North America Aerospace Plastics Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2032

Report ID: MS-343 | Chemicals And Materials | Last updated: Jan, 2025 | Formats*:

Aerospace Plastics Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

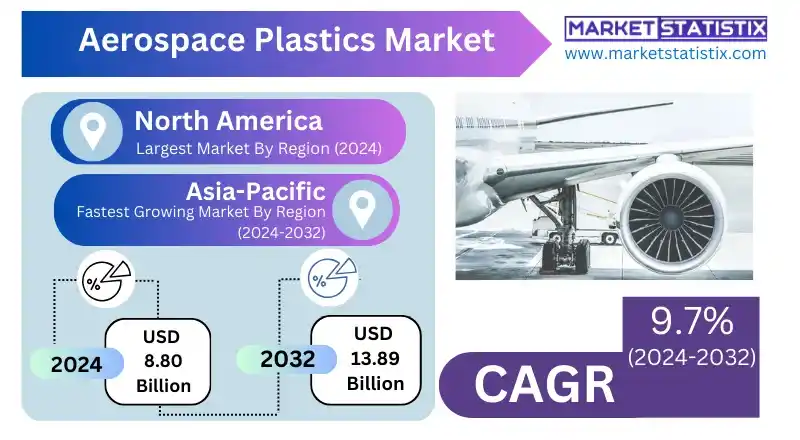

| Growth Rate | CAGR of 9.7% |

| Forecast Value (2032) | USD 13.89 Billion |

| By Product Type | Polymethyl Methacrylate (PMMA), Polyphenylene ether (PPE), Polyetheretherketone (PEEK), Polyphenylsulfone (PPSU), Polyamide-imide (PAI), Polyetherimide (PEI), Polyamide (PA), PolyPhenyleneSulfide (PPS), Polycarbonate (PC), Polyurethane (PU) |

| Key Market Players |

|

| By Region |

|

Aerospace Plastics Market Trends

Principal trends are the fabrication of high-performance composite materials, e.g., carbon fibre-reinforced plastics (CFRP), which display superior strength-to-weight ratios and better fuel economy. Moreover, the intention to be sustainable is inspiring the creation of bio-based and recycled plastics for use in aerospace. Another important trend is the adoption of additive manufacturing (3D printing) technologies to create complex and unique plastic components for aeronautics. This technology not only allows for lighter and more efficient components but also lowers manufacturing costs and throughput.Aerospace Plastics Market Leading Players

The key players profiled in the report are Solvay S.A. (Belgium), BASF SE (Germany), SABIC (Saudi Arabia), Kaman Corporation (US), Mitsubishi Heavy Industries, Ltd. (Japan), Premium AEROTEC (Germany), Evonik Industries AG (Germany), TORAY INDUSTRIES, INC. (Japan), Hyosung Corporation (South Korea), Hexcel Corporation (US)Growth Accelerators

The aerospace plastics market is booming, owing to the growing use of lightweight materials in reducing fuel consumption and minimizing greenhouse gas in the aircraft industry. Polyetheretherketone (PEEK) and polycarbonate plastics are extensively employed in aircraft structures, such as cabins, fuselage structures, and electrical wiring, owing to their high strength-to-weight ratio, corrosion resistance, and durability. Another key driver is the growing adoption of advanced composites and 3D printing technologies in aerospace manufacturing. Such innovations allow for the manufacture of very complex and individually adapted components with a minimum of time and money to produce them. For example, restrictive safety and environmental regulations have promoted flame-retardant and reusable plastic materials, thus further fueling the market.Aerospace Plastics Market Segmentation analysis

The North America Aerospace Plastics is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Polymethyl Methacrylate (PMMA), Polyphenylene ether (PPE), Polyetheretherketone (PEEK), Polyphenylsulfone (PPSU), Polyamide-imide (PAI), Polyetherimide (PEI), Polyamide (PA), PolyPhenyleneSulfide (PPS), Polycarbonate (PC), Polyurethane (PU) . The Application segment categorizes the market based on its usage such as Interior Components, Aerostructure, Fuselage Components, Support Equipment. Geographically, the market is assessed across key Regions like United States (The West, Southwest, The Middle Atlantic, New England, The South, The Midwest) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Competition in the aerospace plastics market is dominated by traditional market leaders and new entrants. Major companies, including Solvay, BASF SE, SABIC, and Victrex, are in the leading position in the market, based on their broad product portfolios and the modern manufacturing facilities. These players are aiming at creating high-performance, lightweight materials that comply with the toughest aerospace industry specifications for weight reduction, thermo-stability, and the robustness of surfaces. Strategic collaborations with aerospace developers, including Boeing and Airbus, to reinforce their market presence. The market is seeing the growing investments in sustainable and recyclable aerospace plastics (applied to decrease the industry's environmental footprint) research and development (R&D). Furthermore, the competitive environment is influenced by mergers, acquisitions, and partnerships designed to increase the breadth of product packages and to establish presence in new markets.Challenges In Aerospace Plastics Market

The aerospace plastics market is faced with a set of major challenges, most of all concerning stringent and demanding regulations and certifications. According to aviation regulatory agencies such as the FAA and EASA, materials need to fulfil demanding safety, flammability, and performance standards, which result in cost increases and a consequent restriction of using novel plastic materials. Also, due to the high design cost of aerospace-grade plastic and the complexity of producing high-precision parts, there are financial and technical limitations for manufacturers. One other problem is the low recycling possibility of aerospace plastics, which is at odds with the increasing sustainability considerations of the aerospace industry. The disposal of end-of-life plastic components, particularly reinforced composites, continues to pose a problem because they are challenging to recycle compared with metals. In addition, competition in the market from modern lightweight metals and alloys (having the same performance characteristics but improved recyclability) puts pressure on the use of plastics by the aerospace sector.Risks & Prospects in Aerospace Plastics Market

The aerospace plastics market presents several promising opportunities. The growing need for lightweight materials in aircraft production for the purpose of improving fuel efficiency and reducing emissions is a key driver. Moreover, progress in polymer technology is making it possible to produce high-performance plastics with better mechanical characteristics, thermal stability, and the ability to withstand extreme environments. In addition, with greater interest in sustainable aviation, this work represents a means of developing and using bio-based and recycled plastics in the aerospace field. These materials provide environmental benefits with the performance requirements needed in demanding aerospace environments.Key Target Audience

, The major target group of the aerospace plastics market is aircraft manufacturers, including those producing commercial, military, and private aircraft. For these manufacturers, aerospace plastics are used on components such as fuselage skins, interior cabin structures, and structural components, owing to their ability to be very light, robust, and impervious to corrosion. Maintenance, repair, and overhaul (MRO) companies are another major user, since aerospace plastics are heavily used for replacing the degraded/damaged parts to improve the fuel consumption and lower the operational cost., The other main stakeholders are the raw material supply chain (suppliers, distributors, and composite suppliers), which brings very high-performance plastic materials (polyetheretherketone (PEEK) and polycarbonate). Additionally, research institutions and technology developers focusing on innovative plastic formulations for advanced aerospace applications form a critical part of the market.Merger and acquisition

The aerospace plastics market has also experienced significant mergers and acquisitions as desired to leverage its competencies and market share. In August 2024, the Trelleborg Group purchased Magee Plastics, a U.S. company that provides high-performance thermoplastic and composite materials to the aerospace industry. This acquisition is anticipated to further the business unit Sealing Solutions of Trelleborg and enrich its portfolio of advanced materials, further consolidating the company's presence in the aerospace industry. Also, Pexco purchased Precise Aerospace Manufacturing in August 2024 to grow its service portfolio and enhance its position in the aerospace market. Another significant development occurred in October 2023 when Demgy Group acquired E.I.S., according to Aircraft GmbH, a thermoplastic and composite component manufacturer of the aerospace industry based in Germany. This acquisition will facilitate Demgy to centralise its activities in Germany and to upgrade its ability to process complex, high-value-added plastics and composites, which will both keep confirming Demgy's leadership in the local aerospace market. These strategic actions are representative of a general pattern of consolidation in the industry, in an attempt to maximise synergies, to improve product portfolios, and to manage the increasing demand for lightweighting in aerospace applications. >Analyst Comment

"The global aerospace plastics market is showing high growth due to the rising demand for the lightweight, high-tech, advanced plastics in the aerospace sector. Major factors responsible for it are the increasing attention to fuel economy, harsh environmental legislation, and progress in polymer science. The marketplace is comprised of a wide array of participants, such as large aerospace producers, material suppliers, and component producers. The main actors are capitalizing on big money behind the research and development of new materials and materials demonstrating advanced properties, i.e., high-temperature resistance, impact toughness, and fatigue resistance."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Aerospace Plastics- Snapshot

- 2.2 Aerospace Plastics- Segment Snapshot

- 2.3 Aerospace Plastics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Aerospace Plastics Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Polyetheretherketone (PEEK)

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Polyphenylsulfone (PPSU)

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Polycarbonate (PC)

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Polyetherimide (PEI)

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Polymethyl Methacrylate (PMMA)

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Polyamide (PA)

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 PolyPhenyleneSulfide (PPS)

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

- 4.9 Polyamide-imide (PAI)

- 4.9.1 Key market trends, factors driving growth, and opportunities

- 4.9.2 Market size and forecast, by region

- 4.9.3 Market share analysis by country

- 4.10 Polyphenylene ether (PPE)

- 4.10.1 Key market trends, factors driving growth, and opportunities

- 4.10.2 Market size and forecast, by region

- 4.10.3 Market share analysis by country

- 4.11 Polyurethane (PU)

- 4.11.1 Key market trends, factors driving growth, and opportunities

- 4.11.2 Market size and forecast, by region

- 4.11.3 Market share analysis by country

5: Aerospace Plastics Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Aerostructure

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Fuselage Components

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Interior Components

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Support Equipment

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Aerospace Plastics Market by Process

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Injection Molding

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 CNC Machining

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Thermoforming

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Extrusion

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 3D Printing

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: Aerospace Plastics Market by End Use

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Commercial & Freighter Aircraft

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 General Aviation

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Military Aircraft

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Rotary Aircraft

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

8: Aerospace Plastics Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 The West

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.3 Southwest

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.4 The Middle Atlantic

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.5 New England

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.6 The South

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.7 The Midwest

- 8.7.1 Key trends and opportunities

- 8.7.2 Market size and forecast, by Type

- 8.7.3 Market size and forecast, by Application

- 8.7.4 Market size and forecast, by country

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Evonik Industries AG (Germany)

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Solvay S.A. (Belgium)

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 SABIC (Saudi Arabia)

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Hyosung Corporation (South Korea)

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Kaman Corporation (US)

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Premium AEROTEC (Germany)

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 BASF SE (Germany)

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Mitsubishi Heavy Industries

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Ltd. (Japan)

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 TORAY INDUSTRIES

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 INC. (Japan)

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Hexcel Corporation (US)

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Process |

|

By End Use |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Aerospace Plastics in 2032?

+

-

How big is the North America Aerospace Plastics market?

+

-

How do regulatory policies impact the Aerospace Plastics Market?

+

-

What major players in Aerospace Plastics Market?

+

-

What applications are categorized in the Aerospace Plastics market study?

+

-

Which product types are examined in the Aerospace Plastics Market Study?

+

-

Which regions are expected to show the fastest growth in the Aerospace Plastics market?

+

-

Which region is the fastest growing in the Aerospace Plastics market?

+

-

What are the major growth drivers in the Aerospace Plastics market?

+

-

Is the study period of the Aerospace Plastics flexible or fixed?

+

-