Global Vehicle Communication Module Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-666 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Vehicle Communication Module Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

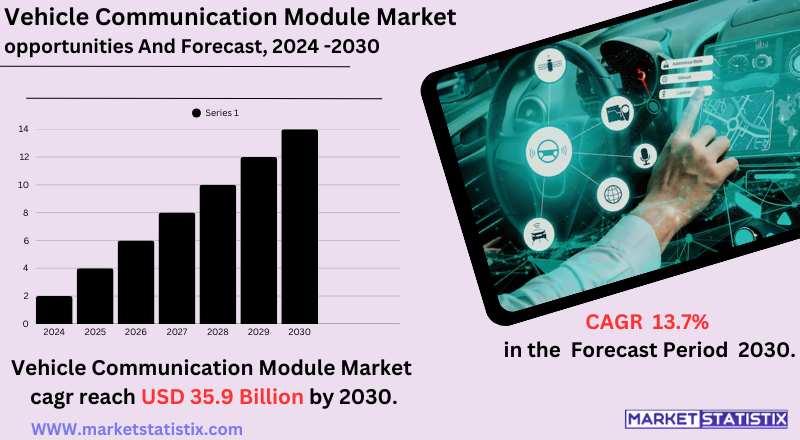

| Growth Rate | CAGR of 13.7% |

| Forecast Value (2030) | USD 35.9 Billion |

| By Product Type | Cellular Module, Non-cellular Module |

| Key Market Players |

|

| By Region |

Vehicle Communication Module Market Trends

A primary trend is that almost all automakers are adopting 5G that allows them to transfer higher data at low latencies, which is vital for real-time applications such as autonomous driving and advanced driver-assistance systems. Coupled with this is the rising focus on advanced security implementations in VCMs to safeguard the data against cyberattacks to ensure privacy. Cybersecurity is paramount as vehicles become increasingly interlinked and reliant on data exchanges. Another trend is that an enhancing field of Vehicle-to-Everything (V2X) communication allows vehicles to communicate with other vehicles, infrastructure, pedestrians, and networks. This serves to improve road safety, optimize traffic flow, and smart city initiatives. The growing onset of software-defined vehicles (SDVs), with the emphasis on software-enabled vehicle function, necessitates more flexible and robust communication modules.Vehicle Communication Module Market Leading Players

The key players profiled in the report are Mercedes-Benz, Daimler AG, General Motors, Ford Motor Company, Harman International Industries, Mobileye, Bayerische Motoren Werke AG (BMW), Toyota Motor Corporation, Audi AG, Volkswagen GroupGrowth Accelerators

Growing demand for connected vehicles and the resultant integration of advanced telematics drive the Vehicle Communication Module (VCM) market. Increased consumer expectations vis-à-vis in-vehicle experiences such as real-time navigation, entertainment, and safety features have compelled OEMs to install powerful communication modules in the vehicles. Some other factors that boost market growth include the push for autonomous driving and the need for seamless data exchange between vehicles and infrastructure. One more important growth factor is the rapidly advancing telecommunications solutions, particularly the deployment of 5G networks. It provides faster and more reliable data transmission, indispensable for near real-time applications like autonomous driving and advanced driver assistance systems (ADAS). However, at the same time, the automotive industry's strong focus on over-the-air (OTA) software updates, remote diagnostics, and predictive maintenance forces manufacturers to integrate sophisticated VCMs into their offers. Furthermore, the growth rates of electric vehicles (EVs) and the efficiency improvement requirements for battery management and charging infrastructure would further increase the demand for advanced vehicle communication modules.Vehicle Communication Module Market Segmentation analysis

The Global Vehicle Communication Module is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Cellular Module, Non-cellular Module . The Application segment categorizes the market based on its usage such as Passenger Car, Commercial Vehicle. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive VCM market combines long-standing automotive technology, telecommunications companies, and new entrants. Global leaders in advanced vehicle communication, V2X, autonomous driving, and connectivity support for modules include Bosch, Continental, and Qualcomm. By utilizing composite capabilities in automotive systems, wireless technologies, and IoT, they are offering dependable communication modules for modern vehicles that create safety, efficiency, and enhanced user experience. Alongside these existing players, there are also emerging opportunities for innovation from startups and tech companies working on such solutions as integrating 5G into the automotive infrastructure, edge computing, and cybersecurity for connected vehicles. There is now fierce competition as automotive OEMs want to develop VCM solutions within, providing them with better control over their connectivity ecosystems.Challenges In Vehicle Communication Module Market

Vehicle Communication Module markets are now under threat of cybersecurity risks and data privacy concerns because connected vehicles are capable of real-time data exchange through wireless communications. The increased risk of cyberattacks on vehicle networks triggers the demand for rigorous security protocols, which result in complexity and cost overheads associated with developing such modules. One of the governing obstacles is the high installation and development cost of infrastructure for Vehicle-to-Everything (V2X) communication that leads to its adoption hindrances. The latter is because of dependence on stable and high-speed networks, particularly 5G, which are oftentimes not available in many areas. Moreover, regulatory complexities and the requirement of both car manufacturers and telecoms to work with government bodies toward the creation of the standard communication framework constrain market growth.Risks & Prospects in Vehicle Communication Module Market

Continuous improvement in automotive safety and navigation services, remote diagnostics, and OTA updates is driving usage of these modules by carmakers and fleet service operators. Furthermore, the fast integration of AI and IoT in automotive communication systems is promising a supermarket of opportunities for tech-savvy companies and telecom providers to factorize solutions for next-generation vehicle connectivity. Regionally, the USA and Western Europe dominate the market by virtue of having the best automotive industries, government automotive safety technology support through regulations, and nationwide uptake by consumers of smart transportation systems. Rapid growth is seen in the Asia Pacific region due to increased vehicle production, governments' proposing intelligent transportation initiatives, and expanding 5G infrastructure in countries like China, Japan, and South Korea. Emerging economies in Latin America and the Middle East appear to be moving gradually toward the adoption of vehicle communication technologies but promise a long-term potential for growth as the connectivity infrastructures improve.Key Target Audience

,, , The major target audience for the Vehicle Communication Module (VCM) markets are automotive manufacturers involved in making connected vehicles, autonomous vehicles, and electric vehicles. VCM is essential for such manufacturers, as it includes the vehicle-to-vehicle communication system, vehicle-to-infrastructure system, and vehicle-to-everything communication that would easily increase safety, navigation, and, overall, a better driving experience. It is further used by fleet management companies and logistics providers for tracking vehicles, monitoring maintenance, and increasing overall operations efficiency., Another notable audience is technology vendors and telecommunications operators who are concentrating their efforts on 5G provisioning and IoT-enabled as well as telematics solutions in the automotive segment. Governments, along with regulatory agencies, are also major stakeholders in the arena of public road safety and infrastructure development, which is why they require and endorse VCM technologies for integrating them into future smart city projects or road safety standards.Merger and acquisition

Reflecting large-scale growth and strategic positioning of the key players in the industry, the vehicle communication module market has witnessed streaks of mergers and acquisitions. In January 2025, Dutch chipmaker NXP announced it would acquire Austria's TTTech Auto for $625 million. The acquisition is good for NXP to strengthen its automotive business by integrating TTTech Auto's safety-critical middleware that allows seamless integration of the car operating system with applications while assuring that critical functions are kept unaffected. The deal is expected to absorb TTTech's Vienna-based team of 1,100 employees into NXP's automotive division, subject to any regulatory approvals. Furthermore, in December 2024, the private equity company Triton acquired the security and communications technology product division of Bosch. The transaction includes three business units—Video, Access and Intrusion, and Communication—together generating over €1 billion in sales and employing 4,300 people. The acquisition is Triton's second carve-out transaction with Bosch, following the sale of Aventics in December 2013. The sale is expected to close by the end of the first half of 2025, subject to regulatory approval. >Analyst Comment

The VCM market, which has experienced significantly fast growth owing to enhanced connectivity and autonomous driving prospects in the automotive industry, is characterized by the incorporation of multiple technologies, such as cellular, Wi-Fi, and Bluetooth, in vehicles for effective data communication and deployment of various advanced features. The key drivers for this market are the increasing demand for connected car services, a growing adoption of electric vehicles (EVs), and the enactment of stringent safety regulations. Technological advancements aiding market growth include 5G networks and the emergence of sophisticated V2X communication systems.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Vehicle Communication Module- Snapshot

- 2.2 Vehicle Communication Module- Segment Snapshot

- 2.3 Vehicle Communication Module- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Vehicle Communication Module Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Cellular Module

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Non-cellular Module

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Vehicle Communication Module Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Passenger Car

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial Vehicle

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Audi AG

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Bayerische Motoren Werke AG (BMW)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Daimler AG

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Ford Motor Company

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 General Motors

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Harman International Industries

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Mercedes-Benz

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Mobileye

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Toyota Motor Corporation

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Volkswagen Group

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Vehicle Communication Module in 2030?

+

-

Which type of Vehicle Communication Module is widely popular?

+

-

What is the growth rate of Vehicle Communication Module Market?

+

-

What are the latest trends influencing the Vehicle Communication Module Market?

+

-

Who are the key players in the Vehicle Communication Module Market?

+

-

How is the Vehicle Communication Module } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Vehicle Communication Module Market Study?

+

-

What geographic breakdown is available in Global Vehicle Communication Module Market Study?

+

-

Which region holds the second position by market share in the Vehicle Communication Module market?

+

-

How are the key players in the Vehicle Communication Module market targeting growth in the future?

+

-