Global Building Energy Modelling Market Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-683 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Building Energy Modelling Report Highlights

| Report Metrics | Details |

|---|---|

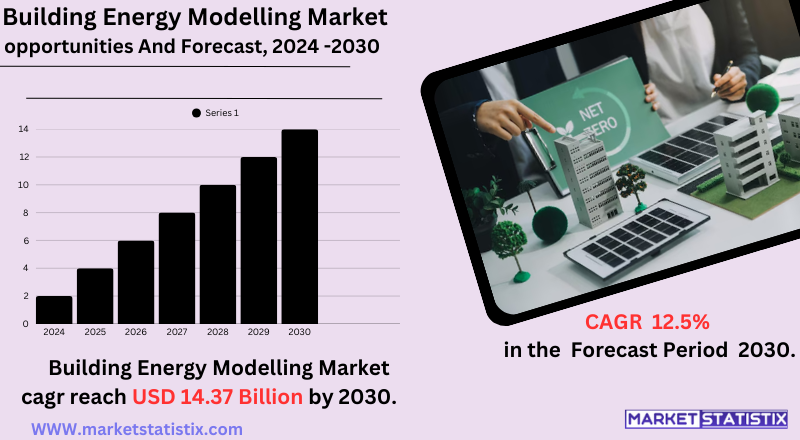

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 12.5% |

| Forecast Value (2030) | USD 14.37 Billion |

| By Product Type | Software, Services |

| Key Market Players |

|

| By Region |

|

Building Energy Modelling Market Trends

A salient evolution is the increase in the integration of BEM software, predicated on BIM, which enables accurate and broad energy analysis, importation and exportation of data, as well as greater cooperation throughout the building lifecycle. A further defining force motivating adoption among users is the increasing number of cloud-enabled BEM solutions. These offered greater access and scalability as well as computational power required for simulating complicated scenarios and conducting real-time analysis. Moreover, now, the application of AI and ML is changing BEM principles. AI-based tools are the new possessions of the BEM toolset, which are automating simulation processes, optimizing building designs, and providing predictive analytics on energy consumption. Therefore, this is raising the utility of BEM in taking decisions for energy-efficient designs and retrofits by building professionals and making the process very efficient. In addition, the increasing emphasis on net-zero energy buildings and certifications in green buildings has also driven increased demand for advanced BEM solutions, which can provide accurate assessment and optimization of building performance.Building Energy Modelling Market Leading Players

The key players profiled in the report are Emerson Electric Co, Cisco, Johnson Controls, Accenture, IBM Corporation, ABB Ltd, Honeywell International IncGrowth Accelerators

The BEM market now thirsts to come up with solutions as every economy intensifies all possible ways to enhance energy efficiency in the construction and management of buildings in the whole region. This is something that has put relevant parties under pressure to go for BEM solutions, as strong government regulations and codes for buildings impose reduced carbon emissions and promote green-built practices. At the same time, energy prices are on the rise, and with the growing environmental consciousness, building owners and developers are looking for ways to optimize energy-use efficiencies and reduce operative costs. Merging BEM with BIM makes designing and analysing all the more efficient; thus, the coordination among a wide variety of project stakeholders becomes seamless. Along with the increased number of cloud-based solutions for BEM, the entry of artificial intelligence and machine learning algorithms is further propelling the market expansion by enabling more effective and insightful assessments of energy performances.Building Energy Modelling Market Segmentation analysis

The Global Building Energy Modelling is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Software, Services . The Application segment categorizes the market based on its usage such as Building Stock Analysis, Building Performance Rating, HVAC Design and Operation, Architectural Design, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Established and new technology companies occupy the competitive landscape of markets like Building Energy Modelling (BEM). Major players are increasingly focused on advancing their software capabilities with features such as AI-enhanced analytics and cloud-based solutions. This continued impetus toward innovation is a result of rising demand for energy simulations with high accuracy to analyze energy-efficient building design and operation. Intensifying competition is directed towards the increasing trend of sustainability, along with the increasing number of stringent regulation frameworks on energy efficiency in the world. This has raised the need for using more BEM software to achieve green building certifications or comply with energy codes. There are also geographical differences in the market, with large shares held by North America and Europe, while the Asia-Pacific region is growing rapidly.Challenges In Building Energy Modelling Market

Accurate data collection and validation for energy modelingStrict energy efficiency standards are being enacted by governments around the globe, opening up space for BEM software vendors and consulting companies. Green building initiatives and retrofitting existing infrastructures into energy-efficient solutions will further propel the market. When it comes to region, North America and Europe lead in the BEM software market due to strict building codes, calls for sustainability, and full-scale adoption of smart energy solutions. These are the countries that lead the pack: the U.S., Canada, Germany, and the U.K. This is largely due to the policies put in place to encourage net-zero buildings. Currently, the Asia-Pacific is developing fast in terms of urbanization, energy efficiency programs put in place by the government, and ongoing smart city projects in countries like China, India, and Japan. Emerging markets in the ME and LATAM these days because of the rising consciousness of energy-efficient infrastructures and high investment in sustainable urban development.Risks & Prospects in Building Energy Modelling Market

Strict energy efficiency standards are being enacted by governments around the globe, opening up space for BEM software vendors and consulting companies. Green building initiatives and retrofitting existing infrastructures into energy-efficient solutions will further propel the market. When it comes to region, North America and Europe lead in the BEM software market due to strict building codes, calls for sustainability, and full-scale adoption of smart energy solutions. These are the countries that lead the pack: the U.S., Canada, Germany, and the U.K. This is largely due to the policies put in place to encourage net-zero buildings. Currently, the Asia-Pacific is developing fast in terms of urbanization, energy efficiency programs put in place by the government, and ongoing smart city projects in countries like China, India, and Japan. Emerging markets in the ME and LATAM these days because of the rising consciousness of energy-efficient infrastructures and high investment in sustainable urban development.Key Target Audience

, The main target groups for the Building Energy Modelling (BEM) market are further segmented into different professions and organizations that participate in building design, construction, and management activities. This includes architects and building designers who use BEM for checking design feasibility towards energy efficiency at upfront planning stages. Further engineers, such as mechanical and electrical engineers, utilize BEM in analysing and improving HVAC systems, lighting, and other building services. For building owners and developers, BEM provides an option to study energy performance at their property, saving them operational expenses owing to energy-efficient measures and appropriate meeting sustainability targets., Apart from all of the above, government agencies and regulatory bodies have significant stakeholders, as they will take advantage of BEM for enacting building energy codes and standards and energy efficiency policies. Educational institutions and research organizations also use BEM significantly, i.e., for purposes of research and producing human resources to train future professionals in sustainable building practices. Therefore, the BEM market claims a very much diversified array of professionals and organizations toward the goal of improving building energy efficiency and sustainability.Merger and acquisition

With significant merger-and-acquisition activity over the past few years, the BEM market seems to be heading toward integrated and sophisticated simulation solutions. An important milestone was the acquisition of Altair Engineering by Siemens in 2024 for $10.6 billion. Altair's simulation capabilities complement Siemens' own portfolio in industrial software and energy modelling applications and aim to solidify Siemens' leadership in this market. Accordingly, in another strategic play, Glodon Company Limited acquired a majority stake in EQUA Simulation AB in February 2023 via its subsidiary, the MagiCAD Group. This collaboration is expected to boost the development of building energy simulation technology and sustainable design practice. With the acquisition of FlexSim in October 2023, Autodesk Inc. is now partly in the simulation of manufacturing and logistics systems, another indicator of a trend toward integrating different simulation tools to thrust building energy modelling solutions onward >Analyst Comment

The current market scenario of the Building Energy Modelling has been quite promising with the global concern towards increasing energy efficiency and sustainable building practices. Stringent government regulations paired with the rising demand for green building certifications encourage architects, engineers, and building owners to use BEM tools. Along with these factors, technological advancements like the introduction of AI and cloud solutions to revolutionize simulation accuracy and accessibility also add a lot of value to the market. It thereby produces greater design optimizations for reduced energy consumption and operational costs.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Building Energy Modelling- Snapshot

- 2.2 Building Energy Modelling- Segment Snapshot

- 2.3 Building Energy Modelling- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Building Energy Modelling Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Software

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Services

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Building Energy Modelling Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Architectural Design

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 HVAC Design and Operation

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Building Performance Rating

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Building Stock Analysis

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Building Energy Modelling Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 IBM Corporation

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Johnson Controls

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Cisco

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Emerson Electric Co

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 ABB Ltd

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Accenture

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Honeywell International Inc

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Building Energy Modelling in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Building Energy Modelling market?

+

-

How big is the Global Building Energy Modelling market?

+

-

How do regulatory policies impact the Building Energy Modelling Market?

+

-

What major players in Building Energy Modelling Market?

+

-

What applications are categorized in the Building Energy Modelling market study?

+

-

Which product types are examined in the Building Energy Modelling Market Study?

+

-

Which regions are expected to show the fastest growth in the Building Energy Modelling market?

+

-

Which application holds the second-highest market share in the Building Energy Modelling market?

+

-

Which region is the fastest growing in the Building Energy Modelling market?

+

-