North America AI in IoT Market – Industry Trends and Forecast to 2032

Report ID: MS-965 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

AI in the IoT market, often called AIot, represents the convergence of artificial intelligence and the Internet of Things. It covers the integration of AI resources, such as machine learning, natural language processing and computational vision, directly on IoT devices, sensors and data generated by them. This synergy transforms independent connected devices into "intelligent" entities capable of autonomous decision-making, real-time data analysis and intelligent automation without constant human intervention. The market includes hardware, software and services that allow this integration, allowing IoT systems not only to collect large amounts of data but also to interpret, learn and act with this data effectively.

AI in IoT allows applications that vary from predictive maintenance in industrial environments to personalised experiments in smart houses and intelligent traffic management in smart cities. By incorporating the AI closer to the data source (Edge AI), AIoT solutions reduce latency, improve safety and optimise the use of bandwidth. This allows more responsive and efficient operations in various sectors, leading to an improvement in productivity, cost savings and the creation of new innovative services and business models.

AI in IoT Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

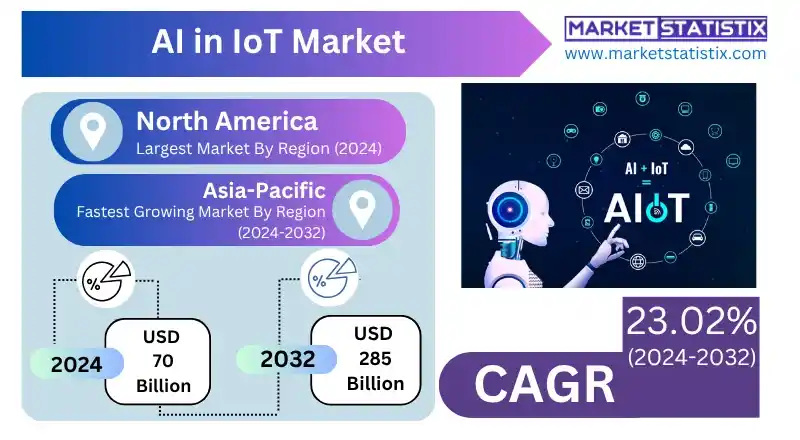

| Growth Rate | CAGR of 23.02% |

| Forecast Value (2032) | USD 285 Billion |

| By Product Type | Machine Learning, Natural Language Processing, Context Awareness, Computer Vision, Predictive Analytics |

| Key Market Players |

|

| By Region |

|

AI in IoT Market Trends

The main tendency is the rise of the AI edge, whereby AI processing is pushed into the data source itself (i.e., the IoT device) rather than fully relying on cloud computing. This reduces latency and improves data privacy as confidential information is processed locally. In addition, less bandwidth is consumed by applications that need instant response within an autonomous vehicle or industrial control systems. On the other hand, 5G developments are coming into play to ensure the availability of huge bandwidth and low latency to support an overwhelming number of AIoT.

Another important trend refers to the growing adoption of AIoT in various verticals of the sector, especially manufacturing, health and intelligent cities. In manufacturing, AIOT is used to perform predictive maintenance, quality control and optimisation of production lines and thus create sector initiatives 4.0. The continuous development of AI algorithms, including recent advances in generative AI for synthetic data creation and the enhanced interfaces of the machine, is also feeding this market, paving the way for more sophisticated and adaptive AIoT solutions applicable to various businesses and business needs.

AI in IoT Market Leading Players

The key players profiled in the report are Intel, PTC, Siemens, Microsoft, Hitachi Vantara, Huawei, Google, Oracle, NVIDIA, GE Digital, Rockwell Automation, Fujitsu, SAP, Arm Holdings, IBM, Amazon Web Services, Bosch, Schneider Electric, Cisco, AdvantechGrowth Accelerators

The AI in IoT (AIoT) marketplace is by and large pushed by means of the exponential increase in facts generated by linked IoT gadgets. Billions of sensors, smart home equipment, business machinery, and cars are continuously producing sizable quantities of uncooked facts. Without AI, extracting significant insights from this deluge is nearly not possible. AI algorithms, specifically device getting to know, are important for processing, analysing, and deciphering these huge records, enabling real-time choice-making, predictive analytics (e.g., for preservation), and self-sustaining operations. This inherent need for sensible facts, control and actionable insights directly fuels the demand for AIoT answers across various industries.

Another huge driver is the increasing demand for automation and stronger operational performance across numerous sectors. Industries like manufacturing, healthcare, and logistics are leveraging AIoT to automate repetitive tasks, optimise methods, and decrease human mistakes, leading to significant price savings and increased productivity. For instance, in smart factories, AIoT facilitates device-to-machine communication and predictive maintenance, minimising downtime.

AI in IoT Market Segmentation analysis

The North America AI in IoT is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Machine Learning, Natural Language Processing, Context Awareness, Computer Vision, Predictive Analytics . The Application segment categorizes the market based on its usage such as Smart Cities, Smart Homes, Industrial IoT (IIoT), Healthcare, Automotive & Transportation. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

AI in the IoT market is characterised by intense competition between major technology companies and innovative startups. Leading companies such as Microsoft, IBM, Google, Amazon Web Services and Intel have established strong positions, offering comprehensive AIoT platforms that make up cloud computing, edge analysis and machine learning features. For example, Microsoft's Azure IoT platform facilitates perfect integration and real-time data analysis for companies. IBM has partnered with Verizon to integrate AI with IoT solutions for 5G corporate applications, improving connectivity and providing advanced solutions for infrastructure and industrial applications of the smart city.

Emerging players like Samsara are gaining strength, focusing on specific industry needs, such as fleet management and industrial operations. Samsara's connected cloud platform provides information for physical operations organizations in various sectors, including transportation and energy. In addition, companies such as Huawei and Siemens are investing in AIoT ecosystems targeted at intelligent houses and industrial automation, respectively. Huawei aims to connect more than 100 million devices by 2025, supported by China's effort towards intelligent city projects. This dynamic scenario highlights the importance of innovation and strategic partnerships to maintain a competitive advantage in the IoT market.

Challenges In AI in IoT Market

IoT integration of AI has significant challenges, especially around data management and security. IoT devices generate vast amounts of data from various sources and in various formats, complicating integration and making it difficult to prepare clean and structured data for AI models. In addition, robust data protection is essential to addressing risks such as surveillance capitalism and cyber threats, as the large volume of sensitive data collected by IoT networks increases concerns about privacy.

Another major challenge is to ensure scalability and efficient use of resources. Empowering AI on edge devices makes computational energy and energy resources, requiring advanced hardware and optimised algorithms to maintain performance without excessive costs or environmental impact. Managing AI workloads distributed through edges, clouds and devices also requires sophisticated orchestration solutions to ensure perfect updates, reliability and real-time decision-making.

Risks & Prospects in AI in IoT Market

The expansion of 5G networks and edge computing further accelerates market growth, offering reduced latency and enhanced connectivity, which unlocks new cases of use in industrial automation, remote monitoring and customer custom experiences. The growing demand for data-orientated insights and operational efficiency is encouraging organizations to invest in AI-driven IoT solutions.

Regionally, North America currently leads the market due to robust technological infrastructure, high adoption of intelligent devices and strong investment in innovation. However, the Asia Pacific region is emerging as the fastest-growing market, fuelled by rapid digital transformation, government initiatives and increased IoT device penetration. These regional dynamics highlight AI's global potential in IoT, with mature and emerging markets contributing to the sustained expansion of the market.

Key Target Audience

,

AI in the IoT market serves a diverse range of industries that seek to increase operational efficiency, predictive capabilities and real-time decision-making. The main sectors include manufacturing, where IoT solutions driven by AI allow predictive maintenance and process optimisation; energy and public services, leveraging smart networks and failure detection systems; transport and mobility, using real-time data for fleet management and traffic optimisation; and the BFSI sector, which employs AI-IoT for personalised bank experiences and fraud detection. In addition, the health sector benefits IoT AI through applications such as remote monitoring of patients and predictive diagnosis.

, Emerging markets, such as retail, agriculture and smart cities, are increasingly adopting AI in IoT technologies. Retailers implement smart shelves and personalised shopping experiences; agriculture uses IoT and AI for precision agriculture sensors; and smart cities are part of IoT qualified for AI for infrastructure and public safety management. The growing demand for automation and data-orientated information in these sectors highlights the expanding target audience for IoT solutions.

Merger and acquisition

AI in the IoT market has witnessed significant merger and acquisition activity (M&A), reflecting a strategic impetus of companies to improve their abilities in this rapidly evolving sector. Notably, in August 2023, Reneas Electronics acquired Sequans Communications, a US $249 million IoT chip manufacturer, aiming to reinforce its product portfolio and market reach. In addition, in June 2023, Renesas completed its acquisition of Panthronics AG, strengthening its position in NFC technology. These acquisitions highlight the sector's focus on the integration of advanced technologies to boost innovation and operational efficiency.

In addition, the sector has received substantial investments, with companies such as Envision Digital raising $210 million in a Series A round to develop its AIoT ENOS ™ and Helium platform, guaranteeing $200 million in a round of the D series led by Andreessen Horowitz and Tiger Global Management. These financing rounds highlight investors' growing confidence in AI-orientated IoT solutions. The Asia Pacific region, in particular, should experience rapid growth due to increased internet penetration, advances in mobile technologies and a prosperous manufacturing sector, making it a point of access for future mergers and acquisition activities.

Analyst Comment

AI in the IoT market is undergoing significant growth, driven by the integration of artificial intelligence resources in the Internet of Things systems. This convergence allows data analysis in real time, predictive maintenance and automation in various sectors. According to Straits Research, IoT Global AI was valued at US $9.25 billion by 2024 and is expected to reach US $47.78 billion by 2033. The main sectors that adopt AIOT solutions include manufacturing processes and health and intelligence, where technology enhances operational efficiency and decision-making processes. The proliferation of intelligent and connected devices, along with advances in AI and cloud computing algorithms, are key factors that drive global AI in the IoT market.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 AI in IoT- Snapshot

- 2.2 AI in IoT- Segment Snapshot

- 2.3 AI in IoT- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: AI in IoT Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Machine Learning

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Natural Language Processing

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Computer Vision

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Context Awareness

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Predictive Analytics

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: AI in IoT Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Smart Homes

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Industrial IoT (IIoT)

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Healthcare

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Smart Cities

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Automotive & Transportation

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: AI in IoT Market by Technologies

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 ML and Deep Learning

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 NLP

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: AI in IoT Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 IBM

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Microsoft

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Google

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Amazon Web Services

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Cisco

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Oracle

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 SAP

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Intel

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 GE Digital

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Siemens

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 PTC

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Hitachi Vantara

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Arm Holdings

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Huawei

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 Bosch

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 NVIDIA

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

- 9.17 Schneider Electric

- 9.17.1 Company Overview

- 9.17.2 Key Executives

- 9.17.3 Company snapshot

- 9.17.4 Active Business Divisions

- 9.17.5 Product portfolio

- 9.17.6 Business performance

- 9.17.7 Major Strategic Initiatives and Developments

- 9.18 Rockwell Automation

- 9.18.1 Company Overview

- 9.18.2 Key Executives

- 9.18.3 Company snapshot

- 9.18.4 Active Business Divisions

- 9.18.5 Product portfolio

- 9.18.6 Business performance

- 9.18.7 Major Strategic Initiatives and Developments

- 9.19 Fujitsu

- 9.19.1 Company Overview

- 9.19.2 Key Executives

- 9.19.3 Company snapshot

- 9.19.4 Active Business Divisions

- 9.19.5 Product portfolio

- 9.19.6 Business performance

- 9.19.7 Major Strategic Initiatives and Developments

- 9.20 Advantech

- 9.20.1 Company Overview

- 9.20.2 Key Executives

- 9.20.3 Company snapshot

- 9.20.4 Active Business Divisions

- 9.20.5 Product portfolio

- 9.20.6 Business performance

- 9.20.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Technologies |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of AI in IoT in 2032?

+

-

Which application type is expected to remain the largest segment in the North America AI in IoT market?

+

-

How big is the North America AI in IoT market?

+

-

How do regulatory policies impact the AI in IoT Market?

+

-

What major players in AI in IoT Market?

+

-

What applications are categorized in the AI in IoT market study?

+

-

Which product types are examined in the AI in IoT Market Study?

+

-

Which regions are expected to show the fastest growth in the AI in IoT market?

+

-

Which application holds the second-highest market share in the AI in IoT market?

+

-

Which region is the fastest growing in the AI in IoT market?

+

-