North America e-Payment Solutions Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-985 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The electronic payment solutions market covers a diverse variety of digital platforms and technologies that facilitate electronic transactions, allowing individuals and companies to transfer funds and make value changes without the need for physical currency. These solutions include mobile portfolios, online banks, credit and debit card payments, peer-to-peer transfers (P2P) and cryptocurrency transactions. The market has experienced significant growth due to the convenience, speed and accessibility offered by these digital payment methods, which are used for various purposes, such as online purchases, accounts, funds transfers and personal purchases. The adoption of electronic payment solutions has fundamentally transformed financial transactions, increasing efficiency and safety in the digital age.

e-Payment Solutions Report Highlights

| Report Metrics | Details |

|---|---|

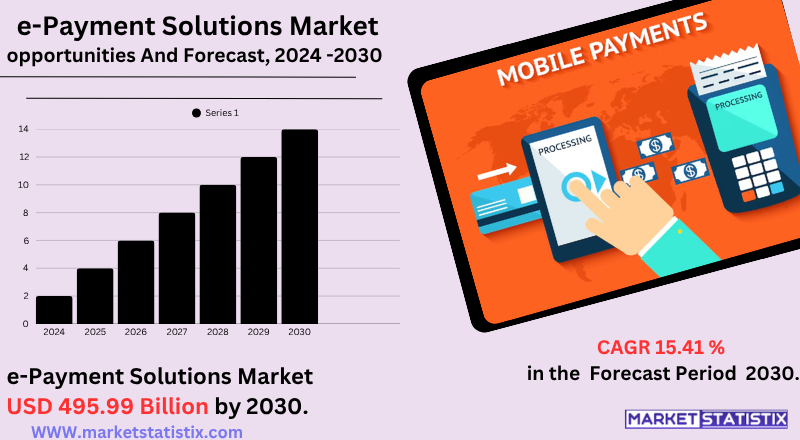

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 15.41% |

| Forecast Value (2030) | USD 495.99 Billion |

| By Product Type | Mobile Payment, Online Banking, Digital Wallet |

| Key Market Players |

|

| By Region |

|

e-Payment Solutions Market Trends

Main trends include widespread adoption and continuous growth of mobile portfolios and contactless payments, usually taking advantage of NFC and QR code technologies, which are becoming the favourite method for consumers in all generations. Real-time payments are gaining significant traction globally, with systems such as UPI in India revolutionising immediate funds transfers to point-to-point transactions and traders. Artificial intelligence (AI) and machine learning (ML) are increasingly integrated for advanced fraud detection, custom user experiences and operational efficiency. The market is also seeing innovations in improved biometric authentication, exploration of Central Bank digital currencies (CBDCs) and increasing the incorporated finances, where payment features are perfectly integrated into various applications and platforms. The overall change is towards a friction-free payment ecosystem, first and foremost, and highly safe mobile.

e-Payment Solutions Market Leading Players

The key players profiled in the report are Pay U (Netherlands), JP Morgan Chase & Co (United States), Fiserv Inc. (United States), ACI Worldwide Inc. (United States), Mastercard Incorporated (United States), Apple Pay (United States), Global Payments Inc. (United States), Google (United States), PayPal Holdings Inc. (United States), Amazon Pay (United States), Visa Inc. (United States)Growth Accelerators

- Surge in Smartphone and Internet Penetration: The wide adoption of smartphones and increased internet accessibility has significantly increased the use of digital payment platforms, facilitating perfect online transactions.

- Expansion of e-commerce: The rapid growth of online retail has increased the demand for efficient and safe electronic payment methods, allowing consumers to purchase conveniently from anywhere.

- Consumer preference for convenience and safety: Modern consumers prioritize easy and secure payment options, boosting the move to digital portfolios and mobile payment solutions that offer user improvement experiences.

- Artificial Intelligence Integration and Machine Learning: AI and ML incorporation into payment systems helps to detect fraud and custom user experiences, reinforcing confidence and efficiency in digital transactions.

e-Payment Solutions Market Segmentation analysis

The North America e-Payment Solutions is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Mobile Payment, Online Banking, Digital Wallet . The Application segment categorizes the market based on its usage such as Healthcare, Retail, IT and telecom services, BFSI, Transportation, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario of the electronic payment solutions market is dynamic and intensely competitive, with a mix of traditional financial institutions, established fintech giants and new agile participants. Main players like PayPal, Stripe, Visa and Mastercard continue to master but face strong competition from technology giants such as Apple Pay (Google Pay), as well as regional powers such as the UPI ecosystem of India and Alipay and WeChat Pay from China. There is a clear tendency to support a wide range of payment methods, including digital wallets, non-contact payments and a growing interest in cryptocurrencies, to meet various consumer preferences and facilitate sewing without sewing transactions online, in stores and on furniture channels. Competition is also boosting comprehensive and integrated solutions that offer companies a unified trade experience, simplify backed operations and ensure robust safety and compliance in an evolving regulatory environment.

Challenges In e-Payment Solutions Market

- Increasing threats to cybersecurity: The growing sophistication of cyber-attacks has significant risks to digital payment systems, requiring robust security measures to protect user data and transaction integrity.

- Regulatory Complexities: Navigating various regulatory landscapes in different regions has challenges for electronic payment providers to ensure compliance and operational efficiency.

- Infrastructure limitations in rural areas: Inadequate Internet connectivity and technological infrastructure in rural and remote regions make it difficult to adopt and effective digital payment solutions.

Addressing these challenges is crucial for the sustained growth and reliability of the e-Payment Solutions Market.

Risks & Prospects in e-Payment Solutions Market

There is a strong demand for real-time payment resources that allow instant transactions and enhanced cash flow for companies and individuals. The decline in the non-banking population worldwide also offers a vast unexplored market for digital payments providers, particularly in developing economies. In addition, advances in technologies such as AI and blockchain are paving the way for detecting more sophisticated fraud, enhanced security and personalised payment experiences, further reinforcing growth prospects. Finally, cross-border payments represent a substantial opportunity, as companies are looking for more efficient and standardised ways to perform international transactions.

Key Target Audience

- ,

Merger and acquisition

- Global Payments Acquires Worldpay: In April 2025, Global Payments announced the acquisition of Worldpay for $24.25 billion. This strategic movement aims to improve global scale and global service resources, focusing exclusively on their main traders' trade solutions.

- FIS Acquires Global Payments' Issuer Solutions Business: FIS has agreed to purchase the global payment issuer solutions unit for $13.5 billion. This acquisition strengthens FIS's position as a fintech leader on a global scale, particularly in credit processing, with the presence of a client in more than 75 countries.

- Global Payments Sells Payroll Division to Acrisure: In May 2025, Global Payments sold its payroll division, Heartland Payroll Solutions, to fintech company Acrisure for $1.1 billion. This divestment aligns with Global Payments' strategy to optimise operations and focus on main payment processing services.

These strategic moves reflect the dynamic nature of the e-payment solutions market, with companies focusing on core competencies, expanding global reach, and embracing emerging technologies like CBDCs.

>

Analyst Comment

The e-payment solutions are experiencing dynamic market growth, which is inspired by a global change towards the expansion of the e-commerce sector to increase smartphone and cashless transactions. In 2023–2024, at a price of about 110–122 billion USD, the market is estimated to reach about 462–712 billion USD by 2032–2033. North America currently has the largest market share (approximately 32–47% in 2024), but the Asia-Pacific region is estimated to show the fastest growth, which is fuelled by widely adopting the growing smartphone penetration and digital wallet and QR code-based payment systems.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 e-Payment Solutions- Snapshot

- 2.2 e-Payment Solutions- Segment Snapshot

- 2.3 e-Payment Solutions- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: e-Payment Solutions Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Mobile Payment

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Online Banking

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Digital Wallet

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: e-Payment Solutions Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 BFSI

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Retail

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Healthcare

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 IT and telecom services

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Transportation

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Others

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: e-Payment Solutions Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 ACI Worldwide Inc. (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Amazon Pay (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Apple Pay (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Fiserv Inc. (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Global Payments Inc. (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Google (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 JP Morgan Chase & Co (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Mastercard Incorporated (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Pay U (Netherlands)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 PayPal Holdings Inc. (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Visa Inc. (United States)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of e-Payment Solutions in 2030?

+

-

Which application type is expected to remain the largest segment in the North America e-Payment Solutions market?

+

-

How big is the North America e-Payment Solutions market?

+

-

How do regulatory policies impact the e-Payment Solutions Market?

+

-

What major players in e-Payment Solutions Market?

+

-

What applications are categorized in the e-Payment Solutions market study?

+

-

Which product types are examined in the e-Payment Solutions Market Study?

+

-

Which regions are expected to show the fastest growth in the e-Payment Solutions market?

+

-

Which application holds the second-highest market share in the e-Payment Solutions market?

+

-

What are the major growth drivers in the e-Payment Solutions market?

+

-

- Surge in Smartphone and Internet Penetration: The wide adoption of smartphones and increased internet accessibility has significantly increased the use of digital payment platforms, facilitating perfect online transactions.

- Expansion of e-commerce: The rapid growth of online retail has increased the demand for efficient and safe electronic payment methods, allowing consumers to purchase conveniently from anywhere.

- Consumer preference for convenience and safety: Modern consumers prioritize easy and secure payment options, boosting the move to digital portfolios and mobile payment solutions that offer user improvement experiences.

- Artificial Intelligence Integration and Machine Learning: AI and ML incorporation into payment systems helps to detect fraud and custom user experiences, reinforcing confidence and efficiency in digital transactions.