North America Automated Dispensing Machines Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-878 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The Automated Dispensing Machines (ADM) market constitutes the business responsible for designing, producing, and implementing automated machinery that dispenses drugs, medical supplies, and other healthcare goods in different medical facilities. From basic pill machines to advanced robots that can prepare and dispense patient-specific medications with high efficacy and precision, these machines span the gamut. ADMs are increasingly used in hospitals, pharmacies, long-term care centers, and even retail settings to automate medication management processes, decrease dispensing mistakes, enhance inventory management, and increase patient convenience and safety.

The expansion of the ADM market is fuelled by a number of factors, such as growing emphasis on drug safety and error reduction, the requirement to enhance the efficiency of workflow in healthcare centers, and the expanding requirement for more efficient management of inventory of drugs. In addition, the increasing size of the geriatric population and the rising incidence of chronic diseases are translating into larger volumes of drugs, consequently supporting the requirement for automated dispensing solutions to efficiently manage the workload and with accuracy.

Automated Dispensing Machines Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

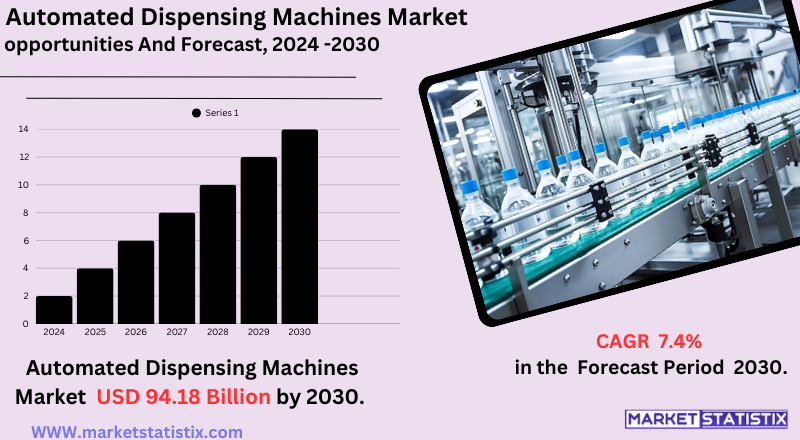

| Growth Rate | CAGR of 7.4% |

| Forecast Value (2030) | USD 94.18 Billion |

| By Product Type | Medication Dispensing Machines, Industrial Material Dispensing Machines, Beverage Dispensing Machines, Snack and Food Dispensing Machines, Others |

| Key Market Players |

|

| By Region |

|

Automated Dispensing Machines Market Trends

The Automated Dispensing Machines (ADM) industry is presently experiencing strong trends aimed at increasing efficiency, safety, and connectivity in drug management. One of the key trends is the growing incorporation of emerging technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) into ADMs. AI is used for activities like predictive analytics to manage inventory and tailored medication recommendation, while IoT connectivity allows remote monitoring, data sharing with Electronic Health Records (EHR), and real-time medication dispensing tracking.

Another prominent trend is the move away from centralised models of dispensing medication toward decentralised models, where ADMs can be situated near the point of care within hospitals and other healthcare settings, improving access times and ease of access for both patients and staff. Additionally, there is increasing focus on ADMs capable of processing a broader range of medication forms, such as speciality drugs and controlled substances, with stronger security features like biometric authentication and strong audit trails for compliance with regulations. Demand is also increasing for ease-of-use interfaces and systems that will easily integrate into current pharmacy procedures and IT infrastructure.

Automated Dispensing Machines Market Leading Players

The key players profiled in the report are TCGRx (United States), Tosho Inc. (Japan), BD (Becton, Dickinson and Company) (UnitedStates), ScriptPro (United States), Aesynt (a subsidiary of Omnicell) (United States), Capsa Healthcare (United States), Swisslog Healthcare (United States), Omnicell, Inc. (United States), Parata Systems (United States), TouchPoint Medical (United States), YUYAMA Co., Ltd. (Japan)Growth Accelerators

The Automated Dispensing Machines (ADM) market is witnessing strong growth fuelled by mounting focus on the safety of drugs and minimising dispensing errors within healthcare environments. With a growing global geriatric population and more prevalence of chronic diseases, the number of medicines being administered is on the rise, requiring automated means for easy and accurate handling. In addition, medical institutions are now more frequently implementing ADMs to automate their processes, enhance medication inventory management, and release healthcare professionals to spend more time on direct patient care instead of administrative tasks for drug dispensing.

Government programs and regulations encouraging the use of technology in healthcare to improve patient safety and operational effectiveness also help in expanding the market. The growth in demand for decentralised medication dispensing across different healthcare facilities, such as hospitals, pharmacies, and long-term care settings, is driving the demand for these automated systems to provide timely and accurate drug delivery at the point of care.

Automated Dispensing Machines Market Segmentation analysis

The North America Automated Dispensing Machines is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Medication Dispensing Machines, Industrial Material Dispensing Machines, Beverage Dispensing Machines, Snack and Food Dispensing Machines, Others . The Application segment categorizes the market based on its usage such as Healthcare, Retail, Hospitality, Manufacturing, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The ADM Market's competitive scenario has a blend of long-standing international firms and niche regional players. Notable firms like Omnicell, BD (Becton, Dickinson and Company), Baxter International, and Capsa Healthcare enjoy substantial market shares because of their comprehensive product offerings, robust distribution networks, and long reputations in the healthcare sector. These major players tend to implement tactics such as mergers, acquisitions, and alliances to extend their market footprint and improve their technology capabilities.

There is competition in this market that is also fuelled by ongoing innovation, as companies concentrate on creating ADMs with sophisticated features such as upgraded security (biometric authentication), enhanced inventory management, integration into Electronic Health Records (EHR) systems, and the addition of AI and IoT technologies to increase efficiency and connectivity. In addition, the capacity to provide affordable solutions, offer extensive customer support and training, and meet strict regulatory requirements are key determinants that set competitors apart in this dynamic market.

Challenges In Automated Dispensing Machines Market

The market for automated dispensing machines (ADM) is confronted with a number of significant challenges, with high capital costs of acquisition proving to be a major obstacle, particularly for small pharmacies and healthcare facilities. The high costs of acquisition, installation, and maintenance of these advanced systems tend to discourage adoption, especially in areas with limited healthcare budgets or where short-term returns on investment are uncertain. In addition, the intricacy of interfacing ADMs with legacy IT infrastructure and electronic health record (EHR) systems further raises implementation expenses and technical challenges.

Other significant challenges involve the requirement for specialised training and maintenance, as well as rigorous regulatory compliance requirements that contribute to operational complexity and expense. Security and privacy of data issues are more significant since ADMs hold confidential patient data and tend to be part of larger hospital networks. Resistance to change from healthcare staff, restricted ability to customise for facilities with specific requirements, and potential downtime during maintenance also create barriers to widespread implementation. These issues notwithstanding, long-term advantages of enhanced medication safety, efficiency, and cost savings continue to fuel market growth.

Risks & Prospects in Automated Dispensing Machines Market

Key opportunities are the adoption of advanced technologies like RFID, barcode systems, artificial intelligence, and electronic health records, which allow for better management of medication, real-time tracking of inventory, and fewer medication errors. Other trends, such as decentralised dispensing, telehealth integration, and the emphasis on speciality medications, are creating new opportunities for market growth, especially as healthcare providers look to simplify workflows and improve patient-centred care.

Regionally, North America dominates the market with its sophisticated healthcare infrastructure, chronic disease prevalence, and early adoption of automation solutions. Europe is a close second with consistent growth, spurred by innovation and efficiency and sustainability focus. The Asia-Pacific region will see the highest growth, led by growing healthcare spending, urbanisation, and demands for high-speed medication systems. At the same time, the Middle East & Africa and Latin America are growing as a result of an increased healthcare infrastructure and an increasing requirement for effective management of medication. This worldwide scenario points to a vibrant market with strong growth opportunities in both emerging and developed markets.

Key Target Audience

, Retail pharmacies are also increasingly leveraging ADMs to manage high prescription volumes effectively, decrease wait times, and minimise medication errors. These systems enable pharmacists to concentrate more on patient counselling and other value-added services. ASCs leverage ADMs to provide accurate medication dosing during surgery, accurate medication records, and minimising medication errors, which is extremely vital in a surgical environment.,,

,,

The major target group for the automated dispensing machines (ADM) market is healthcare facilities, retail pharmacies, and ambulatory surgical centers (ASCs). Hospitals are the biggest buyers, necessitated by an intensive need to handle high volumes of medication, decrease errors, and improve patient safety. Automated dispensing systems reduce drug distribution complexity, maximise inventory management, and interact with electronic health records, enhancing general operational efficiency. The market for automated dispensing machines (ADM) has seen high levels of consolidation based on strategic mergers and acquisitions, improving technological strength and broadening market presence. Omnicell Inc. acquired ReCept Holdings in December 2021 at a cost of $100 million. The acquisition was aimed at strengthening its medication management infrastructure through the addition of speciality pharmacy management services, such as operational strengths, technology, and workflow management. In a like manner, in November 2020, CUBEX LLC's medical division was bought by Becton, Dickinson and Company (BD), which offers cloud-based medication management software. This buyout allowed BD to combine CUBEX's analytics platform with Pyxis automated dispensing systems for improved patient-centric care beyond the acute-care setting. The world automated dispensing machines market is growing strongly, with its value expected to increase from around $4.44 billion in 2025 to $6.22 billion in 2029, demonstrating a strong compound annual growth rate. This growth is being fuelled by growing demand for medication dispensing effectiveness, medication error reduction, growing volumes of medications, and regulatory compliance requirements in healthcare environments. The industry is a beneficiary of these machines' introduction into hospitals and pharmacies to make work easier, reduce wastage of medication, and aid patient-centred care.

, Merger and acquisition

These strategic purchases are part of a larger trend in the ADM market, as firms are concentrating on building out their technological capabilities and service offerings to address the increasing demand for effective and secure medication dispensing solutions. As the market continues to mature, such consolidations will likely be a key driver in defining the future state of automated medication management.Analyst Comment

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Automated Dispensing Machines- Snapshot

- 2.2 Automated Dispensing Machines- Segment Snapshot

- 2.3 Automated Dispensing Machines- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Automated Dispensing Machines Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Medication Dispensing Machines

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Beverage Dispensing Machines

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Snack and Food Dispensing Machines

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Industrial Material Dispensing Machines

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Automated Dispensing Machines Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Healthcare

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Retail

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Manufacturing

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Hospitality

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Automated Dispensing Machines Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 BD (Becton

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Dickinson and Company) (UnitedStates)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Omnicell

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Inc. (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Aesynt (a subsidiary of Omnicell) (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Swisslog Healthcare (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Capsa Healthcare (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 ScriptPro (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Parata Systems (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 TCGRx (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 TouchPoint Medical (United States)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Tosho Inc. (Japan)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 YUYAMA Co.

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Ltd. (Japan)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Automated Dispensing Machines in 2030?

+

-

Which type of Automated Dispensing Machines is widely popular?

+

-

What is the growth rate of Automated Dispensing Machines Market?

+

-

What are the latest trends influencing the Automated Dispensing Machines Market?

+

-

Who are the key players in the Automated Dispensing Machines Market?

+

-

How is the Automated Dispensing Machines } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Automated Dispensing Machines Market Study?

+

-

What geographic breakdown is available in North America Automated Dispensing Machines Market Study?

+

-

Which region holds the second position by market share in the Automated Dispensing Machines market?

+

-

How are the key players in the Automated Dispensing Machines market targeting growth in the future?

+

-

The Automated Dispensing Machines (ADM) market is witnessing strong growth fuelled by mounting focus on the safety of drugs and minimising dispensing errors within healthcare environments. With a growing global geriatric population and more prevalence of chronic diseases, the number of medicines being administered is on the rise, requiring automated means for easy and accurate handling. In addition, medical institutions are now more frequently implementing ADMs to automate their processes, enhance medication inventory management, and release healthcare professionals to spend more time on direct patient care instead of administrative tasks for drug dispensing.

,

, Government programs and regulations encouraging the use of technology in healthcare to improve patient safety and operational effectiveness also help in expanding the market. The growth in demand for decentralised medication dispensing across different healthcare facilities, such as hospitals, pharmacies, and long-term care settings, is driving the demand for these automated systems to provide timely and accurate drug delivery at the point of care.