that require seamless connectivity and mobility. These include IT and telecom, healthcare, and education. The divergence is further steepened with the vendor forging partnerships with third-party app developers for the whole purpose of supporting potential differentiators around and capitalizing on market share for cybersecurity. In terms of regions, North America tops the UCC market on the basis of advanced IT infrastructure, cloud technology adoption, and the presence of key players like Microsoft, Cisco, and Zoom. The most dynamic region is Asia-Pacific, with the rapid digitalization of countries such as China, India, and Japan and government support for 5G and broadband expansion efforts. Europe follows Asia, showing moderate growth due to high regulatory emphasis on data security and a mature communication technology market. In Latin America and the Middle East & Africa, the emerging markets, increasing telecom infrastructure investments, and digital transformation initiatives are creating new demand for UCC solutions, primarily for scalable cloud deployments.Key Target Audience

The Unified Communications and Collaboration (UCC) market is primarily aimed at enterprises, small and medium enterprises (SMEs), and remote workforces—professions that rely on communication tools to increase productivity and collaboration. IT, finance, healthcare, and education are all sectors where UCC implementation supports solutions for real-time messaging, video conferencing, VoIP, and cloud collaboration to further operations and enhance efficiency.,, Also, another key user group is service providers, technology vendors, and system integrators developing and deploying UCC solutions for distinct needs across various specifications of the business. Educational institutions and training need to be interested in extra emerging markets since hybrid learning and virtual collaboration tools are increasingly important. UCC solution providers also include customer service and contact centre solutions to engage customers in a way that AI-powered chatbots, omnichannel communication, and workflow automation make it great.Merger and acquisition

To boost their service offerings and footprint in the UCC marketplace, several mergers and acquisitions have occurred. In January 2024, Nextiva Inc. acquired Thrio, which aims to democratize customer experience by embedding AI. This highlights another trend where much UCC integration in the future will have to integrate through the latest technologies. In other related AI advances in October 2023, Cisco Systems Inc. launched Webex AI tools for hybrid work and contact centres. In October 2023, Mitel Networks Corporation will finalize the acquisition of Unify, an enterprise UCC products and services powerhouse in Germany. This would further strengthen Mitel's offer of services tailored to enterprise clients and further expand reach into growing healthcare, public sector, hospitality, and banking industries. Furthermore, it has led to applications bearing bankruptcy in March 2025 by Mitel for the Chapter 11 procedure by which the company would wipe $1.15 billion clean of debt. However, this acquisition shows that adapting to the growing trend of remote-hybrid work is indeed a very challenging endeavour. These trends confirm the UCC marketplace is dynamic and competitive with convergence through possible merger activities and acquisitions. >Analyst Comment

The Unified Communications and Collaboration (UCC) market has been experiencing a strong growth trend over the years, increasing rapidly in the face of the current growing need for high-end, seamless communication and collaboration tools in today's digital workplaces. There is a convergence of communication technologies such as voice, video, interactive messaging, and data sharing into a wide platform within the emerging markets. Drivers include remote and hybrid working conditions, the trend toward cloud solutions, and the growing call for productivity and efficiency in organizations, and there is also availability.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Unified Communications and Collaboration (UCC)- Snapshot

- 2.2 Unified Communications and Collaboration (UCC)- Segment Snapshot

- 2.3 Unified Communications and Collaboration (UCC)- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Unified Communications and Collaboration (UCC) Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Telephony

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Conferencing

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Unified Messaging

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others (Contact Centers

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Live Streaming)

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Unified Communications and Collaboration (UCC) Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 BFSI

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Healthcare

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 IT & Telecom

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Public Sector

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Retail

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Microsoft Corporation (U.S.)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 IBM Corporation (U.S.)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Cisco Systems

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Inc. (U.S.)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Zoom Video Communications

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Inc. (U.S.)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 8x8

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Inc. (U.S.)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 RingCentral

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Inc. (U.S.)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Verizon Communication

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Inc. (U.S.)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Avaya

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Inc. (U.S.)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Vonage Holdings Corp. (U.S.)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Google LLC (U.S.)

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Unified Communications and Collaboration (UCC) Market?

+

-

What major players in Unified Communications and Collaboration (UCC) Market?

+

-

What applications are categorized in the Unified Communications and Collaboration (UCC) market study?

+

-

Which product types are examined in the Unified Communications and Collaboration (UCC) Market Study?

+

-

Which regions are expected to show the fastest growth in the Unified Communications and Collaboration (UCC) market?

+

-

What are the major growth drivers in the Unified Communications and Collaboration (UCC) market?

+

-

Is the study period of the Unified Communications and Collaboration (UCC) flexible or fixed?

+

-

How do economic factors influence the Unified Communications and Collaboration (UCC) market?

+

-

How does the supply chain affect the Unified Communications and Collaboration (UCC) Market?

+

-

Which players are included in the research coverage of the Unified Communications and Collaboration (UCC) Market Study?

+

-