Global Vision Sensor Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-668 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Vision Sensor Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

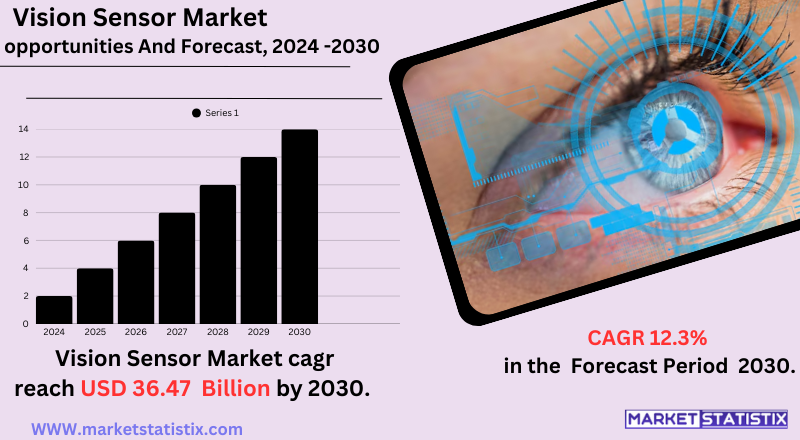

| Growth Rate | CAGR of 12.3% |

| Forecast Value (2030) | USD 36.47 Billion |

| By Product Type | Less Than 3D, 3D |

| Key Market Players |

|

| By Region |

Vision Sensor Market Trends

A significant trend is the deepening infusion of artificial intelligence (AI) and deep learning in vision sensors for more advanced image analysis and object recognition capabilities. This opens many more exciting application avenues, such as real-time defect detection, autonomous navigation, and predictive maintenance. There is also rising demand for 3D vision sensors and hyperspectral imaging to satisfy the appetite for detailed and rich visual data on complex jobs within robotics, agriculture, and healthcare. With the technology being miniaturized and less expensive, the field of vision sensors is ever more becoming attractive for various applications. In turn, this is steering demand in consumer electronics, smart home gadgets, and mobile robots. Simultaneously, in constant demand, there are ever-demanding applications with higher resolution, faster processing, and better low-light performance—pushing the industry to remain dynamic and competitive.Vision Sensor Market Leading Players

The key players profiled in the report are Basler, Omron Adept Technologies, National Instruments, Robotic Vision Technologies, KEYENCE, MVTec Software, FANUC, SICK AG, ISRA VISION, Matrox, FARO Technologies, Teledyne Technologies, Pick-it, Cognex, Visio NerfGrowth Accelerators

The vision sensor market is primarily driven by an increase in demand for automation and quality control in industry. Robotic systems are increasingly adopted across manufacturing, logistics, and automotive sectors, which requires these systems to support accurate visibility data for tasks such as object recognition, inspection, and guidance. Improvement of efficiency and reduction in human error also fuel the need for advanced vision sensor technologies. Furthermore, it complements the greater implementation of Industry 4.0 and smart factory initiatives, particularly in which real-time data analysis is crucial for the complete effect on the developments opening. Continually, focus on high-resolution sensors, evolving image processing algorithms, and the application of AI and machine learning (ML) technologies are improving the performance, as well as the versatility, of vision sensors. The third generation of vision systems has opened the door to a wider scope of applications, including in medical diagnostics and environmental monitoring, via the introduction of hyperspectral imaging.Vision Sensor Market Segmentation analysis

The Global Vision Sensor is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Less Than 3D, 3D . The Application segment categorizes the market based on its usage such as Inspection, Gauging, Code Reading & Localization. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The larger share of competition in the vision sensor market rests on well-established players that cater to the entire spectrum of advanced sensors, industrial vision sensors, machine vision systems, and smart camera technologies. Major companies such as Keyence Corporation, Omron Corporation, Sony Corporation, and Teledyne Technologies dominate this space by offering system solutions that provide high-resolution imaging, 3D vision sensing, and AI-based vision systems. These players focus on the continuous innovation of the technology, incorporating features such as deep learning, AI, and real-time image processing for applications in the automotive sector, manufacturing, robotics, and healthcare. Apart from the prominent players, the segment has numerous small start-up companies emerging, presenting application-oriented specialized vision sensor solutions. Simultaneously, the competition is becoming fiercer as other companies attempt to differentiate their product offerings based on enhanced processing capability, optical performance, and cost structures. Collaboration, mergers and acquisitions, and strategic partnerships are common steps taken by companies to enhance technological capabilities, increase market outreach, and improve product offeringsChallenges In Vision Sensor Market

Difficulties within the vision sensor market are presented as impediments to the sector's growth and the widespread acceptance of vision systems. Major obstacles include the high operational cost of purchasing and integrating vision sensor systems, preventing their adoption by smaller companies with limited budgets. Fragmentation of the market, with many players marketing similar products, makes product differentiation difficult and competition fierce. Another great challenge is the scarcity of a few skilled workers who can operate and maintain these systems, as those require certain specialized knowledge in machine vision and data processing that may not be available in all regions. This impedes the full use of vision sensors for their true potential in automation and quality control applications. Technical limitations too are threatening the market. Vision sensors act sensitively to any change in the lighting conditions, largely influencing their data capture accuracy and, by that, performance. These sensors thus need controlled environments for optimum performance, which drives up the complexity and cost of implementation. In dealing with these issues, stakeholders must invest in workforce training programs, develop advanced sensor technology to enhance less sensitivity to lighting variation effects, and find ways to mitigate financial barriers for adoption on a larger scale.Risks & Prospects in Vision Sensor Market

Emerging trends include developing low-cost and compact sensors with increasing applications in smart homes, health monitoring, and wearable technology. The demand for 3D vision sensors is also on the rise, mainly for their very high precision in measuring dimensions and defect detection, especially in advanced and complex manufacturing processes. From a regional standpoint, Asia-Pacific is likely to grow fastest, with key industrial automation players being China, India, Japan, and South Korea. This region, with rapid industrialization and a strong manufacturing base in automotive, electronics, and consumer goods, is set to witness growth in vision sensors. North America still holds the largest chunk simply because it was the first to adopt advanced technologies and has been witnessing strong demand from the automotive industry. Other major reasons for the global demand for vision sensors will be the increasing focus on quality and safety standards across industries worldwide.Key Target Audience

, The main target audience for the Vision Sensor Market encompasses a wide range of industries and activities, focusing mainly on those seeking to automate and optimize processes. Important targets include manufacturing industries, where vision sensors play a critical role in quality control, inspection, and robotic assembly. Automotive manufacturers constitute an important segment utilizing vision sensors in advanced driver-assistance systems (ADAS), autonomous driving, and production line automation., The second set of targets could include sectors like healthcare and pharma, wherein the use of vision sensors would be in medical imaging, diagnostics, and automated drug manufacturing. The food and beverage industry can be considered another important audience, using vision sensors for quality inspection, sorting, and packaging. In the end, any industry with opportunities for automated visual inspection or study may be qualified as a prospective target audience.Merger and acquisition

Recent merger and acquisition activities that have dominated the vision sensor market reflect such consolidation in the industry and moves by major players into strategies that ensure improvements in technological capabilities. Major acquisitions within this trend include Motorola Solutions' acquisition of Silent Sentinel, a long-distance camera specialized in the UK, now fortifying offerings by the multinational against security and surveillance. Siemens' purchase of Inspekto-holding to AI-driven machine vision, thereby enhancing the way their automated quality-inspection processes will be reinforced for manufacturing, is, again, in line with the trend where big companies go on to integrate the advanced technologies with the rest of the world so as to improve their presence in the market as competition rises from new entrants. Even with these high-profile instances, the vision sensor market is seeing a growing trend in investment into start-ups that are pioneering new technology adoption. Examples of start-ups enjoying this field are Lumotive, as the company invests a considerable amount of money into its optical chips meant for 3D sensing, aiming to replace the heft of current LiDAR systems. Such funding into innovative solutions shows the healthy environment in place with stronger and newer companies alike pushing the envelope on what vision-sensor technology can do and how it can be applied. >Analyst Comment

The market for vision sensors is growing at a strong pace owing to the demand for automation and quality control across various industries. In this market, they then slowly included and realized the development and integration of advanced imaging technologies, enhanced by the use of 2D and 3D imaging and now also the hyperspectral cameras, into industrial and consumer applications. Adoption of robotics, the need for better inspection capabilities, and demand for Industry 4.0 and IoT adoption are some key drivers for the market system. Technological advances, which include the integration of AI and machine learning, are benefiting the market by improving the capabilities of vision sensors and their range of applications.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Vision Sensor- Snapshot

- 2.2 Vision Sensor- Segment Snapshot

- 2.3 Vision Sensor- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Vision Sensor Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Less Than 3D

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 3D

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Vision Sensor Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Inspection

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Gauging

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Code Reading & Localization

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Basler

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Cognex

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 ISRA VISION

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 KEYENCE

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Omron Adept Technologies

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 FANUC

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 FARO Technologies

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Matrox

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 MVTec Software

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 National Instruments

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Pick-it

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Robotic Vision Technologies

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 SICK AG

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Teledyne Technologies

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Visio Nerf

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Vision Sensor in 2030?

+

-

Which type of Vision Sensor is widely popular?

+

-

What is the growth rate of Vision Sensor Market?

+

-

What are the latest trends influencing the Vision Sensor Market?

+

-

Who are the key players in the Vision Sensor Market?

+

-

How is the Vision Sensor } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Vision Sensor Market Study?

+

-

What geographic breakdown is available in Global Vision Sensor Market Study?

+

-

Which region holds the second position by market share in the Vision Sensor market?

+

-

How are the key players in the Vision Sensor market targeting growth in the future?

+

-