North America Aircraft Insurance Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-200 | Business finance | Last updated: Dec, 2024 | Formats*:

Aircraft Insurance Report Highlights

| Report Metrics | Details |

|---|---|

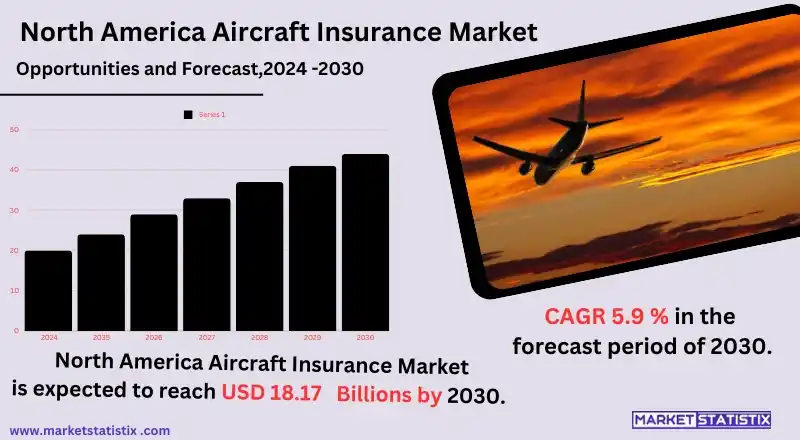

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 5.9% |

| Forecast Value (2031) | USD 18.17 Billion |

| By Product Type | Hull Insurance, Liability Insurance, Personal Accident Insurance, War Risk Insurance |

| Key Market Players |

|

| By Region |

Aircraft Insurance Market Trends

The emergence of new trends in the aircraft insurance market is ascribed to technological innovation in aviation and the increasing sophistication of risks. That is, the increased requirement for coverage of drones and urban air mobility (UAM) vehicles signifies more diversity in the aviation sector. Insurers adapt their coverage to emerging risks that include cyber threats, autonomous systems, and environmental liabilities. Data analytics and artificial intelligence also drive progress in risk assessment, further enabling insurers to create specialised solutions and facilitate claims management processes. Another development is the importance attached to sustainability in aviation, which will also dictate insurance features. Insurers have now been crafting policies in line with environmental, social, and governance (ESG) standards, as many airlines adopt greener technologies and biofuels to reduce carbon footprints. The renewal of interest in liability coverage, particularly for commercial airlines, follows the rebound in passenger and cargo volumes.Aircraft Insurance Market Leading Players

The key players profiled in the report are AIG (American International Group) (United States), Allianz (Germany), American Aviation Insurance (United States), Aon (United Kingdom), Arthur J. Gallagher & Co. (United States), Avemco Insurance Company (United States), Aviation Insurance Holdings (United States), Global Aerospace (United States), Hiscox (United Kingdom)Growth Accelerators

The key factors driving aircraft insurance market growth are the increasing global aviation industry and the increasing number of commercial, private, and cargo aircraft. The demand for air travel leads to a higher demand for insurance coverage against accidents, operational liabilities, and maintenance issues. Also, the government regulations and international safety standards have made it mandatory for airlines and operators to procure strong insurance policies, thereby driving market growth. High adoption of advanced technologies in the aerospace industry will also act as another significant driver of the market, which includes the adoption of drones and unmanned aerial vehicles (UAVs). These innovations would require specialised insurance solutions to cover their unique risks that include cyber threats and operational malfunctions.Aircraft Insurance Market Segmentation analysis

The North America Aircraft Insurance is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Hull Insurance, Liability Insurance, Personal Accident Insurance, War Risk Insurance . The Application segment categorizes the market based on its usage such as Commercial Airlines, General Aviation, Aircraft Manufacturers, Airports and Ground Handlers. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario of the aircraft insurance market is marked by long-established and small emerging players all attempting to share the demand brought by increased air traffic and an expanding fleet of commercial and private aircraft. The prominent industrial players include American International Group, Allianz, AXA, and Tokio Marine HCC; they provide a range of insurance products such as public liability, passenger liability, and hull insurance. The market is expected to see a major boost in growth prospects, including estimates of achieving nearly $8.1 billion by 2033, because of advances in aerospace technology and increasing investments in aviation infrastructure, specifically in developing regions such as Asia-Pacific.Challenges In Aircraft Insurance Market

There are several challenges that the aircraft insurance market faces, and one of those is the volatile nature of the aviation industry itself, which is highly influenced by global economic conditions, ongoing changes in regulations, and unpredictable events such as natural disasters or even pandemics. All of these, at some point, result in variations in the demand for insurance policies, and those directly affect rates on premiums charged. This poses a challenge to accurately assess risk as well as price competitively but profitably. Another important challenge is the increasing pressure imposed on the insurers to come to terms with ever-evolving technological advancements in the aviation sector, like the use of drones, autonomous aircraft, and environmentally friendly innovations. This essentially requires insurers to ring in for new underwriting models for emerging aviation risks, expand their expertise with the affected technologies for better risk management, and leverage new technologies for enhanced risk management. Additional dimensions that add to the risk profile for the industry due to changes in the environment will obviously include the effects due to climate change and the extreme weather situations, hence necessitating the insurers to build policies around extreme frequencies and intensities of weather incidents that will further make the insurance picture cloudy.Risks & Prospects in Aircraft Insurance Market

The aviation industry currently is growing at a pace where the greater the insurance solutions are required, the more aircraft-wise, flight-wise, and passenger-wise they are. Apart from all these reasons, the trends in increasing passenger movement, the growth of low-cost carriers, and private jet markets have made the demand more increasing. In all such cases, the insurers tend to find opportunities to formulate the plans in specialised coverage options like hull insurance, liability insurance, and product liability for aviation manufacturers, keeping in mind the changing safety standards and regulatory requirements in the industry. It introduces opportunities to enter the market through aircraft insurance against this new trend ushered in by technology and the use of unmanned aerial vehicles (UAVs) or drones. As drones become integrated with industries such as logistics, agriculture, and preview, the insurance can develop unique provisions that will cater to the users' special risk needs. Aside from these two considerations, there is another factor that insurers can consider: the adoption of sustainable and greener practices in aviation. Electric aircraft will allow insurance companies to develop novel products for the new aircraft technologies and thus add to the diversity of the market, covering new segments.Key Target Audience

The major target audience of the aircraft insurance market is airlines and aircraft operator aviation companies that require very broad coverage. Commercial airlines and private jet operators take out insurance coverage that protects them from risks of accident, damage, theft, liability, and others. The aforementioned organisations, however, give priority to policies that typically provide coverage for aircraft hull damage, third-party liability, and loss of cargo to enable them to recover financially and even provide alternative operation in the event of a disaster.,, Another significant audience is aircraft manufacturers, maintenance providers, and lessors, who require insurance coverage for their assets; aircraft manufacturers require insuring liability of product defects, maintenance companies’ facilities insurance against operational risks in servicing, and aircraft lease companies’ insurance for their fleets of leased aircraft, damper loss, or otherwise.Merger and acquisition

Recent mergers and acquisitions in the aircraft insurance industry obviously direct the trend towards consolidation in order to strengthen capabilities and presence in the market. The best example of this is Chubb's acquisition of Catalyst Aviation Insurance, a managing general agent based in Melbourne whose specialisation is general aviation insurance. Under this acquisition, expected to close by end-June 2024, Chubb hopes to extend its global aviation underwriting capabilities and offer local market access for Australia. This was underlined also by the country president of Australia and New Zealand for Chubb, who stressed that this means to continue to strengthen their capacity as an insurer of choice in the local aviation market, which aligns with the strategy for continuity of service to clients and distribution partners. The market has yet to rest, however, as Chubb would join Arthur J. Gallagher & Co., which has consumed Aviation Insurance Australia for global aviation insurance capabilities. This, too, shall allow Gallagher to take advantage of the expertise of Aviation Insurance Australia while expanding its regional market share. Factors like the rapid upsurge of air passenger traffic and changing geopolitical dynamics will ensure that the entire aircraft insurance market will enjoy exponential growth. >Analyst Comment

"Across the globe, the aircraft insurance market is flourishing steadily, caused by augmented demands for air travel, growth in airline fleets, and an expanding pool of general aviation services. Aircraft insurance encompasses hull damage, liability, and passenger liability; they are therefore very important if one wants to protect oneself from the financial impacts of risks in the aviation industry. Some of the most important factors causing growth in this market are advancements in aerospace technology, new aircraft manufacturers, and increasing complexity of aviation operations."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Aircraft Insurance- Snapshot

- 2.2 Aircraft Insurance- Segment Snapshot

- 2.3 Aircraft Insurance- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Aircraft Insurance Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Hull Insurance

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Liability Insurance

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Personal Accident Insurance

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 War Risk Insurance

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Aircraft Insurance Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Commercial Airlines

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 General Aviation

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Aircraft Manufacturers

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Airports and Ground Handlers

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 AIG (American International Group) (United States)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Allianz (Germany)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 American Aviation Insurance (United States)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Aon (United Kingdom)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Arthur J. Gallagher & Co. (United States)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Avemco Insurance Company (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Aviation Insurance Holdings (United States)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Global Aerospace (United States)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Hiscox (United Kingdom)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Frequently Asked Questions (FAQ):

What is the estimated market size of Aircraft Insurance in 2031?

+

-

Which type of Aircraft Insurance is widely popular?

+

-

What is the growth rate of Aircraft Insurance Market?

+

-

What are the latest trends influencing the Aircraft Insurance Market?

+

-

Who are the key players in the Aircraft Insurance Market?

+

-

How is the Aircraft Insurance } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Aircraft Insurance Market Study?

+

-

What geographic breakdown is available in North America Aircraft Insurance Market Study?

+

-

Which region holds the second position by market share in the Aircraft Insurance market?

+

-

How are the key players in the Aircraft Insurance market targeting growth in the future?

+

-