Global Electronics Manufacturing Services (EMS) Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-626 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Electronics Manufacturing Services (EMS) Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2014-2030 |

| Base Year Of Estimation | 2024 |

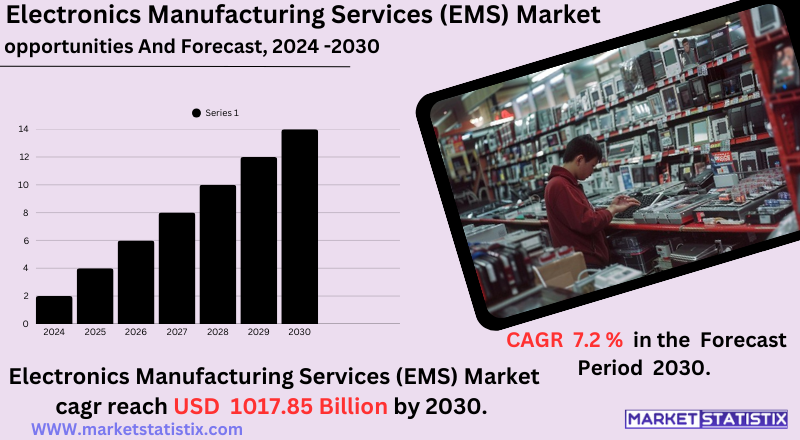

| Growth Rate | CAGR of 7.2% |

| Forecast Value (2030) | USD 1017.85 Billion |

| By Product Type | PCB Assembly Specialists, Box Build and Final Assembly, Test and Inspection Experts, Design and Engineering Consultants, Full-Service EMS, Others |

| Key Market Players |

|

| By Region |

Electronics Manufacturing Services (EMS) Market Trends

A key trend is the rise of Industry 4.0 technologies, embraced in tandem to provide enhancements to manufacturing efficiency and cost reduction. Hence, smarter factories will evolve, with enhanced production precision and reduced turnaround time. In that direction, resilience and diversification within the supply chain have also gotten much attention in the context of risk mitigation due to geopolitical uncertainties and component shortages. Another trend on the rise involves sustainability and green manufacturing practices, as EMS providers introduce greener processes and materials.Electronics Manufacturing Services (EMS) Market Leading Players

The key players profiled in the report are Universal Scientific Industrial Co., Ltd. (China), Plexus Corp. (United States), Venture Corporation Limited (Singapore), Kimball Electronics, Inc. (United States), Foxconn Technology Group (Taiwan), Benchmark Electronics, Inc. (United States), Sanmina Corporation (United States), Inventec Corporation (Taiwan), Zollner Elektronik AG (Germany), Wistron Corporation (Taiwan), Celestica Inc. (Canada), Quanta Computer Inc. (Taiwan), Jabil Inc. (United States), Flex Ltd. (Singapore), Compal Electronics, Inc. (Taiwan)Growth Accelerators

The increasing complexity of electronic products and the need for OEMs to concentrate on their core competencies drive the Electronics Manufacturing Services (EMS) market. With advancing technology, the products become more complex, requiring niche manufacturing capabilities and advanced equipment. Outsourcing to EMS providers allows OEMs to gain access to such facilities without having to put up huge capital investments. OEMs need flexible and scalable solutions due to the pressure of reducing time-to-market and managing fluctuating demands, which are readily offered by EMS companies. Other significant driving forces are global availability and cost optimization. With the demand of EMS providers, OEMs are increasingly trying to cut down all manufacturing costs through supply chain optimization. Taking advantage of cheaper labour costs in certain places and efficient logistics and supply chain management, outsourcing to EMS is a favourable choice. The increasing adoption of IoT, AI, and other advanced technologies across various industries is also adding fuel to the demand for specialized EMS services, contributing to the growth story of the market.Electronics Manufacturing Services (EMS) Market Segmentation analysis

The Global Electronics Manufacturing Services (EMS) is segmented by Type, Application, and Region. By Type, the market is divided into Distributed PCB Assembly Specialists, Box Build and Final Assembly, Test and Inspection Experts, Design and Engineering Consultants, Full-Service EMS, Others . The Application segment categorizes the market based on its usage such as Healthcare, Industrial, IT and Telecom, Automotive, Consumer Electronics, Aerospace and Defense, Other. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for electronics manufacturing services is highly competitive, with leading players trying very hard to expand their presence and improve their technological capabilities. The key players of the industry are Hon Hai Precision Industry Co., Ltd. (Foxconn) (Taiwan), Pegatron Corporation (Taiwan), Jabil Inc. (USA), Flex Ltd. (Singapore), and Wistron Corporation (Taiwan). All of them provide a specialized range of services: design and engineering, assembly, and testing. The industry leaders are focused on product innovation, strategic partnerships, and expanding into emerging markets to keep their competitive advantage in the business.Challenges In Electronics Manufacturing Services (EMS) Market

Intellectual property theft is foremost among the myriad problems that plague the EMS market. Companies remain sceptical of outsourcing proper manufacturing due to concerns over technology and design leakage, corporate espionage, and loss of data. Even though agreements are in place to protect IP, IP protection from one country to another is difficult, if not impossible, to enforce. Further, the increased dependence on cloud technologies and new-age cyber threats puts EMS programs at risk, allowing further erosion of these risks in already sensitive industries like defense and aerospace. Another considerable challenge is the complexity of global supply chains, which are frequently affected by natural disasters, geopolitical tensions, or trade disputes. EMS players ought, therefore, to evolve supply chain management to sufficiently guard against these threats. Among the other pressures is increasing demand for sustainability measures, such as e-waste recycling and greener electronics—which pressurize EMS firms to innovate and do so profitably. OEMs' cost-cutting demands further compromise already shrinking operating margins of the providers, thus compelling them to improve their operations through automation and AI-driven advanced technologies to remain in the competition.Risks & Prospects in Electronics Manufacturing Services (EMS) Market

The trend toward miniaturization and advanced functionality within electronic equipment presents an opportunity for EMS companies to invest in innovative manufacturing techniques and high-precision assembly processes. In terms of regional prospects, Asia-Pacific is still the dominant player within the EMS market, buoyed by strong manufacturing bases in China, Taiwan, and South Korea. These countries enjoy cheaper labour, ready supply chains, and pro-business government policies such as "Made in China 2025," which seek to strengthen local manufacturing capabilities. Emerging economies such as India and Vietnam are slowly catching up, becoming attractive investment destinations with low operating costs and friendly regulatory environments. The North American region, meanwhile, is witnessing upward movement in the EMS market from reshoring strategies and capital government investments, as evidenced by the U.S. CHIPS Act, which released a significant amount of funds for enhancing domestic semiconductor manufacturing.Key Target Audience

The Electronics Manufacturing Services (EMS) market delivers all these functions in many industries with different demands. Consumer electronics are one major segment, comprising a huge chunk of the market—a constant demand for devices like smartphones and wearables. Another rapidly developing sector is automotive, wherein the integration of electronic components into vehicles has been on the rise, especially due to electric vehicles. Others include aerospace and defense, medical and healthcare, industrial applications, and IT and telecommunications, where EMS providers give the required solution for specialized manufacturing.,, EMS helps small and medium-sized enterprises (SMEs) to access advanced manufacturing capabilities without a great capital investment. The market also encompasses companies requiring high-mix, low-volume production, as opposed to high-volume, low-mix manufacturing, suggesting a range of production requirements.Merger and acquisition

Vast transition and evolution in the EMS (Electronics Manufacturing Services) market through rapid and strategically propelled mergers and acquisitions to improve the capabilities and footprints worldwide. Fortive acquired Elektro-Automatik, a German maker of test and measurement devices, for $1.45 billion and the merger of Enics with GPV, Denmark's largest electronics manufacturer during 2022, creating one of the largest EMSs in Europe with over 7,500 employees and revenues exceeding €941 million. North America awards 21 contracts with the completion of 2024, compared to just 18 in 2023. Major highlights in the deal include Kaynes Technology of India acquiring Digicom Electronics in California for $2.5 million in January 2024 and Flex buying the state of FreeFlow Texan in May 2024. With all this going on, added to the increased attention from private equity firms, mergers and acquisitions within this industry are very brisk. The aforementioned landscapes just don't show the consolidation trend due to the above but rather have companies vying to shore up internal technological capabilities, diverse offerings, and strength in the competitive global marketplace. >Analyst Comment

The Electronics Manufacturing Services (EMS) market has seen buoyant growth as a by-product of the increasing complexity of electronic devices and the worldwide push for an efficient supply chain. OEMs in various sectors, such as automotive, healthcare, and telecommunications, have started outsourcing manufacturing and related services to EMS providers for streamlined operations and cost savings. The emergence of technologies such as IoT, 5G, and AI has presented EMS companies with an avenue to provide specialized services: advanced manufacturing, testing, and system integration.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Electronics Manufacturing Services (EMS)- Snapshot

- 2.2 Electronics Manufacturing Services (EMS)- Segment Snapshot

- 2.3 Electronics Manufacturing Services (EMS)- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Electronics Manufacturing Services (EMS) Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Full-Service EMS

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 PCB Assembly Specialists

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Test and Inspection Experts

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Box Build and Final Assembly

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Design and Engineering Consultants

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Electronics Manufacturing Services (EMS) Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Consumer Electronics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Automotive

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Aerospace and Defense

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Healthcare

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 IT and Telecom

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Other

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Foxconn Technology Group (Taiwan)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Flex Ltd. (Singapore)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Sanmina Corporation (United States)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Jabil Inc. (United States)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Celestica Inc. (Canada)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Plexus Corp. (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Benchmark Electronics

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Inc. (United States)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Quanta Computer Inc. (Taiwan)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Wistron Corporation (Taiwan)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Inventec Corporation (Taiwan)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Universal Scientific Industrial Co.

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Ltd. (China)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Zollner Elektronik AG (Germany)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Kimball Electronics

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Inc. (United States)

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 Venture Corporation Limited (Singapore)

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 Compal Electronics

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

- 7.19 Inc. (Taiwan)

- 7.19.1 Company Overview

- 7.19.2 Key Executives

- 7.19.3 Company snapshot

- 7.19.4 Active Business Divisions

- 7.19.5 Product portfolio

- 7.19.6 Business performance

- 7.19.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Electronics Manufacturing Services (EMS) in 2030?

+

-

Which type of Electronics Manufacturing Services (EMS) is widely popular?

+

-

What is the growth rate of Electronics Manufacturing Services (EMS) Market?

+

-

What are the latest trends influencing the Electronics Manufacturing Services (EMS) Market?

+

-

Who are the key players in the Electronics Manufacturing Services (EMS) Market?

+

-

How is the Electronics Manufacturing Services (EMS) } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Electronics Manufacturing Services (EMS) Market Study?

+

-

What geographic breakdown is available in Global Electronics Manufacturing Services (EMS) Market Study?

+

-

Which region holds the second position by market share in the Electronics Manufacturing Services (EMS) market?

+

-

Which region holds the highest growth rate in the Electronics Manufacturing Services (EMS) market?

+

-