Global Vanilla Bean Sauce Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-846 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The Vanilla Bean Sauce Market includes the manufacture, distribution, and retailing of sauces that centrally contain genuine vanilla bean extract or vanilla bean specks as a main flavouring ingredient. The sauces are defined by their deep, sweet, and fragrant profile, which comes directly from the vanilla bean, differentiating them from artificially vanillin-flavoured sauces. The market appeals to retail consumers who want gourmet additions to their home cooking as well as the foodservice market, including restaurants, cafes, and bakeries, that want to add a touch of natural luxury to their dessert and beverage offerings.

Demand for vanilla bean sauce is fuelled by a number of factors, including an expanding consumer desire for natural and high-quality ingredients, rising popularity of premium and artisanal food items, and the multifaceted use of vanilla flavour in a variety of culinary innovations. Vanilla bean sauce is used in a broad range of applications, including ice cream and dessert toppings, ingredients for baked foods, flavour additions to beverages such as coffee and milkshakes, and even a few savoury foods to create an unusual sweet element.

Vanilla Bean Sauce Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

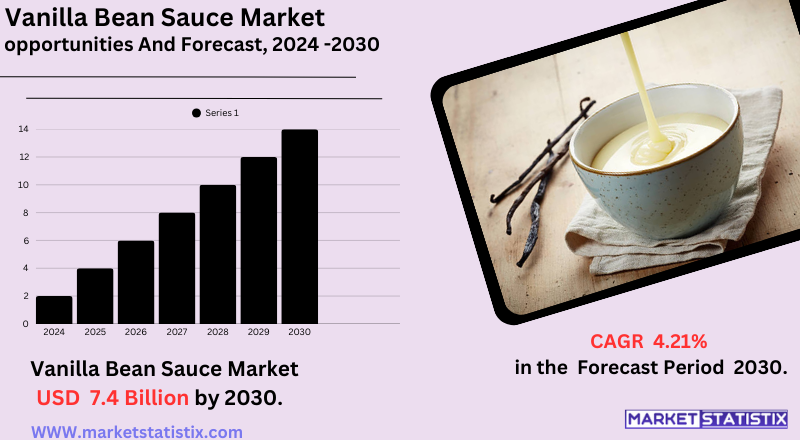

| Growth Rate | CAGR of 4.21% |

| Forecast Value (2030) | USD 7.4 Billion |

| By Product Type | Dry Sauce, Wet Sauce |

| Key Market Players |

|

| By Region |

|

Vanilla Bean Sauce Market Trends

There is a rising demand now for vanilla bean sauce, majorly fuelled by consumers' preferences for natural or high-grade ingredients and the growing trend of gourmet or culinary experiences. This trend has also contributed to the foodservice industry, whereby restaurants and cafes will include real vanilla bean sauce in desserts and beverage preparations for extra consideration. Furthermore, health-conscious consumers are essentially demanding vanilla bean sauces free from any artificial additives, supporting the clean label movement.

Another major trend being observed is the use of vanilla bean sauce with greater versatility, aside from traditional desserts. It has been looked into as a savoury note for dishes, an essential part of speciality beverages, and the development of cosmetics and fragrances. Home baking is another trend underpinning the e-commerce setup of the platform. Consumers demand profile ingredients like vanilla bean sauce to home-kit their gourmet results, while e-commerce brings these availabilities to the masses. Increased areas for application and market availability, therefore, indicate further market growth.

Vanilla Bean Sauce Market Leading Players

The key players profiled in the report are Kerry Group PLC (Ireland), Beanilla (USA), International Flavors & Fragrances Inc. (USA), Blue Cattle Truck Trading (Mexico), LorAnn Oils (USA), Frontier Co-op (USA), Cook's Vanilla (USA), McCormick & Company, Inc. (USA), Amoretti (USA), Heilala (Tonga), Nielsen-Massey (USA)Growth Accelerators

The vanilla bean sauce market is driven by the coming together of vibrant forces that highlight increasing consumer affinity for quality and natural ingredients. Firstly, natural and high-quality ingredients are increasingly preferred by consumers. Consumers have become increasingly aware of what they eat and are going out of their way to purchase products that are prepared using genuine, known components rather than artificial additives and flavourings. Actual vanilla beans, which possess a unique flavour profile and smell, are perfectly attuned to this trend, and vanilla bean sauce is thus an attractive option for consumers who are keen on natural goodness in their diets.

Second, the growing demand for high-end and artisanal foods serves as a strong market impulse. Consumers are becoming more accepting of higher spending on gourmet products that provide a distinctive and refined culinary experience. Vanilla bean sauce, commonly viewed as a high-end and indulgent ingredient, is well within this category. Its use is widespread across different food segments, ranging from complementing desserts and drinks to even providing a touch of sophistication to savoury foods, highlighting the widespread use of vanilla flavour and continuing to drive market growth. This flexibility enables the companies to address a wider consumer market and venture into new product development, thus enhancing the growth of the market.

Vanilla Bean Sauce Market Segmentation analysis

The Global Vanilla Bean Sauce is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Dry Sauce, Wet Sauce . The Application segment categorizes the market based on its usage such as Household, Commercial. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market competition for the Vanilla Bean Sauce Market is moderately fragmented, with a combination of well-established food and flavour businesses along with smaller-scale artisanal producers. Competition revolves around issues like the quality and place of origin of vanilla beans employed (e.g., Madagascar, Tahitian), the formulation of the sauce (thickness, sweetness, addition of vanilla bean specks), innovation in packaging, and pricing models. Large players tend to have established distribution channels and brand name recognition, whereas smaller entrants differentiate themselves on the basis of distinctive flavour profiles, organic or sustainable sourcing, and premium positioning.

Challenges In Vanilla Bean Sauce Market

Major issues affecting the growth and stability of the vanilla bean sauce market involve supply uncertainty for vanilla beans. On account of the climate and labour shortages in top-producing zones like Madagascar, the production levels vary considerably from year to year or even from one season to another. These supply disruptions tend to precipitate price fluctuations and also impact product quality consistency and pricing ability on the part of manufacturers. Logistically, the vendors face hitch delays on international shipments and even limited air freight space for the timely delivery of beans to global markets.

Another main challenge faced is the almost complete dependence on manual labour for vanilla production, thereby raising production costs while also subjecting the industry to risks emanating from a shortage of labour and ethics in sourcing. With the increased consumer insistence on ethically and sustainably sourced ingredients, manufacturers are thus required to provide supply chains that are transparent and demonstrate sustainable farming practices to maintain brand trust and competitiveness. Meeting the challenges requires continual innovation in cultivation, logistics, and sourcing. Would you like to know how the companies are addressing these challenges?

Risks & Prospects in Vanilla Bean Sauce Market

Key market opportunities include the growing demand for natural, premium, and clean-label products, especially with consumers looking for sauces free of synthetic chemicals and favouring sustainable and organic ingredients. The foodservice arena gives a main push to the market, with restaurants, cafes, and bakeries using vanilla bean sauces to complement their dessert and beverage applications. In retail, innovative offers and convenient package formats work to lure retail consumers, whereas e-commerce has brought ease in accessing the market.

Region-wise, North America currently maintains supremacy in hunting the long-established food industry and demand for premium sauces, followed closely by Europe with its considerable culinary recipes. Yet, the fastest market growth is set to occur in Asia-Pacific, wherein emerging markets like China and India, with rising disposable incomes and a steadily growing middle class, are driving the demand for processed foods and beverages. South America and MEA are also one of the major opportunities, as rites of changing consumer preference, along with the increase in income, are resulting in interest in vanilla-based products.

Key Target Audience

,

The primary target market for the vanilla bean sauce market is mainly food and beverage companies, high-end dessert makers, and gourmet restaurants. These consumers look for natural, high-quality flavouring agents to add to their products like ice creams, pastries, coffee drinks, and speciality sweets. This market is driven by a need for real taste and clean-label ingredients, and pure vanilla bean sauce is a desirable option. Artisan and craft food makers also are an increasing market because customers' tastes move towards premium and organic offerings.

, In addition, home bakers and health-conscious consumers comprise a major retail market segment. With the increasing popularity of home cooking influencers and online grocery websites, this audience is increasingly experimenting with gourmet flavours at home. Transparency, origin traceability, and natural additives are all prized by them, making sustainably sourced vanilla bean sauce very appealing. This is further compounded by the increasing interest in allergen-free and plant-based cuisine, where vanilla and other natural flavour enhancers have a major role to play.

Merger and acquisition

The market for vanilla bean sauce has seen significant merger and acquisition deals over the last few years. In 2022, McCormick & Company purchased Nielsen-Massey Vanillas for $400 million, bolstering its portfolio with high-end vanilla offerings. Likewise, in 2021, Kerry Group PLC acquired the vanilla division of Symrise AG for €325 million, as it sought to increase its presence in the natural flavouring business. These strategic steps reflect a wider industry trend as businesses attempt to enlarge their portfolio of natural and organic ingredients to fulfil increasing consumer demand.

Aside from these purchases, the industry is seeing growth fuelled by consumer demand for clean-label and ethically produced products. There is a discernible trend towards premiumisation, where there is a focus on employing high-quality, sustainably sourced vanilla beans, especially from countries such as Madagascar. There is also innovation as companies are launching vanilla bean sauces with distinctive flavour profiles and uses beyond classic desserts, addressing a diverse culinary scene.

>

Analyst Comment

The worldwide vanilla bean sauce market is constantly growing, with its value expected to increase from USD 0.92 billion in 2024 to USD 1.25 billion by 2032. This growth is fuelled by rising consumer demand for organic, natural, and clean-label ingredients, as well as the growing popularity of home-cooked and gourmet foods. Foodservice operators, including restaurants and bakeries, are embracing vanilla bean sauce to upgrade menu items, while retail consumers are attracted by easy-to-use packaging and the product's versatility in both sweet and savoury recipes.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Vanilla Bean Sauce- Snapshot

- 2.2 Vanilla Bean Sauce- Segment Snapshot

- 2.3 Vanilla Bean Sauce- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Vanilla Bean Sauce Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Dry Sauce

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Wet Sauce

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Vanilla Bean Sauce Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Household

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Vanilla Bean Sauce Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Amoretti (USA)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Beanilla (USA)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Blue Cattle Truck Trading (Mexico)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Cook's Vanilla (USA)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Frontier Co-op (USA)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Heilala (Tonga)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 International Flavors & Fragrances Inc. (USA)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Kerry Group PLC (Ireland)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 LorAnn Oils (USA)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 McCormick & Company

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Inc. (USA)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Nielsen-Massey (USA)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Vanilla Bean Sauce in 2030?

+

-

Which type of Vanilla Bean Sauce is widely popular?

+

-

What is the growth rate of Vanilla Bean Sauce Market?

+

-

What are the latest trends influencing the Vanilla Bean Sauce Market?

+

-

Who are the key players in the Vanilla Bean Sauce Market?

+

-

How is the Vanilla Bean Sauce } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Vanilla Bean Sauce Market Study?

+

-

What geographic breakdown is available in Global Vanilla Bean Sauce Market Study?

+

-

Which region holds the second position by market share in the Vanilla Bean Sauce market?

+

-

How are the key players in the Vanilla Bean Sauce market targeting growth in the future?

+

-

,

The vanilla bean sauce market is driven by the coming together of vibrant forces that highlight increasing consumer affinity for quality and natural ingredients. Firstly, natural and high-quality ingredients are increasingly preferred by consumers. Consumers have become increasingly aware of what they eat and are going out of their way to purchase products that are prepared using genuine, known components rather than artificial additives and flavourings. Actual vanilla beans, which possess a unique flavour profile and smell, are perfectly attuned to this trend, and vanilla bean sauce is thus an attractive option for consumers who are keen on natural goodness in their diets.

, Second, the growing demand for high-end and artisanal foods serves as a strong market impulse. Consumers are becoming more accepting of higher spending on gourmet products that provide a distinctive and refined culinary experience. Vanilla bean sauce, commonly viewed as a high-end and indulgent ingredient, is well within this category. Its use is widespread across different food segments, ranging from complementing desserts and drinks to even providing a touch of sophistication to savoury foods, highlighting the widespread use of vanilla flavour and continuing to drive market growth. This flexibility enables the companies to address a wider consumer market and venture into new product development, thus enhancing the growth of the market.