North America Enterprise Financial Management Software Market – Industry Trends and Forecast to 2030

Report ID: MS-988 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

Enterprise Financial Management (EFM) software market covers advanced digital solutions designed to optimise and integrate the main financial processes of an organisation, including accounting, budgeting, forecasting, risk management and compliance. These platforms enable companies to obtain real-time visibility in financial performance, improve decision-making, and ensure regulatory alignment in various business units and geographies. With increasing digitisation, globalisation and demand for agile financial planning, EFM software is becoming a strategic asset for large and medium companies. The market is characterised by the growing adoption of cloud-based financial suites, AI-orientated analyses and automation resources that improve operational efficiency, reduce errors and support scalable financial strategies in dynamic business environments.

Enterprise Financial Management Software Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

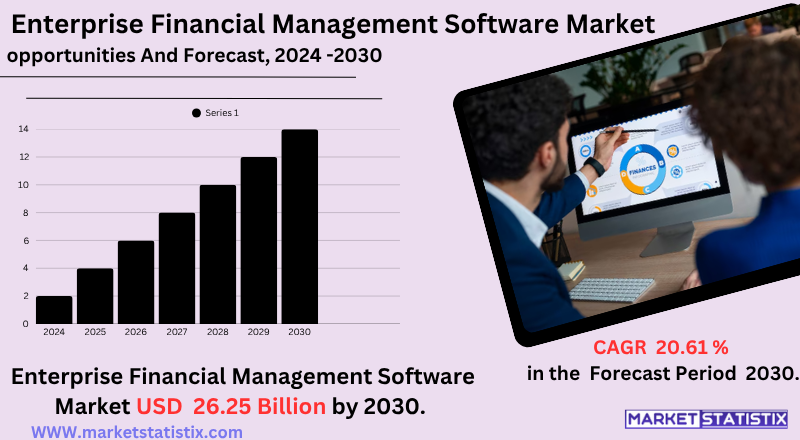

| Growth Rate | CAGR of 20.61% |

| Forecast Value (2030) | USD 26.25 Billion |

| Key Market Players |

|

| By Region |

|

Enterprise Financial Management Software Market Trends

The main trends include the widespread adoption of real-time data analysis for faster decision-making, AI integration and machine learning for improved automation and predictive insights, and a movement for integrated platforms that manage various financial processes under one system. North America currently leads the market due to early adoption and the presence of major technology suppliers, while emerging economies such as India and China are showing significant growth potential.

The growing complexity of global financial regulations and an increasing emphasis on data security also boost the demand for sophisticated EFM solutions that offer robust features of compliance and strong data protection.

Enterprise Financial Management Software Market Leading Players

The key players profiled in the report are Apptio (United States), IBM (United States), Microsoft Corporation (United States), Freshbooks (Canada), Oracle (United States), Epicor (United States), Prismatic (Switzerland), Infor (United States), Intuit, Inc (United States)Lucanet Ag (Germany), Wave Financial (Canada), Xero Limited (New Zealand), LTX (United States), The Sage Group Plc (United Kingdom), Brex (United States), NetSuite (United States), Capital One (United States), Zoho Corporation (India)Growth Accelerators

- Increasing need for real-time financial insights: Organizations are increasingly prioritising real-time visibility in financial performance to support faster and more informed decision-making, boosting the demand for integrated financial management tools.

- Increasing adoption of cloud-based financial solutions: Companies are changing from local systems to cloud-based platforms for better scalability, accessibility, cost efficiency and automatic IT infrastructure updates.

- Regulatory compliance and risk management pressure: The growing complexity of financial regulations globally is pressuring companies to adopt software that ensures compliance, readiness for audit and robust internal controls.

Enterprise Financial Management Software Market Segmentation analysis

The North America Enterprise Financial Management Software is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Enterprise Resource Planning Systems, Billing & Invoice System, Payroll Management Systems, Time & Expense Management Systems, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The Enterprise Financial Management (EFM) software market is highly competitive, dominated by established players such as SAP, Oracle (with NetSuite and Oracle Fusion Cloud EPM) and Workday, which offer integrated comprehensive EFM suites. Along with these giants, specialised suppliers such as Intacct Sage, Zoho Books and QuickBooks meet specific, particularly small and medium-sized segments (SMBs), focusing on ease of use and accessibility. An important competitive differentiator is the ability to integrate perfectly with other business systems (CRM, HR, supply chain) and leverage advanced technologies such as AI and machine learning for predictive analysis and automation. Companies are vying for market share, offering cloud-based robust solutions, emphasising access to real-time data, improved reports, and strong compliance features to meet evolving regulatory demands.

Challenges In Enterprise Financial Management Software Market

- High implementation costs: The initial investment for EFM software, including licensing, personalisation and training, is substantial. This can prevent the adoption between SMEs and the impact of ROI timelines.

- Integration complexities: The integration of EFM systems with the inherited infrastructure is generally technically challenging. This can lead to data silos and stop multifunctional financial operations.

- Cyber security threats: EFM platforms store sensitive financial data, making them main targets for cyber-attacks. Regulatory compliance is critical for risk mitigation.

- Real-time data accessibility: Many companies struggle to access real-time financial ideas due to outdated systems. This delays the accuracy of reports and impairs proactive decision-making.

Risks & Prospects in Enterprise Financial Management Software Market

Enterprise Financial Management (EFM) software market has significant opportunities driven by the growing need for advanced financial reports and real-time insights in various sectors. A large growth area is to serve small and medium-sized SMEs, which are increasingly adopting EFM solutions to optimise operations, manage taxes and improve financial planning, moving away from manual processes. Continuous change towards cloud-based EFM platforms offers scalability, cost-effectiveness and enhanced data accessibility, representing an important opportunity for suppliers. Finally, expansion to emerging markets, particularly in the Asia Pacific region, such as India, has substantial growth potential as these economies adopt digital transformation into their financial services.

Key Target Audience

- ,

Merger and acquisition

- Salesforce to acquire Informatica: Salesforce has announced its intention to purchase the computer data management company to improve its AI platform. The agreement aims to improve data integration and accuracy for corporate customers.

- DataSitis acquires Graca: Datasitis, supported by CapVest, the market intelligence company acquired by AI for more than $200 million. This movement aims to reinforce the transaction services of datasitis with advanced technologies such as agentic AI.

- APAX PARTNERS targets Finsastra's TCM unit: Private equity company Apax Partners is the main candidate to acquire Finastra's Treasury and Capital Division for approximately $2 billion, with the aim of expanding its presence in financial software solutions.

>

Analyst Comment

The Enterprise Financial Management (EFM) software market is undergoing significant expansion, driven by the imperative for enhanced automation, real-time insights and rigorous regulatory compliance in financial operations. The market is expected to grow from approximately US $9.28 billion by 2024 to US $26.85 billion by 2032, displaying a compound annual growth rate (CAGR) of about 14.2%. Main growth factors include the growing adoption of cloud-based EFM solutions for scalability and accessibility and increasing AI integration and machine learning to automate tasks, improve forecasting and reinforce risk management. North America currently leads the market due to early technological adoption and the presence of major players in the industry, while emerging economies are rapidly expanding their adoption.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Enterprise Financial Management Software- Snapshot

- 2.2 Enterprise Financial Management Software- Segment Snapshot

- 2.3 Enterprise Financial Management Software- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Enterprise Financial Management Software Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Payroll Management Systems

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Billing & Invoice System

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Enterprise Resource Planning Systems

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Time & Expense Management Systems

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Enterprise Financial Management Software Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Apptio (United States)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Brex (United States)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Capital One (United States)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Epicor (United States)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Freshbooks (Canada)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 IBM (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Infor (United States)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Intuit

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Inc (United States)Lucanet Ag (Germany)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 LTX (United States)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Microsoft Corporation (United States)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 NetSuite (United States)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Oracle (United States)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Prismatic (Switzerland)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 The Sage Group Plc (United Kingdom)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Wave Financial (Canada)

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 Xero Limited (New Zealand)

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 Zoho Corporation (India)

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Enterprise Financial Management Software in 2030?

+

-

What is the growth rate of Enterprise Financial Management Software Market?

+

-

What are the latest trends influencing the Enterprise Financial Management Software Market?

+

-

Who are the key players in the Enterprise Financial Management Software Market?

+

-

How is the Enterprise Financial Management Software } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Enterprise Financial Management Software Market Study?

+

-

What geographic breakdown is available in North America Enterprise Financial Management Software Market Study?

+

-

How are the key players in the Enterprise Financial Management Software market targeting growth in the future?

+

-

,

,

- ,

- ,

,

- ,

- Regulatory compliance and risk management pressure: The growing complexity of financial regulations globally is pressuring companies to adopt software that ensures compliance, readiness for audit and robust internal controls. ,,

,, ,

What are the opportunities for new entrants in the Enterprise Financial Management Software market?

+

-

What are the major challenges faced by the Enterprise Financial Management Software Market?

+

-