North America Aesthetic Lasers Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-877 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The aesthetic lasers market refers to the business of developing, producing, and selling laser equipment exclusively intended for cosmetic and dermatological treatments. The lasers use concentrated beams of light at particular wavelengths to treat several skin conditions, ranging from removal of hair, skin resurfacing (to smooth wrinkles, scars, and pigmentation), tattoo elimination, treatment of vascular lesions (e.g., spider veins, port wine stain), and body contouring. The technology of aesthetic lasers enables precise and non-invasive or minimally invasive treatments with effective solutions involving relatively brief recovery times as against conventional surgical alternatives.

This market growth is driven by an expanding consumer interest in aesthetic improvement and anti-ageing therapies combined with growing disposable incomes and expanded awareness of available laser technology. Advances in technology continue to increase the range of applications for aesthetic lasers, resulting in more universal devices with enhanced safety profiles and effectiveness over a broader assortment of skin types and conditions.

Aesthetic Lasers Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

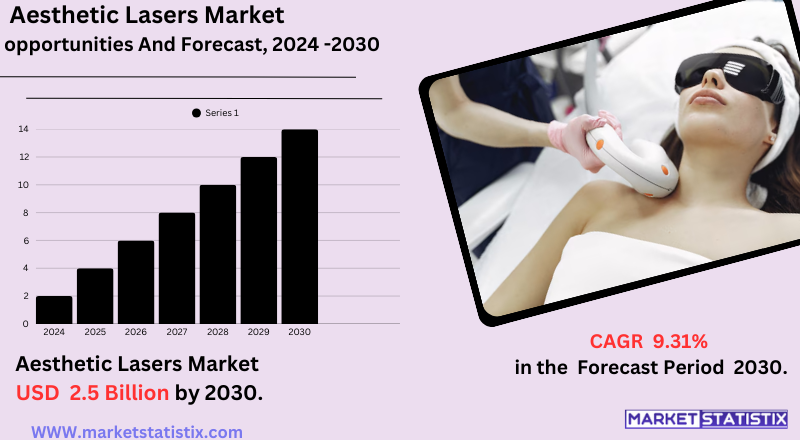

| Growth Rate | CAGR of 9.31% |

| Forecast Value (2030) | USD 2.5 Billion |

| By Product Type | Standalone Lasers, Multiplatform Lasers |

| Key Market Players |

|

| By Region |

|

Aesthetic Lasers Market Trends

The aesthetic lasers market is witnessing tremendous growth fuelled by a number of major trends. One of the major trends is the growing demand for minimally invasive and non-surgical cosmetic treatments. Patients are looking for treatments that provide visible results with less downtime, which is exactly what aesthetic lasers can provide for a range of applications such as skin rejuvenation, hair removal, and body contouring. This demand is compounded by the increasing power of social media and increased focus on physical looks among a broader population, including a significant growth in male clients interested in aesthetic treatments.

Technological innovation is at the centre of market trends, with the transition from single-platform laser machines to multi-platform systems that can incorporate multiple energy-based technologies like laser, intense pulsed light (IPL), and radiofrequency (RF). These multiplatform systems provide clinicians with more flexibility in treating numerous aesthetic issues within a single system, frequently enabling combination therapies and more customized treatment regimens. Advancements in laser technologies themselves, including picosecond lasers and fractional lasers, are improving treatment effectiveness and safety and shortening recovery times, thus driving further adoption and market growth.

Aesthetic Lasers Market Leading Players

The key players profiled in the report are Sciton, Inc. (United States), Solta Medical, Inc. (Valeant Pharmaceuticals)(United States), STRATA Skin Sciences (United States), Cutera (United States), Viora (New York), Lutronic (South Korea), Cynosure, Inc. (United States), Syneron Medical Ltd. (United States), Lumenis (Israel), Lynton Lasers (United Kingdom)Growth Accelerators

The aesthetic lasers market is heavily driven by an expanding worldwide demand for minimally invasive and non-invasive cosmetic treatments. Drivers such as growing awareness of aesthetic treatments, increased disposable income among a large section of the population, and the role of social media and beauty trends play a major role in driving this demand. In addition, advances in laser technology, which provide better safety, efficacy, and versatility in multiple applications such as hair removal, skin rejuvenation, and tattoo removal, will continue to fuel market expansion and acceptance by practitioners and consumers alike.

Another factor is the rising incidence of skin afflictions and the need for effective treatments with minimal downtime. Problems such as acne, scars, pigmentation disorders, and the external signs of ageing are becoming increasingly prevalent because of lifestyle and environmental factors, which cause more people to turn to laser-based treatments. The growing medical tourism market, where people travel to other parts of the world for affordable aesthetic treatments, also adds to the growth of the market. In total, a convergence of demographic change, technological advancements, and changing consumer attitudes are driving the strong expansion of the Aesthetic Lasers Market.

Aesthetic Lasers Market Segmentation analysis

The North America Aesthetic Lasers is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Standalone Lasers, Multiplatform Lasers . The Application segment categorizes the market based on its usage such as Hair Removal, Vascular Lesions, Pigmented Lesion & Tattoo Removal, Skin Rejuvenation, Other. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive dynamics of the aesthetic lasers market are characterised by a combination of mature global leaders and emerging regional players, leading to a moderately fragmented market. Some of the major strategies adopted by these firms to increase or retain market share are ongoing technological innovation, including the innovation of multi-platform systems and improved safety and efficacy lasers for a variety of skin types and uses. Strategic partnerships, mergers, and acquisitions are also prevalent strategies for product portfolio expansion and geographical expansions. Additionally, the growing demand for non-invasive and minimally invasive treatments fosters competition towards the creation of more patient-friendly and effective laser technologies.

Key players in the aesthetic lasers industry are firms such as Lumenis, Candela Medical (Syneron Candela), Cynosure, Cutera, Alma Lasers, and Sciton. Such firms tend to enjoy high brand identification, global distribution channels, and a tradition of innovative products. Competition also comes from smaller, niche-orientated firms specialising in niche applications or particular laser technologies. Product performance, safety features, cost-effectiveness, and the provision of complete training and support for practitioners are key differentiators in this competitive market.

Challenges In Aesthetic Lasers Market

The aesthetic lasers industry is confronted with major challenges on the main fronts of a changing and complicated regulatory environment. Producers and clinics have to find their way through different international, national, and even local requirements, including the FDA device classification system in the United States and the EU's Medical Device Regulation (MDR), both with stringent demands regarding safety, effectiveness, and quality management. These regulatory requirements can postpone product releases, drive up compliance expenditures, and necessitate constant adjustments as standards themselves change with technological advancements and more stringent consumer protection measures.

Expensive manufacturing, stiff market competition, and the necessity of constant innovation add to market dynamics complexities. Moreover, there are issues of standardising training for operators, proper device labelling and record maintenance, and environmental issues regarding disposal of devices. Manufacturers and clinics also have to deal with liability and insurance concerns, as well as the potential for revenue loss through non-compliance or supply chain interruption. These combined elements represent barriers to expansion and entry that necessitate strategic planning and stringent compliance programmes in order to participate in the market over the long term.

Risks & Prospects in Aesthetic Lasers Market

Key opportunities include the increased use of laser treatments for skin renewal, tattoo removal and anti-ageing treatments, as well as the interfacing with AI and hybrid laser systems that allow for more personalised and efficient treatments. The spread of social media and evolving beauty trends are also driving demand, especially among millennials.

North America currently dominates the aesthetic lasers market at the global level, with the highest share driven by the dominance of key industry players, favourable adoption rates for minimally invasive procedures, and superior healthcare infrastructure. The United States, most notably, drives the market strongly with a considerable market share as a result of high procedure volume and emphasis on innovation. Europe is also a major market, driven by an ageing demographic, strong regulatory environments, and high disposable incomes, particularly in Western Europe. In contrast, the Asia-Pacific market is rapidly growing to be the fastest-growing market, driven by expanding urbanisation, rising disposable incomes, and greater aesthetic treatment awareness in China, Japan, South Korea, and India. The region's fast growth is also complemented by the expansion of medical tourism and the rise in the number of dermatology clinics and medical spas.

Key Target Audience

,

The aesthetic lasers market mainly focuses on two major consumer groups: younger adults between the ages of 20 and 20–40 and the older population aged 50 years and older. Younger consumers, driven by social media and the need for non-surgical beauty enhancement, are increasingly turning to procedures such as laser hair removal, acne treatment, and tattoo removal. This group is attracted to the convenience and low downtime of these treatments, commonly provided in medical spas and aesthetic clinics.

, Healthcare professionals, such as dermatology clinics, hospitals, and speciality aesthetic clinics, form the professional end-user market segment. These centers are investing in sophisticated laser technologies to deliver a variety of services, ranging from skin resurfacing to pigmentation correction. The increased incidence of skin ailments, like acne and pigmentation disorders, has also fueled demand for laser-driven solutions. Besides this, the growing rates of obesity and a sedentary lifestyle have contributed to a boom in body contouring procedures, making aesthetic lasers an all-purpose device in medical and cosmetic procedures alike.

Merger and acquisition

The market for aesthetic lasers has seen high levels of merger and acquisition activity over the past few years, which mirrors the dynamic growth and consolidation patterns of the industry. In January 2024, U.S.-based medical aesthetics technology firm Cynosure merged with South Korea's Lutronic Corporation with the goal of establishing a global leader in medical aesthetic systems. This strategic action aims to expand their geographic presence, increase research and development activities, and fortify their supply chain to serve customers worldwide better. Moreover, in April 2023, Lumenis bought Cynosure, further strengthening its leadership position in the market for aesthetic lasers and expanding its portfolio of groundbreaking treatments.

Some other significant activities are Candela Corporation's acquisition of Astanza Laser in September 2023 to boost its range of tattoo removal and pigmented lesion treatments. Additionally, in July 2023, Sensus Healthcare bought Aesthetic Laser Partners, which is an aesthetic laser equipment rental business in the US, to leverage Sensus's expansion into the rental space and offer greater flexibility and lower-cost access to its lasers. These strategic actions highlight the industry's intent to drive growth in capabilities and market reach through mergers and acquisitions.

>

Analyst Comment

The world market of aesthetic lasers is growing at a fast pace, and it’s worth is expected to increase from about USD 2.78 billion in the year 2025 to about USD 10.56 billion by 2034, an indication of a high compound annual growth rate. All this is driven by rising non-invasive cosmetic treatments, technological advances in laser equipment, and growing demand for treatments like skin rejuvenation, hair removal, and the elimination of tattoos. The impact of social media, shifting beauty trends, and increased disposable incomes – particularly in the youth segment – are further fuelling market adoption.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Aesthetic Lasers- Snapshot

- 2.2 Aesthetic Lasers- Segment Snapshot

- 2.3 Aesthetic Lasers- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Aesthetic Lasers Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Standalone Lasers

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Multiplatform Lasers

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Aesthetic Lasers Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hair Removal

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Skin Rejuvenation

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Vascular Lesions

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Pigmented Lesion & Tattoo Removal

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Other

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Aesthetic Lasers Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Solta Medical

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Inc. (Valeant Pharmaceuticals)(United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Cynosure

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Inc. (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Cutera (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Sciton

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Inc. (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 STRATA Skin Sciences (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Syneron Medical Ltd. (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Viora (New York)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Lumenis (Israel)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Lutronic (South Korea)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Lynton Lasers (United Kingdom)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Aesthetic Lasers in 2030?

+

-

Which application type is expected to remain the largest segment in the North America Aesthetic Lasers market?

+

-

How big is the North America Aesthetic Lasers market?

+

-

How do regulatory policies impact the Aesthetic Lasers Market?

+

-

What major players in Aesthetic Lasers Market?

+

-

What applications are categorized in the Aesthetic Lasers market study?

+

-

Which product types are examined in the Aesthetic Lasers Market Study?

+

-

Which regions are expected to show the fastest growth in the Aesthetic Lasers market?

+

-

Which application holds the second-highest market share in the Aesthetic Lasers market?

+

-

What are the major growth drivers in the Aesthetic Lasers market?

+

-

The aesthetic lasers market is heavily driven by an expanding worldwide demand for minimally invasive and non-invasive cosmetic treatments. Drivers such as growing awareness of aesthetic treatments, increased disposable income among a large section of the population, and the role of social media and beauty trends play a major role in driving this demand. In addition, advances in laser technology, which provide better safety, efficacy, and versatility in multiple applications such as hair removal, skin rejuvenation, and tattoo removal, will continue to fuel market expansion and acceptance by practitioners and consumers alike.

Another factor is the rising incidence of skin afflictions and the need for effective treatments with minimal downtime. Problems such as acne, scars, pigmentation disorders, and the external signs of ageing are becoming increasingly prevalent because of lifestyle and environmental factors, which cause more people to turn to laser-based treatments. The growing medical tourism market, where people travel to other parts of the world for affordable aesthetic treatments, also adds to the growth of the market. In total, a convergence of demographic change, technological advancements, and changing consumer attitudes are driving the strong expansion of the Aesthetic Lasers Market.