North America B2B Hand Sanitizer Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-853 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The B2B (business-to-business) hand sanitiser market is that portion of the hand sanitiser industry in which companies sell directly to other businesses, institutions, or organizations. End-users usually include hospitals, schools, corporate offices, restaurants, hotels, manufacturing plants, and government agencies. The B2B market typically accommodates bulk purchases and packaging or formulation customisations and compliance requirements to suit the needs of these organizations. Retail, on the other hand, is aimed at individual consumers who purchase smaller quantities for personal use. The B2B market addresses hygiene and safety concerns for bigger groups of people who work in some office or institutional environment.

The changing dynamics of the B2B hand sanitiser market are affected by such factors as public health regulation, workplace safety standards, and the general concern about hygiene in several sectors. Demand in this end of the market would be brought about by the need to maintain an environment clean and safe for all employees, customers, patients, or the general public. In addition, the market is surrounded by long-term agreements and partnerships between suppliers and organizations, focusing on continuous supply as well as the assurance of quality.

B2B Hand Sanitizer Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

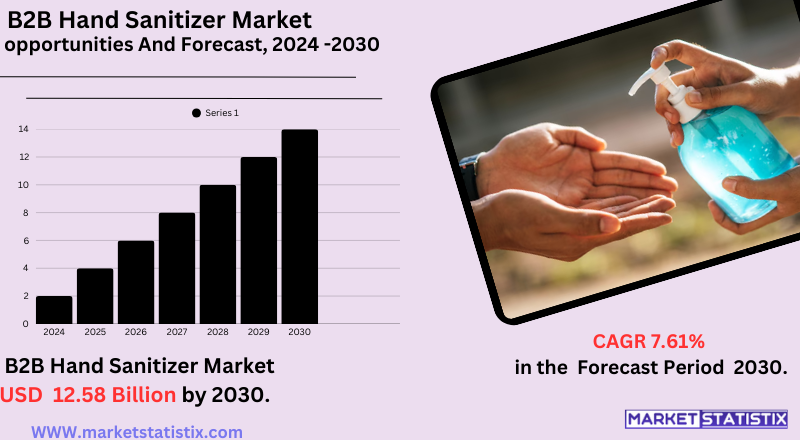

| Growth Rate | CAGR of 7.61% |

| Forecast Value (2030) | USD 12.58 Billion |

| By Product Type | Alcohol Sanitizer, Antimicrobial |

| Key Market Players |

|

| By Region |

|

B2B Hand Sanitizer Market Trends

The primary driver is the increased vigilance of infection prevention and hygiene across sectors such as healthcare, hospitality, education, and manufacturing. This ongoing interest, boosted by recent health emergencies, has resulted in repeat demand for bulk hand sanitisers and the adoption of long-term supply deals. In addition, increased focus is on product innovation, with producers creating environmentally friendly formulations and moisturising and frequently used sanitisers, as well as adding smart dispensing technologies to optimise usage and lower waste.

There is also the emerging trend for the growing call for customized products in the B2B category. Companies want hand sanitisers that are particularly regulatory compliant, have customized packaging choices, or suit their own sustainability initiatives. This has encouraged manufacturers to provide a broader variety of products beyond the traditional alcohol-based gels, such as foam, liquid, and wipe formats, and alcohol-free options. The B2B market is also experiencing an increase in online purchasing and direct-to-business sales models, simplifying the buying process and building closer relationships between suppliers and end-users.

B2B Hand Sanitizer Market Leading Players

The key players profiled in the report are Henkel Corporation (Germany), Procter And Gamble (United States), Medline (United States), Cleenol Group Ltd (United Kingdom)Gojo Industries, Inc. (United States), Byotrol Plc (United Kingdom), 3M Company (United States), SC Johnson Professional (United States), Reckitt Benckiser (United Kingdom), Kimberly Clark Corporation (United States), Unilever (United Kingdom)Growth Accelerators

The growth of the B2B hand sanitiser industry is largely driven by an increased consciousness of health safety and hygiene among institutions and companies. The COVID-19 outbreak was a key driver, emphasising the importance of hand sanitising in curbing the spread of infections, resulting in mass adoption across industries such as healthcare, hospitality, and manufacturing. This heightened emphasis on cleanliness is not a short-term reaction to a crisis but instead represents a lasting change in organisational priorities toward creating healthier environments for employees, customers, and stakeholders.

In addition to this, strict health and safety laws and regulations enforced by governments and regulatory organizations across the globe serve as influential market drivers. For compliance with these requirements, hand sanitisers are required in workplaces and public-facing businesses. Ease of use, along with an increasing focus on corporate social responsibility and sustainability, is also propelling demand for sustainable and user-friendly hand sanitiser solutions for the B2B market.

B2B Hand Sanitizer Market Segmentation analysis

The North America B2B Hand Sanitizer is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Alcohol Sanitizer, Antimicrobial . The Application segment categorizes the market based on its usage such as hospitals, Commercial, Industrial, others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The B2B hand sanitiser market is a competitive landscape where there are large multinational companies, as well as smaller, specialist regional companies. Large players use their existing distribution channels and established brand names to serve large institutional customers. Such players can have a large assortment of hygiene items, such as hand sanitisers, and may provide bulk buys and tailor-made solutions. Competition between such incumbent players usually is based on product innovation, e.g., environmentally friendly formulation or improved skin-care attributes, as well as price and contract terms.

Regional players tend to compete on the basis of servicing particular niches of the B2B market, e.g., hospitals or schools, with customized products and greater individualised service. Competition is also based on the type of hand sanitiser, such as gel, foam, and liquid forms, and alcohol-based versus non-alcohol-based. The efficacy of the sanitiser, its fragrance, and the type of dispenser provided also make up the competitive landscape.

Challenges In B2B Hand Sanitizer Market

The B2B hand sanitiser industry is confronted with a number of major challenges that affect its profitability and growth. They include, among others, the volatility of raw materials like ethanol, isopropyl alcohol, and glycerine, which leads to uncertain production costs and profit margins for manufacturers. Market saturation, particularly in developed markets such as North America and Europe, heightens competition between incumbent brands and new players, frequently leading to price wars that further reduce margins. Furthermore, supply chain disruptions, which were highlighted by the COVID-19 pandemic, still remain a threat by creating shortages and delays in product availability.

Another challenge includes the availability of poisonous ingredients in certain hand sanitiser products, with this resulting in consumer suspicion and regulatory action. Substances like methanol and 1-propanol pose health effects like eye burning and worse depending on consumption, thus affecting market reputation and development. In addition, the prevalence of traditional substitutes like soap and water constrains demand development in certain industries. But firms will have to handle these challenges gingerly in order to maintain growth and ride new industries such as food services, hospitality, and event management.

Risks & Prospects in B2B Hand Sanitizer Market

The B2B hand sanitiser market offers strong opportunities fuelled by ongoing demand from healthcare, institutional, and commercial industries. Bulk buying by hospitals, schools, government buildings, and businesses provides stable and recurring revenues for suppliers as organizations focus on hygiene and infection control post-pandemic. B2B channels also provide scope for customization in formulations, packaging, and delivery to suit sector needs and support long-term alliances.

North America is the regional leader of the B2B hand sanitizer market, supported by superior healthcare infrastructure, high awareness, and the concentration of leading manufacturers with extensive distribution networks. The fast response of the region to health emergencies and developed culture of hand hygiene are the pillars of its leadership. At the same time, the Asia Pacific is the most dynamic region, driven by rising health awareness, urbanization, and governmental campaigns that focus on hygiene, especially in emerging markets such as India, China, Indonesia, and Vietnam. Domestic and international companies are deepening penetration in these economies with affordable and innovative products that respond to a wide range of institutional requirements.

Key Target Audience

Another major segment consists of government organizations, NGOs, and transportation facilities like airports and public transport, where hygiene and crowd management are imperative. These buyers prefer long-term agreements, dependable supply chains, and flexible solutions (e.g., customized branded dispensers or green formulas). Knowing their priorities, like brand credibility, health compliance, and logistics, enables manufacturers and suppliers to customise offerings to drive maximum B2B interaction and revenue.,,

The major target customers in the B2B hand sanitiser industry are mostly institutions and businesses focusing on hygiene and safety during routine operations. They include healthcare settings like hospitals and clinics, where infection control needs medical-grade sanitisers. Further, schools and colleges, food processing units, hospitality industry segments, and corporate offices are prominent buyers owing to regulatory requirements and customer demand. These groups mostly buy in large quantities and seek effectiveness, safety ratings, and affordability. Current merger and acquisition (M&A) activities in the B2B hand sanitiser industry have been necessitated by the necessity to enhance manufacturing capacity and diversify product offerings. For example, in December 2022, Hindustan Foods Limited acquired Benckiser Healthcare India Private Limited's manufacturing unit, its strategic foray into the pharmaceutical and non-pharmaceutical product categories, including hand sanitisers. Besides, key companies such as Reckitt Benckiser, Procter & Gamble, and Unilever have also been actively involved in joint ventures and strategic alliances to expand their geographical presence and respond to increasing demand for hygienic products. The B2B hand sanitiser market is booming, with the overall market projected to increase from $1.8 billion in 2024 to $3.5 billion by 2034. The growth is fuelled by increased awareness of hand cleanliness, particularly in the wake of the COVID-19 pandemic, and the urgent demand for infection prevention in industries like healthcare, hospitality, and factories. Companies are now putting more emphasis on customer and worker safety, contributing to a continuing demand for sanitisers in the commercial and institutional markets.

,, Merger and acquisition

Firms are also emphasising product innovation, including touch-free dispensers and green formulas, to keep pace with changing consumer tastes. These innovations reflect the fluid dynamics of the marketplace and the tactical initiatives by dominant players to preserve a competitive position.Analyst Comment

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 B2B Hand Sanitizer- Snapshot

- 2.2 B2B Hand Sanitizer- Segment Snapshot

- 2.3 B2B Hand Sanitizer- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: B2B Hand Sanitizer Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Alcohol Sanitizer

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Antimicrobial

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: B2B Hand Sanitizer Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Commercial

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Industrial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 hospitals

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: B2B Hand Sanitizer Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 3M Company (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Byotrol Plc (United Kingdom)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Cleenol Group Ltd (United Kingdom)Gojo Industries

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Inc. (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Henkel Corporation (Germany)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Kimberly Clark Corporation (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Medline (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Procter And Gamble (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Reckitt Benckiser (United Kingdom)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 SC Johnson Professional (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Unilever (United Kingdom)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of B2B Hand Sanitizer in 2030?

+

-

Which application type is expected to remain the largest segment in the North America B2B Hand Sanitizer market?

+

-

How big is the North America B2B Hand Sanitizer market?

+

-

How do regulatory policies impact the B2B Hand Sanitizer Market?

+

-

What major players in B2B Hand Sanitizer Market?

+

-

What applications are categorized in the B2B Hand Sanitizer market study?

+

-

Which product types are examined in the B2B Hand Sanitizer Market Study?

+

-

Which regions are expected to show the fastest growth in the B2B Hand Sanitizer market?

+

-

Which application holds the second-highest market share in the B2B Hand Sanitizer market?

+

-

What are the major growth drivers in the B2B Hand Sanitizer market?

+

-

The growth of the B2B hand sanitiser industry is largely driven by an increased consciousness of health safety and hygiene among institutions and companies. The COVID-19 outbreak was a key driver, emphasising the importance of hand sanitising in curbing the spread of infections, resulting in mass adoption across industries such as healthcare, hospitality, and manufacturing. This heightened emphasis on cleanliness is not a short-term reaction to a crisis but instead represents a lasting change in organisational priorities toward creating healthier environments for employees, customers, and stakeholders.

In addition to this, strict health and safety laws and regulations enforced by governments and regulatory organizations across the globe serve as influential market drivers. For compliance with these requirements, hand sanitisers are required in workplaces and public-facing businesses. Ease of use, along with an increasing focus on corporate social responsibility and sustainability, is also propelling demand for sustainable and user-friendly hand sanitiser solutions for the B2B market.